Interns need to provide essential documents such as a valid identification card, proof of enrollment or student status, and a signed internship agreement outlining the terms and duration of the internship. Companies often require a tax identification number and, in some cases, a social security card to process payroll and legal compliance. Health and safety forms or any required vaccinations may also be necessary depending on the industry and location of the internship.

What Documents Does an Intern Need to Start at a Company?

| Number | Name | Description |

|---|---|---|

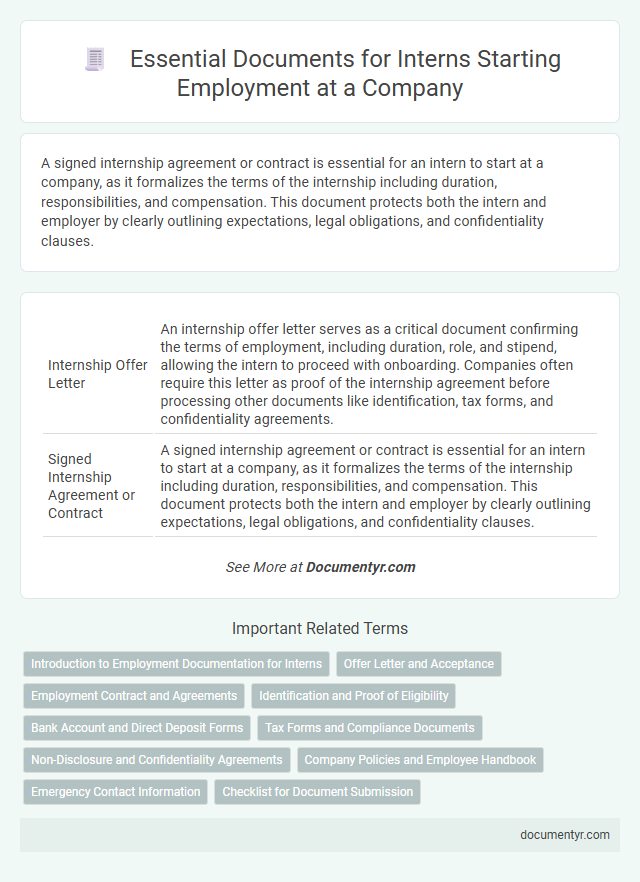

| 1 | Internship Offer Letter | An internship offer letter serves as a critical document confirming the terms of employment, including duration, role, and stipend, allowing the intern to proceed with onboarding. Companies often require this letter as proof of the internship agreement before processing other documents like identification, tax forms, and confidentiality agreements. |

| 2 | Signed Internship Agreement or Contract | A signed internship agreement or contract is essential for an intern to start at a company, as it formalizes the terms of the internship including duration, responsibilities, and compensation. This document protects both the intern and employer by clearly outlining expectations, legal obligations, and confidentiality clauses. |

| 3 | Government-issued Photo ID (e.g., Passport, Driver's License) | A government-issued photo ID such as a passport or driver's license is essential for interns to verify their identity and eligibility to work, ensuring compliance with company policies and legal employment regulations. These documents are typically required during the onboarding process to complete Form I-9 for U.S. employment verification or similar forms internationally. |

| 4 | Social Security Card or Number (for payroll/tax purposes) | An intern must provide their Social Security card or number to the employer for payroll processing and tax documentation, ensuring compliance with federal and state regulations. This information is essential for accurate withholding of income tax and reporting earnings to the Social Security Administration. |

| 5 | Academic Transcripts or Enrollment Verification | Interns typically need to provide academic transcripts or enrollment verification documents to confirm their current student status and academic performance, ensuring eligibility for the internship program. These documents help employers verify educational background, track progress, and comply with company or legal internship requirements. |

| 6 | Curriculum Vitae (CV) or Resume | An intern must submit a Curriculum Vitae (CV) or resume highlighting relevant education, skills, and any prior internship or work experience to demonstrate suitability for the role. These documents serve as essential tools for employers to evaluate the candidate's qualifications and alignment with the company's requirements. |

| 7 | Tax Forms (e.g., W-4, W-9) | Interns must complete tax forms such as the W-4 to determine federal income tax withholding and the W-9 if they are classified as independent contractors for accurate tax reporting. Providing these documents ensures compliance with IRS regulations and facilitates proper payroll processing by the employer. |

| 8 | Direct Deposit Form or Bank Account Details | An intern must provide a completed direct deposit form or accurate bank account details to ensure timely and secure payment of wages. This documentation typically includes the bank's routing number, account number, and account type to facilitate electronic payroll processing. |

| 9 | Non-Disclosure Agreement (NDA) | An intern must sign a Non-Disclosure Agreement (NDA) to protect the company's confidential information and intellectual property during their tenure. This legal document ensures that sensitive data learned or accessed by the intern remains secure and is not disclosed to unauthorized parties. |

| 10 | Confidentiality Agreement | Interns must provide a signed Confidentiality Agreement to protect the company's sensitive information and intellectual property during their tenure. This document legally binds the intern to maintain secrecy regarding proprietary data and trade secrets encountered throughout their internship. |

| 11 | Work Authorization/Visa Documents (if applicable) | Interns must provide valid work authorization or visa documents relevant to the company's jurisdiction, such as a work permit, student visa with employment authorization, or an Employment Authorization Document (EAD) issued by immigration authorities. Employers typically require these documents to verify legal eligibility to work, ensuring compliance with local labor and immigration laws. |

| 12 | Background Check Authorization Form | An intern must submit a Background Check Authorization Form to grant the employer permission to conduct a thorough background screening, which may include criminal records, employment history, and education verification. This document is crucial to ensure compliance with company policies and legal requirements before the internship commences. |

| 13 | Emergency Contact Information Form | An intern must provide an Emergency Contact Information Form containing detailed contact names, phone numbers, and relationship details to ensure swift communication during emergencies. This document is essential for workplace safety protocols and allows employers to respond promptly to any urgent situations involving the intern. |

| 14 | Health and Immunization Records (if required) | Interns may need to provide up-to-date health and immunization records to comply with company policies or industry regulations, especially in healthcare or education sectors. These documents ensure workplace safety and verify that the intern meets necessary health standards before starting their position. |

| 15 | Employee Handbook Acknowledgment Form | An intern must complete the Employee Handbook Acknowledgment Form to confirm their understanding of company policies, workplace expectations, and code of conduct. This document ensures compliance with organizational standards and serves as a legal acknowledgment of the intern's commitment to adhere to company rules. |

| 16 | Intellectual Property Agreement (if required) | Interns must provide an Intellectual Property Agreement if required by the company, ensuring all creations and developments during the internship are legally owned by the employer. This document protects proprietary information and specifies rights related to inventions or work products generated during the employment period. |

Introduction to Employment Documentation for Interns

Internship employment requires specific documentation to ensure compliance with legal and company policies. Proper documentation verifies eligibility, outlines responsibilities, and protects both the intern and employer.

- Identification Documents - Interns must provide government-issued IDs such as a passport or driver's license to verify identity and eligibility to work.

- Internship Agreement - A signed contract detailing the terms, duration, and expectations of the internship is essential for legal clarity and mutual understanding.

- Tax and Payment Forms - Completion of tax forms like the W-4 or equivalent is required to process any stipends or compensation lawfully.

Offer Letter and Acceptance

To begin an internship at a company, an intern must have a formal offer letter detailing the internship role, duration, and terms. This document serves as official confirmation of the internship opportunity.

The intern is required to review and accept the offer letter by signing and returning it to the employer. Acceptance signifies agreement to the internship conditions and allows the company to proceed with onboarding. This step ensures clarity and mutual understanding between the intern and the organization.

Employment Contract and Agreements

| Document | Description | Importance |

|---|---|---|

| Employment Contract | This legal document outlines the terms and conditions of the internship, including duration, responsibilities, remuneration (if any), work hours, and confidentiality clauses. | Establishes clear expectations and protects both the intern and the company legally. |

| Non-Disclosure Agreement (NDA) | Protects sensitive company information by legally binding the intern to confidentiality standards. | Ensures proprietary information remains secure during and after the internship period. |

| Intellectual Property Agreement | Specifies ownership rights related to any work or ideas developed during the internship. | Clarifies intellectual property rights to avoid future disputes. |

| Consent Forms | May include parental consent for minors or consent for background checks if required by the company. | Ensures legal compliance and eligibility to participate in the internship. |

| Tax and Payroll Documents | Forms such as W-4 or equivalent, necessary when the internship is paid. | Facilitates proper tax withholding and payment processing. |

| Verification of Eligibility | Documents like student ID, proof of enrollment, or work authorization permits. | Confirms eligibility to legally work and participate in the internship program. |

| Health and Safety Acknowledgment | Confirms understanding and compliance with company health and safety policies. | Protects both the intern and employer regarding workplace safety standards. |

Identification and Proof of Eligibility

What identification documents does an intern need to start at a company? Interns typically need a government-issued photo ID, such as a driver's license or passport. This helps verify their identity and facilitates background checks if required.

What proof of eligibility is required for interns to begin employment? Interns must provide documents proving their legal right to work, including a Social Security card, birth certificate, or a work authorization document like an Employment Authorization Document (EAD). Employers use these documents to comply with employment eligibility verification laws such as Form I-9.

Bank Account and Direct Deposit Forms

Starting an internship requires submitting several important documents to ensure smooth payroll processing. Among these, bank account information and direct deposit forms are essential for receiving payments.

- Bank Account Information - Provides the company with the necessary details to deposit your earnings securely into your account.

- Direct Deposit Authorization Form - Grants permission for the company to transfer funds electronically, speeding up payment delivery.

- Void Check or Bank Letter - Confirms account accuracy and routing numbers to prevent payment errors.

Submitting these documents promptly helps guarantee timely and accurate compensation throughout your internship.

Tax Forms and Compliance Documents

Starting an internship involves submitting essential tax forms and compliance documents to ensure legal employment status. Proper documentation protects both the intern and the company by verifying tax obligations and eligibility to work.

- Form W-4 - Used to determine federal income tax withholding based on your personal allowances and filing status.

- Form I-9 - Required to verify identity and legal authorization to work in the United States.

- State Tax Withholding Forms - Specific forms depending on the state, ensuring correct state income tax deductions during the internship.

Non-Disclosure and Confidentiality Agreements

Interns must often sign Non-Disclosure Agreements (NDAs) before starting at a company to protect sensitive information. These agreements legally bind the intern to keep proprietary data confidential throughout and after the internship.

Confidentiality agreements ensure that your work and access to company information remain secure. Such documents are standard in industries where protecting trade secrets and client information is critical.

Company Policies and Employee Handbook

Interns must review company policies to understand workplace expectations and compliance requirements. The employee handbook provides essential information on company culture, code of conduct, and safety protocols. Possessing and acknowledging these documents ensures a smooth onboarding process and legal adherence.

Emergency Contact Information

Emergency contact information is a critical document an intern must provide before starting at a company. This includes names, phone numbers, and relationships of individuals to be contacted in case of an emergency.

Employers require this data to ensure prompt communication during unforeseen situations. Your cooperation in submitting accurate emergency contact details enhances workplace safety and preparedness.

What Documents Does an Intern Need to Start at a Company? Infographic