Employees must provide essential documents such as a valid government-issued ID, Social Security card, and proof of residency for benefits enrollment. Employers often require dependent documentation, including birth certificates or marriage certificates, to verify eligibility. Health insurance enrollment may also necessitate recent pay stubs and completed beneficiary forms.

What Documents are Necessary for Employee Benefits Enrollment?

| Number | Name | Description |

|---|---|---|

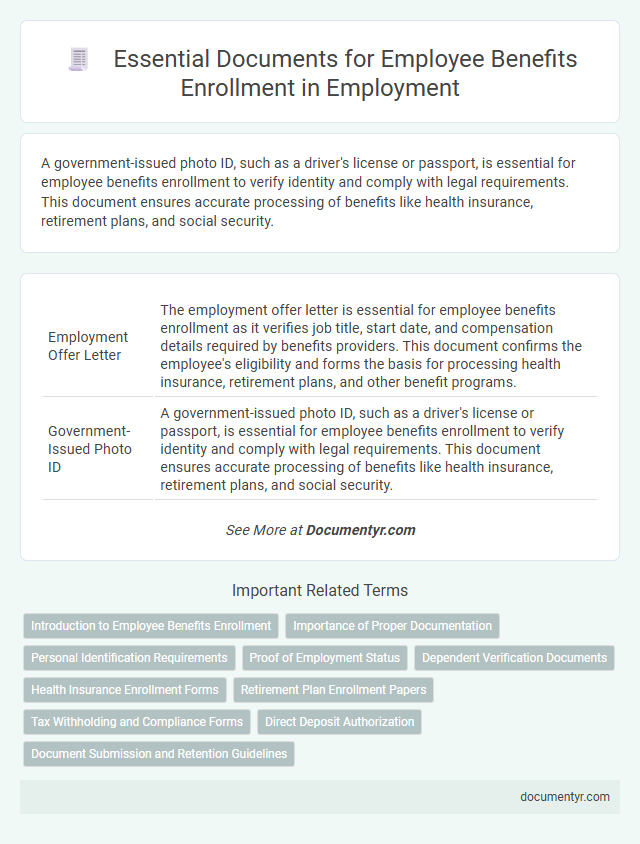

| 1 | Employment Offer Letter | The employment offer letter is essential for employee benefits enrollment as it verifies job title, start date, and compensation details required by benefits providers. This document confirms the employee's eligibility and forms the basis for processing health insurance, retirement plans, and other benefit programs. |

| 2 | Government-Issued Photo ID | A government-issued photo ID, such as a driver's license or passport, is essential for employee benefits enrollment to verify identity and comply with legal requirements. This document ensures accurate processing of benefits like health insurance, retirement plans, and social security. |

| 3 | Social Security Card | A Social Security Card is essential for employee benefits enrollment as it verifies the employee's identity and eligibility for federal programs. Employers require this document to accurately record Social Security numbers for tax withholding and benefits administration. |

| 4 | Birth Certificate | A birth certificate is a critical document required for employee benefits enrollment as it verifies the employee's identity and family relationships, which is essential for dependent coverage. Employers use the birth certificate to confirm eligibility for health insurance, life insurance, and other dependent benefits. |

| 5 | Proof of Address | Proof of address is a critical document for employee benefits enrollment, typically required to verify the employee's residency for eligibility and tax purposes. Common acceptable documents include utility bills, lease agreements, or government-issued correspondence dated within the last three months. |

| 6 | Marriage Certificate (if enrolling spouse) | A valid marriage certificate is essential for employee benefits enrollment when adding a spouse, serving as proof of legal marital status to ensure eligibility for spousal benefits. Employers typically require this document alongside identification and Social Security numbers to verify dependent coverage and process claims accurately. |

| 7 | Dependent Birth Certificates (if enrolling children) | Employee benefits enrollment requires dependent birth certificates to verify the eligibility of children for coverage, ensuring accurate dependent information and compliance with plan requirements. Providing official birth certificates expedites the enrollment process and prevents delays in benefit activation for eligible dependents. |

| 8 | Adoption Papers (if applicable) | Adoption papers, including legal adoption decrees or final orders, are essential documents for employee benefits enrollment to verify the legal status of the adopted child. These documents ensure eligibility for health insurance, dependent coverage, and other related benefits under the employer's plan. |

| 9 | Divorce Decree or Court Order (if applicable) | A Divorce Decree or Court Order is essential for employee benefits enrollment when it outlines spousal or child support obligations, healthcare coverage, or custodial arrangements affecting benefit eligibility. Providing this legal documentation ensures compliance with benefit plan requirements and accurate allocation of coverage or payments. |

| 10 | Previous Employer COBRA Documents | Previous employer COBRA documents are essential for employee benefits enrollment as they provide critical details on healthcare coverage continuation options and deadlines. These documents must be submitted to verify prior coverage and ensure seamless transition to new employer health plans. |

| 11 | Benefit Enrollment Forms | Benefit enrollment forms are essential documents required for employees to officially register for health insurance, retirement plans, and other workplace benefits. These forms typically include personal identification information, dependent details, and selection preferences for various benefit options. |

| 12 | Health Insurance Application | Essential documents for health insurance application during employee benefits enrollment include a valid government-issued ID, Social Security number, proof of employment or offer letter, and dependent information such as birth certificates or marriage certificates for family coverage. Employers may also require completed enrollment forms and previous insurance policy details to ensure accurate plan selection and eligibility verification. |

| 13 | Life Insurance Beneficiary Form | The life insurance beneficiary form requires precise identification details such as full legal names, social security numbers, and relationship to the employee to ensure accurate benefit distribution. This document, along with government-issued ID and proof of employment, is essential for completing employee benefits enrollment efficiently. |

| 14 | Retirement Plan Enrollment Form | The Retirement Plan Enrollment Form is a critical document required for employee benefits enrollment as it authorizes participation in the company's retirement savings program. Employees must provide personal identification, Social Security number, and beneficiary information to complete this form accurately. |

| 15 | Proof of Qualifying Life Event (if enrolling outside open enrollment) | Proof of qualifying life events such as marriage certificates, birth certificates, adoption papers, or divorce decrees is essential for employee benefits enrollment outside the open enrollment period. These documents verify eligibility changes allowing employees to make adjustments to health insurance, dependent coverage, or other benefit plans. |

| 16 | Immigration/Work Authorization Documents (if applicable) | Employees must provide valid immigration or work authorization documents such as Form I-9, Employment Authorization Document (EAD), Permanent Resident Card (Green Card), or valid visa supporting employment eligibility for benefits enrollment. Employers are required to verify these documents to ensure compliance with U.S. Citizenship and Immigration Services (USCIS) regulations before processing employee benefits. |

| 17 | Spouse’s Employer Coverage Letter (if waiving spouse’s employer coverage) | A Spouse's Employer Coverage Letter is required when an employee waives their spouse's employer-provided health insurance to verify that coverage is active and meets eligibility criteria. This document ensures compliance with benefits enrollment policies and prevents duplication of health insurance benefits. |

Introduction to Employee Benefits Enrollment

Employee benefits enrollment is a crucial process for new hires to access healthcare, retirement plans, and other workplace benefits. Proper documentation ensures accurate and timely enrollment in company benefit programs.

- Identification Documents - Necessary for verifying the employee's identity and eligibility for benefits enrollment.

- Proof of Eligibility - Includes documents such as Social Security numbers or immigration status proving the employee qualifies for benefits.

- Enrollment Forms - Required paperwork completed by the employee to select and confirm desired benefits coverage.

Importance of Proper Documentation

Proper documentation is essential for employee benefits enrollment to ensure accurate and timely processing. Required documents typically include government-issued identification, Social Security Number, and proof of eligibility such as a marriage certificate or dependent birth certificates.

Submitting the correct paperwork helps avoid delays or denial of benefits, safeguarding your access to healthcare, retirement plans, and other crucial employee programs. Accurate documentation also facilitates seamless communication between employers and benefit providers. Maintaining organized records supports smooth annual enrollment and any future claims or changes.

Personal Identification Requirements

For employee benefits enrollment, providing accurate personal identification is essential to verify eligibility and prevent fraud. Common documents include a valid government-issued photo ID such as a driver's license, passport, or state ID card.

You may also need your Social Security card or a document showing your Social Security number to ensure proper enrollment and tax reporting. Proof of residency or legal work status might be required depending on the employer's policies and local regulations.

Proof of Employment Status

Proof of employment status is essential for employee benefits enrollment, confirming your eligibility. Commonly required documents include a recent pay stub, employment verification letter, or a signed contract. Providing accurate proof ensures timely access to health insurance, retirement plans, and other benefits offered by your employer.

Dependent Verification Documents

Dependent verification documents are essential for employee benefits enrollment to confirm eligibility. Common documents include birth certificates, marriage certificates, and adoption papers. These records ensure that dependents are accurately registered for health insurance, dental plans, and other benefits.

Health Insurance Enrollment Forms

Health insurance enrollment forms are essential documents required to activate your employee benefits. These forms provide detailed information to verify eligibility and select appropriate coverage options.

- Personal Identification - Required to confirm the identity of the employee applying for benefits.

- Proof of Eligibility - Documents such as employment verification or dependent information to qualify for coverage.

- Completed Enrollment Form - Contains selections for health plan options and beneficiary details necessary for processing.

Having all these documents accurately prepared ensures a smooth and timely health insurance enrollment process.

Retirement Plan Enrollment Papers

Retirement plan enrollment requires specific documents to ensure accurate processing and eligibility verification. Providing complete and accurate paperwork helps employees secure their retirement benefits efficiently.

- Identification Documents - A government-issued ID such as a driver's license or passport is necessary to verify the employee's identity.

- Social Security Number (SSN) - The SSN is required to link the retirement account accurately to the employee's records.

- Enrollment Form - Completed and signed retirement plan enrollment forms detail the employee's chosen contribution options and beneficiaries.

Tax Withholding and Compliance Forms

What documents are necessary for employee benefits enrollment, specifically for tax withholding and compliance forms? Employers require specific forms such as the W-4 for federal income tax withholding and possibly state withholding forms depending on your location. These documents ensure accurate tax deductions and compliance with federal and state regulations.

Direct Deposit Authorization

Direct Deposit Authorization is a crucial document for employee benefits enrollment, enabling automatic transfer of benefits payments into the employee's bank account. This form requires detailed banking information such as account number and routing number to ensure accurate deposits.

Submitting a correctly completed Direct Deposit Authorization helps avoid delays in receiving benefits like health insurance reimbursements, retirement contributions, or wage supplements. Employers often require this document alongside identification and benefits election forms during the enrollment process.

What Documents are Necessary for Employee Benefits Enrollment? Infographic