Independent contractors must maintain a variety of documents for tax purposes, including Form W-9 to provide their taxpayer identification number to clients. Recordkeeping of all invoices, receipts, and expense reports is essential to accurately report income and claim deductions. Additionally, completing Schedule C and retaining Form 1099-NEC from clients helps ensure proper reporting of earnings to the IRS.

What Documents Does an Independent Contractor Need for Tax Purposes?

| Number | Name | Description |

|---|---|---|

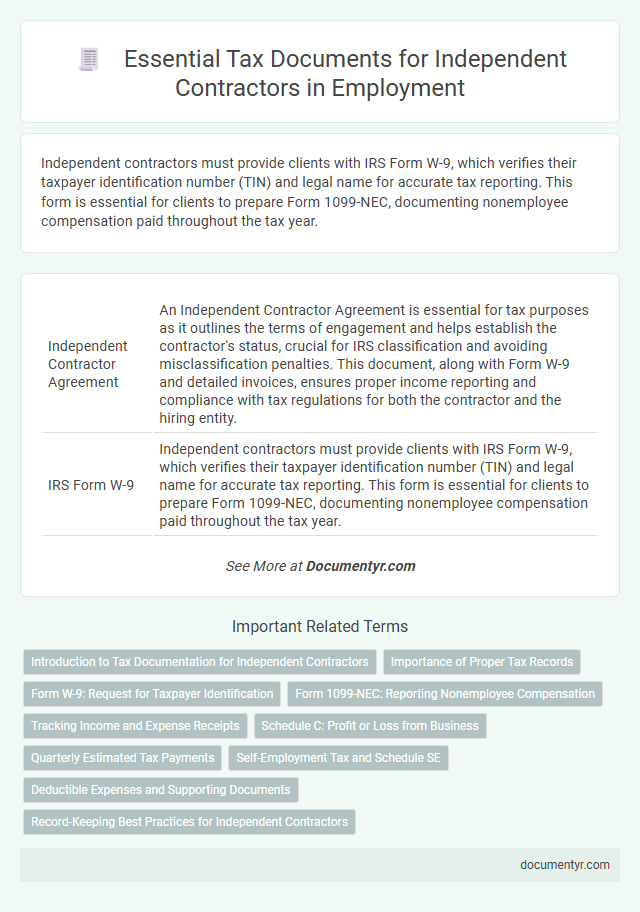

| 1 | Independent Contractor Agreement | An Independent Contractor Agreement is essential for tax purposes as it outlines the terms of engagement and helps establish the contractor's status, crucial for IRS classification and avoiding misclassification penalties. This document, along with Form W-9 and detailed invoices, ensures proper income reporting and compliance with tax regulations for both the contractor and the hiring entity. |

| 2 | IRS Form W-9 | Independent contractors must provide clients with IRS Form W-9, which verifies their taxpayer identification number (TIN) and legal name for accurate tax reporting. This form is essential for clients to prepare Form 1099-NEC, documenting nonemployee compensation paid throughout the tax year. |

| 3 | IRS Form 1099-NEC | Independent contractors must receive IRS Form 1099-NEC from clients who pay them $600 or more during the tax year to report nonemployee compensation. This form is essential for accurately reporting income and fulfilling tax obligations to the IRS. |

| 4 | Invoices | Independent contractors need to maintain detailed invoices that include their business name, contact information, date of service, description of work performed, payment terms, and total amount due to accurately report income for tax purposes. These invoices serve as essential documentation to verify earnings and support deductions during tax filing with the IRS. |

| 5 | Receipts for Business Expenses | Receipts for business expenses are essential for independent contractors to accurately track deductible costs and provide proof of expenses during tax filing. Maintaining organized records of receipts such as office supplies, travel, and equipment purchases helps maximize tax deductions and ensures compliance with IRS requirements. |

| 6 | Bank Statements | Independent contractors should maintain accurate bank statements to verify income deposits and support tax deductions during audits. These financial records provide crucial evidence for the IRS, demonstrating consistent payment receipts and expense transactions related to their contracting work. |

| 7 | Mileage Logs | Independent contractors must maintain detailed mileage logs to accurately track business-related vehicle expenses for tax deductions, documenting dates, locations, purpose of trips, and miles driven. The IRS requires these logs as essential proof to substantiate mileage deductions and reduce taxable income effectively. |

| 8 | Profit and Loss Statement | Independent contractors need a Profit and Loss Statement to accurately report income and expenses on tax returns, helping to determine taxable profit. This document summarizes all business revenues and deductible costs, essential for calculating self-employment tax and qualifying for potential deductions. |

| 9 | Schedule C (IRS Form 1040 Attachment) | Independent contractors need to file Schedule C (IRS Form 1040 Attachment) to report income and expenses related to their business activities, which is essential for calculating taxable profit. Maintaining accurate records such as invoices, receipts, and bank statements supports the information reported on Schedule C and helps ensure compliance with IRS tax regulations. |

| 10 | Home Office Deduction Records | Independent contractors must maintain detailed home office deduction records, including a floor plan of the workspace and evidence of exclusive and regular use such as utility bills and rent receipts. Accurate documentation of expenses related to the home office, like mortgage interest, property taxes, and repairs, is essential for maximizing tax deductions. |

| 11 | Quarterly Estimated Tax Payment Receipts (IRS Form 1040-ES) | Independent contractors must retain Quarterly Estimated Tax Payment Receipts using IRS Form 1040-ES to document timely income tax payments throughout the fiscal year. These receipts serve as critical proof for self-employment tax compliance and accurate filing during annual tax returns. |

| 12 | Records of Asset Purchases and Depreciation | Independent contractors must maintain detailed records of asset purchases, including invoices and receipts, to accurately track business expenses for tax deductions. Proper documentation of depreciation schedules for assets such as equipment and vehicles is essential to comply with IRS requirements and optimize tax benefits. |

| 13 | Health Insurance Premium Documentation | Independent contractors need to maintain detailed health insurance premium documentation, including invoices, receipts, and payment confirmation records, to accurately claim deductions on their tax returns. Properly organized health insurance expense records facilitate compliance with IRS requirements and support eligibility for tax credits or adjustments related to self-employed health coverage. |

| 14 | Retirement Contribution Records | Independent contractors need to maintain detailed retirement contribution records such as Form 5498 for IRAs and plan statements for SEP IRAs or Solo 401(k)s to accurately report deductions and savings on their tax returns. These documents validate contributions, assist in tax planning, and ensure compliance with IRS regulations regarding retirement savings. |

| 15 | Records of Payments to Subcontractors (and their 1099 forms) | Independent contractors must maintain accurate records of payments made to subcontractors, including copies of issued 1099-NEC forms, to comply with IRS reporting requirements. These documents are essential for verifying deductible expenses and ensuring proper tax reporting to avoid penalties. |

Introduction to Tax Documentation for Independent Contractors

Independent contractors must maintain specific tax documents to ensure compliance with tax regulations and accurate reporting of income. Understanding these documents helps prevent errors and potential audits by tax authorities.

- Form W-9 - Used to provide your taxpayer identification number to clients for accurate information reporting.

- Form 1099-NEC - Issued by clients to report nonemployee compensation paid to you during the tax year.

- Expense Records - Detailed receipts and invoices that support deductible business expenses for reducing taxable income.

Proper organization of tax documents is essential for independent contractors to prepare tax returns and fulfill IRS requirements effectively.

Importance of Proper Tax Records

What documents does an independent contractor need for tax purposes? Independent contractors must maintain detailed records such as Form 1099-NEC, invoices, and expense receipts. Proper tax records ensure accurate tax reporting and help in case of IRS audits.

Form W-9: Request for Taxpayer Identification

| Document | Description | Purpose |

|---|---|---|

| Form W-9: Request for Taxpayer Identification | This form is used by independent contractors to provide their correct Taxpayer Identification Number (TIN) to the entity paying them. | Ensures accurate reporting of income to the IRS and helps in issuing Form 1099-MISC or 1099-NEC at year-end. |

| Form 1099-NEC | Provided by the payer to the independent contractor if payments exceed $600 in a tax year. | Reports nonemployee compensation to the IRS for income tax purposes. |

| Invoices and Payment Records | Detailed documents that track services rendered and payments received. | Supports accurate income reporting and helps in tax deductions calculation. |

| Receipts for Business Expenses | Receipts for expenses related to your contracting work. | Used to claim deductions and reduce taxable income appropriately. |

| Estimated Tax Payment Records | Records of quarterly estimated tax payments made to the IRS or state tax authorities. | Demonstrates compliance with tax obligations throughout the year. |

Form 1099-NEC: Reporting Nonemployee Compensation

Independent contractors must maintain specific documents for accurate tax reporting and compliance. Form 1099-NEC is essential for reporting income earned as a nonemployee.

- Form 1099-NEC - Reports nonemployee compensation paid to contractors exceeding $600 in a tax year.

- W-9 Form - Provides the contractor's Taxpayer Identification Number (TIN) used to complete Form 1099-NEC.

- Receipts and Invoices - Document income and expenses to support amounts reported on tax returns and Form 1099-NEC.

Tracking Income and Expense Receipts

Independent contractors must maintain thorough records of all income received to accurately report earnings on tax returns. Tracking expense receipts is crucial for claiming valid deductions, reducing taxable income effectively. Organizing and preserving these documents ensures compliance with tax regulations and simplifies the filing process.

Schedule C: Profit or Loss from Business

Independent contractors must file Schedule C: Profit or Loss from Business to report income and expenses related to their work. This form is essential for calculating net profit or loss, which affects overall taxable income. Accurate record-keeping of receipts, invoices, and business expenses supports the information reported on Schedule C for tax purposes.

Quarterly Estimated Tax Payments

Independent contractors must keep accurate records of their income and expenses for tax purposes. Key documents include Form 1099-NEC and receipts related to business expenditures.

Quarterly estimated tax payments are essential to avoid penalties and underpayment fees. Contractors calculate these payments based on their expected annual income using Form 1040-ES. Maintaining documentation of these payments helps ensure compliance with IRS requirements and accurate tax filing.

Self-Employment Tax and Schedule SE

Independent contractors must maintain accurate records of their income and expenses to properly report earnings for tax purposes. Key documents include Form 1099-NEC, which reports nonemployee compensation received from clients.

Self-employment tax applies to independent contractors, covering Social Security and Medicare obligations. Schedule SE is the form used to calculate and report self-employment tax on the individual's federal tax return.

Deductible Expenses and Supporting Documents

Independent contractors must maintain thorough records for tax purposes, focusing on deductible expenses and the corresponding supporting documents. Proper documentation ensures accurate reporting and maximizes allowable deductions.

- Receipts for Business Expenses - Keep receipts for supplies, equipment, and services directly related to your work to validate deductions.

- Mileage Logs - Document business-related travel with mileage logs to claim vehicle expense deductions accurately.

- Invoices and Payment Records - Maintain copies of invoices issued and payments received to track income and support expense claims.

What Documents Does an Independent Contractor Need for Tax Purposes? Infographic