Proof of employment for a loan typically requires recent pay stubs, a formal employment verification letter, and W-2 tax forms from the past one or two years. Lenders may also request bank statements showing direct deposits or an employment contract to confirm job stability and income. Accurate and up-to-date documentation ensures a smoother loan approval process by verifying consistent employment status.

What Documents are Needed for Proof of Employment for a Loan?

| Number | Name | Description |

|---|---|---|

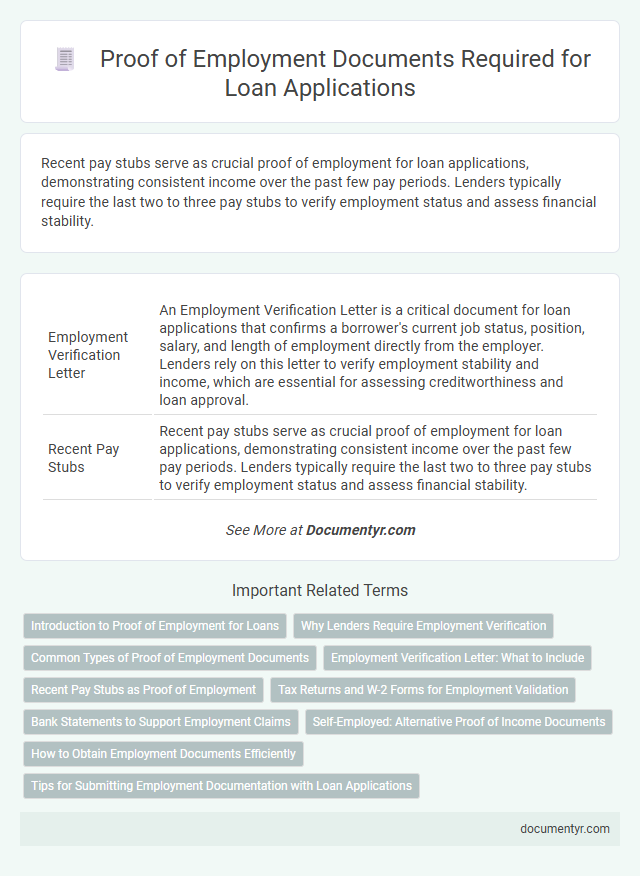

| 1 | Employment Verification Letter | An Employment Verification Letter is a critical document for loan applications that confirms a borrower's current job status, position, salary, and length of employment directly from the employer. Lenders rely on this letter to verify employment stability and income, which are essential for assessing creditworthiness and loan approval. |

| 2 | Recent Pay Stubs | Recent pay stubs serve as crucial proof of employment for loan applications, demonstrating consistent income over the past few pay periods. Lenders typically require the last two to three pay stubs to verify employment status and assess financial stability. |

| 3 | Most Recent Tax Returns (Form 1040) | Most recent tax returns (Form 1040) serve as critical proof of employment and income when applying for a loan, providing detailed documentation of earnings, deductions, and filing status. Lenders rely on these forms to verify consistent income, assess financial stability, and confirm employment history over the previous tax year. |

| 4 | W-2 Forms | W-2 forms serve as primary documents required for proof of employment in loan applications, detailing annual wages and tax withholdings reported by employers to the IRS. Lenders rely on W-2 forms to verify consistent income and employment history, ensuring borrower reliability and loan eligibility. |

| 5 | 1099 Forms (if self-employed or gig worker) | Proof of employment for a loan requires submitting 1099 forms if you are self-employed or a gig worker, as these documents verify income received from contractors or freelance work. Lenders use 1099 forms alongside bank statements and tax returns to assess consistent earnings and financial stability for loan approval. |

| 6 | Bank Statements | Bank statements are essential documents for proof of employment when applying for a loan, as they provide a record of regular salary deposits directly from an employer. Lenders rely on these statements to verify consistent income and financial stability over a defined period, typically the past three to six months. |

| 7 | Offer Letter (for new jobs) | An offer letter serves as crucial proof of employment for loan applications, outlining job title, salary, and start date to validate employment status. Lenders rely on this document to assess income stability and employment verification for new job applicants. |

| 8 | Contract of Employment | A Contract of Employment serves as a primary document to verify proof of employment for loan applications, detailing the employee's job title, salary, and duration of employment. Lenders rely on this legally binding agreement to assess job stability and income consistency before approving loans. |

| 9 | Employer Contact Information | Employer contact information for proof of employment typically includes the company's official name, address, phone number, and email of the human resources department or direct supervisor. Lenders use this information to verify employment status, job title, and salary details directly with the employer. |

| 10 | Social Security Number Verification | Proof of employment for a loan typically requires documents that verify Social Security Number (SSN), such as a Social Security card, W-2 forms, or recent pay stubs displaying the SSN. Lenders often cross-check these documents with the Social Security Administration database to confirm identity and employment status. |

| 11 | Direct Deposit Slips | Direct deposit slips serve as critical proof of consistent income by detailing wages electronically transferred to your bank account, which lenders use to verify employment stability and salary history. These slips typically include the employer's name, pay dates, and payment amounts, providing transparent documentation essential for loan approval processes. |

| 12 | Business License (if self-employed) | A valid business license serves as a crucial proof of employment for self-employed individuals applying for a loan, verifying the legitimacy and continuity of their business operations. Lenders often require this document along with financial statements and tax returns to assess income stability and business credibility. |

| 13 | Profit and Loss Statement | A Profit and Loss Statement serves as a crucial document for verifying self-employment income when applying for a loan, detailing revenue, expenses, and net profit over a specific period. Lenders rely on this financial statement to assess business profitability and income stability, ensuring the borrower's ability to repay the loan. |

| 14 | Schedule C (if self-employed) | Lenders typically require a Schedule C form from self-employed individuals as primary proof of employment and income for a loan application, highlighting business earnings and expenses reported on IRS tax returns. Supporting documents may include recent tax returns, profit and loss statements, and bank statements to verify consistent income and business operations. |

| 15 | Unemployment Benefits Statement (if applicable) | An Unemployment Benefits Statement serves as a critical document to verify income sources when applying for a loan during periods of unemployment. Lenders require this statement to assess financial stability and ensure borrowers meet loan eligibility criteria despite the absence of traditional employment income. |

| 16 | Pension or Retirement Benefit Statement (if applicable) | A pension or retirement benefit statement serves as critical proof of consistent income and financial stability when applying for a loan. This document details monthly or annual pension earnings, confirming the applicant's reliable post-employment income source. |

Introduction to Proof of Employment for Loans

Proof of employment is a crucial requirement when applying for a loan. It verifies your income stability and job status to lenders.

- Employment Verification Letter - Official letter from your employer confirming your job title, salary, and length of employment.

- Recent Pay Stubs - Payslips from the last one to three months that provide evidence of your current earnings.

- Tax Documents - Copies of your W-2 forms or tax returns demonstrating your annual income.

Providing accurate proof of employment helps lenders assess your ability to repay the loan confidently.

Why Lenders Require Employment Verification

Lenders require proof of employment to assess the borrower's ability to repay the loan reliably. Verifying employment ensures the income stated by the applicant is accurate and stable, reducing the risk of default.

- Income Stability - Consistent employment history confirms a steady income stream necessary for loan repayment.

- Fraud Prevention - Employment verification helps detect false or inflated income claims.

- Risk Assessment - Lenders evaluate employment status to determine the borrower's creditworthiness and loan terms.

Common Types of Proof of Employment Documents

What documents are typically required as proof of employment for a loan application? Lenders commonly request official paperwork that verifies your current job status and income. This evidence helps them assess your ability to repay the loan.

What are the common types of proof of employment documents accepted by lenders? Pay stubs, employment verification letters, and recent tax returns are among the most frequently requested forms. These documents provide clear confirmation of your employment and financial stability.

Why are pay stubs important for proving employment during a loan process? Pay stubs show your earnings over a specific period and confirm your steady income. They serve as direct proof of employment payment history to loan officers.

How does an employment verification letter function as a proof document? This letter is usually issued by your employer and states your job title, length of employment, and salary details. Lenders rely on this document to verify your employment status officially.

Are recent tax returns necessary for employment proof when applying for a loan? Tax returns provide comprehensive information about your income over the past year. They support the lender's evaluation by confirming your reported earnings and employment consistency.

Employment Verification Letter: What to Include

Proof of employment is essential when applying for a loan, and an employment verification letter serves as a critical document. This letter confirms the borrower's job status, income, and duration of employment to the lender.

- Employer Information - The letter should include the company's name, address, and contact details for verification purposes.

- Employee Details - It must state the employee's full name, job title, and employment start date to establish identity and work history.

- Salary and Employment Status - The letter should clearly mention the employee's current salary, payment frequency, and whether the employment is full-time, part-time, or contract-based.

Recent Pay Stubs as Proof of Employment

Recent pay stubs serve as a primary document for proof of employment when applying for a loan. They provide current income information, verify the borrower's job status, and demonstrate consistent earnings. Lenders rely on these documents to assess financial stability and repayment capability.

Tax Returns and W-2 Forms for Employment Validation

Tax returns serve as crucial proof of your income and employment status when applying for a loan. Lenders often request the most recent two years of tax returns to verify consistent earnings and employment history.

W-2 forms provide detailed information on wages earned and taxes withheld by your employer. These forms complement tax returns by confirming employment status and income, helping lenders assess loan eligibility accurately.

Bank Statements to Support Employment Claims

Proof of employment is essential when applying for a loan, as lenders require verification of your income and job stability. Among the various documents, bank statements provide critical evidence supporting your employment claims.

Bank statements demonstrate consistent salary deposits, reflecting regular income from your employer. These documents help lenders assess your financial reliability and repayment capacity. Providing multiple months of bank statements strengthens your loan application by confirming steady cash flow aligned with your employment status.

Self-Employed: Alternative Proof of Income Documents

Self-employed individuals must provide alternative proof of income when applying for a loan, as traditional pay stubs are often unavailable. Lenders typically require documents that demonstrate consistent earnings and business viability.

Common documents include personal and business tax returns from the past two years, profit and loss statements, and bank statements showing regular deposits. A letter from a certified accountant verifying income and business activity can also strengthen the loan application.

How to Obtain Employment Documents Efficiently

| Document Type | Description | How to Obtain Efficiently |

|---|---|---|

| Employment Verification Letter | Official letter from the employer confirming current employment status, job title, and salary details. | Contact Human Resources directly via email or HR portal. Request the letter specifying the purpose for the loan application to expedite processing. |

| Recent Pay Stubs | Documents showing recent earnings, usually covering the last 2-3 pay periods. | Access the company payroll system or employee self-service portal. Download or print the required pay stubs to provide proof of consistent income. |

| Employment Contract | Official agreement between employee and employer outlining job role, salary, and employment terms. | Retrieve from your personal records or request a copy from Human Resources; maintaining an updated digital copy streamlines the loan application process. |

| Tax Returns | Documents filed with tax authorities reflecting income earned during the year. | Use tax preparation software or consult your accountant. Obtain official copies from the tax agency's online portal for verified income proof. |

| Bank Statements | Statements showing salary deposits as indirect proof of employment and income. | Download statements via your online banking platform. Highlight or summarize salary deposits if required by the lender. |

What Documents are Needed for Proof of Employment for a Loan? Infographic