Freelancers in the US need to gather several essential documents for tax filing, including Form 1099-NEC from clients who paid them $600 or more, which reports nonemployee compensation. They should also maintain records of all income received, invoices, and receipts for deductible business expenses to accurately report earnings and reduce taxable income. Keeping detailed documentation of estimated tax payments made throughout the year is crucial to avoid penalties and ensure compliance with IRS requirements.

What Documents Does a Freelancer Need for Tax Filing in the US?

| Number | Name | Description |

|---|---|---|

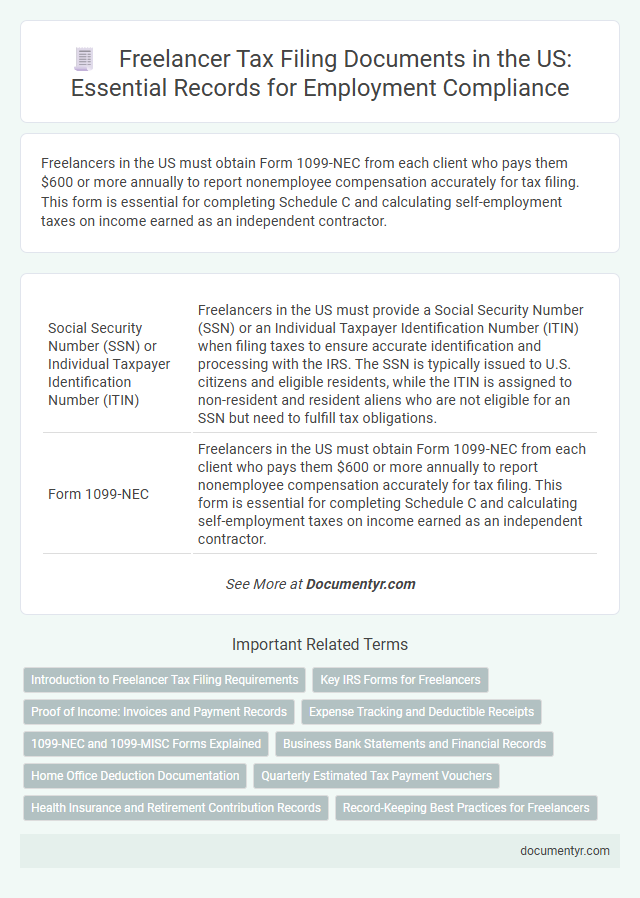

| 1 | Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) | Freelancers in the US must provide a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) when filing taxes to ensure accurate identification and processing with the IRS. The SSN is typically issued to U.S. citizens and eligible residents, while the ITIN is assigned to non-resident and resident aliens who are not eligible for an SSN but need to fulfill tax obligations. |

| 2 | Form 1099-NEC | Freelancers in the US must obtain Form 1099-NEC from each client who pays them $600 or more annually to report nonemployee compensation accurately for tax filing. This form is essential for completing Schedule C and calculating self-employment taxes on income earned as an independent contractor. |

| 3 | Form 1099-MISC | Freelancers in the US need Form 1099-MISC to report income received from clients who paid them $600 or more during the tax year, ensuring accurate income reporting to the IRS. This form details non-employee compensation, which freelancers must use to file their taxes and calculate self-employment tax obligations. |

| 4 | Form 1099-K | Freelancers in the US must obtain Form 1099-K from payment platforms if their transactions exceed $600 annually, which details gross payment card and third-party network transactions necessary for accurate tax reporting. This form, combined with detailed income records and expense receipts, enables precise calculation of taxable income and compliance with IRS freelance tax filing requirements. |

| 5 | Form W-9 | Freelancers in the US need Form W-9 to provide their Taxpayer Identification Number (TIN) to clients for accurate income reporting to the IRS. This form is essential for tax filing as it ensures proper documentation of earnings and helps in issuing Form 1099-MISC or 1099-NEC at year-end. |

| 6 | Schedule C (Form 1040) | Freelancers in the US must file Schedule C (Form 1040) to report income and expenses from self-employment, making it essential to maintain accurate records of invoices, receipts, and business-related expenses. Supporting documents such as 1099-NEC forms received from clients, detailed mileage logs, and proof of home office deductions are crucial for substantiating claims and ensuring compliance with IRS tax filing requirements. |

| 7 | Schedule SE (Form 1040) | Freelancers in the US must file Schedule SE (Form 1040) to calculate self-employment tax, which covers Social Security and Medicare contributions. Essential documents include Form 1099-NEC from clients, detailed income records, and expense receipts to accurately complete Schedule SE and report net earnings. |

| 8 | Business Expense Receipts | Freelancers in the US must keep detailed business expense receipts to accurately report deductible expenses and reduce taxable income on tax filings. These receipts serve as crucial proof for IRS audits and include documentation for purchases like office supplies, travel expenses, and software subscriptions. |

| 9 | Bank Statements | Freelancers in the US need bank statements to verify income and track business expenses for accurate tax filing, as these documents provide a detailed record of all transactions related to freelance work. Maintaining organized bank statements ensures compliance with IRS requirements and supports claims for deductions and credits during tax reporting. |

| 10 | Invoices Issued | Freelancers in the US must keep detailed invoices issued to clients, including dates, services rendered, payment amounts, and tax identification numbers, as critical documentation for tax filing and audit purposes. Accurate invoices support income verification reported on Schedule C and help claim eligible business deductions with the IRS. |

| 11 | Contracts or Agreements | Freelancers in the US must retain signed contracts or agreements with clients to substantiate income and clarify the scope of work for tax filing purposes. These documents provide essential evidence of earnings and business expenses, ensuring accurate reporting to the IRS. |

| 12 | Mileage Log | Freelancers in the US must maintain a detailed mileage log to accurately deduct vehicle expenses for tax filing, tracking date, purpose, starting and ending locations, and miles driven for each business trip. The IRS requires this documentation to validate deductions for travel-related costs, making precise record-keeping essential for maximizing tax benefits. |

| 13 | Home Office Expense Records | Freelancers in the US must maintain accurate home office expense records, including mortgage or rent statements, utility bills, and property tax receipts, to claim deductions on tax filings. Proper documentation of the dedicated workspace's square footage and related expenses ensures compliance with IRS guidelines and maximizes allowable tax benefits. |

| 14 | Health Insurance Documentation (Form 1095) | Freelancers in the US must retain Form 1095 to verify compliance with the Affordable Care Act's health coverage requirements during tax filing. This document, issued by health insurers or employers, details months of coverage and is essential for accurately completing Form 8962 to claim the Premium Tax Credit if applicable. |

| 15 | Prior Year Tax Return | Freelancers in the US must have their prior year tax return, including Form 1040 and Schedule C, to accurately report income and deductions for current tax filing. This document provides essential reference for estimating quarterly taxes, verifying income records, and ensuring compliance with IRS requirements. |

| 16 | Estimated Tax Payment Receipts (Form 1040-ES) | Freelancers in the US must retain Estimated Tax Payment Receipts from Form 1040-ES to accurately report quarterly tax payments and avoid penalties. These receipts provide essential proof of income tax prepayments based on self-employment earnings, ensuring compliance with IRS requirements during annual tax filing. |

| 17 | State Tax Forms | Freelancers in the US must gather specific state tax forms such as Form 540 for California or IT-201 for New York, depending on their state of residence to accurately report income and pay state taxes. Ensuring the completion of Schedule C and state-specific schedules for business deductions is critical for compliance with state tax authorities. |

| 18 | Retirement Contribution Records (IRA, SEP-IRA) | Freelancers in the US must maintain accurate retirement contribution records, including IRA and SEP-IRA statements, to ensure proper tax filing and eligibility for relevant deductions or credits. These documents verify contributions made throughout the tax year and are essential for calculating taxable income and potential tax benefits associated with retirement savings. |

| 19 | Education Expense Receipts (if applicable) | Freelancers in the US should retain education expense receipts to claim deductions on continuing education or skill development related to their freelance work, which can reduce taxable income. These documents must be accurate and itemized, including course fees, materials, and any associated costs, to comply with IRS requirements during tax filing. |

| 20 | Professional License or Certification Documentation | Freelancers in the US must retain professional license or certification documentation to verify eligibility and compliance with industry regulations during tax filing. This documentation supports deductions related to maintaining licensure, such as education expenses and renewal fees, ensuring accurate reporting to the IRS. |

Introduction to Freelancer Tax Filing Requirements

What documents does a freelancer need for tax filing in the US? Freelancers must gather specific tax forms and records to comply with IRS requirements. Your accurate tax filing depends on maintaining proper documentation throughout the year.

Key IRS Forms for Freelancers

Freelancers in the US must gather specific IRS forms for accurate tax filing. These documents ensure compliance with tax regulations and proper income reporting.

- Form 1040 - The standard individual income tax return used to report overall income including freelance earnings.

- Schedule C (Form 1040) - Reports income or loss from a business you operated as a sole proprietor.

- Form 1099-NEC - Issued by clients to report nonemployee compensation paid to freelancers.

Maintaining and submitting these key forms streamlines tax filing for freelancers while meeting IRS requirements.

Proof of Income: Invoices and Payment Records

Freelancers in the US must provide proof of income when filing taxes, primarily through invoices and payment records. These documents validate the earnings reported to the IRS and ensure accurate tax assessment.

Invoices detail the services rendered, dates, and amounts charged to clients, serving as official records of income. Payment records, such as bank statements or payment platform summaries, confirm receipt of funds. Maintaining organized and detailed proof of income facilitates smooth tax filing and compliance with IRS regulations.

Expense Tracking and Deductible Receipts

Freelancers in the US must keep detailed records of their expenses to accurately file taxes. Receipts for deductible expenses such as office supplies, travel, and software subscriptions are essential for maximizing deductions. Maintaining organized expense tracking helps you substantiate claims and streamline the tax filing process.

1099-NEC and 1099-MISC Forms Explained

Freelancers in the US must understand the importance of specific tax forms for proper tax filing. The 1099-NEC and 1099-MISC forms are essential for reporting income received as an independent contractor or for miscellaneous payments.

- 1099-NEC Form - This form reports non-employee compensation to freelancers and independent contractors who earned $600 or more from a client.

- 1099-MISC Form - Used to report various types of income such as rent, prizes, and other payments not reported on the 1099-NEC.

- Deadline Awareness - Clients must send these forms to freelancers by January 31 each year to ensure timely and accurate tax filing.

Business Bank Statements and Financial Records

Freelancers in the US must maintain accurate business bank statements to support their income and expense claims during tax filing. These statements provide a clear record of all financial transactions related to their freelance work, essential for verifying reported earnings.

Financial records, including receipts, invoices, and expense reports, help freelancers substantiate deductions and credits claimed on tax returns. Keeping organized financial documents ensures compliance with IRS requirements and reduces the risk of audits or penalties.

Home Office Deduction Documentation

Freelancers in the US must keep detailed records to claim the home office deduction accurately. Essential documents include a floor plan showing the dedicated workspace and evidence of expenses related to that area.

Receipts for utilities, rent, mortgage interest, and repairs are crucial for supporting your deduction claims. Maintaining a mileage log can also help if you use your vehicle for business purposes linked to your home office.

Quarterly Estimated Tax Payment Vouchers

| Quarterly Estimated Tax Payment Vouchers for Freelancers in the US | |

|---|---|

| Purpose | Enable freelancers to make timely quarterly estimated tax payments on income not subject to withholding. |

| Key Document | Form 1040-ES, Estimated Tax for Individuals, which includes payment vouchers for each quarter. |

| Payment Deadlines | April 15, June 15, September 15, and January 15 of the following year. |

| Information Included | Estimated income, tax liability calculations, and payment instructions. |

| Submission Methods | Mailing the voucher with payment, or electronic payment through IRS Direct Pay or EFTPS. |

| Importance | Helps avoid penalties and interest for underpayment of taxes on freelance earnings. |

| Supporting Documents | Previous year's tax return, income records, and expense receipts to estimate quarterly payments accurately. |

Health Insurance and Retirement Contribution Records

Freelancers in the US must maintain accurate health insurance records, including Form 1095-A, 1095-B, or 1095-C, to report coverage when filing taxes. Retirement contribution documents, such as records of contributions to SEP IRAs, SIMPLE IRAs, or Solo 401(k) plans, are essential for claiming deductions. Proper documentation ensures compliance with IRS requirements and maximizes eligible tax benefits for independent contractors.

What Documents Does a Freelancer Need for Tax Filing in the US? Infographic