Contractors must provide a completed Form W-9 to confirm their taxpayer identification number and certification for 1099 employee status. They should also maintain records of invoices and contracts outlining the scope of work and payment terms. Proper documentation ensures accurate tax reporting and compliance with IRS regulations for independent contractors.

What Documents Does a Contractor Need for 1099 Employee Status?

| Number | Name | Description |

|---|---|---|

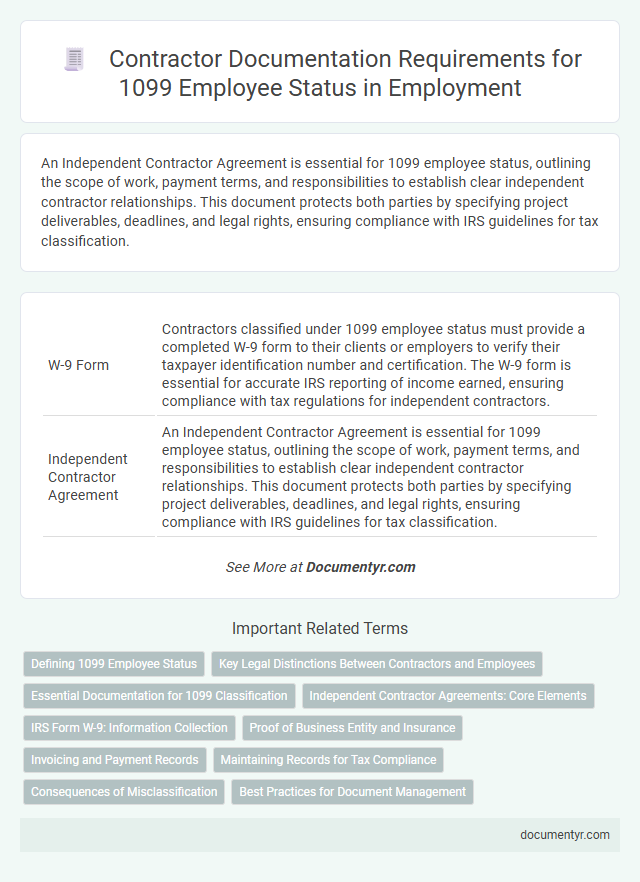

| 1 | W-9 Form | Contractors classified under 1099 employee status must provide a completed W-9 form to their clients or employers to verify their taxpayer identification number and certification. The W-9 form is essential for accurate IRS reporting of income earned, ensuring compliance with tax regulations for independent contractors. |

| 2 | Independent Contractor Agreement | An Independent Contractor Agreement is essential for 1099 employee status, outlining the scope of work, payment terms, and responsibilities to establish clear independent contractor relationships. This document protects both parties by specifying project deliverables, deadlines, and legal rights, ensuring compliance with IRS guidelines for tax classification. |

| 3 | 1099-NEC Form | Contractors classified as 1099 employees must provide the completed 1099-NEC form, which reports nonemployee compensation to the IRS and the contractor. This form is essential for tracking income and ensuring accurate self-employment tax payments. |

| 4 | Invoice(s) | Contractors need to provide detailed invoices specifying services rendered, dates, and payment terms to establish 1099 employee status and ensure accurate tax reporting. Properly prepared invoices support income verification and compliance with IRS regulations for independent contractor classification. |

| 5 | Proof of Business Registration (if applicable) | A contractor classified under 1099 employee status must provide proof of business registration, such as a business license or a certificate of incorporation, to verify their legitimate operation as an independent entity. This documentation is essential for confirming compliance with local and state regulations and ensuring accurate tax reporting. |

| 6 | Proof of Insurance (if required) | Contractors classified as 1099 employees must provide proof of insurance, such as general liability or workers' compensation insurance, to meet client or state requirements and ensure compliance with contract terms. Maintaining up-to-date insurance documentation is crucial for validating coverage and mitigating potential liabilities during the contract period. |

| 7 | State or Local Business License | Contractors classified as 1099 employees must obtain a state or local business license to operate legally and ensure compliance with regulations governing independent contractors. Securing this license is essential for validity in contracts, tax reporting, and avoiding penalties related to unlicensed business activities. |

| 8 | Timesheets or Work Logs | Contractors classified as 1099 employees must maintain accurate timesheets or work logs to substantiate hours worked and services rendered for tax and payment purposes. Proper documentation of time entries ensures compliance with IRS requirements and supports invoicing and record-keeping accuracy. |

| 9 | Payment Records | Contractors need to maintain accurate payment records including invoices, payment receipts, and bank statements to substantiate earnings for 1099 employee status. Detailed documentation of payments facilitates IRS reporting compliance and helps track income for tax deductions and audits. |

| 10 | Tax Identification Number (TIN) Documentation | Contractors must provide a valid Tax Identification Number (TIN), typically a Social Security Number (SSN) or Employer Identification Number (EIN), on IRS Form W-9 to establish 1099 employee status. Accurate TIN documentation ensures proper tax reporting and compliance with IRS regulations for independent contractors. |

| 11 | Copies of Paid Receipts | Contractors should maintain copies of paid receipts to provide proof of expenses and verify payments related to 1099 income, which supports accurate tax reporting and compliance with IRS requirements. These receipts serve as essential documentation for business deductions and help substantiate income and expenditure during audits or financial reviews. |

| 12 | Expense Documentation | Contractors must maintain detailed expense documentation, including receipts, invoices, and proof of payment, to accurately report business-related deductions for 1099 employee status. Organized records of travel, supplies, and operational costs ensure compliance with IRS guidelines and facilitate tax filing. |

| 13 | IRS Determination Letter (if worker status is questioned) | A contractor classified as a 1099 employee should obtain an IRS Determination Letter if their worker status is disputed or unclear, as this letter officially verifies their independent contractor classification. This document helps prevent misclassification issues by providing legal confirmation of their employment status for tax purposes. |

| 14 | Client Engagement Letters | Client engagement letters outline the scope of work, payment terms, and project timelines, serving as crucial documentation to establish a contractor's independent status for 1099 classification. These letters provide clear evidence of the agreed-upon services, protecting both parties and ensuring compliance with IRS guidelines for non-employee compensation. |

| 15 | Correspondence with Client Regarding Employment Terms | Contractors must provide a signed Independent Contractor Agreement detailing payment terms, project scope, and deadlines to establish clear 1099 employee status. Maintaining thorough written correspondence with the client, including emails or letters confirming agreed-upon work conditions and responsibilities, ensures proper documentation for tax classification and legal compliance. |

Defining 1099 Employee Status

What documents does a contractor need for 1099 employee status? A 1099 employee, also known as an independent contractor, is a worker who provides services to a business but is not considered an employee. Defining 1099 employee status involves understanding that these workers handle their own taxes and are responsible for submitting IRS Form 1099-MISC or 1099-NEC to report income.

Key Legal Distinctions Between Contractors and Employees

Contractors classified as 1099 employees must provide specific documents to verify their independent status. Key documents include a completed Form W-9, invoices for payment, and evidence of business registration or licensing when applicable.

Legal distinctions between contractors and employees hinge on control and financial aspects of the work relationship. Contractors retain control over how tasks are performed and typically supply their own tools, unlike employees who follow employer directions and use company-provided resources.

Essential Documentation for 1099 Classification

Contractors must provide specific documentation to ensure proper 1099 employee classification. These documents verify independent contractor status and support tax reporting requirements.

- Form W-9 - Collects the contractor's Taxpayer Identification Number (TIN) and certification for accurate IRS reporting.

- Contractor Agreement - Defines the scope of work, payment terms, and independent contractor relationship.

- Invoices - Submitted by the contractor to document work performed and facilitate payment tracking.

Independent Contractor Agreements: Core Elements

Independent Contractor Agreements are essential documents when establishing 1099 employee status. Key elements include clear descriptions of services, payment terms, and project timelines. Your agreement should also outline confidentiality clauses, dispute resolution methods, and tax responsibilities to ensure compliance and protect both parties.

IRS Form W-9: Information Collection

Contractors require specific documents to establish 1099 employee status, with IRS Form W-9 being essential for information collection. This form provides critical taxpayer identification details needed by employers to issue accurate 1099-MISC or 1099-NEC forms.

IRS Form W-9 collects your name, business name (if applicable), address, and Taxpayer Identification Number (TIN). Proper completion ensures compliance with IRS reporting requirements and helps avoid backup withholding.

Proof of Business Entity and Insurance

Contractors seeking 1099 employee status must provide specific documentation to verify their business legitimacy. Key requirements include proof of business entity and valid insurance coverage to ensure compliance and protection.

- Proof of Business Entity - Contractors need to submit official documents such as a business license, articles of incorporation, or a DBA certificate to demonstrate their registered business status.

- Business Insurance - Providing general liability insurance or professional liability insurance is essential to cover potential risks and protect both the contractor and the client.

- Tax Identification Number - Contractors must supply a valid Employer Identification Number (EIN) or Social Security Number (SSN) for tax reporting purposes under 1099 employment.

Submitting these documents ensures contractors meet the legal and financial standards required for 1099 employee classification.

Invoicing and Payment Records

Contractors must maintain detailed invoicing documents to verify the services provided and ensure accurate payment tracking for 1099 employee status. These invoices should include dates, descriptions of work performed, and agreed-upon payment amounts. Payment records such as bank statements or payment confirmations are essential to substantiate income and support tax reporting obligations.

Maintaining Records for Tax Compliance

| Document Type | Purpose | Key Details |

|---|---|---|

| Form W-9 | Provides the contractor's Taxpayer Identification Number (TIN) | Essential for accurate 1099 reporting to the IRS |

| 1099-NEC Forms | Reports non-employee compensation paid to contractors | Must be issued by the business if payments exceed $600 annually |

| Invoices and Payment Records | Tracks services rendered and payments made | Supports verification of income and expenses |

| Contracts and Agreements | Defines scope of work and payment terms | Useful during tax audits to establish independent contractor status |

| Expense Receipts | Documents deductible business expenses | Important for maximizing tax deductions |

| Bank Statements | Records payment deposits and withdrawals | Supports reconciliation of financial records |

Consequences of Misclassification

Contractors classified as 1099 employees must provide specific documents to verify their independent status and avoid legal complications. Misclassification can lead to serious financial and legal consequences for both the contractor and the hiring company.

- Form W-9 - Your taxpayer identification information is necessary for accurate reporting to the IRS.

- Contract Agreement - A written contract outlining the scope of work and terms establishes the independent contractor relationship.

- Proof of Business Licenses - Documentation of relevant business licenses confirms your status as a legitimate independent contractor.

What Documents Does a Contractor Need for 1099 Employee Status? Infographic