Freelancers need several key documents to ensure tax compliance, including invoices, receipts, and bank statements that track income and expenses accurately. Maintaining proper records such as a tax identification number, proof of business registration, and completed tax return forms is essential for meeting legal obligations. Keeping organized documentation simplifies the process of filing taxes and supports claims for deductions and credits.

What Documents Does a Freelancer Need for Tax Compliance?

| Number | Name | Description |

|---|---|---|

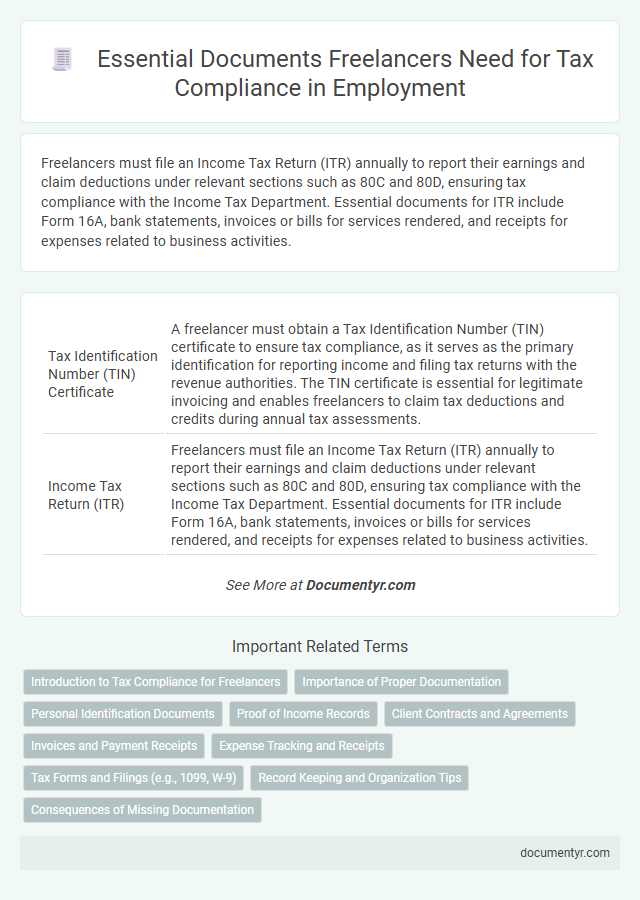

| 1 | Tax Identification Number (TIN) Certificate | A freelancer must obtain a Tax Identification Number (TIN) certificate to ensure tax compliance, as it serves as the primary identification for reporting income and filing tax returns with the revenue authorities. The TIN certificate is essential for legitimate invoicing and enables freelancers to claim tax deductions and credits during annual tax assessments. |

| 2 | Income Tax Return (ITR) | Freelancers must file an Income Tax Return (ITR) annually to report their earnings and claim deductions under relevant sections such as 80C and 80D, ensuring tax compliance with the Income Tax Department. Essential documents for ITR include Form 16A, bank statements, invoices or bills for services rendered, and receipts for expenses related to business activities. |

| 3 | Form 1099-MISC / 1099-NEC (for US freelancers) | US freelancers must collect and retain Form 1099-NEC or 1099-MISC from clients who pay $600 or more annually to ensure accurate income reporting for tax compliance. These forms detail nonemployee compensation essential for filing federal tax returns and calculating self-employment taxes. |

| 4 | Self-Employment Tax Return | Freelancers must accurately file a Self-Employment Tax Return using Form Schedule SE to report income and calculate Social Security and Medicare taxes. Essential documents include Form 1099-MISC or 1099-NEC from clients, detailed income records, business expense receipts, and previous year's tax returns for reference. |

| 5 | Invoice Records | Freelancers must maintain detailed invoice records that include client information, service descriptions, payment amounts, and dates to ensure accurate tax reporting and compliance. Properly organized invoices serve as primary evidence for income declaration and facilitate smoother interactions with tax authorities during audits. |

| 6 | Receipts for Business Expenses | Freelancers need to maintain organized receipts for all business expenses to ensure accurate tax reporting and maximize deductions. These receipts serve as essential proof of deductible expenses, helping freelancers comply with tax regulations and reduce taxable income. |

| 7 | Proof of Payment (Bank Statements, PayPal Records) | Freelancers must retain proof of payment documents such as bank statements and PayPal records to verify income for accurate tax reporting and compliance with tax authorities. These records provide essential evidence of received payments and are crucial for substantiating reported earnings during audits or tax assessments. |

| 8 | Business Registration Certificate | Freelancers must obtain a Business Registration Certificate to legally operate and ensure tax compliance, as it serves as official proof of their business entity. This document is essential for reporting income, claiming deductions, and fulfilling local tax authority requirements. |

| 9 | VAT Registration Certificate (if applicable) | Freelancers must provide a VAT Registration Certificate for tax compliance if their annual turnover exceeds the threshold set by local tax authorities, which varies by country. This certificate validates their obligation to charge, collect, and remit Value Added Tax on services rendered, ensuring adherence to legal tax requirements. |

| 10 | Professional Contracts/Agreements | Freelancers must retain professional contracts or agreements detailing the scope of work, payment terms, and deadlines to ensure accurate tax reporting and compliance. These documents serve as critical proof of income and business activities during audits by tax authorities. |

| 11 | Client Payment Statements | Freelancers must retain client payment statements as essential documents for tax compliance, providing detailed records of income received throughout the fiscal year. These statements, including invoices, payment confirmations, and bank transaction records, support accurate income reporting and help substantiate tax deductions during audits. |

| 12 | Timesheets or Work Logs | Freelancers must maintain accurate timesheets or work logs detailing hours worked, project descriptions, and client information to ensure proper tax compliance and support income claims during audits. These records are essential for calculating billable hours, tracking invoiced projects, and substantiating deductible business expenses in accordance with tax regulations. |

| 13 | Deduction Receipts (e.g., for office supplies, travel) | Freelancers must retain deduction receipts for office supplies, travel expenses, and other business-related costs to ensure accurate tax compliance and maximize deductible expenses. Proper documentation of these receipts supports claims during audits and helps reduce taxable income according to IRS regulations. |

| 14 | Annual Financial Statements | Freelancers must prepare accurate annual financial statements, including income statements and balance sheets, to ensure tax compliance and provide a clear record of earnings and expenses. These documents are essential for filing tax returns, claiming deductions, and demonstrating financial transparency to tax authorities. |

| 15 | Social Security Registration (if required) | Freelancers must register with the Social Security system to ensure proper tax compliance and access to social benefits, submitting their Social Security Identification Number (SSN) or equivalent documentation as proof. This registration is essential for tracking contributions and fulfilling legal obligations related to income tax and social insurance payments. |

| 16 | Health Insurance Records (if tax-deductible) | Freelancers must maintain comprehensive health insurance records, including policy documents, premium payment receipts, and coverage statements, to substantiate tax-deductible medical expenses during tax filing. Accurate documentation ensures compliance with tax regulations and eligibility for permissible deductions related to health insurance costs. |

Introduction to Tax Compliance for Freelancers

Freelancers must understand the essential documents required for tax compliance to ensure accurate reporting and avoid penalties. Proper record-keeping supports transparency and simplifies the filing process with tax authorities.

- Income Records - Detailed invoices and payment receipts document all earnings from freelance work.

- Expense Receipts - Validated receipts for business-related expenses help in claiming deductions.

- Tax Identification Number - Registered tax ID is mandatory for filing tax returns and maintaining legal compliance.

Importance of Proper Documentation

Proper documentation is essential for freelancers to ensure accurate tax reporting and avoid legal complications. Maintaining organized records supports compliance with tax regulations and simplifies financial management.

- Invoices and Payment Records - These documents provide proof of income and are critical for calculating taxable earnings.

- Expense Receipts - Retaining receipts helps freelancers claim legitimate deductions and reduce taxable income.

- Tax Forms and Filings - Keeping copies of submitted tax returns and related forms ensures accurate record-keeping and verification during audits.

Personal Identification Documents

Freelancers must provide personal identification documents to ensure accurate tax compliance and verification. These documents serve as proof of identity and are essential for tax reporting purposes.

- Government-Issued ID - A valid passport or driver's license verifies the freelancer's identity with tax authorities.

- Social Security Number (SSN) or Tax Identification Number (TIN) - This number is required for income reporting and tax processing by the IRS or relevant tax agencies.

- Proof of Residency - Documents like utility bills or rental agreements establish the freelancer's residential address for tax jurisdiction purposes.

Keeping these personal identification documents organized and up-to-date helps freelancers maintain compliance with tax regulations efficiently.

Proof of Income Records

Freelancers must maintain detailed proof of income records to ensure accurate tax reporting and compliance. These records typically include invoices, payment receipts, and bank statements that verify earnings from various clients.

Keeping organized proof of income simplifies the process during audits and helps track taxable revenue across different projects. Proper documentation supports accurate tax filings and minimizes the risk of penalties or disputes with tax authorities.

Client Contracts and Agreements

Freelancers must maintain comprehensive client contracts and agreements to ensure clear terms and proper tax compliance. These documents outline the scope of work, payment terms, and responsibilities, serving as essential proof during tax assessments.

Client contracts and agreements provide evidence of income and business activity, which is crucial for accurate tax reporting. Detailed records help freelancers justify deductions and validate their self-employment status to tax authorities. Maintaining organized contracts minimizes disputes and supports a transparent financial audit trail.

Invoices and Payment Receipts

Freelancers must keep accurate invoices to document services provided and amounts charged for tax compliance. Payment receipts serve as proof of income received, essential for verifying reported earnings. You should organize these documents systematically to ensure smooth tax reporting and audits.

Expense Tracking and Receipts

Freelancers must maintain accurate records of all expenses to ensure tax compliance. Expense tracking helps in maximizing deductions and reducing taxable income.

Receipts for business-related purchases are essential documents that support your expense claims during tax filing. Proper documentation not only simplifies audits but also verifies the legitimacy of your deductions.

Tax Forms and Filings (e.g., 1099, W-9)

Freelancers must maintain accurate tax forms such as the W-9, which clients use to report payments. The 1099-NEC form is essential for income reporting if earnings exceed $600 from a single client. Proper filing of these forms ensures compliance with IRS regulations and facilitates accurate tax reporting.

Record Keeping and Organization Tips

What documents does a freelancer need for tax compliance? Freelancers must keep detailed records including invoices, receipts, and bank statements to accurately report their income and expenses. Organized documentation simplifies tax filing and helps avoid potential audits.

How can freelancers maintain effective record keeping for tax purposes? Using digital tools like accounting software and cloud storage ensures that all financial documents are securely stored and easily accessible. Consistently categorizing and updating records reduces errors and saves time during tax season.

Why is organization important for freelancer tax compliance? Proper organization enables freelancers to track deductible expenses and comply with tax regulations efficiently. Keeping all tax-related documents in one place minimizes the risk of missing critical paperwork.

What Documents Does a Freelancer Need for Tax Compliance? Infographic