Opening a business bank account requires essential documents including a government-issued identification, business formation paperwork such as Articles of Incorporation or a partnership agreement, and an Employer Identification Number (EIN) issued by the IRS. Banks often request proof of address and a business license or permit relevant to the industry. Ensuring all these documents are accurate and up-to-date facilitates a smooth account setup process and legal compliance.

What Documents Are Necessary for Opening a Business Bank Account?

| Number | Name | Description |

|---|---|---|

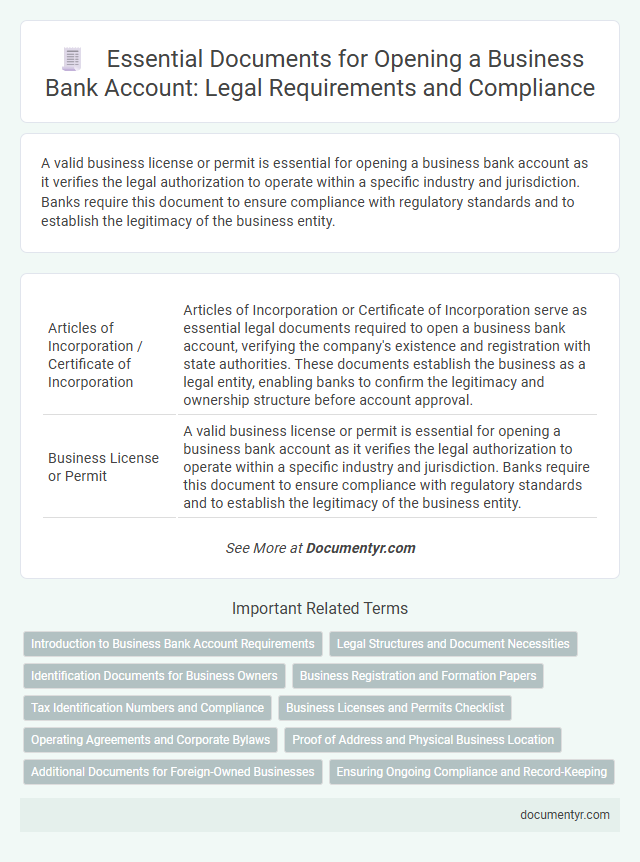

| 1 | Articles of Incorporation / Certificate of Incorporation | Articles of Incorporation or Certificate of Incorporation serve as essential legal documents required to open a business bank account, verifying the company's existence and registration with state authorities. These documents establish the business as a legal entity, enabling banks to confirm the legitimacy and ownership structure before account approval. |

| 2 | Business License or Permit | A valid business license or permit is essential for opening a business bank account as it verifies the legal authorization to operate within a specific industry and jurisdiction. Banks require this document to ensure compliance with regulatory standards and to establish the legitimacy of the business entity. |

| 3 | Employer Identification Number (EIN) / Federal Tax ID | An Employer Identification Number (EIN), also known as a Federal Tax ID, is a critical document required for opening a business bank account as it uniquely identifies the business entity for tax purposes. Banks mandate the EIN to verify the legitimacy of the business and ensure compliance with federal tax regulations. |

| 4 | Partnership Agreement (if applicable) | A partnership agreement is essential for opening a business bank account when the business structure is a partnership, as it outlines the roles, responsibilities, and ownership percentages of each partner. Banks require this document to verify the legitimacy of the partnership and ensure all parties involved agree to the account terms and financial obligations. |

| 5 | Operating Agreement (for LLCs) | An Operating Agreement is essential for opening a business bank account for LLCs, as it outlines the ownership structure, management responsibilities, and operational procedures required by banks to verify the legitimacy of the business. This document provides proof of authority for signatories and helps prevent internal disputes, ensuring smooth banking transactions and compliance with financial regulations. |

| 6 | Corporate Bylaws (for corporations) | Corporate bylaws are essential documents required for opening a business bank account as they establish the internal governance structure and authority of a corporation, proving its legitimacy to financial institutions. Banks typically request certified copies of corporate bylaws to verify the company's operating procedures, the appointment of authorized signatories, and compliance with regulatory requirements. |

| 7 | Fictitious Business Name (DBA) Registration | Submitting a Fictitious Business Name (DBA) registration document is crucial when opening a business bank account to verify the legal name under which the company operates. Banks require this registration to ensure compliance with state laws and to validate the entity's authority to conduct business under the assumed name. |

| 8 | Board Resolution (authorizing account opening) | A board resolution authorizing the opening of a business bank account is essential to legally empower designated company officers to manage banking activities and sign related documents. This formal authorization, usually approved during a corporate meeting, must be presented to the bank alongside identification and incorporation documents to verify legitimacy and compliance. |

| 9 | Personal Identification (e.g., Passport, Driver’s License) | Personal identification documents such as a valid passport or driver's license are essential for opening a business bank account, as they verify the identity of the account holder and comply with regulatory requirements. Banks typically require these forms of ID to prevent fraud, ensure anti-money laundering compliance, and confirm legal authorization to operate the business. |

| 10 | Certificate of Good Standing (sometimes required) | A Certificate of Good Standing is often required to open a business bank account as it verifies that the company is legally registered and compliant with state regulations. This document demonstrates that the business is authorized to operate and has met all reporting and tax obligations. |

| 11 | Business Formation Documents (state filings) | Business formation documents, such as Articles of Incorporation, Certificates of Formation, or Certificates of Organization filed with the state, are essential for opening a business bank account as they verify the legal existence of the entity. These state filings confirm the business structure and legitimacy, providing banks with the necessary proof to establish the account in the company's name. |

| 12 | Ownership Agreements / Shareholder Agreements | Ownership agreements and shareholder agreements are essential documents for opening a business bank account as they clearly establish the legal structure and ownership distribution of the company. Banks require these agreements to verify authorized signatories, clarify decision-making authority, and ensure compliance with regulatory standards. |

| 13 | Organization’s Meeting Minutes (authorizing representatives) | Organization's meeting minutes are essential for opening a business bank account as they formally document the authorization of representatives who can act on behalf of the company. These minutes provide banks with verified proof of the decision-making process and empower designated individuals to manage financial transactions legally and transparently. |

| 14 | Tax Exemption Certificate (if applicable) | A Tax Exemption Certificate is necessary for opening a business bank account if the business qualifies for tax-exempt status, as it verifies eligibility and ensures proper handling of tax-related transactions. Banks require this document alongside standard identification and business formation papers to comply with regulatory and financial reporting standards. |

Introduction to Business Bank Account Requirements

Opening a business bank account requires specific documents to verify the identity and legitimacy of the business. Commonly requested items include the business formation documents, employer identification number (EIN), and personal identification of the business owner. Understanding these requirements ensures a smooth account setup process for your business.

Legal Structures and Document Necessities

Opening a business bank account requires specific documentation that varies according to the legal structure of the business. Providing the correct legal documents ensures compliance with banking regulations and facilitates smooth account management.

- Sole Proprietorship - Typically needs a government-issued ID, Social Security number, and a business license or DBA (Doing Business As) certificate.

- Partnership - Requires a partnership agreement, federal EIN (Employer Identification Number), and personal identification from all partners.

- Corporation and LLC - Must submit articles of incorporation or organization, bylaws or operating agreement, and an EIN issued by the IRS.

Proper documentation aligned with the business's legal structure prevents account opening delays and legal issues.

Identification Documents for Business Owners

What identification documents are necessary for business owners to open a business bank account? Banks require valid government-issued photo identification such as a passport or driver's license. Your Social Security Number or Tax Identification Number is also essential for verification purposes.

Are there additional identification documents needed besides your personal ID? Yes, banks often ask for documentation proving your business's legal status, such as Articles of Incorporation or a DBA certificate. These confirm ownership and the legitimacy of your business entity.

How does the bank verify your identity when opening a business account? Banks cross-check your ID with federal databases to comply with anti-money laundering regulations. This process ensures that the business owner is legally authorized to operate the account.

Business Registration and Formation Papers

Opening a business bank account requires specific legal documents to verify your company's legitimacy. Business registration and formation papers are essential components of this verification process.

- Articles of Incorporation - This document proves your business is officially registered as a corporation with the state.

- Operating Agreement or Bylaws - These papers outline the company's governance and operational structure, necessary for banks to understand your business entity.

- Business License - A valid license confirms that your business is authorized to operate legally within a specific jurisdiction.

Tax Identification Numbers and Compliance

Opening a business bank account requires specific documentation to ensure legal compliance and proper tax identification. Tax Identification Numbers (TINs) are crucial for linking your business to tax authorities and verifying your legitimacy.

- Tax Identification Number (TIN) - A valid TIN must be provided to confirm the business's registered tax status with government agencies.

- Business Registration Documents - Official paperwork such as articles of incorporation or business licenses verifies the entity's legal existence.

- Personal Identification - Government-issued photo ID of authorized signatories is necessary for compliance with anti-money laundering regulations.

Business Licenses and Permits Checklist

Opening a business bank account requires submitting specific documents to verify your business's legitimacy. Business licenses and permits are essential components of this documentation, proving your company complies with local, state, and federal regulations.

A comprehensive business licenses and permits checklist includes your general business license, zoning permits, health permits, and any industry-specific licenses necessary for your operations. You must gather all relevant permits that apply to your business type and location to avoid delays. Ensuring you have these documents ready simplifies the bank account opening process and establishes credibility with the financial institution.

Operating Agreements and Corporate Bylaws

Opening a business bank account requires specific documents to verify your company's legal status and operational structure. Two crucial documents often requested are the Operating Agreement for LLCs and Corporate Bylaws for corporations.

The Operating Agreement outlines the management and ownership arrangements, providing clear guidelines for business operations. Corporate Bylaws establish rules for governance, defining roles, responsibilities, and decision-making processes within the corporation.

Proof of Address and Physical Business Location

When opening a business bank account, providing proof of address is essential to verify the legitimacy of the business owner and compliance with banking regulations. Acceptable documents for proof of address include utility bills, lease agreements, or bank statements dated within the last three months. A physical business location must also be documented, often through a commercial lease, property deed, or a certificate of occupancy, ensuring the business operates from a verifiable address.

Additional Documents for Foreign-Owned Businesses

Opening a business bank account requires essential documents such as your business license, Employer Identification Number (EIN), and formation documents like Articles of Incorporation or Operating Agreement. These establish your company's legal identity and tax status.

For foreign-owned businesses, banks often require additional documentation including a Certificate of Good Standing from the jurisdiction of incorporation and valid identification for all beneficial owners. Proof of a U.S. address and completed IRS Form W-8BEN may also be necessary to comply with regulatory standards.

What Documents Are Necessary for Opening a Business Bank Account? Infographic