Independent contractors need to provide a completed W-9 form to verify their taxpayer identification information for payment processing. A signed contract outlining the scope of work, payment terms, and deadlines is essential to ensure clear expectations and legal compliance. Invoices must be submitted regularly, containing detailed descriptions of services rendered, dates, and amounts due to facilitate timely payment.

What Documents Does an Independent Contractor Need for Payment Setup?

| Number | Name | Description |

|---|---|---|

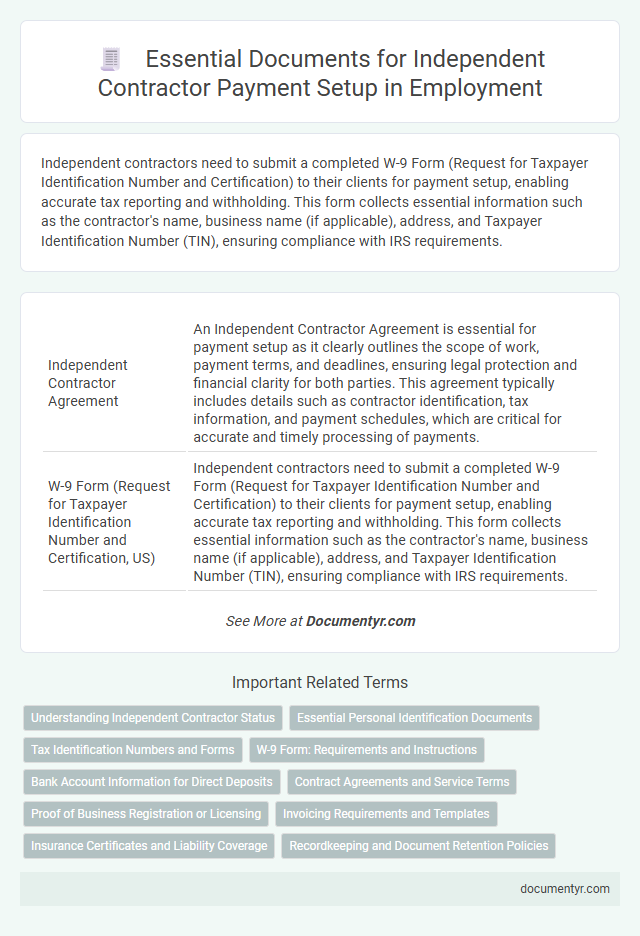

| 1 | Independent Contractor Agreement | An Independent Contractor Agreement is essential for payment setup as it clearly outlines the scope of work, payment terms, and deadlines, ensuring legal protection and financial clarity for both parties. This agreement typically includes details such as contractor identification, tax information, and payment schedules, which are critical for accurate and timely processing of payments. |

| 2 | W-9 Form (Request for Taxpayer Identification Number and Certification, US) | Independent contractors need to submit a completed W-9 Form (Request for Taxpayer Identification Number and Certification) to their clients for payment setup, enabling accurate tax reporting and withholding. This form collects essential information such as the contractor's name, business name (if applicable), address, and Taxpayer Identification Number (TIN), ensuring compliance with IRS requirements. |

| 3 | Invoice | An independent contractor needs to provide a detailed invoice to set up payment, including their name, contact information, payment terms, description of services rendered, hours worked, rate, and total amount due. Accurate and professional invoicing ensures timely payment processing and compliance with accounting standards. |

| 4 | Proof of Identity (Government-issued ID) | An independent contractor must provide a government-issued ID such as a driver's license or passport to verify their identity during the payment setup process. This crucial documentation ensures compliance with tax regulations and enables accurate payroll processing. |

| 5 | Banking Information (Direct Deposit Authorization or Bank Details) | Independent contractors must provide accurate banking information, such as a direct deposit authorization form or detailed bank account information, to ensure seamless payment processing. This typically includes the bank name, account number, routing number, and account type to enable secure and timely transfers. |

| 6 | Business License (if applicable) | An independent contractor may need to provide a valid business license to verify legal authorization for operation when setting up payment, especially if required by local or state regulations. This document ensures compliance with tax and regulatory authorities and facilitates smooth processing of payments from clients. |

| 7 | Proof of Address | Independent contractors must provide valid proof of address documents such as utility bills, bank statements, or government-issued correspondence dated within the last three months to verify their residency for payment setup. These documents ensure accurate billing and compliance with tax and legal requirements during contract processing. |

| 8 | Tax Registration Certificate (if required) | An independent contractor must provide a Tax Registration Certificate when required by local tax authorities to verify tax compliance and enable proper payment processing. This document ensures that the contractor is officially registered for tax purposes, facilitating accurate withholding and reporting of income. |

| 9 | Portfolio or Work Samples (if requested) | Independent contractors may be required to submit a portfolio or work samples showcasing relevant skills and previous projects to verify expertise and support payment setup. These documents help clients assess the contractor's qualifications and ensure alignment with project requirements before processing payments. |

| 10 | Purchase Order (if provided by client) | An independent contractor must provide a Purchase Order (PO) if required by the client to initiate payment setup, ensuring clear authorization and specification of services rendered. This document facilitates accurate invoicing and expeditious payment processing by detailing agreed-upon terms, quantities, and costs. |

| 11 | Insurance Certificate (if required) | An independent contractor may need to provide a Certificate of Insurance to verify liability coverage and protect both parties during the payment setup process. This document ensures compliance with client requirements and mitigates potential financial risks associated with the contracted work. |

| 12 | Non-Disclosure Agreement (if required) | Independent contractors may need to provide a signed Non-Disclosure Agreement (NDA) to ensure confidentiality of sensitive company information before payment setup. This document legally binds the contractor to protect proprietary data, trade secrets, and client information during and after the project duration. |

| 13 | Statement of Work (SOW) | An independent contractor needs a detailed Statement of Work (SOW) outlining project scope, deliverables, timelines, and payment terms to ensure clear agreement and smooth payment setup. The SOW serves as a critical contractual document that protects both parties by defining responsibilities and expectations in the employment relationship. |

Understanding Independent Contractor Status

Understanding independent contractor status is crucial for proper payment setup in employment. Accurate documentation ensures compliance with tax laws and smooth financial transactions.

- W-9 Form - Provides your Taxpayer Identification Number to the payer for IRS reporting purposes.

- Contract or Agreement - Details the scope of work and terms between you and the hiring party.

- Invoice - Serves as a formal request for payment, outlining services rendered and amounts due.

Essential Personal Identification Documents

Independent contractors must provide essential personal identification documents to establish payment setup efficiently. These documents verify identity and ensure compliance with payment processing requirements.

Key identification documents include a government-issued photo ID such as a driver's license or passport. Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) is also necessary for tax reporting purposes.

Tax Identification Numbers and Forms

Setting up payment as an independent contractor requires specific documentation to ensure proper tax reporting. Tax Identification Numbers and relevant forms are essential for accurate payment processing and compliance.

- Tax Identification Number (TIN) - The TIN, such as a Social Security Number (SSN) or Employer Identification Number (EIN), is necessary for tax reporting and payment tracking.

- Form W-9 - This form collects your TIN and certifies your taxpayer status to the payer for accurate tax withholding and reporting.

- Form 1099-NEC - Used by clients to report payments made to independent contractors to the IRS, ensuring correct income documentation.

W-9 Form: Requirements and Instructions

Setting up payment as an independent contractor requires submitting specific documents to ensure compliance and timely processing. One essential document is the W-9 form, which verifies your taxpayer identification information.

The W-9 form requires your name, business name (if applicable), address, and Taxpayer Identification Number (TIN), such as a Social Security Number or Employer Identification Number. You must complete the form accurately to avoid payment delays or reporting issues. The completed W-9 should be submitted to the company or client requesting payment setup, not the IRS.

Bank Account Information for Direct Deposits

Independent contractors need to provide accurate bank account information to set up direct deposit payments efficiently. Essential details include the bank name, routing number, account number, and account type (checking or savings). This information ensures timely and secure transfer of funds directly into the contractor's bank account.

Contract Agreements and Service Terms

| Document Type | Purpose | Key Details |

|---|---|---|

| Contract Agreement | Defines the working relationship and Payment terms |

|

| Service Terms | Details responsibilities and expectations during engagement |

|

Proof of Business Registration or Licensing

Proof of business registration or licensing is essential for independent contractors to establish legitimacy when setting up payment. This documentation verifies that your business operates legally and complies with local regulations. Providing these documents ensures smoother payment processing and builds trust with clients.

Invoicing Requirements and Templates

What documents are essential for an independent contractor to set up payment? Proper invoicing is crucial to ensure timely and accurate payments. Your invoice should include detailed information such as your business name, contact details, payment terms, and a clear description of services rendered.

How can invoicing templates simplify the payment process for independent contractors? Using standardized templates helps maintain consistency and reduces errors in billing. Templates often feature essential fields like invoice number, date, itemized charges, and total amount due, streamlining communication with clients.

Insurance Certificates and Liability Coverage

Independent contractors must provide specific documents to complete payment setup, ensuring compliance and protection. Insurance certificates and liability coverage are essential components of these required documents.

- Insurance Certificates - Proof of commercial general liability insurance validates coverage against potential claims related to your work.

- Liability Coverage - Adequate liability insurance protects both the contractor and client from financial losses arising from damages or injuries.

- Document Verification - Businesses verify the authenticity of insurance policies to mitigate risks before processing payments.

Providing accurate insurance certificates and liability coverage documentation facilitates smooth payment processing for independent contractors.

What Documents Does an Independent Contractor Need for Payment Setup? Infographic