New hire onboarding requires essential documents such as a signed offer letter, completed tax forms (W-4 or equivalent), and proof of identity and eligibility to work, like a passport or driver's license. Employers may also request direct deposit information, emergency contact details, and completion of benefits enrollment forms. Accurate and timely submission of these documents ensures a smooth transition into the new role and compliance with employment regulations.

What Documents Are Required for New Hire Onboarding?

| Number | Name | Description |

|---|---|---|

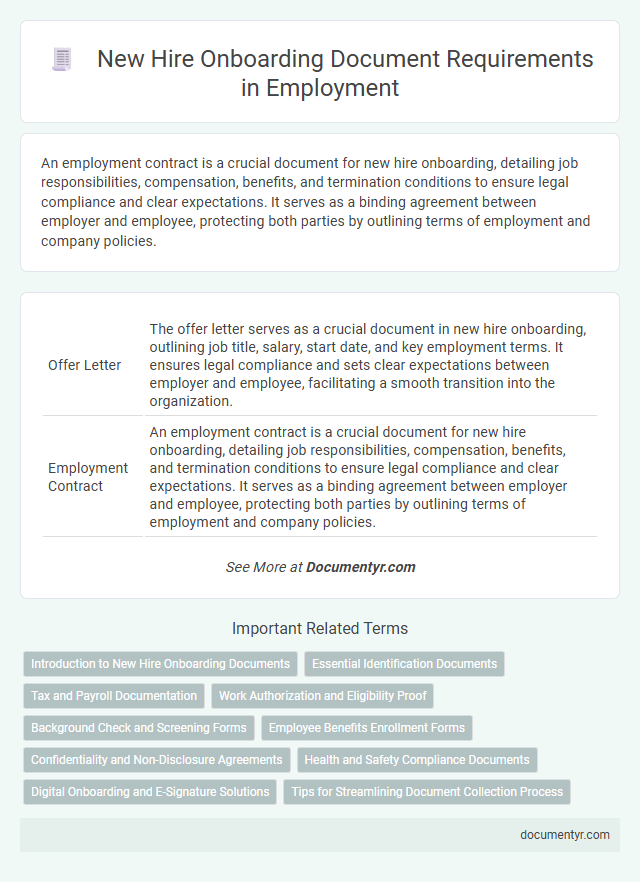

| 1 | Offer Letter | The offer letter serves as a crucial document in new hire onboarding, outlining job title, salary, start date, and key employment terms. It ensures legal compliance and sets clear expectations between employer and employee, facilitating a smooth transition into the organization. |

| 2 | Employment Contract | An employment contract is a crucial document for new hire onboarding, detailing job responsibilities, compensation, benefits, and termination conditions to ensure legal compliance and clear expectations. It serves as a binding agreement between employer and employee, protecting both parties by outlining terms of employment and company policies. |

| 3 | Job Description | The job description provides new hires with detailed information about their roles, responsibilities, and expectations, essential for aligning their tasks during onboarding. Accurate job descriptions ensure legal compliance and set clear performance standards, facilitating a smoother integration into the organization. |

| 4 | Tax Withholding Forms (W-4 or equivalent) | New hire onboarding requires completion of tax withholding forms such as the IRS Form W-4 or state-specific equivalents to ensure accurate federal and state income tax deductions. Employers must collect these forms before the employee's first paycheck to comply with tax regulations and avoid withholding errors. |

| 5 | I-9 Employment Eligibility Verification | New hire onboarding requires submitting Form I-9 Employment Eligibility Verification to confirm the employee's identity and authorization to work in the United States, using acceptable documents such as a U.S. passport or a combination of a driver's license and Social Security card. Employers must complete and retain Form I-9 within three business days of the employee's start date to comply with federal immigration laws and avoid penalties. |

| 6 | Direct Deposit Authorization | New hire onboarding requires essential documents including the Direct Deposit Authorization form, which enables automatic salary payments into the employee's bank account. This form typically collects banking information such as account number, routing number, and authorization signature to ensure secure and timely payroll processing. |

| 7 | Identification Documents (e.g., passport, driver’s license) | New hire onboarding requires valid identification documents such as a passport or driver's license to verify identity and comply with employment eligibility regulations. Employers must collect copies of these IDs to complete I-9 verification and maintain accurate personnel records. |

| 8 | Social Security Card | A Social Security card is essential for new hire onboarding as it verifies an employee's eligibility to work in the United States and is required for completing Form I-9. Employers use the Social Security number to report wages for tax purposes and ensure proper employee identification. |

| 9 | Background Check Consent Form | New hire onboarding requires a Background Check Consent Form to authorize the employer to verify criminal records, employment history, and educational qualifications, ensuring compliance with legal standards. This document is essential for safeguarding company integrity and maintaining a secure workplace environment. |

| 10 | Non-Disclosure Agreement (NDA) | The Non-Disclosure Agreement (NDA) is a critical document required during new hire onboarding to protect company confidential information and trade secrets. Signing the NDA ensures employees legally commit to maintaining privacy and preventing unauthorized disclosure of sensitive business data. |

| 11 | Non-Compete Agreement | A Non-Compete Agreement is a critical document required during new hire onboarding to protect company interests by restricting employees from engaging with competitors for a specified period. This agreement must comply with state laws and clearly outline duration, geographic scope, and prohibited activities to ensure enforceability and safeguard proprietary information. |

| 12 | Employee Handbook Acknowledgment | The Employee Handbook Acknowledgment is a critical document in new hire onboarding, confirming that the employee has received, read, and understood company policies and procedures. This acknowledgment safeguards employers by ensuring compliance and clarifies expectations related to workplace conduct and benefits. |

| 13 | Benefits Enrollment Forms | Benefits enrollment forms are essential documents required for new hire onboarding, enabling employees to select health insurance, retirement plans, and other company-sponsored benefits. Completing these forms promptly ensures access to coverage and compliance with employer timelines and legal requirements. |

| 14 | Emergency Contact Information Form | The Emergency Contact Information Form is essential for new hire onboarding as it provides critical details for quick communication in case of workplace emergencies. This form typically includes the employee's emergency contacts, their relationship to the employee, and multiple contact numbers to ensure prompt response and safety management. |

| 15 | Confidentiality Agreement | New hire onboarding requires signing a Confidentiality Agreement to protect company trade secrets and sensitive information, ensuring compliance with data protection laws and maintaining competitive advantage. This legally binding document outlines the employee's obligations to safeguard proprietary information during and after their employment. |

| 16 | State-Specific Employment Forms | State-specific employment forms required for new hire onboarding include the W-4 form for federal tax withholding, along with state tax withholding forms that vary by state such as California's DE 4 or New York's IT-2104. Employers must also ensure completion of state-specific new hire reports and verification documents like the I-9 form for employment eligibility, which may have state-mandated supplementary requirements or deadlines. |

| 17 | Equal Opportunity Employment Forms | New hire onboarding requires completing Equal Opportunity Employment Forms such as the EEOC (Equal Employment Opportunity Commission) self-identification questionnaire and the Affirmative Action Survey to ensure compliance with federal anti-discrimination laws. Employers must also collect the I-9 Employment Eligibility Verification form and provide employees with the EEO-1 report information to maintain workplace diversity records. |

| 18 | Drug Testing Consent Form | The Drug Testing Consent Form is a critical document required for new hire onboarding, ensuring compliance with company policies and legal regulations regarding workplace safety and substance abuse. This form authorizes the employer to conduct pre-employment drug screening, which helps maintain a drug-free work environment and protects both employees and the organization. |

| 19 | Health and Safety Policy Acknowledgment | New hires must provide signed Health and Safety Policy Acknowledgment forms to confirm understanding of workplace safety protocols and compliance requirements. This document ensures employees are informed about hazard prevention, emergency procedures, and company safety standards critical to maintaining a secure work environment. |

| 20 | Technology and Equipment Acknowledgment | New hire onboarding requires employees to complete a Technology and Equipment Acknowledgment form to confirm receipt and understanding of company-issued devices such as laptops, smartphones, and software licenses. This document ensures accountability for equipment usage, security policies, and return protocols, protecting company assets and compliance with IT guidelines. |

| 21 | Code of Conduct Acknowledgment | New hire onboarding requires employees to review and sign the Code of Conduct Acknowledgment, confirming their understanding of company policies, ethical standards, and workplace behavior expectations. This document ensures compliance with legal regulations and promotes a culture of integrity and accountability from the first day of employment. |

| 22 | Immigration Documents (if applicable) | New hire onboarding requires immigration documents such as a valid work visa, Employment Authorization Document (EAD), or Form I-9 with acceptable identification and work eligibility proof. Employers must verify these documents to ensure compliance with U.S. Citizenship and Immigration Services (USCIS) regulations and maintain accurate employment records. |

| 23 | Professional Licenses or Certifications (if applicable) | New hire onboarding requires submission of relevant professional licenses or certifications to verify qualifications and compliance with industry standards. Employers must collect original or notarized copies of these documents to ensure validity and maintain accurate employment records. |

Introduction to New Hire Onboarding Documents

New hire onboarding requires a set of essential documents to ensure a smooth transition into the workplace. These documents verify identity, eligibility to work, and provide critical information for payroll and benefits.

You will need to complete forms such as the I-9 Employment Eligibility Verification, W-4 Tax Withholding Certificate, and direct deposit authorization. Employers also request emergency contact information and acknowledgment of company policies. Proper documentation helps streamline the onboarding process and ensures compliance with labor regulations.

Essential Identification Documents

Essential identification documents for new hire onboarding typically include a government-issued photo ID, such as a passport or driver's license, to verify your identity. Employers also require a Social Security card or tax identification number to ensure proper tax documentation. Proof of work authorization, like a work visa or permanent resident card, is necessary to confirm legal employment eligibility.

Tax and Payroll Documentation

New hire onboarding requires specific tax and payroll documents to ensure compliance and accurate employee compensation. Proper documentation facilitates correct tax withholding and timely payroll processing.

- Form W-4 - Employees complete this form to determine federal income tax withholding based on their filing status and allowances.

- Form I-9 - This form verifies the employee's identity and eligibility to work in the United States.

- Direct Deposit Authorization - Employees provide banking information to enable electronic payment of wages.

Work Authorization and Eligibility Proof

New hire onboarding requires specific documents to verify work authorization and eligibility. Employers use these documents to ensure compliance with federal employment laws.

- Work Authorization Documents - These include documents such as a U.S. Passport, Permanent Resident Card (Green Card), or Employment Authorization Document (EAD) that prove legal permission to work.

- Identity Verification - Documents like a driver's license or state ID are used to confirm your identity during onboarding.

- Form I-9 Compliance - Employers must complete Form I-9 using the provided documents to verify eligibility for employment in the United States.

Providing accurate work authorization and eligibility documents is essential for successful new hire onboarding.

Background Check and Screening Forms

| Document Type | Description | Purpose |

|---|---|---|

| Background Check Authorization Form | Consent form allowing employer to conduct criminal, employment, and education history checks. | Ensures candidate meets company standards and legal compliance requirements. |

| Identity Verification Documents | Government-issued ID such as driver's license, passport, or state ID card. | Verifies the legal identity and eligibility to work in the country. |

| Employment Screening Questionnaire | Form capturing details about previous employment, qualifications, and references. | Facilitates verification of candidate's background and work history. |

| Authorization for Drug Screening | Consent form to perform pre-employment drug testing. | Ensures compliance with company policies and industry regulations. |

| Credit Check Authorization (if applicable) | Consent form to review credit history for positions involving financial responsibilities. | Assesses financial reliability and trustworthiness of the candidate. |

Employee Benefits Enrollment Forms

What documents are required for new hire onboarding related to employee benefits enrollment? Employers typically provide employee benefits enrollment forms to new hires during onboarding. These forms collect essential information for health insurance, retirement plans, and other benefit programs.

Confidentiality and Non-Disclosure Agreements

New hire onboarding requires several important documents to ensure smooth integration into the company. Among these, Confidentiality and Non-Disclosure Agreements (NDAs) are critical for protecting sensitive information.

Confidentiality agreements establish the employee's duty to safeguard proprietary data and trade secrets. NDAs legally bind new hires to refrain from sharing company information with unauthorized parties during and after their employment.

Health and Safety Compliance Documents

Health and safety compliance documents are essential for new hire onboarding to ensure a safe work environment. Required documents often include proof of medical clearance, emergency contact information, and safety training acknowledgments. You must provide these forms promptly to meet regulatory standards and maintain workplace safety.

Digital Onboarding and E-Signature Solutions

New hire onboarding requires essential documents such as identification, tax forms, and employment agreements. Digital onboarding platforms streamline this process by allowing employees to submit these documents online securely.

E-signature solutions enhance efficiency by enabling electronically signed contracts and compliance forms. This reduces paperwork, accelerates onboarding timelines, and ensures legal validity for all employment documents.

What Documents Are Required for New Hire Onboarding? Infographic