Proof of self-employment requires documents such as tax returns, invoices, bank statements, and business licenses that verify income and business activity. A profit and loss statement or a letter from an accountant can further substantiate the self-employed status. Maintaining thorough records ensures credibility and simplifies verification during financial or legal processes.

What Documents are Needed for Proof of Self-Employment?

| Number | Name | Description |

|---|---|---|

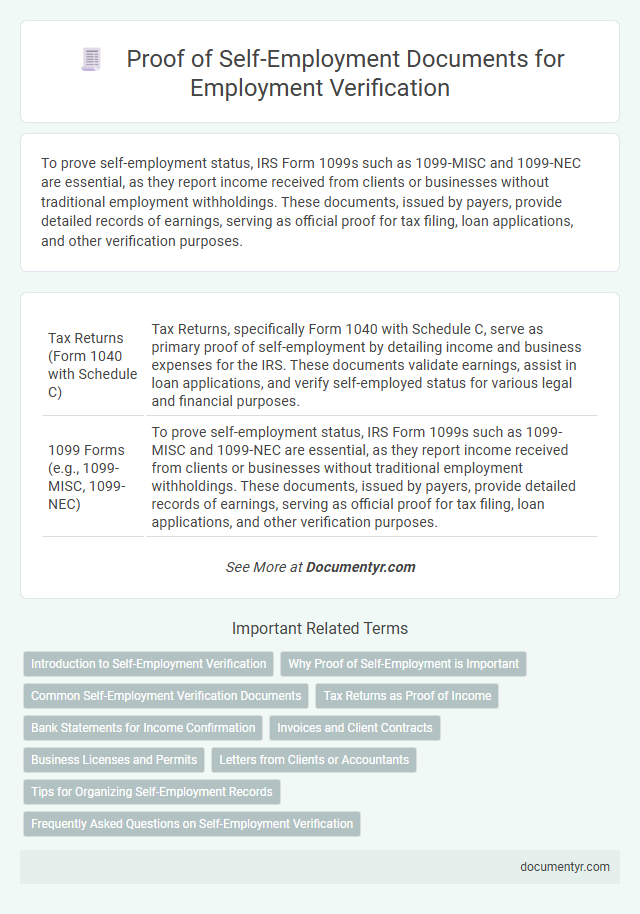

| 1 | Tax Returns (Form 1040 with Schedule C) | Tax Returns, specifically Form 1040 with Schedule C, serve as primary proof of self-employment by detailing income and business expenses for the IRS. These documents validate earnings, assist in loan applications, and verify self-employed status for various legal and financial purposes. |

| 2 | 1099 Forms (e.g., 1099-MISC, 1099-NEC) | To prove self-employment status, IRS Form 1099s such as 1099-MISC and 1099-NEC are essential, as they report income received from clients or businesses without traditional employment withholdings. These documents, issued by payers, provide detailed records of earnings, serving as official proof for tax filing, loan applications, and other verification purposes. |

| 3 | Business Licenses or Permits | Business licenses or permits serve as official documentation confirming the legal operation of a self-employed enterprise, often required to validate employment status and meet regulatory standards. These documents vary by industry and location, including general business licenses, health permits, or specialized trade licenses essential for demonstrating compliance in self-employment verification. |

| 4 | Bank Statements (Business or Personal) | Bank statements, whether business or personal, provide essential financial evidence of self-employment income, showcasing consistent deposits from clients or customers. These documents help validate income stability and business activity duration, making them crucial for tax verification, loan applications, or legal proof of self-employment status. |

| 5 | Profit and Loss Statements | Profit and loss statements serve as essential documents for proof of self-employment, detailing income, expenses, and net profit over a specific period to demonstrate business activity and financial performance. These statements, often prepared quarterly or annually, provide accurate evidence of ongoing self-employment to employers, lenders, and tax authorities. |

| 6 | Invoices Issued to Clients | Invoices issued to clients serve as essential documentation for proving self-employment, detailing services rendered, payment terms, and transaction dates. These records verify income and business activity, supporting tax filings and applications for loans or permits. |

| 7 | Client Contracts or Agreements | Client contracts or agreements serve as primary evidence of self-employment by detailing the nature, duration, and terms of work between the freelancer or business owner and their clients, showcasing the legitimacy of income sources. These documents often include signatures, payment terms, project scopes, and timelines, which help verify ongoing business activity for tax authorities or financial institutions. |

| 8 | Business Insurance Papers | Business insurance papers serve as crucial proof of self-employment by verifying active business operations and risk management. These documents include liability insurance policies, workers' compensation certificates, and commercial property insurance, all demonstrating legitimate business coverage essential for contracts and client trust. |

| 9 | Accountant Letters or CPA Statements | Accountant Letters or CPA Statements serve as credible proof of self-employment by verifying income, business operations, and tax compliance. These documents typically include a letter on official letterhead detailing the nature of the business, duration of self-employment, and financial substantiation, making them essential for loan applications, tax purposes, and employment verification. |

| 10 | Payment Receipts | Payment receipts serve as critical proof of self-employment, documenting income and business transactions between the self-employed individual and clients. Maintaining organized and detailed payment receipts, including date, amount, and service description, helps verify earnings during tax filings and loan applications. |

| 11 | Articles of Incorporation or Organization (for LLC/Corporation) | Articles of Incorporation or Organization serve as essential legal documents proving self-employment status for LLCs or corporations, detailing the business's formation and registered information. These documents validate the existence of the entity and are often required for tax filings, bank accounts, and contractual agreements. |

| 12 | Employer Identification Number (EIN) Certificate | An Employer Identification Number (EIN) certificate serves as a crucial document proving self-employment by verifying a business's legal registration with the IRS. This certificate is essential for tax reporting, opening business bank accounts, and establishing credibility with clients and vendors. |

| 13 | Proof of Business Address (utility bills, lease agreement) | Proof of business address for self-employment verification typically requires documents such as recent utility bills and a valid lease agreement, which must clearly display the business name and physical address. These documents serve as essential evidence for tax filings, bank account setups, and official registrations. |

| 14 | Business Account Statements (credit card, PayPal, etc.) | Business account statements, including credit card and PayPal records, serve as critical proof of self-employment by verifying consistent income and transaction history. These documents demonstrate financial activity directly linked to the business, supporting claims of independent work and revenue generation. |

| 15 | Work Orders or Job Sheets | Work orders or job sheets serve as critical documents for proof of self-employment by detailing specific tasks completed, client information, dates, and payment terms, thereby validating business activity and income. These records offer tangible evidence for tax filings, loan applications, and legal verification of service-based or freelance work. |

Introduction to Self-Employment Verification

Verifying self-employment status requires specific documentation to confirm income and business activity. These documents serve as evidence for lenders, government agencies, and clients.

- Business Licenses or Permits - Official certifications that demonstrate legal authorization to operate a business.

- Tax Returns - Filed income tax forms that report earnings from self-employment activities.

- Bank Statements - Financial records showing deposits and transactions related to the business.

Why Proof of Self-Employment is Important

Proof of self-employment establishes your status as an independent business owner and verifies your income. This documentation is crucial for financial, legal, and tax-related purposes.

- Tax Returns - Official documents that demonstrate your reported income and taxes paid as a self-employed individual.

- Bank Statements - Records showing business-related transactions that support your income claims.

- Invoices or Contracts - Proof of services rendered or products sold that confirm ongoing business activity.

Providing clear proof of self-employment helps secure loans, rental agreements, and compliance with legal requirements.

Common Self-Employment Verification Documents

Verifying self-employment requires specific documentation to establish income and business activity. Common documents help lenders, clients, and government agencies confirm a person's self-employed status.

- Tax Returns - Personal and business tax returns from recent years provide detailed income information and proof of ongoing self-employment.

- Bank Statements - Business or personal bank statements show transactions related to self-employment earnings and expenses.

- Invoices and Contracts - Copies of invoices issued to clients and contracts demonstrate ongoing business operations and client relationships.

Tax Returns as Proof of Income

Tax returns are essential documents for verifying self-employment income. They provide official records of earnings reported to tax authorities over a specific period.

Submitting complete and accurate tax returns is critical when proof of income is required. These documents reflect your financial stability and help establish credibility with employers or financial institutions.

Bank Statements for Income Confirmation

Bank statements serve as a crucial document for proving self-employment income. They provide a detailed record of deposits, reflecting consistent cash flow and earnings from business activities.

Employers and financial institutions often require bank statements to verify the stability and amount of income. These documents must cover several months to establish reliable proof of ongoing self-employment revenue.

Invoices and Client Contracts

Invoices serve as crucial proof of self-employment by detailing the services rendered, payment amounts, and transaction dates. Client contracts further validate business relationships by outlining the scope of work, agreed terms, and obligations between parties. Providing both invoices and client contracts strengthens your documentation for income verification and tax purposes.

Business Licenses and Permits

| Document Type | Description | Purpose |

|---|---|---|

| Business Licenses | Official authorizations issued by local, state, or federal authorities that allow you to operate your business legally within a specific jurisdiction. | Demonstrates legal compliance and legitimacy of your self-employment activities. |

| Permits | Special permissions required for certain types of business activities, such as health permits, zoning permits, or environmental permits. | Confirms that your business meets regulatory standards and industry-specific guidelines. |

| Renewal Receipts | Proof that business licenses and permits have been renewed and are currently valid. | Ensures continuous authorization to conduct your business without interruption. |

Letters from Clients or Accountants

Letters from clients or accountants serve as crucial documents for proof of self-employment. These letters validate income, services provided, and the duration of business relationships. You must ensure these documents clearly state the nature of work and payment details to support your self-employment claims.

Tips for Organizing Self-Employment Records

What documents are needed for proof of self-employment? Common documents include tax returns, invoices, bank statements, and business licenses. Maintaining detailed records helps demonstrate consistent income and business activity.

How can you organize self-employment records effectively? Use digital folders categorized by year and type of document, such as receipts, contracts, and tax filings. Regularly updating your records ensures easy access when needed for tax purposes or loan applications.

Why is it important to keep copies of client agreements and invoices? Client agreements provide proof of your work scope and terms, while invoices show transaction details. These documents establish a clear record of your business relationships and payment history.

What role do bank statements play in documenting self-employment? Bank statements verify income deposits and business expenses, supporting your financial claims. Keeping separate business accounts simplifies tracking in case of audits.

How can consistent bookkeeping benefit self-employed individuals? Accurate bookkeeping supports tax reporting, financial planning, and legal compliance. Using accounting software automates record-keeping tasks and reduces human error.

What Documents are Needed for Proof of Self-Employment? Infographic