Remote employees must submit essential documents such as a signed employment contract, government-issued identification, and tax forms like the W-4 or equivalent. Proof of residency, bank details for direct deposit, and any required work permits or visas should also be provided to ensure compliance. Accurate and timely document submission streamlines HR processing and helps maintain proper employment records.

What Documents Does a Remote Employee Need to Submit for HR Processing?

| Number | Name | Description |

|---|---|---|

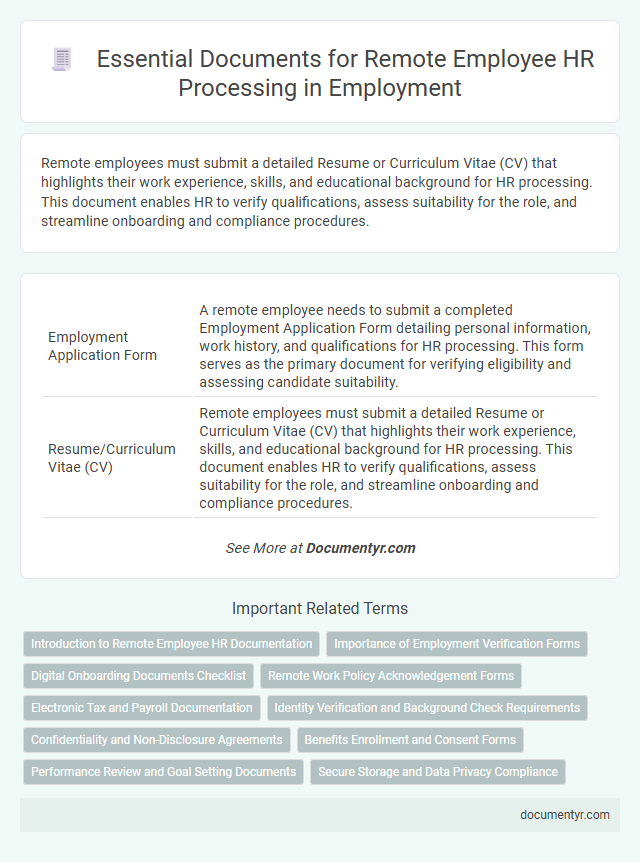

| 1 | Employment Application Form | A remote employee needs to submit a completed Employment Application Form detailing personal information, work history, and qualifications for HR processing. This form serves as the primary document for verifying eligibility and assessing candidate suitability. |

| 2 | Resume/Curriculum Vitae (CV) | Remote employees must submit a detailed Resume or Curriculum Vitae (CV) that highlights their work experience, skills, and educational background for HR processing. This document enables HR to verify qualifications, assess suitability for the role, and streamline onboarding and compliance procedures. |

| 3 | Signed Offer Letter | A remote employee must submit a signed offer letter as a primary document for HR processing to confirm agreement on employment terms and conditions. This signed offer letter serves as a formal acceptance of the job offer, ensuring clarity on role, salary, and start date. |

| 4 | Government-issued Photo ID | A remote employee must submit a government-issued photo ID, such as a passport or driver's license, to verify identity and comply with employment eligibility requirements. This document ensures accurate HR records and meets legal standards for worker verification processes like Form I-9. |

| 5 | Social Security Number (SSN) or Tax Identification Number (TIN) | Remote employees must submit their Social Security Number (SSN) or Tax Identification Number (TIN) to HR for tax reporting and verification purposes. These documents ensure compliance with federal employment laws and enable accurate payroll processing and benefits administration. |

| 6 | W-4 Form (US) / Tax Declaration Form | Remote employees must submit the W-4 Form to accurately establish federal income tax withholding based on their filing status and allowances, ensuring compliance with IRS regulations. This document is essential for HR to process payroll correctly and avoid under- or over-withholding of taxes. |

| 7 | I-9 Form and Supporting Documents (US) | Remote employees in the US must submit a completed I-9 Form along with acceptable supporting documents that establish both identity and employment authorization, such as a U.S. passport or a combination of a driver's license and social security card. HR processing requires these documents to be verified, often through electronic or in-person review within three business days of the employee's start date. |

| 8 | Direct Deposit Authorization Form | Remote employees must submit a completed Direct Deposit Authorization Form to ensure timely and accurate payroll processing. This form typically requires bank account details such as the account number and routing number to facilitate seamless electronic salary deposits. |

| 9 | Proof of Address | Remote employees must submit valid proof of address documents such as utility bills, lease agreements, or bank statements dated within the last three months for HR processing. Accurate and current address verification ensures compliance with company policies and supports tax and legal record-keeping requirements. |

| 10 | Work Authorization Document (if applicable) | Remote employees must submit valid work authorization documents, such as a visa, Employment Authorization Document (EAD), or permanent resident card, to verify legal eligibility for employment in the hiring country. These documents are crucial for HR to comply with labor laws and ensure lawful employment status throughout the remote work engagement. |

| 11 | Non-Disclosure Agreement (NDA) | Remote employees must submit a signed Non-Disclosure Agreement (NDA) to ensure the protection of sensitive company information and intellectual property during HR processing. This legal document is crucial for maintaining confidentiality and safeguarding business interests in remote work environments. |

| 12 | Employee Handbook Acknowledgment | Remote employees must submit a signed Employee Handbook Acknowledgment form to confirm they have read and understood company policies, ensuring compliance with workplace standards. This document is essential for HR to verify awareness of remote work expectations, code of conduct, and legal obligations. |

| 13 | Remote Work Agreement | A remote employee must submit a signed Remote Work Agreement outlining work hours, communication protocols, and data security measures to comply with HR policies. This document ensures clarity on responsibilities and legal compliance for both the employee and employer in a remote work setup. |

| 14 | Emergency Contact Information | Remote employees must submit accurate emergency contact information, including the name, phone number, and relationship of at least one emergency contact person, to ensure prompt communication during emergencies. This data is essential for HR departments to maintain up-to-date records that comply with workplace safety and health regulations. |

| 15 | Background Check Consent Form | Remote employees must submit a signed Background Check Consent Form to authorize verification of their criminal, employment, and educational history, ensuring compliance with company policies and legal requirements. This document is essential for HR to proceed with comprehensive screening and maintain a secure hiring process. |

| 16 | Benefits Enrollment Forms | Remote employees must submit benefits enrollment forms such as health insurance applications, retirement plan documents, and dependent coverage authorizations to HR for processing. These forms ensure eligibility and accurate setup of employee benefits according to company policies and legal requirements. |

| 17 | Confidentiality Agreement | A remote employee must submit a signed Confidentiality Agreement to ensure the protection of sensitive company information and compliance with data privacy regulations. This document legally binds the employee to safeguard proprietary information, trade secrets, and customer data during and after their employment. |

| 18 | Intellectual Property Agreement | Remote employees must submit an Intellectual Property Agreement to protect company innovations and clarify ownership of work-related creations. This document ensures that all intellectual property developed during employment legally belongs to the employer, safeguarding proprietary information and inventions. |

| 19 | Data Protection Consent (GDPR, if applicable) | Remote employees must submit a signed Data Protection Consent form to comply with GDPR regulations, ensuring the lawful processing of their personal data by HR. This consent document authorizes the company to collect, store, and use employee information securely, safeguarding privacy rights throughout employment. |

| 20 | Health and Safety Declaration (Remote Workstation Safety) | Remote employees must submit a Health and Safety Declaration to HR, confirming their remote workstation complies with ergonomic standards and safety regulations to prevent work-related injuries. This document ensures proper assessment of the home office environment, supporting the employer's responsibility under occupational health and safety laws. |

Introduction to Remote Employee HR Documentation

Employment processes for remote employees require specific documentation to ensure compliance and smooth HR management. Proper collection of these documents supports accurate payroll, benefits, and legal adherence for remote staff.

- Identification Documents - Government-issued IDs verify employee identity and eligibility to work.

- Tax Forms - Completed tax withholding forms such as W-4 or equivalent are necessary for accurate payroll processing.

- Employment Agreements - Signed contracts outline job roles, responsibilities, and terms tailored for remote work.

Submitting comprehensive HR documents enables efficient onboarding and ongoing administration of remote employees.

Importance of Employment Verification Forms

Submitting the correct employment verification forms is crucial for remote employees during HR processing. These documents confirm your work eligibility and ensure a smooth onboarding experience.

- Identity Verification - Valid government-issued ID proves your identity and legal right to work.

- Employment Eligibility Form - Forms like the I-9 verify your authorization to work in the country.

- Reference Checks - Previous employer verifications confirm your work history and skills.

Digital Onboarding Documents Checklist

Remote employees must submit essential digital onboarding documents for HR processing, including a government-issued ID, tax forms, and signed employment agreements. HR departments often require proof of address, direct deposit information, and completed compliance training certificates. Ensuring all digital documents are accurately uploaded speeds up onboarding and maintains regulatory compliance.

Remote Work Policy Acknowledgement Forms

Remote employees must submit essential documents to complete HR processing efficiently. One critical document is the Remote Work Policy Acknowledgement Form, which confirms understanding and compliance with company guidelines.

This form outlines expectations, work hours, communication protocols, and security measures tailored for remote work. You should review and sign the Remote Work Policy Acknowledgement Form to ensure alignment with organizational standards.

Electronic Tax and Payroll Documentation

Remote employees must submit electronic tax forms such as the W-4 for federal tax withholding and any state-specific tax documents required by their location. Payroll documentation includes direct deposit authorization forms and digital copies of identification for verification purposes. Your timely submission of these electronic documents ensures accurate and efficient HR processing for payroll and tax compliance.

Identity Verification and Background Check Requirements

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Valid passport, driver's license, or national identity card | Confirms identity and eligibility to work remotely |

| Social Security Number (SSN) or Tax Identification Number (TIN) | Official documentation showing your SSN or TIN | Enables tax reporting and employment verification |

| Employment Authorization Document (if applicable) | Work permit or visa for non-citizens | Verifies legal authorization to work |

| Background Check Consent Form | Signed authorization allowing HR to perform background screening | Ensures compliance with pre-employment screening requirements |

| Criminal Record Report | Official record from relevant authorities or agencies | Assesses candidate suitability and risk factors |

| Employment History Verification | References or documents confirming previous job roles | Validates work experience and qualifications |

Confidentiality and Non-Disclosure Agreements

Remote employees must submit essential documents for HR processing, including Confidentiality and Non-Disclosure Agreements. These agreements protect sensitive company information and maintain data security.

Ensuring your signed Confidentiality and Non-Disclosure Agreements are on file is critical for safeguarding proprietary information. HR requires these documents to establish clear expectations regarding confidentiality obligations.

Benefits Enrollment and Consent Forms

What documents does a remote employee need to submit for benefits enrollment and consent forms? Remote employees must provide completed benefits enrollment forms to ensure proper registration in company healthcare, retirement, and other benefit plans. Submission of signed consent forms allows HR to process personal data in compliance with legal requirements.

Performance Review and Goal Setting Documents

Remote employees must submit performance review and goal setting documents for thorough HR processing. These records help evaluate work progress and set clear objectives aligned with company standards.

Performance review documents typically include self-assessments, manager evaluations, and feedback summaries. Goal setting documents outline specific, measurable, achievable, relevant, and time-bound (SMART) objectives for the review period. Submitting these documents on time ensures accurate performance tracking and supports your career growth within the organization.

What Documents Does a Remote Employee Need to Submit for HR Processing? Infographic