Freelancers working with international clients must have a valid identification document, such as a passport, to verify their identity. They also need a detailed contract outlining project scope, payment terms, and deadlines to ensure clear agreements. Invoices and tax documents are essential for legal compliance and smooth payment processing across different countries.

What Documents Does a Freelancer Need for International Clients?

| Number | Name | Description |

|---|---|---|

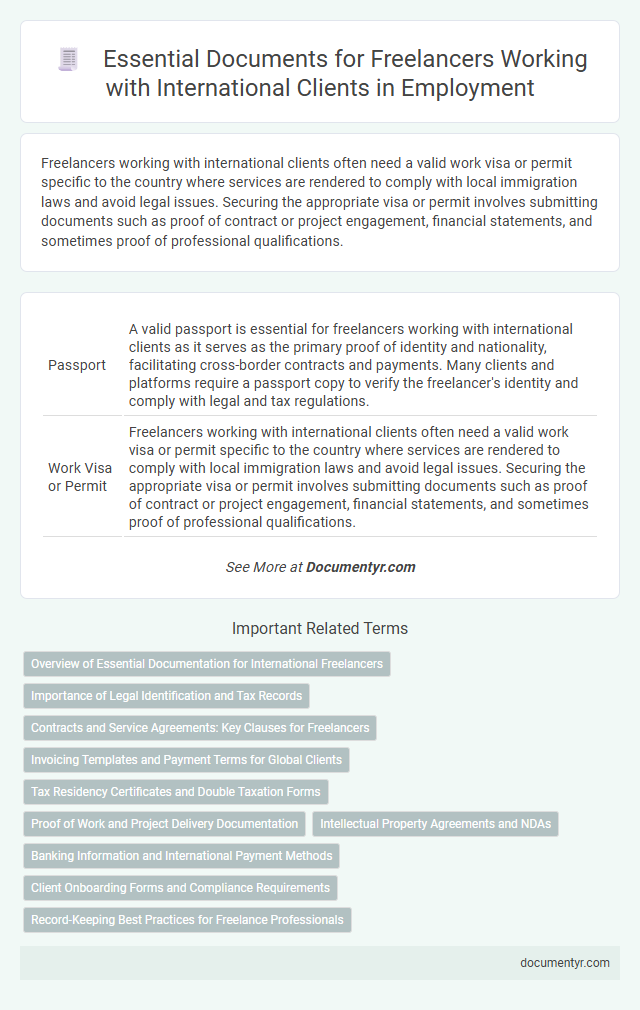

| 1 | Passport | A valid passport is essential for freelancers working with international clients as it serves as the primary proof of identity and nationality, facilitating cross-border contracts and payments. Many clients and platforms require a passport copy to verify the freelancer's identity and comply with legal and tax regulations. |

| 2 | Work Visa or Permit | Freelancers working with international clients often need a valid work visa or permit specific to the country where services are rendered to comply with local immigration laws and avoid legal issues. Securing the appropriate visa or permit involves submitting documents such as proof of contract or project engagement, financial statements, and sometimes proof of professional qualifications. |

| 3 | Tax Identification Number (TIN) | Freelancers working with international clients must provide a valid Tax Identification Number (TIN) to ensure proper tax reporting and compliance across different jurisdictions. This unique identifier helps clients with tax withholding, invoicing accuracy, and facilitates smoother cross-border transactions. |

| 4 | Proof of Address | Freelancers working with international clients must provide a valid proof of address document, such as a utility bill, bank statement, or rental agreement, to verify their residency and comply with client verification processes. This documentation ensures trust and facilitates seamless communication, invoicing, and contractual agreements across borders. |

| 5 | Bank Account Information | Freelancers working with international clients must provide accurate bank account information, including the SWIFT/BIC code and IBAN, to ensure smooth cross-border payments. Ensuring these details match the registered account holder's name helps avoid delays and transaction errors. |

| 6 | Invoices | Freelancers working with international clients must provide detailed, professional invoices that include their business information, client details, a clear description of services rendered, payment terms, and applicable taxes such as VAT or GST. Ensuring invoices comply with the client's country's legal requirements and currency preferences facilitates smooth payment processing and maintains transparent financial records. |

| 7 | Signed Service Agreement/Contract | A signed service agreement or contract is essential for freelancers working with international clients as it clearly outlines project scope, payment terms, and deadlines, providing legal protection and preventing misunderstandings. This document serves as proof of the agreed terms and can be crucial in resolving disputes or enforcing payment across different jurisdictions. |

| 8 | Portfolio or Work Samples | A portfolio or work samples are essential documents for freelancers seeking international clients, showcasing their skills, expertise, and the quality of previous projects. These materials help establish credibility, demonstrate versatility across different markets, and build trust with potential clients worldwide. |

| 9 | Resume/Curriculum Vitae (CV) | A freelancer must provide a well-structured Resume or Curriculum Vitae (CV) highlighting relevant skills, project experience, and client testimonials to attract international clients. Including certifications, language proficiencies, and a portfolio link enhances credibility and demonstrates professionalism in a competitive global market. |

| 10 | Certificate of Incorporation (if registered as a business) | Freelancers working with international clients should provide a Certificate of Incorporation if registered as a business to validate their legal entity status and enhance client trust. This document confirms business legitimacy, enabling smoother contract negotiations and compliance with international tax and regulatory requirements. |

| 11 | Non-Disclosure Agreement (NDA) | A Non-Disclosure Agreement (NDA) is essential for freelancers working with international clients to protect confidential information and intellectual property during collaborations. This legally binding document ensures that sensitive project details, trade secrets, and client data remain secure, fostering trust and professional integrity across different legal jurisdictions. |

| 12 | Statement of Work (SOW) | A Statement of Work (SOW) is essential for freelancers working with international clients as it clearly defines project deliverables, timelines, payment terms, and responsibilities, reducing misunderstandings and legal risks. This document ensures both parties have a mutual agreement on scope and expectations, facilitating smooth collaboration across different legal jurisdictions. |

| 13 | Payment Receipts | Freelancers working with international clients must provide detailed payment receipts that include the transaction date, amount, currency, payment method, and client details to ensure transparency and facilitate smooth financial tracking. Clear and accurate payment receipts help freelancers maintain proper records for tax compliance and protect against payment disputes in cross-border contracts. |

| 14 | Tax Residency Certificate | A Tax Residency Certificate (TRC) is essential for freelancers working with international clients to avoid double taxation and comply with cross-border tax regulations. This official document verifies the freelancer's tax residence status and enables treaties that reduce withholding tax rates on income earned abroad. |

| 15 | Professional Licenses or Certifications | Freelancers working with international clients must provide valid professional licenses or certifications relevant to their field to ensure compliance with industry standards and enhance credibility. These documents validate expertise and may be required for tax purposes, contract agreements, or regulatory adherence in different countries. |

| 16 | Letter of Reference | A letter of reference is essential for freelancers working with international clients as it validates their skills, reliability, and professional experience. This document often includes detailed endorsements from previous clients or employers, enhancing trust and credibility in cross-border collaborations. |

| 17 | Client Testimonials | Client testimonials provide crucial social proof that enhances a freelancer's credibility and trustworthiness when dealing with international clients, often influencing hiring decisions. Including detailed testimonials highlighting successful project outcomes, communication skills, and reliability can significantly improve a freelancer's profile and attract global business opportunities. |

| 18 | Business Registration Certificate | Freelancers working with international clients should obtain a Business Registration Certificate to establish legal legitimacy and facilitate smoother transactions across borders. This certificate verifies the freelancer's business identity, helping to comply with foreign tax regulations and enhancing client trust. |

| 19 | Insurance Certificates | Freelancers working with international clients must provide insurance certificates such as professional liability insurance and general liability insurance to demonstrate coverage and protect against potential legal claims. These documents validate their commitment to risk management and are often required to meet client or regulatory standards in cross-border engagements. |

| 20 | W-8BEN Form (for US clients) | Freelancers working with international clients in the US must submit the W-8BEN form to certify their foreign status and claim tax treaty benefits, reducing withholding tax on payments. This IRS document is essential for proper tax compliance and ensures timely payment processing between freelancers and US-based clients. |

| 21 | Proof of Payment (bank statements, PayPal confirmations, etc.) | Freelancers working with international clients must provide clear proof of payment, such as detailed bank statements, PayPal confirmations, or transaction receipts, to verify income and ensure transparency. These documents are essential for tax compliance, invoicing accuracy, and building client trust across borders. |

| 22 | Digital Signature File | Freelancers working with international clients require a digital signature file to authenticate contracts electronically, ensuring legal compliance across borders. This secure digital credential streamlines approval processes, reduces paperwork, and provides verifiable proof of agreement essential for global freelance transactions. |

Overview of Essential Documentation for International Freelancers

| Document Type | Description | Purpose for International Clients |

|---|---|---|

| Valid Identification | Government-issued ID such as passport or national identity card | Confirms freelancer's identity and legal work eligibility across borders |

| Freelance Contract | Written agreement outlining scope, deadlines, deliverables, payment terms, and intellectual property rights | Clarifies mutual expectations and protects both parties in international collaborations |

| Tax Identification Number (TIN) | Official tax number or equivalent issued by freelancer's home country | Ensures proper tax documentation and compliance for cross-border earnings |

| Invoices | Detailed billing statements including services rendered, rates, VAT or GST if applicable | Facilitates transparent payment proces and proper accounting internationally |

| Proof of Address | Recent utility bill, bank statement, or official correspondence showing current address | Supports identity verification and sometimes required for payment setup or tax compliance |

| Portfolio or Work Samples | Collection of previous projects, case studies, or deliverables relevant to client's industry | Demonstrates expertise and builds trust with international clients in competitive markets |

| Bank Account Details | International-friendly bank account information including SWIFT/BIC and IBAN if applicable | Enables smooth and secure cross-border payments or wire transfers |

| Business Registration (if applicable) | Proof of legal business entity registration or freelancing license in home country | Establishes professionalism and legal status for international commercial dealings |

| Non-Disclosure Agreement (NDA) | Confidentiality contract to protect client data and intellectual property | Essential for projects involving sensitive information or proprietary technologies |

Importance of Legal Identification and Tax Records

Freelancers working with international clients must provide valid legal identification to establish their identity and ensure trust in cross-border transactions. This typically includes government-issued IDs such as a passport or national ID card, which verify your legitimacy.

Tax records play a crucial role in compliance with both local and international regulations, helping to avoid legal complications and ensure proper invoicing. Maintaining clear tax documentation, such as VAT registration or a tax identification number, supports transparent financial interactions with clients worldwide.

Contracts and Service Agreements: Key Clauses for Freelancers

Freelancers working with international clients must have clear contracts and service agreements to define project scope, payment terms, and deadlines. Key clauses include confidentiality, intellectual property rights, and dispute resolution to protect both parties. Well-drafted agreements minimize risks and ensure smooth collaboration across borders.

Invoicing Templates and Payment Terms for Global Clients

What documents are essential for freelancers working with international clients? Invoicing templates specifically tailored for global transactions help ensure clarity and professionalism. Clearly defined payment terms protect your interests and streamline the payment process across different currencies and time zones.

Tax Residency Certificates and Double Taxation Forms

Freelancers working with international clients must provide specific documents to ensure proper tax compliance and avoid double taxation. Tax Residency Certificates and Double Taxation Forms are crucial for verifying tax status and facilitating correct tax treatment between countries.

- Tax Residency Certificate - Confirms the freelancer's country of tax residence to prevent being taxed twice on the same income.

- Double Taxation Avoidance Agreement (DTAA) Forms - Allows freelancers to benefit from agreements between countries that allocate taxing rights and reduce tax liabilities.

- Client Requirement Compliance - International clients may request these documents to fulfill their own tax reporting and withholding obligations accurately.

Proof of Work and Project Delivery Documentation

Proof of work is essential for freelancers working with international clients to establish credibility and showcase skills. This includes portfolios, work samples, and client testimonials that demonstrate your expertise and past achievements.

Project delivery documentation is crucial to confirm that tasks were completed as agreed. Invoices, signed contracts, and detailed project reports provide clear evidence of work completed. Maintaining organized records helps resolve potential disputes and fosters trust between freelancers and clients.

Intellectual Property Agreements and NDAs

Freelancers working with international clients must prepare key documents to protect their intellectual property rights. Intellectual Property Agreements clearly define ownership and usage rights of the created work.

Non-Disclosure Agreements (NDAs) safeguard confidential information exchanged during collaboration. Ensuring these agreements are in place helps protect your creative assets and maintain trust.

Banking Information and International Payment Methods

Freelancers working with international clients must provide accurate banking information, including their bank name, account number, SWIFT/BIC code, and IBAN to facilitate smooth transactions. Understanding international payment methods such as wire transfers, PayPal, and digital wallets helps ensure timely and secure payments. You should verify that your bank supports foreign currency transactions to avoid delays or additional fees.

Client Onboarding Forms and Compliance Requirements

Freelancers working with international clients must prepare specific documents to ensure smooth client onboarding and strict compliance with global regulations. Proper documentation helps to establish trust and legal clarity in cross-border projects.

- Client Onboarding Forms - These include contracts, project briefs, and payment agreements tailored to meet both parties' expectations and legal standards.

- Tax Identification Documents - Necessary for compliance with international tax laws and to facilitate proper invoicing and payments.

- Data Protection Compliance - Ensuring adherence to GDPR or other regional data privacy regulations to protect client information and avoid legal penalties.

What Documents Does a Freelancer Need for International Clients? Infographic