Freelancers must provide a valid form of identification, such as a passport or driver's license, to verify their identity when starting work with a US client. They also need to complete a W-8BEN form for tax purposes if they are non-US residents, or a W-9 form if they are US citizens or residents, to establish their tax status. A detailed contract outlining the scope of work, payment terms, and deadlines is essential to protect both parties and ensure clear communication.

What Documents Does a Freelancer Need to Start Work with a US Client?

| Number | Name | Description |

|---|---|---|

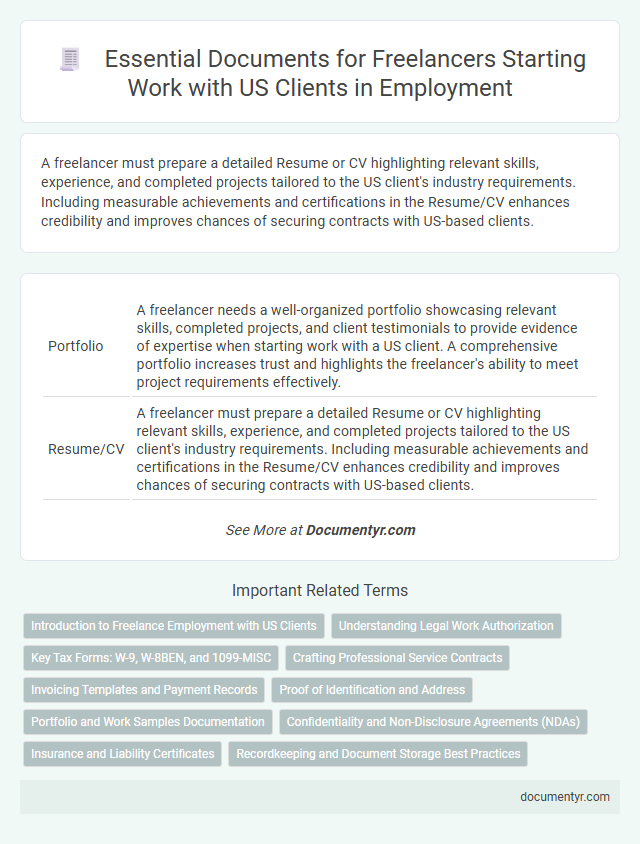

| 1 | Portfolio | A freelancer needs a well-organized portfolio showcasing relevant skills, completed projects, and client testimonials to provide evidence of expertise when starting work with a US client. A comprehensive portfolio increases trust and highlights the freelancer's ability to meet project requirements effectively. |

| 2 | Resume/CV | A freelancer must prepare a detailed Resume or CV highlighting relevant skills, experience, and completed projects tailored to the US client's industry requirements. Including measurable achievements and certifications in the Resume/CV enhances credibility and improves chances of securing contracts with US-based clients. |

| 3 | Proposal/Project Plan | A detailed proposal or project plan is crucial for freelancers to outline the scope, deliverables, timelines, and payment terms when starting work with a US client. This document serves as a formal agreement to ensure mutual understanding and secure the freelance contract. |

| 4 | Statement of Work (SOW) | A Statement of Work (SOW) is essential for freelancers collaborating with US clients, detailing project scope, deliverables, timelines, and payment terms to ensure clear expectations and legal protection. This document serves as a contractual blueprint that minimizes misunderstandings and facilitates smoother project execution. |

| 5 | Independent Contractor Agreement | A freelancer working with a US client needs a signed Independent Contractor Agreement outlining project scope, payment terms, intellectual property rights, and confidentiality clauses to ensure clear legal protection and expectations. This document is essential for defining the working relationship and preventing disputes throughout the contract duration. |

| 6 | Non-Disclosure Agreement (NDA) | A freelancer working with a US client typically needs a Non-Disclosure Agreement (NDA) to protect sensitive information and ensure confidentiality during the project. This legal document outlines the terms of confidentiality, preventing unauthorized disclosure of proprietary data and client trade secrets. |

| 7 | W-8BEN Form (Non-US freelancers) | Non-US freelancers working with US clients must submit the W-8BEN form to certify their foreign status and claim any applicable tax treaty benefits, reducing or eliminating withholding tax on payments. This IRS document is essential for compliance and ensures proper tax withholding on income earned from US-based clients. |

| 8 | W-9 Form (US freelancers) | Freelancers working with US clients must complete a W-9 form to provide their Taxpayer Identification Number (TIN) and certify their tax status for accurate IRS reporting. This essential document enables clients to issue Form 1099-NEC, ensuring compliance with US tax regulations and proper income reporting. |

| 9 | Invoice Template | Freelancers working with US clients need a professional invoice template that includes key elements such as their business name, contact information, invoice number, date, detailed description of services provided, payment terms, and total amount due to ensure clear communication and prompt payment. Using an invoice template tailored to US standards facilitates compliance with tax regulations and streamlines financial tracking for both parties. |

| 10 | Timesheet Template | A freelancer working with a US client typically needs a timesheet template to accurately record billable hours, ensuring transparent and organized invoicing. This document should detail dates, hours worked, project descriptions, and client approval sections to meet standard US business practices and facilitate timely payments. |

| 11 | Payment Details Document | Freelancers starting work with a US client must provide a Payment Details Document, including bank account information, preferred payment methods (such as ACH, wire transfer, or PayPal), and relevant tax identification numbers like an IRS Form W-9. Accurate payment documentation ensures timely invoicing, compliance with US tax regulations, and seamless financial transactions between the freelancer and the client. |

| 12 | Proof of Identity (Passport/ID) | Freelancers starting work with a US client must provide proof of identity, typically a valid passport or government-issued ID, to comply with legal and tax requirements. These documents establish the freelancer's identity and eligibility to work, ensuring smooth contract verification and payment processing. |

| 13 | Work Samples Authorization (if required) | Freelancers starting work with US clients often need to provide work samples to demonstrate their skills, along with written authorization or consent if the samples contain proprietary or copyrighted content. Securing explicit permission ensures compliance with intellectual property laws and protects both the freelancer and the client in contractual agreements. |

| 14 | Business Registration Certificate (if applicable) | Freelancers working with US clients may need a Business Registration Certificate if operating as a formal business entity, which establishes legal recognition and compliance with state regulations. Obtaining this certificate ensures legitimacy, enabling access to contracts and tax benefits while protecting personal assets. |

| 15 | Tax Identification Number (if applicable) | Freelancers working with US clients often need a Tax Identification Number (TIN), such as a Social Security Number (SSN) or an Employer Identification Number (EIN), to comply with IRS reporting requirements. Providing the TIN on Form W-9 enables clients to issue accurate 1099-MISC or 1099-NEC forms for tax reporting purposes. |

| 16 | Professional References | Freelancers seeking to work with US clients often require professional references such as letters of recommendation or contact information from previous clients or employers to establish credibility and trust. These references help validate skills and experience, increasing the likelihood of securing contracts and timely payments. |

| 17 | Insurance Certificate (if required) | Freelancers working with US clients may need an insurance certificate, such as professional liability insurance or general liability insurance, to meet contract requirements and protect against potential claims. This certificate verifies coverage and ensures compliance with client policies, providing financial security and enhancing trust in professional engagements. |

Introduction to Freelance Employment with US Clients

Starting freelance work with US clients requires understanding essential documentation. Proper paperwork ensures smooth collaboration and legal compliance.

- Identification Documents - Valid government-issued ID verifies your identity for US clients.

- Tax Forms - Form W-8BEN or W-9 is necessary to comply with US tax regulations.

- Contracts and Agreements - Clear contracts outline project scope, payment terms, and deadlines for mutual protection.

Your preparedness with these documents facilitates trust and professionalism in freelance employment with US clients.

Understanding Legal Work Authorization

Freelancers aiming to work with US clients must understand the legal documents required to demonstrate work authorization. Proper documentation ensures compliance with US regulations and smooth contract execution.

- Work Visa or ESTA Authorization - Indicates legal permission for freelancers physically present in the US to provide services.

- IRS Form W-8BEN or W-9 - Confirms tax identification status for non-US and US freelancers, respectively, to report earnings correctly.

- Independent Contractor Agreement - Outlines work terms and legal responsibilities, establishing the freelancer's authorized scope of work.

Key Tax Forms: W-9, W-8BEN, and 1099-MISC

| Document | Description | Purpose | Who Requires It | Notes |

|---|---|---|---|---|

| Form W-9 | Request for Taxpayer Identification Number and Certification | Used by US freelancers to provide their Taxpayer Identification Number (TIN) to US clients for reporting income | US-based freelancers working with US clients | Supplies necessary information for clients to issue 1099 forms |

| Form W-8BEN | Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting | Used by non-US freelancers to certify foreign status and claim tax treaty benefits | Non-US freelancers contracting with US clients | Reduces or eliminates US withholding tax on payments |

| Form 1099-MISC | Miscellaneous Income | Issued by US clients to freelancers reporting payments of $600 or more within a tax year | US clients to their freelance contractors | Used to report income to the IRS and freelancer |

Crafting Professional Service Contracts

Freelancers working with US clients must have a clear, professional service contract to outline project scope, payment terms, and deadlines. This document protects both parties by defining responsibilities and expectations.

Essential elements include client and freelancer details, deliverables, pricing, payment schedule, intellectual property rights, and termination clauses. A well-crafted contract reduces disputes and ensures smooth collaboration in the freelance employment process.

Invoicing Templates and Payment Records

Freelancers working with US clients must maintain clear invoicing templates to ensure accurate billing and prompt payments. Invoicing templates typically include details such as the freelancer's contact information, service descriptions, payment terms, and tax identification numbers. Keeping organized payment records is essential for tracking income, managing taxes, and providing proof of transactions to clients or tax authorities.

Proof of Identification and Address

Freelancers working with US clients must provide proof of identification to verify their identity. Common documents include a valid passport, driver's license, or government-issued ID card.

Proof of address is also essential to confirm the freelancer's residence. Utility bills, bank statements, or rental agreements with the freelancer's name and address are widely accepted.

Portfolio and Work Samples Documentation

To start work with a US client, freelancers must present comprehensive documentation that showcases their skills and experience. A strong portfolio and relevant work samples are crucial for building trust and demonstrating professional capability.

- Portfolio - A curated collection of previous projects highlighting relevant skills and successful outcomes tailored to the client's industry.

- Work Samples - Specific examples of completed tasks or projects that directly relate to the scope of work expected by the US client.

- Presentation Format - Digital or physical formats such as PDFs, websites, or online platforms that allow easy access and review by potential clients.

Confidentiality and Non-Disclosure Agreements (NDAs)

What documents does a freelancer need to start work with a US client focusing on confidentiality? Confidentiality and Non-Disclosure Agreements (NDAs) are essential to protect sensitive client information legally. These documents outline the terms under which proprietary data must be handled, ensuring trust and compliance.

Insurance and Liability Certificates

Freelancers working with US clients often need insurance and liability certificates to protect themselves and their clients from potential risks. These documents demonstrate professional responsibility and reduce legal exposure during the project.

Professional liability insurance, also known as errors and omissions insurance, covers claims related to negligence or mistakes in service delivery. General liability insurance protects against property damage or bodily injury that may occur during the work process. Obtaining these certificates provides assurance that the freelancer is financially prepared to handle unforeseen incidents, making clients more comfortable with the contract.

What Documents Does a Freelancer Need to Start Work with a US Client? Infographic