Background checks in financial sector jobs typically require documents such as a government-issued ID, proof of education, and employment history records to verify credentials and experience. Candidates may also need to provide authorization forms for credit checks and criminal background screenings to ensure compliance with industry regulations. Accurate documentation helps employers assess trustworthiness and reduce risks associated with financial responsibilities.

What Documents Are Necessary for Background Checks in Financial Sector Jobs?

| Number | Name | Description |

|---|---|---|

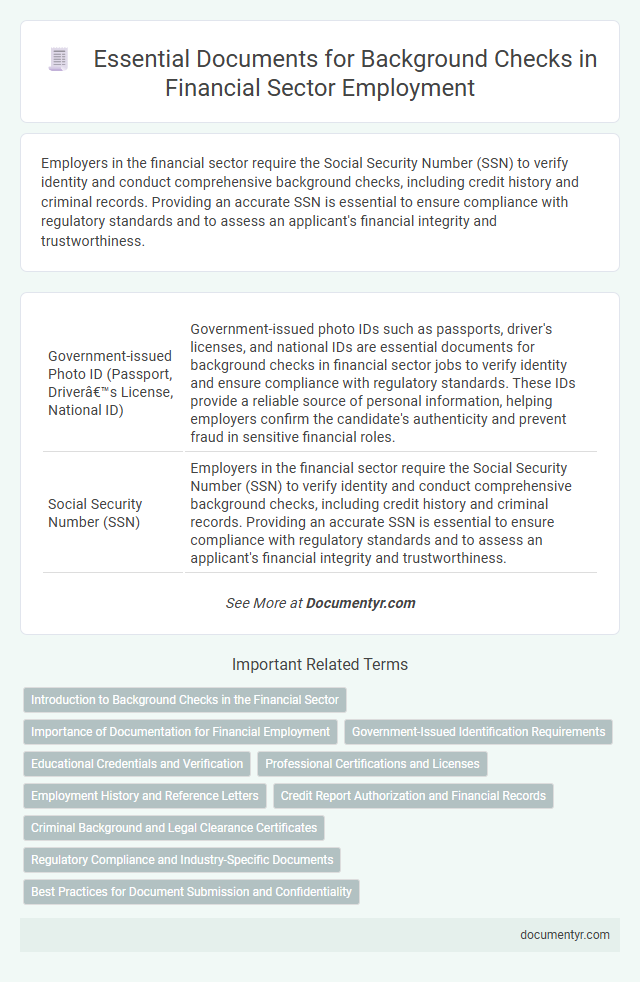

| 1 | Government-issued Photo ID (Passport, Driver’s License, National ID) | Government-issued photo IDs such as passports, driver's licenses, and national IDs are essential documents for background checks in financial sector jobs to verify identity and ensure compliance with regulatory standards. These IDs provide a reliable source of personal information, helping employers confirm the candidate's authenticity and prevent fraud in sensitive financial roles. |

| 2 | Social Security Number (SSN) | Employers in the financial sector require the Social Security Number (SSN) to verify identity and conduct comprehensive background checks, including credit history and criminal records. Providing an accurate SSN is essential to ensure compliance with regulatory standards and to assess an applicant's financial integrity and trustworthiness. |

| 3 | Employment Verification Letters | Employment verification letters are essential documents in background checks for financial sector jobs, confirming the candidate's work history, job titles, and dates of employment to ensure accuracy and integrity. These letters help employers validate claims, assess reliability, and comply with regulatory standards critical to maintaining trust in financial services. |

| 4 | Previous Employer Reference Letters | Previous employer reference letters are crucial documents in background checks for financial sector jobs, providing verified insights into a candidate's work ethic, reliability, and professional conduct. These letters help employers assess the applicant's past job performance and integrity, ensuring compliance with stringent financial industry regulations. |

| 5 | Academic Transcripts and Degree Certificates | Academic transcripts and degree certificates are essential documents for background checks in financial sector jobs, verifying educational qualifications and ensuring candidate credibility. Employers rely on these authenticated records to confirm the legitimacy of degrees and assess relevant academic performance. |

| 6 | Professional Licenses or Certifications (FINRA, CFA, CPA, etc.) | Professional licenses and certifications such as FINRA registrations, CFA charters, and CPA licenses are essential documents for background checks in financial sector jobs, verifying candidates' qualifications and regulatory compliance. Employers require these credentials to confirm the applicant's expertise, ethical standards, and eligibility to perform specific financial roles, ensuring trustworthiness and industry adherence. |

| 7 | Credit Report Authorization Form | Credit report authorization forms are essential documents in background checks for financial sector jobs, granting employers legal permission to access an applicant's credit history, which helps assess financial responsibility and integrity. This form ensures compliance with the Fair Credit Reporting Act (FCRA) and protects applicant privacy while enabling thorough evaluation. |

| 8 | Criminal Background Check Consent Form | A Criminal Background Check Consent Form is essential in financial sector employment, authorizing employers to verify an applicant's criminal history in compliance with regulatory standards like the Fair Credit Reporting Act (FCRA). This document ensures transparency and legal adherence, enabling organizations to assess risk and maintain trustworthiness in sensitive financial roles. |

| 9 | Proof of Address (Utility Bill, Lease Agreement) | Proof of address documents such as utility bills and lease agreements are essential for background checks in financial sector jobs to verify the candidate's residential information accurately. These documents help employers comply with regulatory requirements and prevent identity fraud by confirming the applicant's current living address. |

| 10 | Military Service Records (if applicable) | Military service records are essential for background checks in financial sector jobs when applicants have a military history, as these documents verify service dates, discharge status, and any security clearances held. Accurate evaluation of military records helps employers assess character, reliability, and suitability for sensitive financial roles. |

| 11 | Work Visa or Green Card (for non-citizens) | Non-citizens applying for financial sector jobs must provide valid work visas or green cards as essential documents for background checks to verify legal employment eligibility. These documents ensure compliance with immigration laws and confirm the candidate's authorization to work in the United States. |

| 12 | OFAC/Sanctions List Declarations | Background checks for financial sector jobs require OFAC/Sanctions List Declarations to ensure candidates are not listed on terrorist, sanctioned, or restricted parties' databases maintained by the Office of Foreign Assets Control. Employers must verify applicants against these lists to comply with federal regulations and mitigate risks associated with money laundering, fraud, and financial crimes. |

| 13 | Self-Disclosure Forms (criminal, civil, regulatory history) | Self-disclosure forms in financial sector jobs require candidates to reveal any criminal, civil, or regulatory history, enhancing transparency during background checks. These documents help employers assess potential risks and compliance with industry regulations such as FINRA and SEC standards. |

| 14 | Regulatory Filings (U4, U5 for FINRA roles) | Regulatory filings such as Form U4, which details an individual's employment history and disclosure information, and Form U5, documenting termination reasons, are essential for background checks in FINRA-regulated financial sector jobs. These documents provide critical insights into an applicant's professional conduct and compliance record, ensuring adherence to industry regulations and enhancing risk management in hiring decisions. |

| 15 | Bankruptcy Records (if applicable) | Bankruptcy records are essential documents in background checks for financial sector jobs, offering critical insight into an applicant's financial responsibility and stability. Employers review these records to assess risk factors and ensure compliance with regulatory standards. |

| 16 | Drug Screening Authorization | Drug screening authorization is a mandatory document for background checks in financial sector jobs, ensuring compliance with industry regulations and workplace safety standards. Employers require signed consent forms to conduct comprehensive drug tests, protecting sensitive financial environments from potential risks associated with substance abuse. |

| 17 | Fingerprint Card (for certain jurisdictions/roles) | A Fingerprint Card is often required for background checks in financial sector jobs, especially in jurisdictions with stringent regulatory requirements such as the SEC or FINRA. This document facilitates a comprehensive criminal history check by authorized agencies, ensuring candidates meet industry standards for trust and security. |

Introduction to Background Checks in the Financial Sector

Background checks in the financial sector are essential for ensuring trust and compliance within the industry. These checks verify the integrity and qualifications of potential employees, protecting both the organization and its clients.

- Identity Verification - Documents like government-issued IDs and passports confirm your legal identity and eligibility to work.

- Employment History - Past job records and references validate your professional experience and reliability.

- Criminal Record Check - Background screening includes reviewing criminal history to assess risk and maintain regulatory compliance.

Importance of Documentation for Financial Employment

Background checks in financial sector jobs require crucial documentation to verify an applicant's identity, employment history, and criminal record. Key documents include government-issued identification, proof of past employment, educational certificates, and credit reports. Proper documentation ensures regulatory compliance, protects sensitive financial information, and maintains trust within the industry.

Government-Issued Identification Requirements

Government-issued identification is crucial for background checks in financial sector employment to verify identity and ensure security compliance. Your identity proof must meet strict regulatory standards to pass these screening processes.

- Valid Passport - A current passport serves as an internationally recognized proof of identity and citizenship.

- Driver's License - A government-issued driver's license confirms your identity and address within the issuing state.

- State Identification Card - State IDs provide an alternative identity verification for individuals without a driver's license.

Educational Credentials and Verification

Educational credentials are essential documents for background checks in financial sector jobs. Employers verify your degrees and certifications to ensure authenticity and relevance to the position.

Verification involves contacting issuing institutions to confirm your academic records and qualifications. Transcripts, diplomas, and professional certifications are commonly reviewed. Accurate educational verification helps maintain compliance and trust within financial organizations.

Professional Certifications and Licenses

Background checks in financial sector jobs rigorously verify professional certifications and licenses to ensure candidate credibility. Accurate documentation of certifications like CFA, CPA, or FINRA licenses is essential for employment consideration.

You must provide valid and current copies of all relevant professional credentials during the screening process. These documents confirm your qualifications and compliance with industry regulatory standards.

Employment History and Reference Letters

Employment history and reference letters are essential documents for background checks in financial sector jobs. These documents verify a candidate's professional experience and reliability.

- Employment History - Detailed records of previous job titles, durations, and responsibilities confirm the candidate's professional background.

- Reference Letters - Written endorsements from past employers or colleagues validate work ethic and trustworthiness.

- Verification Process - Employers cross-check employment history and reference letters with listed contacts to ensure authenticity.

Accurate employment history and credible reference letters significantly strengthen a candidate's background check in the financial industry.

Credit Report Authorization and Financial Records

Credit report authorization is essential for background checks in financial sector jobs, allowing employers to access your financial history. Financial records, including bank statements and investment portfolios, provide insight into your fiscal responsibility and stability. These documents help verify your trustworthiness and suitability for roles involving financial management.

Criminal Background and Legal Clearance Certificates

Criminal background checks are a critical part of the hiring process in financial sector jobs, ensuring candidates have no history of fraud, theft, or other financial crimes. Employers require official criminal records from authorized law enforcement agencies to verify applicant integrity.

Legal clearance certificates confirm that candidates meet regulatory and compliance standards essential for financial roles. These documents often include certificates of good conduct or court clearance papers to validate the candidate's eligibility for employment.

Regulatory Compliance and Industry-Specific Documents

| Document Type | Purpose | Regulatory Reference | Industry-Specific Requirement |

|---|---|---|---|

| Government-issued ID (Passport, Driver's License) | Verify identity and legal authorization to work | USA PATRIOT Act compliance | Must be valid and unexpired for financial institutions |

| Social Security Number (SSN) or Taxpayer Identification Number (TIN) | Confirm credit history, criminal records, and employment history | Fair Credit Reporting Act (FCRA) | Essential for credit and criminal background checks in finance roles |

| Professional Licenses or Certifications | Validate qualifications such as Series 7, CFA, CPA, or FINRA registration | Financial Industry Regulatory Authority (FINRA) guidelines | Mandatory for roles involving financial advising, trading, or auditing |

| Employment History and References | Confirm previous work experience and performance | Industry best practices for due diligence | Focus on roles relevant to fiduciary responsibilities and client trust |

| Criminal Background Check Authorization Form | Obtain legal permission to perform background checks | Fair Credit Reporting Act (FCRA) | Required in nearly all financial sector job applications |

| Credit Reports | Assess financial responsibility and risk factors | Fair Credit Reporting Act (FCRA), Dodd-Frank Act | Critical for positions managing client funds or sensitive investments |

| Education Verification Documents | Confirm academic credentials relevant to financial positions | Industry standards for compliance and qualification validation | Often required for roles requiring degrees in finance, economics, or law |

Your compliance with these document requirements ensures adherence to regulatory standards and safeguards the integrity of the financial sector hiring process.

What Documents Are Necessary for Background Checks in Financial Sector Jobs? Infographic