To set up payroll for remote employees, essential documents include a completed W-4 form to determine federal tax withholding, state tax forms based on the employee's work location, and a direct deposit authorization form for seamless salary payments. Employers also need to collect copies of identification documents such as a passport or driver's license to verify identity and eligibility to work. Maintaining accurate and up-to-date records helps ensure compliance with tax laws and smooth payroll processing for remote workers.

What Documents Do You Need for Remote Employee Payroll Setup?

| Number | Name | Description |

|---|---|---|

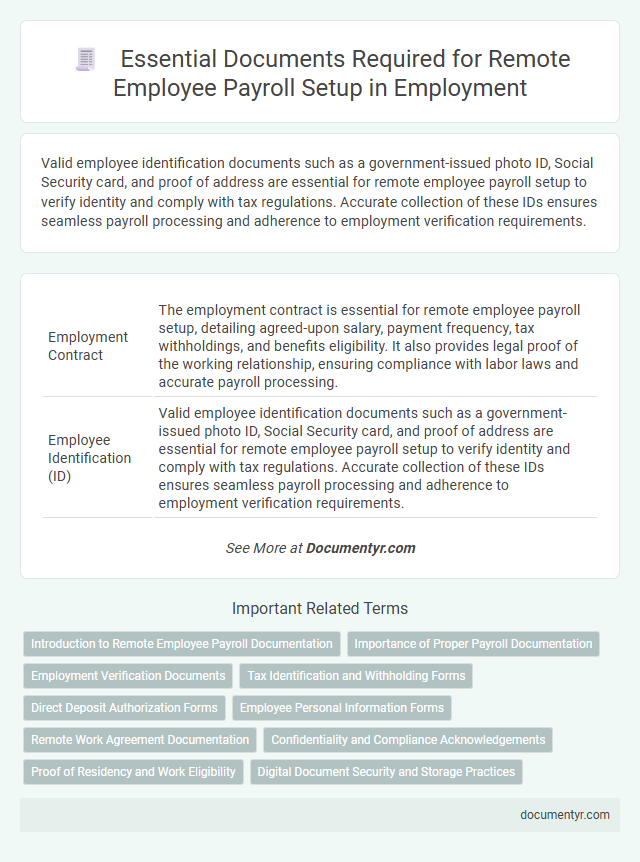

| 1 | Employment Contract | The employment contract is essential for remote employee payroll setup, detailing agreed-upon salary, payment frequency, tax withholdings, and benefits eligibility. It also provides legal proof of the working relationship, ensuring compliance with labor laws and accurate payroll processing. |

| 2 | Employee Identification (ID) | Valid employee identification documents such as a government-issued photo ID, Social Security card, and proof of address are essential for remote employee payroll setup to verify identity and comply with tax regulations. Accurate collection of these IDs ensures seamless payroll processing and adherence to employment verification requirements. |

| 3 | Social Security Card | A Social Security card is essential for remote employee payroll setup as it verifies the employee's Social Security Number (SSN) for tax reporting and payroll compliance. Employers must collect and securely store this document to ensure accurate wage reporting to the IRS and to prevent identity fraud. |

| 4 | W-4 Form (Employee’s Withholding Certificate) | The W-4 Form (Employee's Withholding Certificate) is essential for remote employee payroll setup as it determines federal income tax withholding based on personal allowances and filing status. Employers must collect a completed W-4 from each remote employee to ensure accurate tax calculations and compliance with IRS regulations. |

| 5 | Direct Deposit Authorization Form | The Direct Deposit Authorization Form is essential for remote employee payroll setup, enabling secure and timely electronic transfers of wages to the employee's bank account. This document requires the employee's banking details such as account number, routing number, and account type to ensure accurate payroll processing. |

| 6 | I-9 Employment Eligibility Verification | The I-9 Employment Eligibility Verification form is essential for remote employee payroll setup, ensuring compliance with federal regulations by verifying the employee's identity and eligibility to work in the United States. Employers must collect, review, and retain the completed I-9 form alongside acceptable identification documents, maintaining accurate records to avoid legal penalties during audits or inspections. |

| 7 | State Tax Withholding Forms | State tax withholding forms, such as the W-4 for federal and corresponding state-specific forms like the DE 4 in California or the IT-4 in Illinois, are essential for accurately determining the correct amount of state income tax to withhold from remote employees' paychecks. Employers must collect and verify these completed forms to ensure compliance with each employee's state tax regulations during the payroll setup process. |

| 8 | Local Tax Forms (if applicable) | For remote employee payroll setup, local tax forms such as state withholding certificates (e.g., Form W-4 for federal and state-specific equivalents) and any required local tax registration documents must be collected to ensure accurate tax withholding. Employers should verify each remote employee's work location to determine applicable local tax obligations and secure corresponding forms to remain compliant with regional tax authorities. |

| 9 | Remote Work Agreement | A Remote Work Agreement is essential for remote employee payroll setup as it outlines work terms, hours, and compensation details, ensuring compliance with labor laws in the employee's location. This document supports accurate tax withholding, benefits administration, and verifies the employee's eligibility for payroll processing. |

| 10 | Employee Bank Account Information | For remote employee payroll setup, providing accurate bank account information--including account number, routing number, and bank name--is essential to ensure timely direct deposit payments. Employers must verify these details alongside employee identification documents to maintain payroll accuracy and compliance with financial regulations. |

| 11 | Personal Information Form | A Personal Information Form is essential for remote employee payroll setup, capturing key data such as full name, address, social security number, tax filing status, and direct deposit details. This form ensures accurate tax withholding, compliance with payroll regulations, and timely processing of employee payments. |

| 12 | Signed Offer Letter | A signed offer letter is essential for remote employee payroll setup as it verifies the employment agreement, including job title, salary, and start date. This document ensures accurate payroll processing and compliance with tax and labor regulations. |

| 13 | Non-Disclosure Agreement (NDA) | A Non-Disclosure Agreement (NDA) is essential for remote employee payroll setup to ensure the confidentiality of sensitive payroll data and protect company information from unauthorized disclosure. This legal document safeguards proprietary payroll processes and employee compensation details by legally binding both parties to maintain strict privacy. |

| 14 | Proof of Address | Proof of address is essential for remote employee payroll setup to verify the worker's location, typically requiring documents such as utility bills, bank statements, or government-issued correspondence dated within the last three months. Accurate address verification ensures compliance with tax regulations and proper withholding of state and local taxes based on the employee's physical residence. |

| 15 | Emergency Contact Information | Emergency contact information is essential for remote employee payroll setup to ensure quick communication during unforeseen situations affecting employee well-being. This information typically includes the contact's full name, relationship to the employee, phone number, and address, enabling employers to maintain a reliable communication channel for emergencies. |

| 16 | Electronic Consent Form | An Electronic Consent Form is essential for remote employee payroll setup, as it authorizes the employer to process payroll data digitally and ensures compliance with electronic record-keeping regulations. This document must be securely signed and retained to validate consent for direct deposit, tax withholding, and payroll communication through electronic means. |

| 17 | Form 8850 (if Work Opportunity Tax Credit applies) | Form 8850 must be submitted within 28 days of the employee's start date to qualify for the Work Opportunity Tax Credit, providing employers with potential payroll tax savings. Accurate completion of Form 8850, along with other essential payroll documents like W-4 and I-9, ensures compliance and smooth remote employee payroll setup. |

| 18 | Independent Contractor Agreement (if applicable) | Remote employee payroll setup requires specific documentation, including a completed Independent Contractor Agreement that clearly outlines the terms of engagement, payment schedule, and tax obligations if the worker is classified as a contractor. This agreement protects both parties by defining responsibilities and ensuring compliance with federal and state labor laws related to independent contractors. |

| 19 | Worker’s Compensation Acknowledgement | The worker's compensation acknowledgement is a crucial document that confirms the remote employee is informed about their rights and coverage under the company's workers' compensation policy. This acknowledgment ensures compliance with state labor laws and helps facilitate proper payroll deductions related to workers' compensation insurance. |

| 20 | State and Local Department of Revenue Registrations | State and local Department of Revenue registrations are essential documents for remote employee payroll setup, ensuring compliance with tax withholding and reporting requirements specific to each jurisdiction. Employers must register with the relevant revenue departments to obtain necessary tax identification numbers and authorize payroll tax remittance for accurate and timely employee tax processing. |

| 21 | Equal Employment Opportunity (EEO) Self-Identification Form | The Equal Employment Opportunity (EEO) Self-Identification Form is essential for remote employee payroll setup as it ensures compliance with federal regulations by collecting voluntarily provided demographic data on race, gender, and disability status. This form supports accurate reporting for affirmative action plans and helps employers maintain workplace diversity and equal opportunity standards. |

Introduction to Remote Employee Payroll Documentation

Setting up payroll for remote employees requires specific documentation to ensure compliance with legal and tax regulations. Accurate payroll documentation safeguards both employers and employees by providing clear records.

- Employee Identification Documents - Verify the identity and eligibility to work using government-issued IDs and completed Form I-9.

- Tax Withholding Forms - Collect W-4 forms for federal tax withholding and any applicable state or local tax forms.

- Direct Deposit Authorization - Obtain employee consent and bank details to enable secure and timely salary payments.

Proper payroll documentation is essential to streamline the payment process and maintain compliance in remote employment settings.

Importance of Proper Payroll Documentation

Proper payroll documentation is essential for accurate and compliant remote employee payment processing. Collecting and verifying the correct documents prevents errors and legal complications in payroll management.

- Employee Identification - Official IDs such as a passport or driver's license verify the remote worker's identity for payroll records.

- Tax Forms - Completed tax forms like W-4 or W-9 ensure accurate tax withholding and reporting.

- Direct Deposit Authorization - Written consent for direct deposit allows secure and timely salary payments to the employee's bank account.

Employment Verification Documents

Employment verification documents are essential for setting up remote employee payroll accurately. These documents typically include proof of identity, such as a government-issued ID, and employment eligibility verification forms like the I-9 in the United States. Payroll departments use this information to confirm the employee's work authorization and ensure compliance with labor laws.

Tax Identification and Withholding Forms

Setting up payroll for a remote employee requires accurate Tax Identification information, such as a Social Security Number (SSN) or Employer Identification Number (EIN). These identifiers ensure correct tax reporting and compliance with federal and state regulations.

Withholding forms like the W-4 for federal income tax and any applicable state withholding certificates must be collected. Proper completion of these forms determines the correct amount of tax to withhold from the employee's paycheck.

Direct Deposit Authorization Forms

What documents are essential for setting up payroll for a remote employee? Direct Deposit Authorization Forms are crucial as they allow employers to deposit salaries directly into the employee's bank account. These forms typically require bank account details, routing numbers, and employee signatures to ensure accurate and timely payments.

Employee Personal Information Forms

Employee personal information forms are essential for remote employee payroll setup, as they collect necessary data such as full name, address, and Social Security number. These forms also include tax withholding details like W-4 or equivalent state forms to ensure accurate payroll tax calculation. Employers rely on this information to comply with legal requirements and facilitate timely payment processing.

Remote Work Agreement Documentation

| Document | Description |

|---|---|

| Remote Work Agreement | A formal contract that outlines the terms and conditions of remote employment, including work hours, job responsibilities, communication protocols, and equipment usage. This document ensures the employee's remote status is legally recognized for payroll and tax purposes. |

| Employee Identification | Official identification documents such as a government-issued ID or passport required to verify the employee's identity and eligibility to work remotely in their location. |

| Tax Withholding Forms | Necessary forms such as W-4 for U.S. employees or equivalent tax documents in other countries, used to determine the correct amount of tax to withhold from the employee's paycheck. |

| Banking Information | Details of the employee's bank account for direct deposit of payroll. This includes bank name, account number, and routing number or IBAN, depending on the country. |

| Proof of Address | Documents like utility bills or lease agreements to confirm the employee's remote work location, which can affect tax and legal compliance. |

Confidentiality and Compliance Acknowledgements

To set up payroll for a remote employee, you need essential documents such as a completed W-4 form, proof of identity, and direct deposit information. Confidentiality and compliance acknowledgements are critical to protect sensitive employee data and meet legal requirements.

Confidentiality agreements ensure that both the employer and payroll providers handle personal information securely, preventing unauthorized access. Compliance acknowledgements confirm adherence to federal, state, and local tax regulations, labor laws, and data protection standards. These documents safeguard the integrity of payroll processing and maintain trust between the employer and employee.

Proof of Residency and Work Eligibility

Setting up payroll for a remote employee requires specific documentation to ensure compliance. Proof of residency and work eligibility are essential parts of this process.

- Proof of Residency - Documents such as a utility bill, lease agreement, or government-issued ID confirm the employee's physical address for tax and legal purposes.

- Work Eligibility Verification - Forms like the I-9 and supporting documents verify the employee's legal right to work in the country.

- Payroll Compliance - Accurate residency and work status prevent payroll errors and ensure adherence to federal and state regulations.

What Documents Do You Need for Remote Employee Payroll Setup? Infographic