Freelancers need to maintain accurate records of invoices, receipts, and expense documentation to ensure proper tax reporting. Essential documents include a valid taxpayer identification number, proof of income, and any relevant contracts or agreements that outline payment terms. Keeping organized financial statements and timely filing appropriate tax forms helps avoid penalties and ensures compliance with tax regulations.

What Documents Does a Freelancer Need for Tax Purposes?

| Number | Name | Description |

|---|---|---|

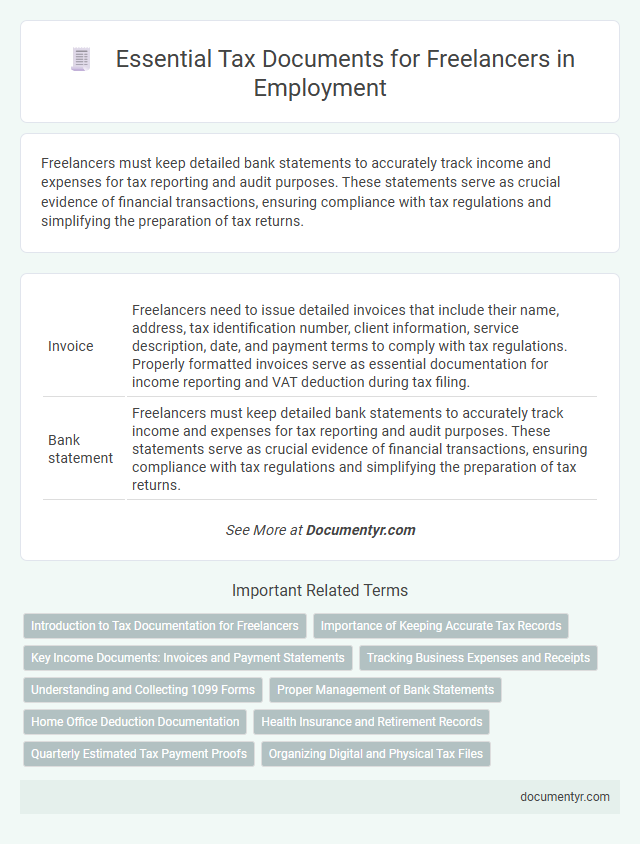

| 1 | Invoice | Freelancers need to issue detailed invoices that include their name, address, tax identification number, client information, service description, date, and payment terms to comply with tax regulations. Properly formatted invoices serve as essential documentation for income reporting and VAT deduction during tax filing. |

| 2 | Bank statement | Freelancers must keep detailed bank statements to accurately track income and expenses for tax reporting and audit purposes. These statements serve as crucial evidence of financial transactions, ensuring compliance with tax regulations and simplifying the preparation of tax returns. |

| 3 | Receipts | Freelancers need to retain detailed receipts for all business-related expenses, including equipment purchases, software subscriptions, and travel costs, to accurately claim deductions and reduce taxable income. These receipts serve as essential proof of expenditure during tax audits and help ensure compliance with tax regulations. |

| 4 | Expense report | Freelancers need to maintain a detailed expense report that includes receipts, invoices, and proof of payment for all business-related costs to accurately track deductible expenses. This documentation is crucial for preparing tax returns, substantiating deductions, and ensuring compliance with tax authorities. |

| 5 | 1099-NEC form | Freelancers must keep accurate records of their income and expenses and obtain a 1099-NEC form from each client who pays them $600 or more annually to report nonemployee compensation to the IRS. This form is crucial for filing taxes, as it ensures freelancers report all taxable earnings and comply with tax regulations. |

| 6 | W-9 form | Freelancers need to complete and submit the IRS Form W-9 to provide their correct taxpayer identification number (TIN) to clients for tax reporting purposes. This form is essential for accurately reporting income and ensuring proper filing of 1099-MISC or 1099-NEC forms at year-end. |

| 7 | Contract agreement | Freelancers need a detailed contract agreement outlining the scope of work, payment terms, and tax responsibilities to ensure clarity and compliance with tax regulations. This document serves as critical evidence for income declaration and deductible expenses during tax filing. |

| 8 | Proof of payment | Freelancers need to retain proof of payment documents such as invoices, bank statements, and payment receipts to accurately report income for tax purposes. These records are essential for verifying earnings during tax filing and can support claims for deductions and expenses. |

| 9 | Mileage log | Freelancers must maintain a detailed mileage log to accurately track business-related travel expenses for tax deductions, including dates, destinations, purpose, and miles driven. This documentation supports claims on IRS Form 1040 Schedule C, reducing taxable income by substantiating vehicle expenses. |

| 10 | Home office deduction worksheet | Freelancers must maintain a Home Office Deduction Worksheet to accurately track expenses such as rent, utilities, and internet proportional to the dedicated workspace area. This documentation supports claims for tax deductions by detailing the percentage of the home used exclusively for business purposes. |

| 11 | Profit and loss statement | Freelancers must maintain a detailed profit and loss statement showcasing all income and expenses to accurately report taxable earnings and justify deductions to tax authorities. This document is essential for calculating net profit, which determines the amount of tax owed and supports compliance during audits. |

| 12 | Quarterly estimated tax payment receipts | Freelancers must retain quarterly estimated tax payment receipts as essential records to verify timely tax payments and avoid penalties. These documents demonstrate compliance with IRS requirements by reflecting accurate income reporting and tax liability throughout the fiscal year. |

| 13 | IRS Schedule C (Form 1040) | Freelancers must file IRS Schedule C (Form 1040) to report income and expenses related to their self-employment activities, providing detailed documentation such as invoices, receipts, and bank statements as evidence. Maintaining organized records of all business transactions is essential for accurate tax reporting and maximizing deductible expenses on Schedule C. |

| 14 | Tax identification number (TIN) documentation | Freelancers must provide a valid Tax Identification Number (TIN) for tax reporting and compliance with government regulations. The TIN documentation typically includes an official certificate or card issued by the tax authority, which verifies the freelancer's registration and enables proper filing of income and tax returns. |

| 15 | Health insurance statement | Freelancers must provide a health insurance statement, typically known as a certificate of coverage or proof of payment, to verify continuous health insurance coverage for tax deductions or credits. This document is essential for accurate tax filing and to avoid penalties related to uninsured status under tax regulations. |

Introduction to Tax Documentation for Freelancers

Understanding tax documentation is crucial for freelancers to manage their financial responsibilities accurately. Proper organization of these documents ensures compliance with tax laws and smooth filing processes.

- Income Records - Documents such as invoices and payment receipts track the total earnings received throughout the tax year.

- Expense Receipts - Records of business-related expenses help in claiming eligible deductions and reducing taxable income.

- Tax Forms - Essential forms like 1099-MISC or self-employment tax returns must be prepared and filed to report income and calculate taxes owed.

Importance of Keeping Accurate Tax Records

Freelancers must maintain accurate tax records to ensure compliance with tax laws and avoid penalties. Essential documents include invoices, payment receipts, expense receipts, and bank statements that verify income and deductions. Keeping detailed records simplifies tax filing, facilitates audits, and supports accurate income reporting to tax authorities.

Key Income Documents: Invoices and Payment Statements

Freelancers must maintain accurate records of their income for tax reporting. Key income documents include invoices issued to clients and payment statements received, which verify earnings. Your careful organization of these documents ensures compliance and simplifies tax filing.

Tracking Business Expenses and Receipts

| Document Type | Description | Purpose for Tax |

|---|---|---|

| Receipts for Business Expenses | Invoices and receipts from purchases related to freelance work, such as office supplies, software, equipment, and travel costs. | Proof of deductible expenses to reduce taxable income and validate claims during tax filing. |

| Expense Tracking Spreadsheet or Software Records | Detailed records maintained manually or through accounting software showing dates, amounts, and vendors for business expenses. | Organized expense tracking simplifies tax reporting, ensures accuracy, and helps identify eligible deductions. |

| Bank and Credit Card Statements | Monthly statements highlighting transactions related to freelance business activities. | Corroborates expense claims and assists in verifying amounts for tax audits or reviews. |

| Mileage Logs | Records of travel distance for business purposes including date, destination, and purpose of the trip. | Supports deduction of vehicle-related expenses when using a personal vehicle for freelance work. |

| Contracts and Invoices Issued | Agreements and bills related to freelance projects and payments received. | Evidence of business income and related expenditures for accurate profit and loss reporting. |

Understanding and Collecting 1099 Forms

Freelancers must understand the importance of collecting 1099 forms for accurate tax reporting. These forms report income earned from clients and are essential for filing federal taxes.

Clients are required to issue a 1099-NEC if payments to a freelancer exceed $600 in a tax year. Freelancers should gather all 1099 forms by January 31 to ensure compliance and avoid penalties.

Proper Management of Bank Statements

Freelancers must maintain organized bank statements for accurate tax reporting and verification. Proper management of these documents supports income tracking and expense deductions.

Bank statements provide essential evidence of financial transactions related to freelance work. Keeping detailed records helps streamline tax preparation and reduces the risk of errors. Your ability to present clear bank statements can simplify audits and ensure compliance with tax regulations.

Home Office Deduction Documentation

What documents are necessary for claiming the home office deduction as a freelancer? Detailed records of your home office space, such as floor plans or photographs, are essential to prove the area is used exclusively for business purposes. Receipts and bills for expenses like rent, utilities, and repairs related to the office space support your deduction claim.

Health Insurance and Retirement Records

Freelancers must organize specific documents for tax purposes, focusing on health insurance and retirement records. Proper documentation ensures compliance and maximizes eligible deductions.

- Health Insurance Statements - These documents verify premiums paid and coverage periods, which are necessary for claiming deductions and credits.

- Form 1095-A, 1095-B, or 1095-C - These forms provide proof of health insurance coverage required by the IRS.

- Retirement Account Statements - Records from IRAs, SEP IRAs, or solo 401(k) plans detail contributions and distributions relevant for tax reporting.

Maintaining organized health insurance and retirement records streamlines the tax filing process for freelancers.

Quarterly Estimated Tax Payment Proofs

Freelancers must maintain accurate records of quarterly estimated tax payments to comply with tax regulations and avoid penalties. These documents serve as proof of timely tax submissions and help track tax liabilities throughout the year.

- Payment Receipts - Official receipts from the IRS or state tax agency confirming the amount and date of each quarterly tax payment.

- Bank Statements - Records showing the withdrawal or transfer of funds used to make estimated tax payments for verification purposes.

- Estimated Tax Payment Vouchers - Completed forms, such as IRS Form 1040-ES, submitted quarterly as evidence of intent to pay estimated taxes.

What Documents Does a Freelancer Need for Tax Purposes? Infographic