Employee benefits enrollment requires essential documents such as a government-issued photo ID, Social Security number, and proof of eligibility like a birth certificate or passport. Enrollment forms provided by the employer must be completed accurately, along with beneficiary designation forms for life insurance or retirement plans. Proof of dependents, such as marriage certificates or children's birth certificates, is often necessary to include family members in health or dental insurance coverage.

What Documents Are Needed for Employee Benefits Enrollment?

| Number | Name | Description |

|---|---|---|

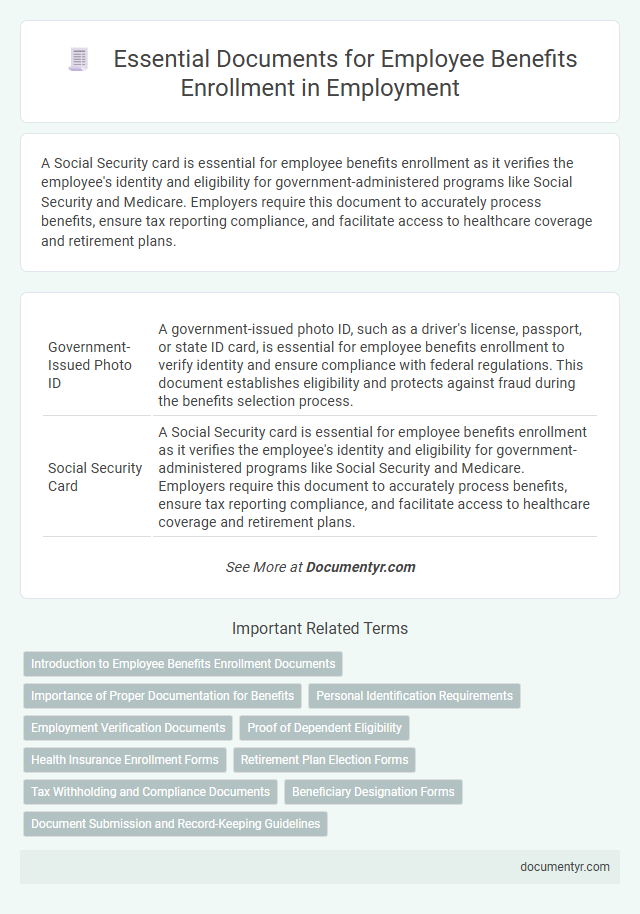

| 1 | Government-Issued Photo ID | A government-issued photo ID, such as a driver's license, passport, or state ID card, is essential for employee benefits enrollment to verify identity and ensure compliance with federal regulations. This document establishes eligibility and protects against fraud during the benefits selection process. |

| 2 | Social Security Card | A Social Security card is essential for employee benefits enrollment as it verifies the employee's identity and eligibility for government-administered programs like Social Security and Medicare. Employers require this document to accurately process benefits, ensure tax reporting compliance, and facilitate access to healthcare coverage and retirement plans. |

| 3 | Birth Certificate | A birth certificate is a fundamental document required for employee benefits enrollment, serving as proof of identity and eligibility for dependent coverage. Employers often request an original or certified copy to verify the employee's or dependents' birth details accurately during the benefits registration process. |

| 4 | Work Authorization Document | A valid work authorization document, such as a Permanent Resident Card, Employment Authorization Document (EAD), or valid visa, is essential for employee benefits enrollment to verify eligibility for employment and benefits. Employers typically require submission of these documents alongside the Social Security number to comply with federal regulations and ensure proper benefits processing. |

| 5 | Marriage Certificate | A marriage certificate is a critical document for employee benefits enrollment as it verifies spousal eligibility for health insurance, retirement plans, and other dependent-related benefits. Employers require an official, government-issued marriage certificate to process spousal coverage and ensure compliance with benefit policies and legal regulations. |

| 6 | Domestic Partnership Certificate | A Domestic Partnership Certificate is required to verify eligibility for employee benefits extended to same-sex or domestic partners, ensuring accurate enrollment and coverage. Employers typically request this document alongside identification and proof of residency to confirm the domestic partnership status. |

| 7 | Dependent's Birth Certificates | Dependent's birth certificates are essential documents for employee benefits enrollment, verifying the eligible dependents' identity and relationship to the employee. Employers require these certificates to ensure accurate benefits allocation, compliance with plan rules, and to prevent fraudulent claims. |

| 8 | Adoption Papers | Adoption papers are essential documents required for employee benefits enrollment to verify the legal guardianship of the adopted child and ensure eligibility for dependent coverage. Including official adoption records helps employers accurately process benefits such as health insurance, dental plans, and dependent care accounts. |

| 9 | Court Orders (for dependents) | Court orders are essential documents for employee benefits enrollment when adding dependents, as they legally establish guardianship or custody rights. These orders ensure compliance with employer benefits policies and provide verification for dependent eligibility under health, dental, and other benefit plans. |

| 10 | Benefits Enrollment Form | The Benefits Enrollment Form is a critical document required for employee benefits enrollment, capturing essential information such as personal details, selected benefits plans, and dependent coverage. Accurate completion of this form ensures proper processing of health insurance, retirement plans, and other employee benefits offered by the employer. |

| 11 | Health Insurance Application | For health insurance application during employee benefits enrollment, essential documents include a government-issued photo ID, Social Security number or proof of eligibility to work, and recent pay stubs or income verification. Medical records or proof of previous coverage may be required to determine eligibility and pre-existing condition exclusions. |

| 12 | Proof of Address | Proof of address documents required for employee benefits enrollment typically include utility bills, bank statements, or lease agreements dated within the last three months to verify residency. Employers may also accept government-issued correspondence or official mail that clearly displays the employee's name and current residential address. |

| 13 | Previous Coverage Certificate (COBRA/Other Insurance) | Previous Coverage Certificates such as COBRA or other insurance documentation are essential for employee benefits enrollment to verify continuous coverage and prevent gaps in health insurance. These documents ensure accurate plan transition, eligibility confirmation, and help coordinate benefits effectively between prior and new insurance providers. |

| 14 | Beneficiary Designation Form | The Beneficiary Designation Form is a critical document required for employee benefits enrollment, ensuring proper allocation of benefits such as life insurance and retirement accounts in the event of the employee's death. This form typically requires personal identification details, beneficiary names, relationships, and percentage allocations to validate and process the employee's benefit claims accurately. |

| 15 | Direct Deposit Authorization | Direct Deposit Authorization requires employees to submit a completed authorization form along with a voided check or a bank statement to verify account details. This ensures accurate and timely deposit of employee benefits into the designated bank account. |

| 16 | Tax Forms (W-4, State Tax Forms) | Employees must provide tax forms such as the IRS W-4 and applicable state tax withholding forms during benefits enrollment to ensure accurate payroll deductions and tax compliance. Correctly completed forms enable employers to withhold the proper federal and state income taxes, optimizing employees' take-home pay and eligibility for benefits. |

| 17 | Proof of Disability (if applicable) | Proof of disability for employee benefits enrollment typically requires documentation such as a recent medical certification from a licensed healthcare provider verifying the nature and extent of the disability, alongside official disability determination letters from government agencies like the Social Security Administration. Employers may also request completed disability claim forms and any relevant supporting medical records to ensure eligibility for specific benefits. |

| 18 | Veterans/Military Service Papers (DD214, if applicable) | Veterans or military personnel must provide their DD214 form, a crucial document verifying service history, to enroll in employee benefits related to military service. This form ensures access to veterans' health benefits, retirement plans, and other specialized programs offered by employers. |

Introduction to Employee Benefits Enrollment Documents

Employee benefits enrollment requires specific documentation to verify eligibility and facilitate accurate processing. Understanding these necessary documents helps ensure a smooth enrollment experience.

- Proof of Identity - Documents such as a government-issued ID or passport confirm the employee's identity.

- Social Security Number - Providing a Social Security card or number is essential for tax and benefits tracking purposes.

- Dependent Verification - Birth certificates, marriage certificates, or adoption papers are used to verify dependent eligibility for coverage.

Importance of Proper Documentation for Benefits

Proper documentation is essential for accurate and timely employee benefits enrollment. Key documents typically include government-issued identification, proof of eligibility such as Social Security cards or immigration papers, and relevant dependent information. Maintaining these records ensures employees receive the correct benefits and prevents delays or errors in the enrollment process.

Personal Identification Requirements

What personal identification documents are required for employee benefits enrollment? Typically, you need a government-issued photo ID, such as a passport or driver's license. These documents verify your identity and ensure accurate processing of your benefits application.

Employment Verification Documents

Employment verification documents are essential for validating an employee's eligibility during benefits enrollment. These documents confirm the individual's current job status and employment details to ensure proper benefit allocation.

- Employment Verification Letter - Official letter from the employer confirming job title, start date, and employment status.

- Pay Stubs - Recent pay statements that demonstrate active employment and income verification.

- Tax Forms (e.g., W-2 or 1099) - Government-issued documents that verify earnings and employment history.

Proof of Dependent Eligibility

Proof of dependent eligibility is essential for employee benefits enrollment to ensure that only qualified dependents receive coverage. You must provide certain documents verifying the relationship between you and your dependents.

- Birth Certificate - Confirms the legal parent-child relationship for dependent children.

- Marriage Certificate - Verifies the legal spouse's eligibility for benefits.

- Legal Guardianship Papers - Demonstrates legal responsibility for dependents who are not your biological children.

Submitting accurate proof of dependent eligibility helps avoid delays or denials in your benefits enrollment process.

Health Insurance Enrollment Forms

Health insurance enrollment forms are essential documents required to initiate employee benefits. These forms collect critical information such as personal details, coverage options, and dependent information. Submitting accurate health insurance enrollment forms ensures timely processing of your benefits and access to medical coverage.

Retirement Plan Election Forms

Retirement plan election forms are essential documents required for employee benefits enrollment. These forms allow you to choose your preferred retirement savings options and contribution amounts.

Submitting accurate and complete retirement election forms ensures timely processing of your benefits. Keep these documents ready along with your identification and employment verification paperwork for a smooth enrollment experience.

Tax Withholding and Compliance Documents

Tax withholding documents are essential for accurate payroll processing and compliance with government regulations. Employees must complete Form W-4 to specify their federal income tax withholding preferences.

Compliance documents verify eligibility and adherence to labor laws during benefits enrollment. Common forms include proof of identity, Social Security numbers, and eligibility verification such as Form I-9.

Beneficiary Designation Forms

Employee benefits enrollment requires specific documentation to ensure accurate processing. One critical document is the Beneficiary Designation Form, which identifies who will receive benefits in the event of the employee's death.

The Beneficiary Designation Form must be completed carefully to reflect your true intentions. This form typically requires full names, social security numbers, and contact information of designated beneficiaries. Submitting this form promptly helps avoid delays in benefit distribution.

What Documents Are Needed for Employee Benefits Enrollment? Infographic