Employers need to collect several key documents for payroll setup, including the employee's W-4 form to determine tax withholdings and the I-9 form to verify employment eligibility. Accurate personal information such as Social Security numbers and direct deposit details are essential to ensure timely and correct payment. Maintaining these records helps comply with federal and state payroll regulations and avoids legal issues.

What Documents Does an Employer Need for Payroll Setup?

| Number | Name | Description |

|---|---|---|

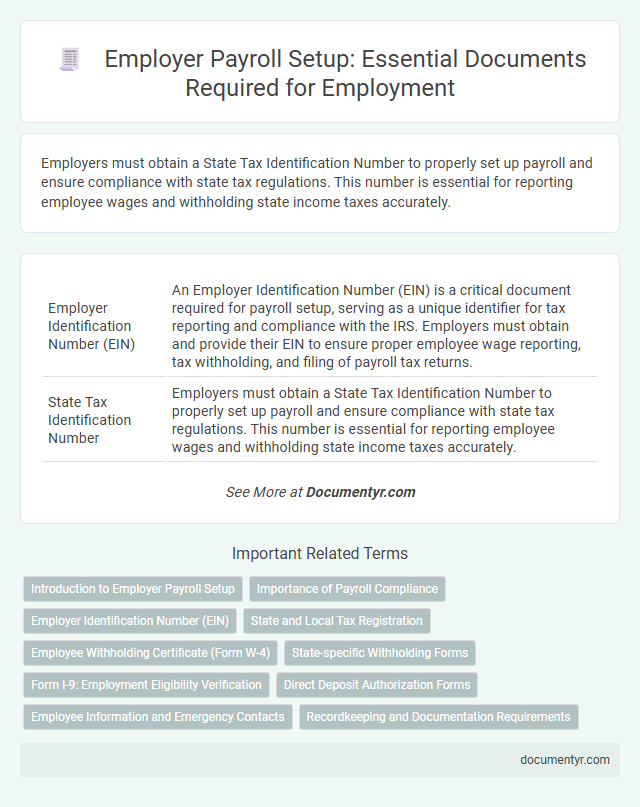

| 1 | Employer Identification Number (EIN) | An Employer Identification Number (EIN) is a critical document required for payroll setup, serving as a unique identifier for tax reporting and compliance with the IRS. Employers must obtain and provide their EIN to ensure proper employee wage reporting, tax withholding, and filing of payroll tax returns. |

| 2 | State Tax Identification Number | Employers must obtain a State Tax Identification Number to properly set up payroll and ensure compliance with state tax regulations. This number is essential for reporting employee wages and withholding state income taxes accurately. |

| 3 | Business Registration Documents | Employers must provide business registration documents such as a Certificate of Incorporation, Employer Identification Number (EIN), and state tax registration certificates to establish payroll accounts and comply with tax reporting requirements. These documents verify the legal status of the business and are essential for accurate payroll setup and regulatory adherence. |

| 4 | Employee W-4 Form | The Employee W-4 form is essential for payroll setup as it provides the employer with the employee's tax withholding information, ensuring accurate federal income tax deductions. Employers must collect and maintain this form to comply with IRS regulations and correctly calculate withholding amounts based on the employee's filing status and allowances. |

| 5 | Employee I-9 Form | Employers require the Employee I-9 Form to verify the identity and employment authorization of new hires, ensuring compliance with U.S. immigration laws. Accurate completion and retention of the I-9 form are crucial for payroll setup and audit readiness. |

| 6 | State Withholding Allowance Certificate | Employers require the State Withholding Allowance Certificate, often referred to as Form W-4 or its state equivalent, to accurately determine the amount of state income tax to withhold from employees' paychecks. This document ensures compliance with state tax laws and helps in setting up correct payroll deductions based on individual withholding allowances claimed by the employee. |

| 7 | Direct Deposit Authorization Form | Employers require a Direct Deposit Authorization Form to securely collect employee bank account details for seamless electronic salary transfers. This form typically includes the employee's bank name, account number, routing number, and authorization signature to comply with payroll and banking regulations. |

| 8 | Employment Agreement or Offer Letter | An employer requires a signed Employment Agreement or Offer Letter to establish payroll details, clearly outlining job title, salary, pay frequency, and employment terms. These documents serve as the legal basis for payroll setup, ensuring compliance with labor laws and accurate employee compensation. |

| 9 | Workers’ Compensation Insurance Policy | Employers need a valid Workers' Compensation Insurance Policy to ensure compliance with state regulations and provide coverage for employee injuries during work-related activities. This policy protects both the employer and employees by covering medical expenses and lost wages resulting from workplace accidents. |

| 10 | Local Tax Registration Certificates | Employers must obtain Local Tax Registration Certificates to accurately register employees with municipal tax authorities and ensure compliance with regional payroll tax regulations. These documents are essential for processing local income tax withholdings and remittances in payroll systems. |

| 11 | Payroll Account Bank Details | Employers need employees' bank account details, including account number and routing number, to ensure accurate payroll deposits. These payroll account bank details enable timely direct deposit of salaries and compliance with payroll processing regulations. |

| 12 | Independent Contractor 1099 Forms (if applicable) | Employers require completed IRS Form W-9 from independent contractors to collect accurate taxpayer identification information necessary for payroll setup and issuing 1099 forms. These 1099-MISC or 1099-NEC forms must be submitted to the IRS and provided to contractors annually to report nonemployee compensation for tax purposes. |

| 13 | New Hire Reporting Form | Employers need the New Hire Reporting Form to comply with state and federal regulations, ensuring accurate payroll processing and tax withholdings for new employees. This form provides critical employee information such as Social Security number, address, and employment details necessary for setting up payroll and reporting new hires to government agencies. |

| 14 | Proof of Unemployment Insurance Registration | Employers must provide proof of unemployment insurance registration to fulfill payroll setup requirements, ensuring compliance with state labor laws and tax regulations. This document verifies the employer's account with the state unemployment insurance agency, enabling accurate calculation and remittance of unemployment taxes. |

| 15 | Payroll Service Provider Agreement (if outsourcing) | Employers must provide a signed Payroll Service Provider Agreement when outsourcing payroll to ensure legal compliance, data security, and clearly defined responsibilities. This document outlines service terms, payment schedules, and confidentiality clauses essential for accurate payroll setup and management. |

| 16 | Department of Labor Registration (where required) | Employers must provide Department of Labor Registration documents, where required, to ensure compliance with federal and state labor laws during payroll setup. This includes registration certificates or proof of submission necessary for wage and hour compliance, tax reporting, and employee eligibility verification. |

| 17 | Wage and Hour Records Compliance Documents | Employers must maintain accurate wage and hour records, including timesheets, pay stubs, and employee wage agreements, to ensure compliance with the Fair Labor Standards Act (FLSA) and state labor laws. Essential payroll setup documents also include Form W-4 for tax withholding and records of hours worked to verify proper compensation and overtime calculations. |

Introduction to Employer Payroll Setup

What documents does an employer need for payroll setup? Setting up payroll requires collecting specific documents to ensure accurate employee compensation and legal compliance. Employers must gather essential forms to streamline payroll processing and avoid errors.

Importance of Payroll Compliance

Employers must gather essential documents such as employees' W-4 forms, Social Security numbers, and valid identification to accurately set up payroll. These records ensure correct tax withholding and verification of employment eligibility.

Maintaining payroll compliance is critical to avoid penalties and legal issues stemming from erroneous tax filings or missing documentation. Proper documentation supports timely wage payments and accurate reporting to government agencies, safeguarding both employer and employee rights.

Employer Identification Number (EIN)

An Employer Identification Number (EIN) is essential for payroll setup, serving as a unique identifier for your business with the IRS. This nine-digit number enables accurate tax reporting and compliance with federal regulations. Employers must provide their EIN to ensure proper withholding and submission of employee taxes.

State and Local Tax Registration

Employers must gather specific documents for payroll setup, with a focus on state and local tax registration to ensure compliance. Proper registration is essential for accurate tax withholding and reporting at various government levels.

- State Tax Registration Certificate - Confirms the employer's registration with the state tax authority for payroll tax purposes.

- Local Tax Registration Documents - Required for employers operating in jurisdictions with local income or payroll taxes to comply with municipal regulations.

- Employer Identification Number (EIN) - Issued by the IRS, this number is necessary for state and local tax filings related to payroll.

Collecting these state and local tax registration documents enables employers to properly manage payroll tax obligations and avoid penalties.

Employee Withholding Certificate (Form W-4)

| Document | Description | Purpose in Payroll Setup |

|---|---|---|

| Employee Withholding Certificate (Form W-4) | IRS form completed by employees providing information on tax withholding allowances and filing status. | Determines the correct federal income tax withholding amount from employee wages for accurate payroll tax calculations. |

| Form I-9 | Employment eligibility verification form required by the Department of Homeland Security. | Confirms legal authorization for an employee to work in the United States, required before payroll processing. |

| Direct Deposit Authorization Form | Employee authorization form providing bank details for electronic salary deposit. | Facilitates timely and accurate payment by enabling direct deposit payroll setup. |

| State Tax Withholding Forms | State-specific forms analogous to the federal W-4 to determine state tax withholding amounts. | Ensures compliance with state tax requirements during payroll processing. |

| Employment Agreement or Offer Letter | Official document specifying the terms of employment, including salary and benefits. | Provides essential payroll details and compensation structure for accurate payroll setup. |

State-specific Withholding Forms

Employers must collect specific documents to set up payroll accurately, including state-specific withholding forms. These forms ensure proper tax withholding according to your state's regulations.

- State Withholding Certificate - Employees complete this form to indicate their state tax withholding preferences.

- Employer Registration Form - This form registers your business with the state tax agency for payroll tax purposes.

- Certificate of Exemption - Some states require this form if an employee claims exemption from state income tax withholding.

Form I-9: Employment Eligibility Verification

Form I-9: Employment Eligibility Verification is a crucial document employers need for payroll setup. This form verifies an employee's identity and legal authorization to work in the United States. Employers must retain the completed Form I-9 for each hired employee to comply with federal regulations and avoid penalties.

Direct Deposit Authorization Forms

Direct Deposit Authorization Forms are essential documents required for payroll setup. They authorize the employer to deposit an employee's paycheck directly into their bank account.

The form typically includes bank account details such as routing and account numbers. You must complete this form accurately to ensure timely and correct payments.

Employee Information and Emergency Contacts

Employers require specific documents to set up payroll accurately, focusing on employee information and emergency contacts. Collecting these details ensures compliance with legal standards and facilitates efficient payroll processing.

Essential employee information includes Social Security numbers, tax withholding forms like the W-4, and direct deposit details. Employers must also gather emergency contact information to address any urgent situations involving the employee. Proper documentation streamlines payroll administration and supports workplace safety protocols.

What Documents Does an Employer Need for Payroll Setup? Infographic