Freelancers must have a valid government-issued ID, proof of business registration if applicable, and a completed W-9 form to begin client work. Essential contracts outlining project scope, payment terms, and confidentiality agreements help protect both parties. Keeping accurate records of invoices and receipts ensures smooth financial management and tax compliance.

What Documents Does a Freelancer Need to Start Client Work?

| Number | Name | Description |

|---|---|---|

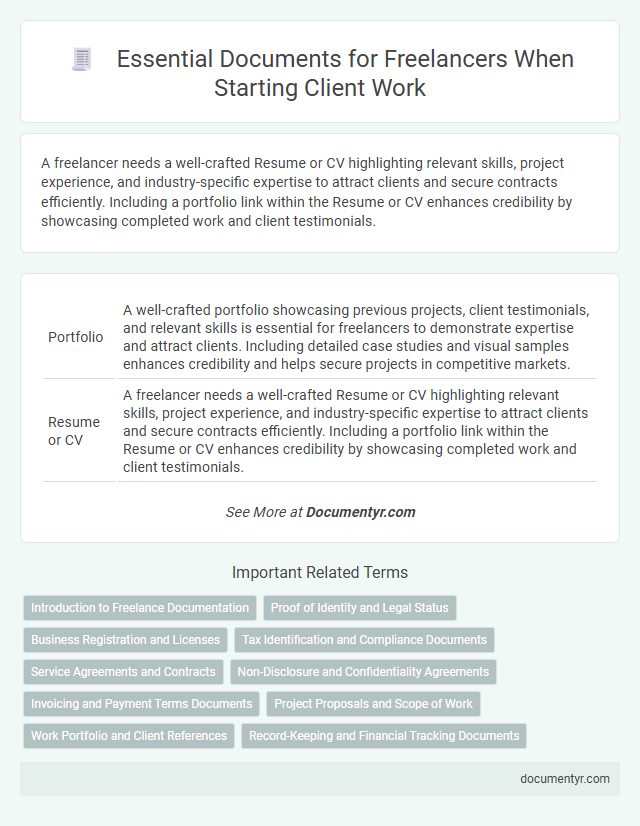

| 1 | Portfolio | A well-crafted portfolio showcasing previous projects, client testimonials, and relevant skills is essential for freelancers to demonstrate expertise and attract clients. Including detailed case studies and visual samples enhances credibility and helps secure projects in competitive markets. |

| 2 | Resume or CV | A freelancer needs a well-crafted Resume or CV highlighting relevant skills, project experience, and industry-specific expertise to attract clients and secure contracts efficiently. Including a portfolio link within the Resume or CV enhances credibility by showcasing completed work and client testimonials. |

| 3 | Business Registration Certificate | A freelancer needs a Business Registration Certificate to legally establish their business entity and demonstrate compliance with local regulations. This certificate serves as proof of legitimacy for clients and enables access to essential tax identification and financial services. |

| 4 | Tax Identification Number (TIN) or EIN | Freelancers must obtain a Tax Identification Number (TIN) or Employer Identification Number (EIN) to accurately report income and comply with tax regulations, ensuring their client work is legally recognized. These identifiers facilitate proper tax withholding, filing, and eligibility for business deductions, which are essential for financial transparency and legal compliance in freelance employment. |

| 5 | Bank Account Information | Freelancers need to provide accurate bank account information, including account number, routing number, and bank name, to facilitate seamless payment processing from clients. Having verified banking details ensures timely receipt of funds and helps maintain transparent financial records for tax and contract purposes. |

| 6 | Service Agreement/Contract | A freelancer needs a detailed service agreement or contract outlining project scope, deliverables, payment terms, deadlines, and confidentiality clauses to start client work. This legally binding document protects both parties by clearly defining expectations and responsibilities. |

| 7 | Non-Disclosure Agreement (NDA) | A Non-Disclosure Agreement (NDA) is essential for freelancers to protect confidential client information and establish trust before starting any project. This legally binding document ensures that sensitive data, proprietary ideas, and trade secrets remain secure, minimizing the risk of unauthorized disclosure or misuse. |

| 8 | Invoice Template | Freelancers need a professional invoice template that includes essential details such as their name, contact information, client's details, a clear description of services provided, payment terms, and due dates to ensure timely and accurate payments. Incorporating tax identification numbers and customizable fields for project specifics optimizes record-keeping and client communication throughout the employment process. |

| 9 | Statement of Work (SOW) | A Statement of Work (SOW) is essential for freelancers to clearly outline project scope, deliverables, timelines, and payment terms, ensuring mutual understanding between client and freelancer. This document minimizes disputes and serves as a legal reference throughout the project lifecycle. |

| 10 | Proof of Identity (e.g., Passport, National ID) | Freelancers must provide proof of identity, such as a passport or national ID, to verify their legal status and build client trust when starting work. These documents ensure compliance with tax regulations and help prevent fraud during contract negotiations and payment processing. |

| 11 | Work Permit (if applicable) | Freelancers must secure a valid work permit if local laws require one for self-employment or contracting, ensuring legal compliance and the ability to invoice clients officially. This document verifies authorization to operate within the jurisdiction and is critical for avoiding legal penalties and establishing credibility with clients. |

| 12 | Reference Letters or Testimonials | Freelancers need reference letters or testimonials from previous clients to demonstrate credibility and showcase their expertise when starting new client work. These documents serve as valuable proof of professionalism and successful project outcomes, helping to build trust with potential clients. |

| 13 | Insurance Certificate (Professional Liability, if required) | Freelancers need to obtain a professional liability insurance certificate to protect against potential claims of negligence or errors in their client work, which is often a client requirement before starting a project. This insurance certificate not only demonstrates credibility but also provides financial protection against legal disputes related to professional services. |

| 14 | Payment Method Setup Document (e.g., PayPal, Stripe, Bank Account Details) | Freelancers must provide payment method setup documents such as PayPal or Stripe account information, along with accurate bank account details, to ensure timely and secure client payments. Verifying these documents helps establish trust and facilitates smooth financial transactions throughout the project lifecycle. |

| 15 | Intellectual Property Agreement (if applicable) | Freelancers should secure an Intellectual Property Agreement when starting client work to define ownership rights and usage terms of the created content or deliverables. This document protects both parties by clarifying who retains copyrights, licenses, and any potential transfer of intellectual property. |

| 16 | Proposal Document | A detailed proposal document is essential for freelancers starting client work, clearly outlining project scope, deliverables, timelines, and payment terms to ensure mutual understanding and avoid disputes. This document serves as a legally binding agreement that protects both parties by setting expectations and defining responsibilities before work begins. |

| 17 | Timesheet Template | A freelancer needs a detailed timesheet template to accurately track billable hours and project milestones, ensuring transparent communication with clients and precise invoicing. This document typically includes date, start and end times, task descriptions, and total hours worked to promote efficient work management and payment processing. |

| 18 | Project Brief/Scope Document | A Project Brief or Scope Document outlines the key objectives, deliverables, timelines, and responsibilities for a freelance assignment, serving as a foundational agreement between freelancer and client. This document is essential for clarifying expectations, minimizing scope creep, and ensuring successful project outcomes in freelance engagements. |

| 19 | Confidentiality Agreement | A freelancer must have a signed Confidentiality Agreement to protect client information and ensure data privacy before starting work. This document legally binds both parties to maintain the confidentiality of sensitive project details and proprietary information. |

| 20 | Data Processing Agreement (if handling client data) | Freelancers handling client data must have a Data Processing Agreement (DPA) to ensure compliance with data protection regulations like GDPR. This document outlines responsibilities, data handling procedures, and security measures, safeguarding both client information and freelancer liability. |

Introduction to Freelance Documentation

Starting freelance work requires proper documentation to establish credibility and ensure smooth client interactions. Understanding the essential documents helps streamline your onboarding process and protects both parties.

Key documents include a signed contract outlining project scope, payment terms, and deadlines. Invoices are necessary for billing clients and maintaining financial records. Additionally, having proof of identity and tax forms ensures compliance with legal and tax regulations.

Proof of Identity and Legal Status

Proof of identity and legal status are essential documents freelancers need before starting client work. These documents verify who you are and confirm your eligibility to offer services legally.

- Government-issued ID - A valid passport or driver's license serves as official proof of identity.

- Work Permit or Visa - Documents that demonstrate legal authorization to work in a specific country.

- Tax Identification Number - Required for tax reporting and compliance with local laws.

Securing these documents establishes trust and ensures compliance with client and regulatory requirements.

Business Registration and Licenses

What business registration documents does a freelancer need to start client work? Freelancers must often register their business with local or state authorities to operate legally. This registration establishes their business identity and allows them to invoice clients properly.

Are specific licenses required for freelancers before beginning client projects? Depending on the industry and location, freelancers might need professional licenses or permits. These credentials ensure compliance with regulations and build client trust in the freelancer's expertise.

Tax Identification and Compliance Documents

| Document Type | Description | Purpose |

|---|---|---|

| Tax Identification Number (TIN) | A unique number issued by the tax authority to identify you as a taxpayer. | Essential for filing tax returns and reporting income from freelance work. |

| Business Registration Certificate | Official documentation proving your freelance business is registered with local authorities. | Confirms legal status and compliance for client contracts and invoicing. |

| Tax Compliance Certificate | Proof of adherence to tax regulations, often issued after submitting required tax returns and payments. | Demonstrates your compliance to clients and government agencies. |

| VAT Registration (if applicable) | Registration with tax authorities to collect and remit Value Added Tax on taxable services. | Required if your freelance income exceeds the VAT threshold determined by local tax laws. |

| Income Tax Returns | Documents filed annually to declare your freelance earnings and calculate owed taxes. | Serves as evidence of income and tax compliance for clients and tax authorities. |

| Invoices | Detailed statements issued to clients listing services provided, payment terms, and tax information. | Supports tax reporting and payment collection for freelance work. |

Service Agreements and Contracts

Freelancers must have clear service agreements and contracts before starting client work to establish project scope and payment terms. These documents protect both parties by outlining deliverables, deadlines, and fees.

A well-drafted contract minimizes disputes and ensures legal compliance. Including confidentiality and termination clauses further safeguards the freelancer's professional interests.

Non-Disclosure and Confidentiality Agreements

Freelancers must secure essential documents before commencing client projects to ensure legal and professional protection. Non-Disclosure and Confidentiality Agreements are critical in safeguarding sensitive information shared during the engagement.

- Non-Disclosure Agreement (NDA) - A legal contract that prevents freelancers from disclosing proprietary or confidential client information.

- Confidentiality Agreement - Ensures that any private data accessed or created remains secure and not shared beyond authorized parties.

- Mutual Confidentiality Clause - Sometimes included in contracts, this clause protects both the freelancer's and client's sensitive information during and after the project.

Invoicing and Payment Terms Documents

Freelancers must prepare clear invoicing documents to ensure timely and accurate payment. Invoices should include essential details such as your name, contact information, client details, service description, payment amount, and due date.

Payment terms documents outline conditions like payment methods, deadlines, late fees, and any advance payment requirements. Establishing these terms upfront protects your rights and fosters transparent communication with clients.

Project Proposals and Scope of Work

A freelancer needs a well-crafted project proposal to clearly outline the services offered, timelines, and payment terms. The scope of work document defines the specific tasks, deliverables, and expectations to avoid misunderstandings between the freelancer and the client. These documents establish a professional framework that protects both parties and ensures smooth project execution.

Work Portfolio and Client References

A freelancer needs a well-organized work portfolio to showcase their skills and previous projects effectively. This portfolio should include detailed descriptions, outcomes, and any measurable results to demonstrate expertise. Client references provide valuable credibility by offering testimonials that highlight reliability and professionalism to potential clients.

What Documents Does a Freelancer Need to Start Client Work? Infographic