Opening a trust account requires specific legal documents to ensure proper management and compliance. Key documents include the trust agreement or declaration of trust, which outlines the terms and conditions, along with identification documents for all trustees and beneficiaries. Financial institutions may also request a taxpayer identification number and proof of address to verify the legitimacy of the trust.

What Documents Are Needed for Opening a Trust Account?

| Number | Name | Description |

|---|---|---|

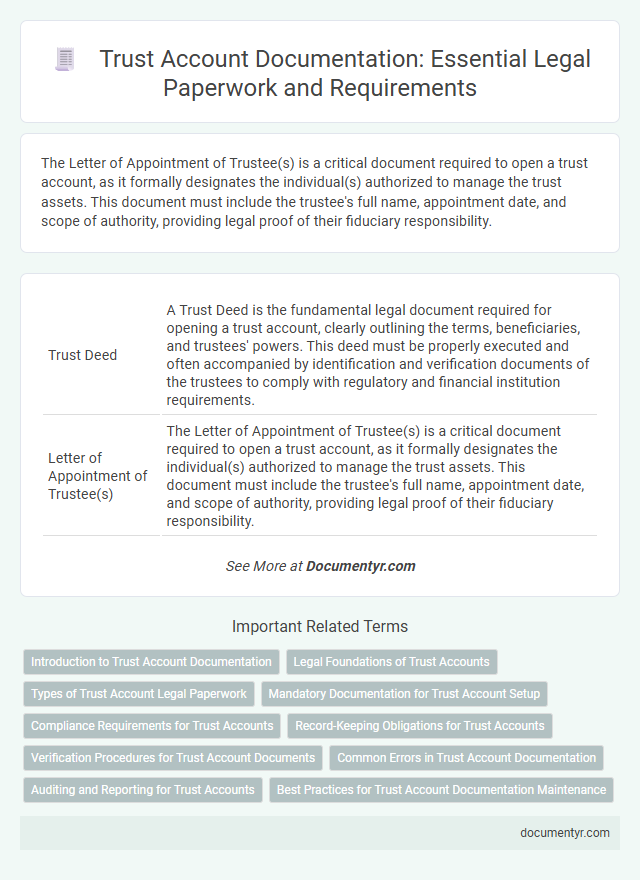

| 1 | Trust Deed | A Trust Deed is the fundamental legal document required for opening a trust account, clearly outlining the terms, beneficiaries, and trustees' powers. This deed must be properly executed and often accompanied by identification and verification documents of the trustees to comply with regulatory and financial institution requirements. |

| 2 | Letter of Appointment of Trustee(s) | The Letter of Appointment of Trustee(s) is a critical document required to open a trust account, as it formally designates the individual(s) authorized to manage the trust assets. This document must include the trustee's full name, appointment date, and scope of authority, providing legal proof of their fiduciary responsibility. |

| 3 | Identification Documents of Trustee(s) | Trustee(s) must provide valid government-issued identification documents such as a passport, driver's license, or national ID card to verify their identity when opening a trust account. These identification documents ensure compliance with anti-money laundering regulations and help establish the trustee's legal authority to manage the trust. |

| 4 | Identification Documents of Settlor | The settlor must provide valid government-issued identification documents such as a passport, driver's license, or national ID card to verify their identity when opening a trust account. These identification documents are critical for compliance with anti-money laundering (AML) regulations and to establish the settlor's legal authority over the trust assets. |

| 5 | Identification Documents of Beneficiaries | Identification documents required for opening a trust account commonly include government-issued photo IDs such as passports or driver's licenses to verify the beneficiaries' identities. Trust institutions may also request Social Security numbers or tax identification numbers to ensure compliance with regulatory and anti-money laundering requirements. |

| 6 | Tax Identification Number (TIN) | Opening a trust account requires a valid Tax Identification Number (TIN) to ensure compliance with tax reporting regulations and verify the trust's legal status. The TIN must be accompanied by trust formation documents such as the trust deed, identification of trustees, and sometimes a certification of trust to complete the account setup. |

| 7 | Proof of Address of Trustee(s) | Proof of address for trustee(s) typically includes recent utility bills, bank statements, or government-issued correspondence dated within the last three months to verify residency. These documents must display the trustee's full name and residential address to comply with legal and financial institution requirements for opening a trust account. |

| 8 | Proof of Address of Settlor | Proof of address of the settlor is a critical document required for opening a trust account, typically including recent utility bills, bank statements, or government-issued correspondence showing the settlor's residential address. This verification ensures compliance with anti-money laundering regulations and helps establish the identity and legitimacy of the settlor in trust account agreements. |

| 9 | Proof of Address of Beneficiaries | Proof of address for beneficiaries in opening a trust account typically requires government-issued documents such as utility bills, bank statements, or lease agreements dated within the last three months to validate residency. These documents must clearly display the beneficiary's name and residential address to comply with Know Your Customer (KYC) regulations and anti-money laundering (AML) policies. |

| 10 | Board Resolution (if trustee is a company/entity) | A Board Resolution is essential when opening a trust account if the trustee is a company or entity, as it authorizes specific individuals to act on behalf of the company in managing the trust. This document must be formally adopted by the company's board of directors, detailing the approval to open and operate the trust account, including authorized signatories and delegated powers. |

| 11 | Certificate of Incorporation (if corporate trustee/entity) | A Certificate of Incorporation is essential for opening a trust account when a corporate trustee or entity is involved, as it legally verifies the entity's existence and authority to act as trustee. This document confirms the company's registration details and legitimacy, which financial institutions require to comply with regulatory and anti-money laundering standards. |

| 12 | Memorandum and Articles of Association (corporate trustee/entity) | The Memorandum and Articles of Association are essential documents for opening a trust account under a corporate trustee, as they establish the entity's legal existence, governance framework, and authority to act as trustee. Financial institutions require certified copies of these documents to verify the corporate entity's structure, powers, and compliance with regulatory requirements before approving the trust account. |

| 13 | Bank Account Opening Forms | Bank account opening forms for a trust account typically require the trust deed, identification documents for trustees and beneficiaries, and a tax identification number. These forms collect detailed information about the trust's legal structure, authorized signatories, and the trust's purpose to ensure compliance with banking regulations. |

| 14 | FATCA/CRS Declaration Forms | Opening a trust account requires submitting FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard) declaration forms to comply with international tax reporting and transparency regulations. These forms are critical for identifying the tax residency and status of the trust and its beneficiaries to ensure compliance with anti-money laundering and tax evasion prevention laws. |

| 15 | Signature Specimen Cards | Signature specimen cards are essential documents for opening a trust account, providing verified signatures of authorized signatories to prevent fraud and ensure legal compliance. These cards must be accurately completed and notarized, serving as a reference for validating all future transactions involving the trust account. |

| 16 | Source of Funds Declaration | Opening a trust account requires a Source of Funds Declaration to verify the legitimacy and origin of the deposited assets, ensuring compliance with anti-money laundering regulations. This declaration must detail the exact provenance of the funds, including supporting financial documents such as bank statements, sale agreements, or inheritance records. |

| 17 | Purpose of Account Letter | The Purpose of Account Letter is a critical document for opening a trust account, detailing the specific intent and objectives of the trust to ensure compliance with legal and financial regulations. This letter assists banks and fiduciaries in verifying the legitimacy of transactions and maintaining transparency throughout the account's operation. |

| 18 | Professional Reference Letter (if required by bank) | A Professional Reference Letter may be required by banks to verify the trust account holder's identity, financial history, and credibility, ensuring compliance with regulatory standards. This letter typically comes from a qualified professional such as an attorney, accountant, or financial advisor familiar with the trust's activities and reputation. |

| 19 | Minutes of Trust Meeting (if applicable) | Minutes of Trust Meeting are essential documents that record the decisions and authorizations made by trustees during the formation of a trust account, providing legal evidence of their consent and operational directives. These minutes typically include details such as the appointment of trustees, approval of the trust agreement, and authorization to open and manage the trust account with specified financial institutions. |

Introduction to Trust Account Documentation

| Document Type | Description | Purpose |

|---|---|---|

| Trust Agreement | A legal document establishing the trust, outlining its terms, trustee powers, and beneficiary rights. | Defines the structure and operations of the trust account. |

| Trustee Identification | Government-issued ID such as passport or driver's license for all trustees involved. | Verifies identity to comply with anti-money laundering regulations and bank requirements. |

| Tax Identification Number (TIN) | IRS-issued Employer Identification Number (EIN) or Social Security Number (SSN) for the trust. | Required for tax reporting and identification of the trust during financial transactions. |

| Trustee Resolution or Authorization | Document that authorizes specific individuals to act on behalf of the trust in opening and managing the account. | Confirms authorized signatories and decision-makers for the trust account. |

| Certificate of Trust | A summarized document confirming the trust's existence without disclosing sensitive details. | Serves as proof of the trust's validity when full trust agreement disclosure is not required. |

| Beneficiary Information | Details of all beneficiaries including names and identification documents. | Ensures proper account management aligned with beneficiary rights and legal compliance. |

Legal Foundations of Trust Accounts

Opening a trust account requires specific legal documentation to ensure compliance with fiduciary duties and regulatory standards. These documents establish the legal foundation and authority for managing the trust assets appropriately.

Key documents include the trust agreement, which outlines the terms, beneficiaries, and trustee powers, and identification documents verifying the trustee's identity. A certification of trust may also be required to confirm the trust's existence without revealing sensitive details. Depending on jurisdiction, additional notarization or court approval might be necessary to validate the trust account setup legally.

Types of Trust Account Legal Paperwork

Opening a trust account requires specific legal documents to ensure proper management and compliance. Essential paperwork includes the trust agreement, which outlines the terms and conditions set by the grantor, and identification documents for the trustee and beneficiaries. Additional documents may involve tax identification numbers, letters of instruction, and proof of the trust's validity depending on jurisdictional requirements.

Mandatory Documentation for Trust Account Setup

What documents are needed for opening a trust account? Mandatory documentation for trust account setup includes a valid government-issued ID, trust agreement, and proof of address. You must also provide the trust's Tax Identification Number (TIN) and any relevant court orders if applicable.

Compliance Requirements for Trust Accounts

Opening a trust account requires specific documentation to ensure compliance with legal and regulatory standards. Meeting these compliance requirements protects your interests and maintains the integrity of the trust account.

- Identification Documents - Valid government-issued IDs such as a passport or driver's license are necessary to verify the identity of trustees and beneficiaries.

- Trust Agreement - A certified copy of the trust deed outlining the terms, trustees, and beneficiaries is mandatory to establish the trust's legal framework.

- Tax Identification Numbers - Providing the trust's Employer Identification Number (EIN) or Tax Identification Number ensures compliance with tax reporting obligations.

Record-Keeping Obligations for Trust Accounts

Opening a trust account requires specific documents to ensure compliance with legal and fiduciary duties. Proper record-keeping is essential to maintain transparency and accountability in managing the trust.

- Identification Documents - Valid government-issued IDs for all trustees and beneficiaries verify identities involved in the trust.

- Trust Agreement - The original or certified copy of the trust deed outlines the terms, beneficiaries, and trustee powers.

- Record-Keeping Obligations - Detailed financial records, including deposits, withdrawals, and distributions, are required to track all trust account activity accurately.

Your adherence to these document requirements supports legal integrity and effective trust management.

Verification Procedures for Trust Account Documents

Opening a trust account requires a thorough verification of specific legal documents to ensure compliance with regulatory standards. Your trust account documents must be authenticated and accurately reflect the trust's terms and authorized parties.

- Trust Agreement - This foundational document outlines the terms, trustee powers, and beneficiaries, serving as the primary reference for account setup.

- Identification Documents - Valid government-issued IDs for trustees verify their identity and prevent fraud during account opening.

- IRS Tax Identification Number - The EIN for the trust confirms its tax status and is mandatory for financial transactions and reporting.

Common Errors in Trust Account Documentation

Opening a trust account requires specific documentation, including the trust agreement, identification of the trustee, and a taxpayer identification number. These documents establish the legal framework and verify the parties involved in managing the trust.

Common errors in trust account documentation include incomplete trust agreements and mismatched identification information. Such mistakes can delay account opening and cause compliance issues with financial institutions and regulatory bodies.

Auditing and Reporting for Trust Accounts

Opening a trust account requires specific documentation to ensure compliance with legal and regulatory standards. Essential documents include trust deeds, identity verification for trustees and beneficiaries, and a completed account application form. Accurate auditing and reporting depend on maintaining these records to provide transparency and accountability for all trust transactions.

What Documents Are Needed for Opening a Trust Account? Infographic