Independent contractors must maintain several key documents for IRS compliance, including Form W-9 to provide their taxpayer identification number, invoices detailing services rendered, and copies of contracts outlining the scope and terms of work. Keeping accurate records of all payments received, as well as receipts for business expenses, is crucial for proper tax reporting and deductions. Additionally, contractors should file Form 1099-NEC by year-end to report non-employee compensation to the IRS.

What Documents Does an Independent Contractor Need for IRS Compliance?

| Number | Name | Description |

|---|---|---|

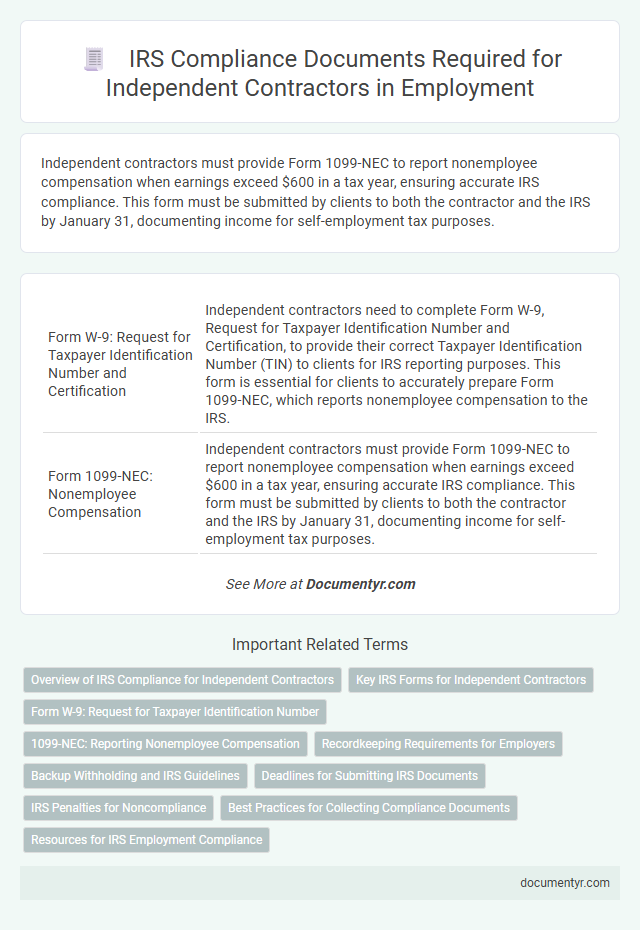

| 1 | Form W-9: Request for Taxpayer Identification Number and Certification | Independent contractors need to complete Form W-9, Request for Taxpayer Identification Number and Certification, to provide their correct Taxpayer Identification Number (TIN) to clients for IRS reporting purposes. This form is essential for clients to accurately prepare Form 1099-NEC, which reports nonemployee compensation to the IRS. |

| 2 | Form 1099-NEC: Nonemployee Compensation | Independent contractors must provide Form 1099-NEC to report nonemployee compensation when earnings exceed $600 in a tax year, ensuring accurate IRS compliance. This form must be submitted by clients to both the contractor and the IRS by January 31, documenting income for self-employment tax purposes. |

| 3 | Form 1096: Annual Summary and Transmittal of U.S. Information Returns | Form 1096 serves as the Annual Summary and Transmittal of U.S. Information Returns, required for independent contractors who submit paper Forms 1099 to the IRS. This form summarizes the total number of information returns filed, ensuring IRS compliance by accurately transmitting contractor income data. |

| 4 | Invoice Records | Independent contractors must maintain detailed invoice records that include the contractor's name, business name (if applicable), services provided, dates of service, payment amounts, and payment dates to ensure IRS compliance. Accurate and organized invoices support income reporting and verify deductions during tax filings, reducing the risk of IRS audits and penalties. |

| 5 | Payment Receipts | Independent contractors must retain detailed payment receipts to verify income for IRS compliance, including invoices, bank statements, and proof of payment. These documents serve as critical evidence during tax reporting and audits, ensuring accurate revenue declaration and deductible expense claims. |

| 6 | Written Contracts or Agreements | Independent contractors must have a written contract or agreement detailing the scope of work, payment terms, and project timelines to ensure IRS compliance and clearly establish the business relationship. This documentation supports proper tax classification and helps prevent misclassification issues by outlining the independent contractor's responsibilities and the non-employee status. |

| 7 | Proof of Business Registration (if applicable) | An independent contractor must provide proof of business registration, such as a state-issued business license or a certificate of formation, to demonstrate compliance with IRS regulations. This documentation verifies the legal establishment of the business entity, which is critical for accurate tax reporting and eligibility for certain tax deductions. |

| 8 | Business License (if applicable) | Independent contractors must secure a valid business license in their operating jurisdiction to ensure IRS compliance, as this document verifies the legal authorization to conduct business activities. Possessing a business license supports accurate tax reporting and validates eligibility for deductions related to business expenses. |

| 9 | Proof of Insurance (if applicable) | Independent contractors must provide proof of insurance, such as general liability or professional liability coverage, to ensure IRS compliance and verify financial responsibility. This documentation supports tax deductions and protects both the contractor and clients in case of claims or damages. |

| 10 | Expense Receipts and Records | Independent contractors must maintain detailed expense receipts and records to accurately document business-related costs for IRS compliance and potential deductions. Properly organized receipts for travel, supplies, and services ensure substantiation of expenses during audits and help streamline tax reporting. |

| 11 | Bank Statements | Independent contractors must provide accurate bank statements to verify income and expenses for IRS compliance, ensuring all financial transactions are properly documented. These statements support tax filings by substantiating reported earnings and deductible costs, facilitating accurate self-employment tax calculations. |

| 12 | Mileage Logs (if claiming vehicle expenses) | Independent contractors claiming vehicle expenses must maintain detailed mileage logs that record the date, purpose, starting and ending locations, and miles driven for each trip to ensure IRS compliance. Accurate mileage logs are essential for substantiating deductions on Form 1040 Schedule C and avoiding potential audits or penalties. |

| 13 | Record of Estimated Tax Payments (Form 1040-ES) | Independent contractors must maintain accurate records of estimated tax payments using Form 1040-ES to ensure IRS compliance and avoid underpayment penalties. This form helps track quarterly tax payments based on anticipated income, Social Security, and Medicare taxes, which are not withheld from contractor earnings. |

| 14 | Prior Year Tax Returns | Independent contractors need to retain prior year tax returns such as Form 1099-MISC or 1099-NEC to verify income reported to the IRS and ensure accurate tax reporting. Maintaining these documents supports compliance with IRS requirements and facilitates the preparation of current tax filings. |

| 15 | Schedule C (Form 1040): Profit or Loss from Business | Independent contractors must file Schedule C (Form 1040) to report income and expenses from self-employment, detailing profit or loss from their business activities to comply with IRS requirements. Accurate record-keeping of receipts, invoices, and expense documentation is essential for filling out Schedule C and ensuring proper tax reporting and deduction claims. |

| 16 | Schedule SE (Form 1040): Self-Employment Tax | Independent contractors must file Schedule SE (Form 1040) to calculate and report self-employment tax owed to the IRS, ensuring compliance with federal tax obligations. Proper documentation includes accurate records of income, expenses, and receipts to support the amounts reported on Schedule SE, which determines Social Security and Medicare tax liabilities. |

Overview of IRS Compliance for Independent Contractors

Independent contractors must maintain accurate documentation to ensure IRS compliance. Essential documents include Form W-9, invoices, and records of payments received. You should also keep copies of any contracts, expense receipts, and proof of business-related activities.

Key IRS Forms for Independent Contractors

Independent contractors must provide key IRS forms to ensure proper tax compliance. The primary document is Form W-9, which collects your Taxpayer Identification Number (TIN) for accurate reporting. Additionally, contractors receive Form 1099-NEC from clients, detailing non-employee compensation essential for filing tax returns.

Form W-9: Request for Taxpayer Identification Number

Independent contractors must provide specific documents to ensure IRS compliance, with Form W-9 being a critical requirement. This form collects taxpayer identification information essential for accurate tax reporting.

- Form W-9 collection - Independent contractors complete Form W-9 to supply their Taxpayer Identification Number (TIN) to the hiring entity.

- Purpose of Form W-9 - The form enables businesses to correctly prepare and file Form 1099-NEC, reporting payments made to contractors.

- Compliance importance - Submitting a W-9 prevents backup withholding and ensures proper IRS documentation for income tax purposes.

1099-NEC: Reporting Nonemployee Compensation

Independent contractors must provide specific documents to ensure IRS compliance, primarily focusing on accurate reporting of income. The 1099-NEC form is crucial for reporting nonemployee compensation received during the tax year.

You need to submit a completed W-9 form to your clients to provide your Taxpayer Identification Number (TIN). This information allows clients to prepare the 1099-NEC form accurately, reflecting your earnings for IRS reporting.

Recordkeeping Requirements for Employers

Independent contractors must maintain specific documents to ensure IRS compliance. Proper recordkeeping helps employers verify work status and manage tax obligations efficiently.

- Form W-9 - Contractors provide this form with their Taxpayer Identification Number for accurate reporting.

- Invoices and Payment Records - Detailed records of payments support expense tracking and income verification.

- Contracts and Agreements - Written contracts establish the terms of service, clarifying the relationship for tax purposes.

Backup Withholding and IRS Guidelines

Independent contractors must provide specific documents to ensure IRS compliance, including the W-9 form which captures their Taxpayer Identification Number (TIN). These documents help determine if backup withholding is necessary.

The IRS requires backup withholding when a contractor fails to provide a correct TIN or if the IRS notifies the payer about underreporting. Contractors should submit a completed Form W-9, allowing the payer to avoid withholding tax unless notified. Failure to comply with these IRS guidelines may result in a mandatory 24% backup withholding on payments made to the contractor.

Deadlines for Submitting IRS Documents

| Document | Description | Submission Deadline |

|---|---|---|

| Form W-9 | Used to provide your taxpayer identification number (TIN) to the entity paying you. Essential for accurate IRS reporting. | Before starting work or payment |

| Form 1099-NEC | Issued by the payer to report nonemployee compensation to the IRS for payments of $600 or more. | File with IRS by January 31 following the tax year |

| Form 1040 Schedule C | Report income and expenses from self-employment for calculating taxable income. | File with your individual tax return by April 15 |

| Estimated Tax Payments | Quarterly payments made to cover self-employment taxes and income tax liabilities. | Quarterly due dates: April 15, June 15, September 15, January 15 of the following year |

IRS Penalties for Noncompliance

Independent contractors must provide specific documents to ensure IRS compliance, including a completed W-9 form and detailed invoices for services rendered. These documents verify income and support accurate tax reporting.

Failure to submit proper documentation can result in significant IRS penalties, such as fines and interest on unpaid taxes. Maintaining accurate records protects you from costly noncompliance issues and potential audits.

Best Practices for Collecting Compliance Documents

What documents does an independent contractor need for IRS compliance? Independent contractors must provide a W-9 form to confirm their Taxpayer Identification Number (TIN). This form is essential to ensure accurate reporting of payments to the IRS.

How should businesses collect compliance documents from independent contractors? Businesses should request and retain a completed W-9 form before issuing any payments. Maintaining organized records of these forms helps avoid IRS penalties and streamlines tax reporting.

What other documentation supports IRS compliance for independent contractors? Contracts outlining work scope and payment terms protect both parties and clarify tax responsibilities. Keeping copies of invoices and payment records further supports accurate income reporting to the IRS.

Why is timely collection of compliance documents important? Collecting all required documents before payments reduces the risk of misclassification and IRS audits. Prompt documentation ensures contractors' tax filings align with reported income, minimizing compliance issues.

What Documents Does an Independent Contractor Need for IRS Compliance? Infographic