New employees must provide essential documents for onboarding, including a valid government-issued ID, Social Security card, and completed tax forms such as the W-4. Proof of eligibility to work in the country, typically through documents like a passport or employment authorization card, is mandatory. Employers may also require direct deposit information and any relevant certifications or licenses related to the job.

What Documents Does a New Employee Need for Onboarding?

| Number | Name | Description |

|---|---|---|

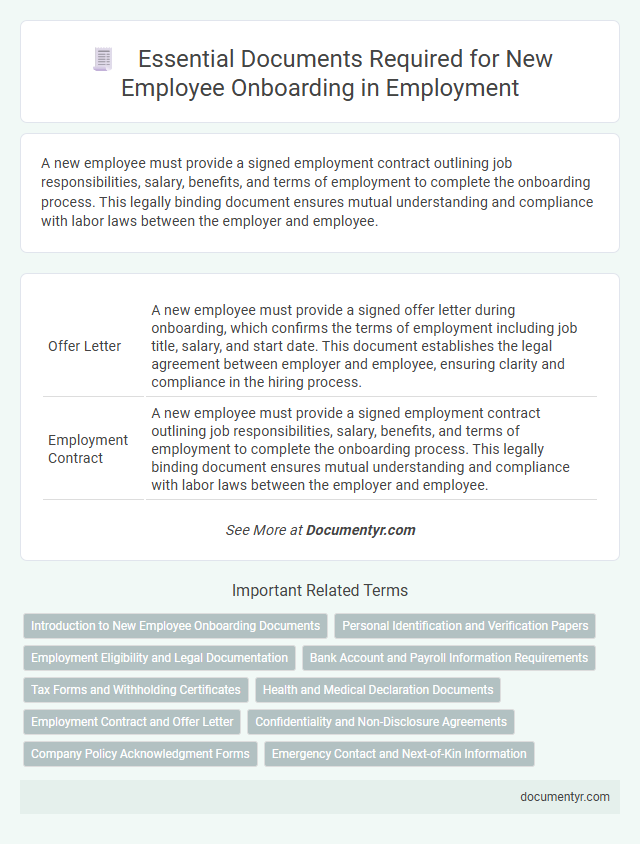

| 1 | Offer Letter | A new employee must provide a signed offer letter during onboarding, which confirms the terms of employment including job title, salary, and start date. This document establishes the legal agreement between employer and employee, ensuring clarity and compliance in the hiring process. |

| 2 | Employment Contract | A new employee must provide a signed employment contract outlining job responsibilities, salary, benefits, and terms of employment to complete the onboarding process. This legally binding document ensures mutual understanding and compliance with labor laws between the employer and employee. |

| 3 | Government-Issued ID (e.g., Passport, Driver’s License) | A new employee must provide a government-issued ID, such as a passport or driver's license, to verify their identity and eligibility for employment. This documentation is essential for completing Form I-9 and complying with federal employment verification requirements. |

| 4 | Social Security Card | A new employee must provide their Social Security Card during onboarding to verify their identity and ensure accurate tax reporting and benefits enrollment. This mandatory document helps employers comply with federal requirements such as completing Form I-9 and administering payroll deductions correctly. |

| 5 | Tax Forms (e.g., W-4, W-9, State Tax Withholding Forms) | New employees must complete tax forms such as the W-4 for federal income tax withholding, W-9 for taxpayer identification, and relevant state tax withholding forms to ensure accurate payroll deductions. These documents are essential for compliance with IRS regulations and state tax authorities during onboarding. |

| 6 | Direct Deposit Authorization Form | New employees must complete a Direct Deposit Authorization Form to facilitate seamless salary payments directly into their bank accounts, ensuring timely and secure compensation. This form typically requires bank account details, routing numbers, and employee signatures to authorize electronic funds transfers. |

| 7 | Proof of Address | A new employee typically needs to provide proof of address documents such as utility bills, bank statements, or rental agreements dated within the last three months to verify their residency during onboarding. Employers require these documents to comply with legal regulations and ensure accurate employee records for payroll and tax purposes. |

| 8 | Background Check Authorization | New employees must provide a signed Background Check Authorization form to allow employers to verify employment history, criminal records, and education credentials as part of the onboarding process. This document is essential for compliance with company policies and regulatory requirements, ensuring a secure and trustworthy workforce. |

| 9 | I-9 Employment Eligibility Verification | New employees must complete the Form I-9 Employment Eligibility Verification to confirm identity and authorize work in the United States, presenting acceptable documents such as a U.S. passport, permanent resident card, or a combination of a driver's license and Social Security card. Employers are required by the U.S. Citizenship and Immigration Services (USCIS) to retain the I-9 form for all hires and ensure compliance with federal employment eligibility verification laws. |

| 10 | Emergency Contact Information | Emergency contact information is essential for new employee onboarding to ensure quick communication in case of accidents or medical emergencies. Employers typically require the full name, relationship, and phone numbers of one or more emergency contacts to maintain accurate and accessible records. |

| 11 | Bank Account Details | New employees must provide accurate bank account details, including the account number and bank name, to ensure timely salary deposits and direct payments. Verifying these details during onboarding prevents payment delays and supports seamless payroll processing. |

| 12 | Non-Disclosure Agreement (NDA) | A new employee must sign a Non-Disclosure Agreement (NDA) to protect proprietary information and maintain company confidentiality during and after employment. This critical onboarding document legally binds the employee to prevent unauthorized sharing of sensitive business data, trade secrets, and intellectual property. |

| 13 | Employee Handbook Acknowledgement | New employees must review and sign the Employee Handbook Acknowledgement to confirm understanding of company policies, procedures, and expectations, ensuring compliance and smooth integration. This document is essential for legal protection and sets clear guidelines for workplace behavior and responsibilities from the start. |

| 14 | Health Insurance Enrollment Forms | New employees must complete health insurance enrollment forms to ensure timely coverage under the employer's group health plan, which typically include personal information, beneficiary details, and plan selection. Providing accurate documentation such as Social Security numbers and prior insurance information facilitates seamless processing and compliance with healthcare regulations. |

| 15 | Benefits Enrollment Forms | New employees must complete benefits enrollment forms to activate health insurance, retirement plans, and other company-sponsored benefits essential for their compensation package. Submitting accurate documents like Social Security numbers, dependents' information, and beneficiary designations ensures timely processing and eligibility. |

| 16 | Professional Certifications or Licenses (if applicable) | New employees must provide valid professional certifications or licenses relevant to their job roles, such as medical licenses for healthcare workers or teaching certificates for educators. These documents ensure compliance with industry regulations and verify the employee's qualifications during onboarding. |

| 17 | Resume or Curriculum Vitae | A new employee must provide a comprehensive resume or curriculum vitae (CV) detailing their work experience, education, skills, and certifications to facilitate accurate onboarding and role placement. This document serves as a foundational record for HR to verify qualifications, conduct background checks, and tailor orientation programs. |

| 18 | References Contact List | A new employee typically needs to provide a References Contact List containing the names, phone numbers, and email addresses of professional contacts who can verify their work experience and skills. Employers use these references to assess the candidate's qualifications and reliability during the onboarding process. |

| 19 | Company Policy Acknowledgment Forms | New employees must complete Company Policy Acknowledgment Forms during onboarding to confirm understanding and compliance with workplace rules and expectations. These documents typically include acknowledgments for code of conduct, confidentiality agreements, and safety protocols. |

| 20 | Work Authorization Permit (if applicable) | New employees must provide a valid work authorization permit, such as an Employment Authorization Document (EAD) or relevant visa, to verify legal eligibility for employment. Employers require this documentation to comply with federal regulations, including Form I-9 verification, ensuring all hires are authorized to work in the United States. |

Introduction to New Employee Onboarding Documents

Starting a new job involves submitting essential documents to complete the onboarding process. These documents verify your identity, employment eligibility, and agreement to company policies.

- Identification Documents - Typically includes a passport or driver's license to confirm your identity.

- Employment Eligibility Forms - Forms like the I-9 in the U.S. verify your legal right to work.

- Tax and Direct Deposit Forms - W-4 forms and bank details are required for payroll and tax purposes.

Having these documents ready ensures a smooth and efficient onboarding experience.

Personal Identification and Verification Papers

New employees must provide essential personal identification and verification documents to complete onboarding. These documents confirm your identity and eligibility to work legally.

Commonly required papers include a government-issued photo ID, such as a passport or driver's license, and Social Security or tax identification numbers. Employers may also request employment eligibility verification forms like the I-9.

Employment Eligibility and Legal Documentation

New employees must provide essential documents to verify employment eligibility and comply with legal requirements. These documents ensure the company adheres to labor laws and immigration regulations.

Common documents include a government-issued photo ID, such as a passport or driver's license, and a Social Security card or tax identification number for payroll purposes. Form I-9, Employment Eligibility Verification, is mandatory to confirm that the employee is authorized to work in the United States. Additional legal documentation might include work visas or permanent resident cards for non-citizen employees.

Bank Account and Payroll Information Requirements

What documents are required to set up your bank account and payroll information during onboarding? Employers typically need a voided check or direct deposit form to link your bank account for salary payments. Providing accurate payroll details ensures timely and correct compensation without delays.

Tax Forms and Withholding Certificates

New employees must complete specific tax forms to comply with federal and state employment regulations. The most common documents include the IRS Form W-4, which determines federal income tax withholding.

State withholding certificates, such as the Form DE 4 in California or the Form MW507 in Maryland, adjust state tax deductions based on personal allowances. Accurate submission of these forms ensures correct payroll tax withholding from the employee's salary.

Health and Medical Declaration Documents

| Document Type | Description | Purpose | Required By |

|---|---|---|---|

| Health Declaration Form | Employee provides detailed information about current health status, chronic conditions, allergies, and recent illnesses. | Ensures workplace safety and allows employers to make necessary accommodations or adjustments. | HR Department, Occupational Health and Safety Regulations |

| Medical Examination Report | Results from a pre-employment physical examination conducted by a licensed medical professional. | Confirms employee fitness for specific job roles requiring physical demands or exposure to hazards. | Medical Examiner, Employer Compliance Teams |

| Vaccination Records | Documentation of immunizations such as influenza, hepatitis B, or COVID-19 vaccines. | Meets public health standards and reduces risk of infectious disease transmission within the workplace. | Public Health Authorities, Employer Health Policies |

| Emergency Medical Contact Information | Names and phone numbers of contacts to be notified in case of a workplace medical emergency. | Facilitates prompt response and support during health incidents. | HR Records, Emergency Response Teams |

| Consent for Medical Treatment | Written authorization allowing the employer to seek medical assistance on behalf of the employee if necessary. | Ensures legal compliance and quick action during medical emergencies. | Corporate Legal Department, HR |

Employment Contract and Offer Letter

New employees must provide key documents to complete the onboarding process efficiently. The Employment Contract and Offer Letter are foundational paperwork that outline job roles, compensation, and company policies.

- Employment Contract - This legal document details terms of employment, including job responsibilities, salary, benefits, and confidentiality agreements.

- Offer Letter - It formally confirms the job offer, specifying position title, start date, and initial compensation details.

- Verification Purpose - These documents ensure mutual agreement and protect both employer and employee rights throughout the employment period.

Confidentiality and Non-Disclosure Agreements

New employees must complete Confidentiality and Non-Disclosure Agreements to protect sensitive company information. These documents outline your obligation to maintain privacy and prevent unauthorized sharing of proprietary data. Signing these agreements ensures trust and legal compliance throughout your employment.

Company Policy Acknowledgment Forms

Company policy acknowledgment forms are essential documents that new employees must review and sign during onboarding. These forms confirm that the employee understands and agrees to adhere to the organization's rules and regulations.

- Code of Conduct Acknowledgment - Confirms the employee's commitment to ethical behavior and workplace standards.

- Confidentiality Agreement - Ensures the employee agrees to protect sensitive company information from unauthorized disclosure.

- Employee Handbook Receipt - Verifies that the employee has received, read, and will comply with the company's policies and procedures.

What Documents Does a New Employee Need for Onboarding? Infographic