Contractors need to provide several essential documents for onboarding, including a signed contract or agreement outlining the scope of work and payment terms. Proof of identity, such as a government-issued ID or passport, is required to verify eligibility to work. Additionally, contractors often must submit tax forms, insurance certificates, and any necessary permits or licenses related to their profession.

What Documents Does a Contractor Need for Onboarding?

| Number | Name | Description |

|---|---|---|

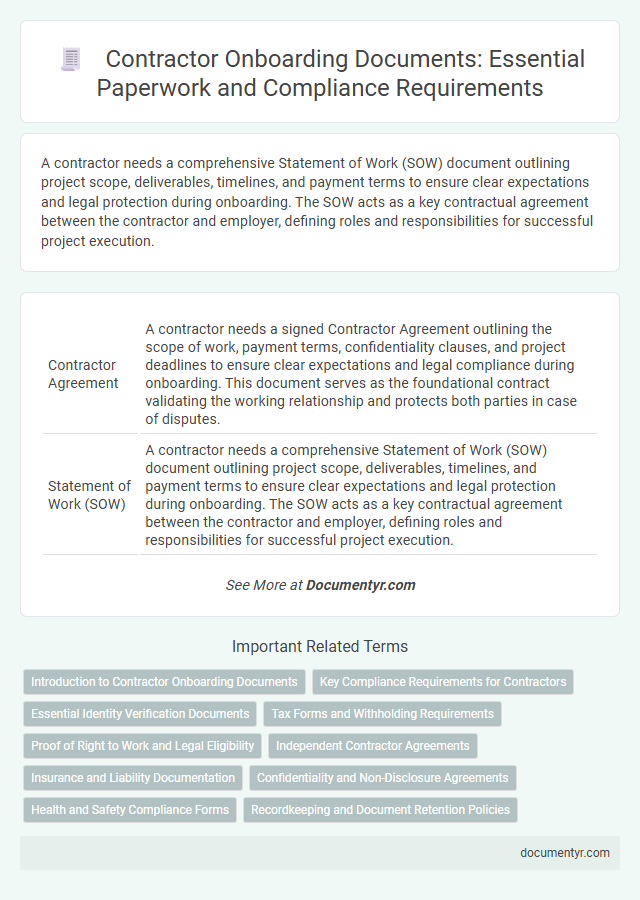

| 1 | Contractor Agreement | A contractor needs a signed Contractor Agreement outlining the scope of work, payment terms, confidentiality clauses, and project deadlines to ensure clear expectations and legal compliance during onboarding. This document serves as the foundational contract validating the working relationship and protects both parties in case of disputes. |

| 2 | Statement of Work (SOW) | A contractor needs a comprehensive Statement of Work (SOW) document outlining project scope, deliverables, timelines, and payment terms to ensure clear expectations and legal protection during onboarding. The SOW acts as a key contractual agreement between the contractor and employer, defining roles and responsibilities for successful project execution. |

| 3 | Tax Identification Documents (W-9, W-8BEN, etc.) | Contractors must provide tax identification documents such as the W-9 form for U.S. persons or the W-8BEN form for foreign contractors to verify their taxpayer status and enable accurate tax reporting. These documents are essential for compliance with IRS regulations and ensure proper withholding and reporting of payments made to contractors. |

| 4 | Proof of Identity (Passport, Driver’s License) | Contractors must provide valid proof of identity, such as a passport or driver's license, to verify their legal eligibility for work and comply with employment regulations. These documents ensure accurate background checks and secure onboarding processes essential for contractor verification. |

| 5 | Business Registration Certificate | A contractor must provide a valid Business Registration Certificate during onboarding to verify the legitimacy of their business and ensure compliance with tax and legal requirements. This document confirms the contractor's authorized operation status, facilitating smooth contract execution and payment processing. |

| 6 | Proof of Insurance (Liability, Workers’ Compensation) | Contractors must provide proof of liability insurance and workers' compensation coverage during onboarding to ensure compliance with legal requirements and protect both parties from potential risks. These documents verify that the contractor is insured against property damage, bodily injury, and workplace accidents, reducing financial liability for the hiring company. |

| 7 | Bank Account Details (for payment) | Contractors must provide accurate bank account details during onboarding to ensure timely and secure payment processing. Essential documents typically include a voided check or a bank statement verifying account number, routing number, and account holder name. |

| 8 | Non-Disclosure Agreement (NDA) | A contractor must provide a signed Non-Disclosure Agreement (NDA) during onboarding to ensure confidentiality of sensitive company information and protect intellectual property. This legally binding document outlines the contractor's obligations regarding data privacy and restricts the disclosure of proprietary materials throughout and after the contract period. |

| 9 | Intellectual Property Agreement | Contractors must provide a signed Intellectual Property Agreement to clarify ownership rights and protect proprietary information during onboarding. This document ensures that all work created remains the company's intellectual property and prevents unauthorized use or distribution. |

| 10 | Background Check Authorization | Contractors need to provide a signed Background Check Authorization form, granting the employer permission to verify criminal records, employment history, and education credentials. This document ensures compliance with company policies and legal requirements, safeguarding a trustworthy onboarding process. |

| 11 | Compliance Certifications (if applicable) | Contractors must submit compliance certifications such as OSHA safety training certificates, HIPAA compliance documentation for healthcare-related work, and any industry-specific licenses to meet regulatory standards during onboarding. These certifications ensure legal adherence and validate the contractor's qualifications for the assigned projects. |

| 12 | Work Eligibility Documents | Contractors must provide work eligibility documents such as a valid government-issued photo ID, Social Security card or Individual Taxpayer Identification Number (ITIN), and proof of citizenship or legal authorization to work in the country, like a U.S. Permanent Resident Card (Green Card) or an Employment Authorization Document (EAD). These documents are essential for compliance with Form I-9 requirements during the onboarding process. |

| 13 | Emergency Contact Information | Contractors must provide accurate emergency contact information during onboarding to ensure prompt communication in case of an incident at the workplace. This document typically includes the contact's name, relationship, phone numbers, and any relevant medical or insurance details to facilitate immediate assistance and safety compliance. |

| 14 | Direct Deposit Authorization Form | Contractors must provide a Direct Deposit Authorization Form during onboarding to ensure timely and secure electronic payments directly to their bank accounts. This document requires essential banking information, including the account number, routing number, and bank name, facilitating efficient payroll processing and compliance with company payment policies. |

Introduction to Contractor Onboarding Documents

Onboarding contractors requires a clear set of essential documents to ensure compliance and smooth integration. Understanding these documents helps streamline the hiring process and sets expectations from the start.

- Contractor Agreement - Outlines the scope of work, payment terms, and legal obligations between the contractor and the company.

- Tax Forms - Documents like W-9 or W-8BEN are necessary for tax reporting and compliance purposes.

- Proof of Insurance - Ensures the contractor carries the required liability and worker's compensation insurance for protection.

Key Compliance Requirements for Contractors

Contractors must provide specific documents to meet key compliance requirements during onboarding. Ensuring all necessary paperwork is submitted helps maintain legal and regulatory standards.

- Proof of Identification - Valid government-issued ID verifies the contractor's identity and eligibility to work.

- Tax Forms - Completed W-9 or equivalent tax documentation ensures accurate tax reporting and withholding.

- Signed Contract Agreement - A formal contract outlines work terms, protecting both parties and confirming compliance.

Submitting these documents promptly facilitates a smooth onboarding process and regulatory compliance.

Essential Identity Verification Documents

Contractors require essential identity verification documents to ensure compliance with legal and organizational standards during onboarding. These documents validate the contractor's identity and eligibility to work.

Commonly requested documents include a government-issued photo ID such as a passport or driver's license. Proof of Social Security Number or Tax Identification Number is also necessary for payroll and tax purposes.

Tax Forms and Withholding Requirements

| Document Type | Description | Purpose |

|---|---|---|

| W-9 Form | Request for Taxpayer Identification Number and Certification | Collects contractor's Taxpayer Identification Number (TIN) for accurate IRS reporting of payments made. |

| State Tax Withholding Forms | Forms vary by state (e.g., DE-4, IT-2104) | Determines the appropriate amount of state income tax to withhold based on contractor's residency and work location. |

| Federal Withholding Notice | Information regarding federal income tax withholding obligations | Clarifies if any federal tax withholding applies to contractor payments, often non-applicable for independent contractors. |

| 1099-MISC / 1099-NEC Forms | Year-end IRS forms reporting payments to contractors | Used for tax reporting purposes when payments exceed $600 within a calendar year. |

| Contractor Agreement with Tax Clauses | Legal document outlining payment terms and tax responsibilities | Specifies withholding responsibilities and compliance with tax regulations. |

Your onboarding requires submitting key tax forms to ensure compliance with IRS regulations and withholding laws. Proper documentation supports accurate tax reporting and avoids penalties.

Proof of Right to Work and Legal Eligibility

Contractors must provide valid proof of right to work, such as a government-issued ID or work visa, to confirm legal eligibility. Employment verification documents, including social security information or tax identification numbers, are essential during onboarding. You must ensure all paperwork complies with local labor laws to avoid delays in contract processing.

Independent Contractor Agreements

Independent Contractor Agreements are essential documents required during the onboarding process for contractors. These agreements define the scope of work, payment terms, and the nature of the relationship between the contractor and the hiring company.

Contractors must provide a signed Independent Contractor Agreement to establish clear expectations and legal protections. This document typically includes confidentiality clauses, deliverables, deadlines, and intellectual property rights. Proper execution of this agreement helps ensure compliance with labor laws and reduces the risk of misclassification.

Insurance and Liability Documentation

What insurance and liability documents does a contractor need for onboarding? Contractors must provide proof of general liability insurance and workers' compensation coverage to protect both parties from potential risks. Your liability documentation ensures compliance with legal standards and safeguards against financial losses.

Confidentiality and Non-Disclosure Agreements

Contractors must provide specific documents during onboarding to ensure compliance with company policies and legal requirements. Confidentiality and Non-Disclosure Agreements are critical to safeguarding sensitive information shared during the contract period.

- Confidentiality Agreement - This document legally binds the contractor to protect proprietary information and prevents unauthorized disclosure.

- Non-Disclosure Agreement (NDA) - It defines the scope of confidential information and restricts its use beyond the terms set in the contract.

- Signed Agreement Acknowledgment - Contractors must sign to confirm their understanding and acceptance of confidentiality obligations and data protection protocols.

Health and Safety Compliance Forms

Health and safety compliance forms are essential documents required for contractor onboarding. These forms typically include risk assessments, safety training certifications, and incident reporting procedures. Ensuring these documents are complete helps maintain a safe work environment and meet regulatory standards for your project.

What Documents Does a Contractor Need for Onboarding? Infographic