New hire onboarding requires essential documents such as a completed employment application, proof of identity and eligibility to work, and signed tax forms including the W-4. Employers also need the new employee's direct deposit information and signed acknowledgment of company policies and confidentiality agreements. Collecting these documents ensures compliance with legal requirements and smooth integration into the organization.

What Documents are Necessary for New Hire Onboarding?

| Number | Name | Description |

|---|---|---|

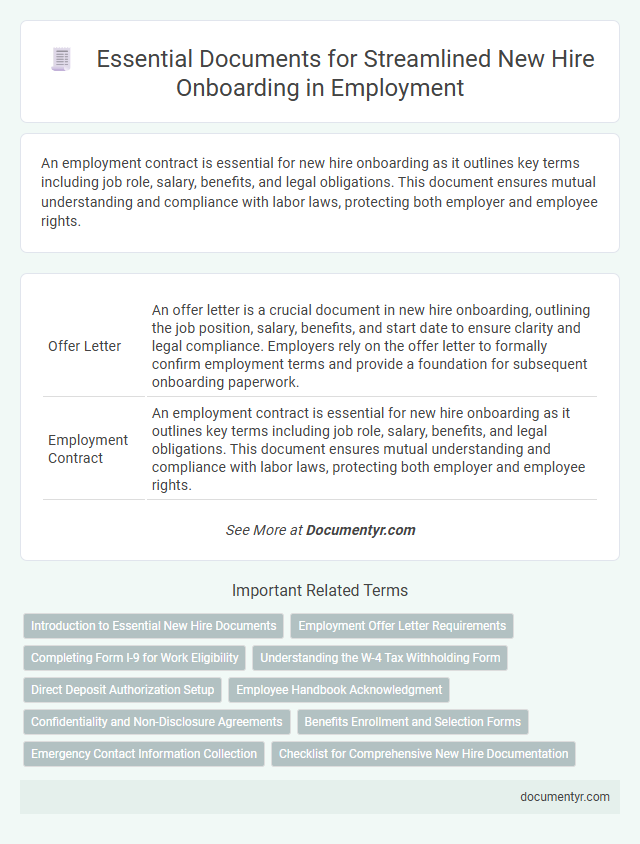

| 1 | Offer Letter | An offer letter is a crucial document in new hire onboarding, outlining the job position, salary, benefits, and start date to ensure clarity and legal compliance. Employers rely on the offer letter to formally confirm employment terms and provide a foundation for subsequent onboarding paperwork. |

| 2 | Employment Contract | An employment contract is essential for new hire onboarding as it outlines key terms including job role, salary, benefits, and legal obligations. This document ensures mutual understanding and compliance with labor laws, protecting both employer and employee rights. |

| 3 | Job Description | A detailed job description is essential for new hire onboarding as it outlines specific roles, responsibilities, and expectations, ensuring alignment between the employee and employer. This document serves as a reference for performance evaluation and compliance with labor laws during the employment process. |

| 4 | Tax Withholding Forms (e.g., W-4, W-9) | New hire onboarding requires employees to complete tax withholding forms such as the W-4 for federal income tax and the W-9 for taxpayers exempt from withholding or contractors. These documents ensure accurate tax withholding based on personal exemptions and filing status, streamlining payroll compliance and reporting obligations. |

| 5 | Direct Deposit Authorization | Direct deposit authorization forms are essential for new hire onboarding, allowing employers to electronically transfer employees' paychecks directly into their bank accounts, ensuring timely and secure payments. This document requires employees to provide their bank account number, routing number, and account type, facilitating efficient payroll processing and reducing manual handling errors. |

| 6 | I-9 Employment Eligibility Verification | Employers must complete the I-9 Employment Eligibility Verification form to confirm a new hire's identity and legal authorization to work in the United States, requiring acceptable documents such as a U.S. passport, permanent resident card, or a combination of a driver's license and social security card. Retaining the completed I-9 form and supporting documents is mandatory for compliance with U.S. Citizenship and Immigration Services regulations and must be made available for inspection upon request. |

| 7 | Identification Documents (e.g., Passport, Driver’s License) | New hire onboarding requires valid identification documents such as a passport or driver's license to verify the employee's identity and eligibility to work. These documents ensure compliance with federal regulations like the I-9 form, which mandates proof of identity and work authorization within the United States. |

| 8 | Benefits Enrollment Forms | Benefits enrollment forms are essential documents for new hire onboarding, enabling employees to select health insurance, retirement plans, and other company-sponsored benefits. Employers must provide clear instructions and deadlines for submitting these forms to ensure timely coverage and compliance with benefits administration requirements. |

| 9 | Non-Disclosure Agreement (NDA) | A Non-Disclosure Agreement (NDA) is essential for new hire onboarding to protect company trade secrets and confidential information from unauthorized disclosure. This legal document ensures employees understand their obligations regarding sensitive data, safeguarding intellectual property and competitive advantage. |

| 10 | Employee Handbook Acknowledgment | Employee Handbook Acknowledgment is a critical document in new hire onboarding, ensuring employees understand company policies, procedures, and expectations. This acknowledgment fosters compliance and helps protect the organization by confirming that new hires have reviewed and agreed to adhere to workplace standards. |

| 11 | Emergency Contact Information Form | The Emergency Contact Information Form is essential during new hire onboarding to ensure quick communication in case of workplace accidents or medical emergencies. This document typically includes the contact names, phone numbers, and relationships of individuals authorized to be notified if the employee cannot be reached. |

| 12 | Confidentiality Agreement | A Confidentiality Agreement is essential for new hire onboarding to protect company trade secrets, proprietary information, and intellectual property from unauthorized disclosure. This legal document ensures that employees understand their obligations to maintain confidentiality throughout and after their employment. |

| 13 | Code of Conduct Agreement | New hire onboarding requires submission of essential documents, including the signed Code of Conduct Agreement, which outlines company policies and ethical standards. This document ensures employees understand workplace expectations, compliance requirements, and professional behavior from the first day. |

| 14 | Background Check Consent Form | The Background Check Consent Form is essential for new hire onboarding as it authorizes the employer to verify the candidate's criminal history, employment record, and credit report if applicable. Ensuring this form is signed and collected early in the onboarding process streamlines compliance with legal requirements and supports informed hiring decisions. |

| 15 | Workplace Safety/Compliance Forms | New hire onboarding requires essential workplace safety and compliance forms such as OSHA training certifications, emergency contact information, and signed acknowledgments of company safety policies to ensure adherence to regulatory standards. These documents are critical to maintaining a safe work environment and demonstrating compliance with federal and state labor laws. |

| 16 | Intellectual Property Agreement | New hire onboarding requires the completion of an Intellectual Property Agreement to protect company innovations and ensure ownership rights of any work created during employment. This document legally binds employees to confidentiality and assigns intellectual property developed on company time to the employer. |

| 17 | Policy Acknowledgment Forms (e.g., IT, Cybersecurity) | Policy acknowledgment forms, including IT and cybersecurity agreements, are essential documents for new hire onboarding to ensure employees understand and comply with company regulations and data protection standards. These signed forms help mitigate risks by confirming that new hires are aware of policies related to information security, acceptable use, and confidentiality. |

| 18 | State-Specific Employment Forms | State-specific employment forms such as Form W-4 in California, the New York State IT-2104, and the Texas Workforce Commission's new hire reporting form are essential for new hire onboarding to ensure compliance with local tax withholding and employment regulations. Employers must provide and collect these forms promptly to verify employee eligibility, establish withholding allowances, and report new hires in accordance with state laws. |

| 19 | Equal Opportunity Employment Forms | Equal Opportunity Employment forms, such as the EEO-1 report and voluntary self-identification surveys, are essential documents for new hire onboarding to ensure compliance with federal anti-discrimination laws. These forms help employers collect data on workforce diversity and promote fair hiring practices aligned with the Equal Employment Opportunity Commission (EEOC) guidelines. |

| 20 | Consent for Drug Screening (if applicable) | New hire onboarding requires several essential documents, including the Consent for Drug Screening form when applicable, to comply with company policies and legal regulations. This consent ensures that employers can perform substance tests to maintain a safe and productive workplace environment. |

Introduction to Essential New Hire Documents

New hire onboarding requires a collection of essential documents to ensure a smooth employment process. These documents verify identity, eligibility, and agreement to company policies.

- Employment Eligibility Verification (Form I-9) - Confirms authorization to work legally within the country.

- Tax Withholding Forms (W-4 or equivalent) - Establishes the correct amount of tax to withhold from paychecks.

- Signed Offer Letter or Employment Contract - Details job role, compensation, and terms of employment agreed upon by you and the employer.

Employment Offer Letter Requirements

The employment offer letter serves as a formal confirmation of job terms between the employer and the new hire. It outlines key details such as job title, salary, start date, and reporting structure.

The letter must include legal disclaimers and conditions of employment to ensure compliance with labor laws. Clear communication of benefits, probation periods, and termination policies is essential for successful onboarding.

Completing Form I-9 for Work Eligibility

| Document | Description | Purpose | Examples |

|---|---|---|---|

| Form I-9 | Employment Eligibility Verification form required by the U.S. Citizenship and Immigration Services (USCIS) | Verify the identity and work authorization of new hires | Completed Section 1 by employee on or before first day; Section 2 completed by employer within 3 business days |

| Employee Identification Documents | Documents that establish identity and employment eligibility as listed on the Form I-9 Lists A, B, or C | Support Form I-9 verification process | List A: U.S. Passport, Permanent Resident Card List B: Driver's License, State ID List C: Social Security Card, Birth Certificate |

| Employment Authorization Documents | Valid certification proving eligibility to work in the United States | Verify legal authorization to accept employment | Employment Authorization Document (EAD), Form I-766 |

| Additional Onboarding Documents | Other required forms for payroll, tax, and benefits setup | Ensure compliance and successful employee integration | W-4 Tax Form, Direct Deposit Authorization, Employee Handbook Acknowledgment |

Understanding the W-4 Tax Withholding Form

During new hire onboarding, providing accurate tax information is essential for proper payroll processing. Understanding the W-4 Tax Withholding Form ensures correct federal income tax deductions from your paycheck.

- Purpose of the W-4 Form - Determines the amount of federal income tax withheld from wages based on personal and financial details.

- Completing the Form - Requires information such as filing status, dependents, and any additional withholding amounts to be specified.

- Impact on Paychecks - Accurate W-4 data helps prevent underpayment or overpayment of taxes throughout the year.

Direct Deposit Authorization Setup

Direct deposit authorization is a critical document for new hire onboarding, enabling employees to receive their paychecks electronically. This setup streamlines payroll processing and ensures timely payments.

The authorization form requires the employee's bank account number, routing number, and a voided check or deposit slip for verification. Employees must provide consent to allow the employer to deposit funds directly. Proper completion and submission of this document prevent payment delays and errors during the onboarding process.

Employee Handbook Acknowledgment

The Employee Handbook Acknowledgment is a critical document for new hire onboarding, confirming that the employee has received, read, and understood company policies. This acknowledgment helps protect the organization legally and ensures employees are aware of workplace expectations and guidelines.

Employers must obtain the signed acknowledgment form to maintain compliance and foster clear communication. Including this document in the onboarding packet streamlines the integration process and sets a foundation for a positive work environment.

Confidentiality and Non-Disclosure Agreements

New hire onboarding requires several essential documents to ensure compliance and a smooth integration into the company. Confidentiality and Non-Disclosure Agreements protect sensitive business information and establish clear expectations regarding privacy and intellectual property. You must review and sign these agreements to safeguard proprietary data and maintain trust within the organization.

Benefits Enrollment and Selection Forms

Benefits enrollment and selection forms are essential documents during new hire onboarding. These forms allow employees to choose health insurance, retirement plans, and other company-provided benefits. Completing these documents accurately ensures timely access to all available employee benefits.

Emergency Contact Information Collection

Collecting emergency contact information is a crucial part of new hire onboarding. It ensures quick communication during any unforeseen incidents at the workplace.

- Emergency Contact Form - A document where employees list people to contact in case of an emergency.

- Contact Verification - Confirming the accuracy of the provided emergency details to avoid communication delays.

- Confidentiality Assurance - Securing personal contact data to comply with privacy regulations and protect employee information.

Your timely submission of emergency contact information enhances workplace safety and responsiveness.

What Documents are Necessary for New Hire Onboarding? Infographic