Essential documents for remote work payroll processing include the employee's signed employment contract, tax withholding forms such as the W-4 or equivalent, and valid identification for tax and verification purposes. Employers must also collect timesheets or digital attendance records to accurately calculate hours worked and payroll amounts. Compliance with state and local tax regulations requires maintaining documentation of the employee's work location and any applicable labor law notices.

What Documents are Necessary for Remote Work Payroll Processing?

| Number | Name | Description |

|---|---|---|

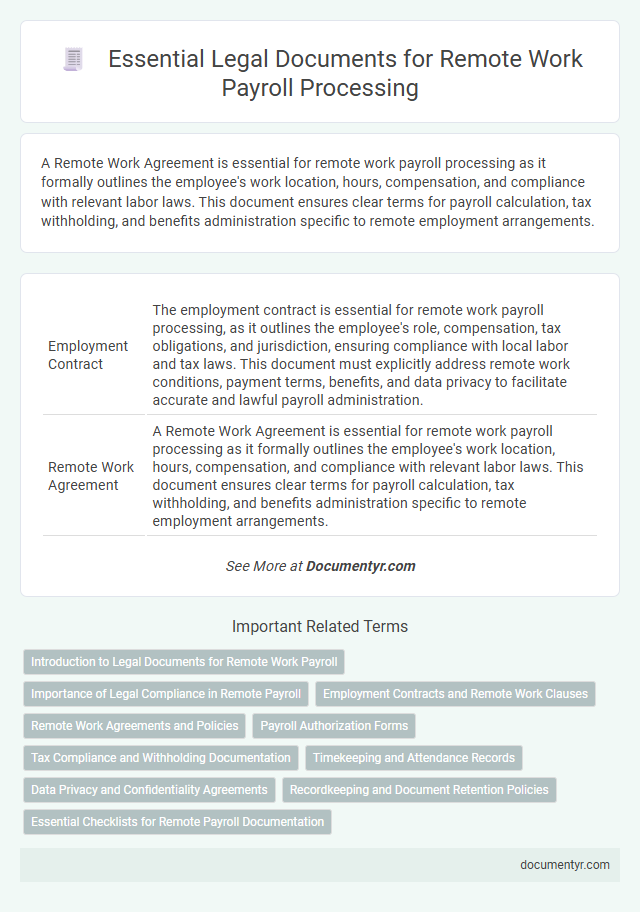

| 1 | Employment Contract | The employment contract is essential for remote work payroll processing, as it outlines the employee's role, compensation, tax obligations, and jurisdiction, ensuring compliance with local labor and tax laws. This document must explicitly address remote work conditions, payment terms, benefits, and data privacy to facilitate accurate and lawful payroll administration. |

| 2 | Remote Work Agreement | A Remote Work Agreement is essential for remote work payroll processing as it formally outlines the employee's work location, hours, compensation, and compliance with relevant labor laws. This document ensures clear terms for payroll calculation, tax withholding, and benefits administration specific to remote employment arrangements. |

| 3 | Employee Personal Information Form | The Employee Personal Information Form is crucial for remote work payroll processing as it collects essential data such as social security numbers, tax withholding details, and banking information. Accurate completion of this form ensures compliance with legal payroll obligations and facilitates timely salary disbursements and tax reporting. |

| 4 | Bank Account Details Form | The Bank Account Details Form is essential for remote work payroll processing as it ensures accurate salary deposits directly into employees' accounts, reducing errors and processing delays. This document typically includes certified bank name, account number, routing number, and account holder's authorization, complying with legal payroll standards. |

| 5 | Tax Withholding Certificate (W-4, W-9, or country equivalent) | Employers must collect the appropriate tax withholding certificates, such as the W-4 for U.S. employees or the W-9 for independent contractors, to ensure accurate federal and state tax deductions during remote work payroll processing. These forms provide critical information on employee tax status and exemptions, helping to comply with tax regulations and avoid penalties. |

| 6 | Payroll Authorization Form | Payroll Authorization Forms are essential documents for remote work payroll processing, as they provide legal consent from employees to receive payments through specified channels and confirm their employment details. Properly executed authorization forms help ensure compliance with tax regulations, accurate wage disbursements, and secure handling of personal information in distributed workforce settings. |

| 7 | Timesheets | Accurate timesheets are essential documents for remote work payroll processing, capturing detailed hours worked to ensure proper calculation of wages and compliance with labor laws. Employers must collect approved electronic timesheets or digital time-tracking records from remote employees to validate attendance and support payroll disbursements. |

| 8 | Work Schedule Documentation | Accurate work schedule documentation, including timesheets or digital attendance records, is essential for remote work payroll processing to ensure compliance with labor laws and accurate wage calculation. Employers must maintain detailed records of employee hours, breaks, and overtime to support payroll accuracy and facilitate audits or dispute resolutions. |

| 9 | Residency Certificate (if applicable) | A Residency Certificate is essential for remote work payroll processing to verify an employee's tax residency status and ensure correct withholding tax rates are applied according to local tax laws. This document helps employers comply with international tax regulations and avoid double taxation issues by confirming the employee's jurisdiction of residence. |

| 10 | Direct Deposit Authorization Form | The Direct Deposit Authorization Form is essential for remote work payroll processing as it enables employers to securely transfer employees' salaries directly into their bank accounts, ensuring timely and accurate payments. This document typically includes employees' bank details, consent for electronic payments, and authorization signatures, which comply with payroll regulations and reduce the risk of payment errors. |

| 11 | Non-Disclosure Agreement (NDA) | A Non-Disclosure Agreement (NDA) is essential for remote work payroll processing to protect sensitive employee information and maintain confidentiality between employers and payroll service providers. This legally binding document ensures compliance with data privacy regulations by restricting unauthorized access and disclosure of payroll data. |

| 12 | Proof of Identification | Proof of identification documents such as government-issued passports, driver's licenses, or national ID cards are essential for remote work payroll processing to verify employee identity and comply with employment laws. These documents help prevent payroll fraud, ensure accurate tax reporting, and maintain compliance with labor regulations across different jurisdictions. |

| 13 | Social Security Number (or National ID equivalent) | Accurate payroll processing for remote work requires the employee's Social Security Number (SSN) or equivalent national identification to ensure compliance with tax reporting and benefits administration. This identifier verifies the worker's eligibility, facilitates proper tax withholding, and supports accurate government filings across jurisdictions. |

| 14 | Benefit Enrollment Forms | Benefit enrollment forms are essential documents for remote work payroll processing, ensuring accurate deductions and employer contributions for health insurance, retirement plans, and other employee benefits. Employers require completed forms to comply with legal regulations and maintain up-to-date records for tax reporting and payroll accuracy. |

| 15 | Expense Reimbursement Forms | Expense reimbursement forms are essential documents for remote work payroll processing as they provide detailed records of employee-incurred expenses eligible for reimbursement, ensuring compliance with tax regulations and company policies. Accurate submission and approval of these forms facilitate timely payroll adjustments and maintain transparent financial reporting. |

| 16 | Independent Contractor Agreement (if applicable) | An Independent Contractor Agreement is essential for remote work payroll processing, as it clearly defines the terms of services, payment structure, and independent status, ensuring compliance with tax and labor regulations. Including tax forms such as W-9 or W-8BEN alongside this agreement facilitates accurate reporting and withholding procedures for contractors. |

| 17 | Payroll Change Request Form | Payroll Change Request Form is essential for remote work payroll processing as it authorizes updates to employee compensation, tax withholdings, and direct deposit details, ensuring accurate and timely salary payments. This document also helps maintain compliance with labor laws and company policies by recording official payroll modifications securely. |

| 18 | Emergency Contact Information Form | The Emergency Contact Information Form is a critical document for remote work payroll processing, ensuring that employers can quickly reach designated individuals in case of urgent situations involving employees. Maintaining accurate and up-to-date emergency contacts supports compliance with workplace safety regulations and facilitates efficient human resource management. |

| 19 | Leave Request Forms | Leave request forms are essential documents in remote work payroll processing as they provide official records of employee absences, ensuring accurate calculation of paid and unpaid leave. These forms must include detailed information such as the employee's name, leave type, duration, and approval status to comply with labor laws and maintain payroll accuracy. |

| 20 | Local Labor Law Compliance Certificate (if required) | The Local Labor Law Compliance Certificate ensures that the remote work payroll processing adheres to regional employment regulations, verifying legal work status and tax obligations. Employers must obtain this certificate to avoid penalties and confirm compliance with jurisdiction-specific labor laws during payroll administration. |

Introduction to Legal Documents for Remote Work Payroll

Remote work payroll processing requires specific legal documents to ensure compliance with labor laws and accurate employee compensation. These documents provide a framework for verifying work hours, tax obligations, and payment methods.

Key legal documents include employment contracts outlining remote work agreements, payroll authorization forms, and tax withholding certificates such as W-4 or equivalent forms based on jurisdiction. Companies must also maintain records of work hours and timesheets to comply with wage and hour regulations. Proper documentation safeguards both employers and employees from potential legal disputes related to payroll.

Importance of Legal Compliance in Remote Payroll

Accurate legal documentation is crucial for remote work payroll processing to ensure compliance with labor laws and tax regulations. Essential documents include signed employment contracts, tax withholding forms such as W-4 or W-9, and time tracking records. Maintaining these records protects employers from legal disputes and penalties, facilitating smooth payroll management across different jurisdictions.

Employment Contracts and Remote Work Clauses

Efficient remote work payroll processing requires specific legal documentation to ensure compliance and accuracy. Employment contracts and remote work clauses are essential components in this process.

- Employment Contracts - These legally binding agreements define job roles, salaries, and payment terms critical for payroll calculation.

- Remote Work Clauses - Clauses specifying work location, hours, and equipment usage protect both employer and employee rights in remote setups.

- Tax and Compliance Documentation - Proper documentation ensures adherence to jurisdictional payroll taxes and labor laws affecting remote employees.

Remote Work Agreements and Policies

Remote work agreements are essential documents that define the terms and conditions of employment for remote employees, including work hours, responsibilities, and communication protocols. Payroll processing requires these agreements to ensure compliance with labor laws and tax regulations specific to remote work locations. Clear remote work policies help employers maintain accurate records and facilitate timely and accurate payroll management for off-site employees.

Payroll Authorization Forms

Payroll authorization forms are critical documents required for processing remote work payroll accurately and legally. These forms grant permission to handle payroll deductions and confirm employee details.

- Consent for Direct Deposit - Authorizes the company to deposit your salary directly into your chosen bank account.

- Tax Withholding Forms - Ensures correct tax deductions based on your declared status and exemptions.

- Employee Verification Form - Confirms identity and eligibility to work remotely, complying with labor regulations.

Properly completing and submitting payroll authorization forms helps streamline remote payroll operations and ensures legal compliance.

Tax Compliance and Withholding Documentation

Remote work payroll processing requires specific documentation to ensure tax compliance and accurate withholding. Properly managing these documents protects your business from legal and financial penalties.

- Employee Tax Forms - Forms such as W-4 for the U.S. or equivalent local tax declaration forms are essential for determining withholding amounts.

- State and Local Tax Registration - Employers must register with appropriate tax authorities in the employee's work location to comply with withholding obligations.

- Proof of Remote Work Location - Documentation verifying the employee's remote work address helps in applying the correct tax jurisdiction rules.

Timekeeping and Attendance Records

Accurate timekeeping and attendance records are essential for remote work payroll processing. These documents verify the hours worked and ensure compliance with labor laws.

You must maintain detailed timesheets or digital time-tracking reports. These records include clock-in and clock-out times, break periods, and total hours worked.

Data Privacy and Confidentiality Agreements

What documents are necessary for remote work payroll processing with a focus on data privacy and confidentiality agreements? Employers must secure signed confidentiality agreements to ensure protection of sensitive employee information. Data privacy policies specific to remote work environments are essential to comply with legal standards and safeguard personal data.

Recordkeeping and Document Retention Policies

| Document Type | Purpose | Retention Period | Key Considerations |

|---|---|---|---|

| Employee Payroll Records | Track wages, hours worked, and deductions for accurate payroll processing | Minimum 3 years as required by the Fair Labor Standards Act (FLSA) | Include time sheets, pay stubs, and wage calculation details in digital or physical formats |

| Tax Documents (W-4, I-9, etc.) | Verify employee eligibility and determine tax withholdings | At least 4 years after the tax year they relate to, per IRS regulations | Maintain compliant digital copies accessible for audits and federal reviews |

| Direct Deposit Authorization Forms | Authorize electronic payment transfers | Retain for the duration of employment plus 3 years | Ensure secure storage to protect sensitive banking information |

| Remote Work Agreements and Policies | Document employee remote work terms and compliance guidelines | Until termination of employment plus 3 to 5 years depending on jurisdiction | Include specific clauses related to payroll processing and data privacy compliance |

| Timekeeping and Attendance Reports | Support accurate calculation of hours worked, particularly for hourly employees | At least 3 years in accordance with labor laws | Use reliable digital systems with date-and-time stamps to prevent discrepancies |

Maintaining meticulous records and clearly defined document retention policies is essential to comply with legal payroll requirements for remote work. Your ability to access and safeguard these documents ensures smooth payroll processing and reduces risks associated with non-compliance.

What Documents are Necessary for Remote Work Payroll Processing? Infographic