To set up payroll direct deposit, employees typically need to provide a completed direct deposit authorization form along with a voided check or a bank account verification letter. These documents ensure accurate bank account details are recorded for seamless electronic payments. Employers may also require a government-issued ID to verify the employee's identity and protect against fraud.

What Documents Are Needed for Payroll Direct Deposit Setup?

| Number | Name | Description |

|---|---|---|

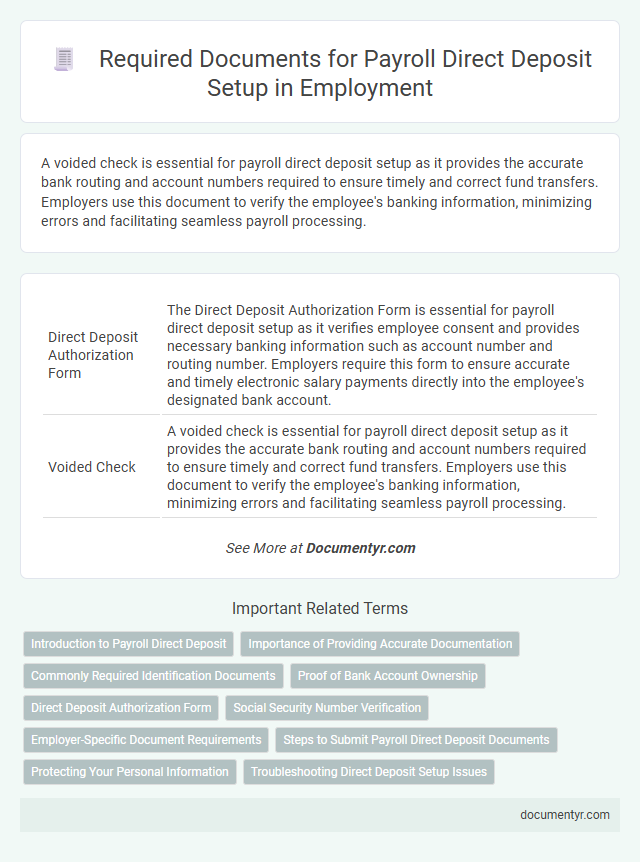

| 1 | Direct Deposit Authorization Form | The Direct Deposit Authorization Form is essential for payroll direct deposit setup as it verifies employee consent and provides necessary banking information such as account number and routing number. Employers require this form to ensure accurate and timely electronic salary payments directly into the employee's designated bank account. |

| 2 | Voided Check | A voided check is essential for payroll direct deposit setup as it provides the accurate bank routing and account numbers required to ensure timely and correct fund transfers. Employers use this document to verify the employee's banking information, minimizing errors and facilitating seamless payroll processing. |

| 3 | Bank Statement | A recent bank statement is essential for payroll direct deposit setup as it verifies account ownership and provides accurate routing and account numbers needed for transaction processing. Employers use this document to ensure that salary payments are securely and accurately deposited into the correct bank account. |

| 4 | Bank Account Information Form | The Bank Account Information Form is essential for payroll direct deposit setup, requiring details such as the bank name, account number, routing number, and account type (checking or savings). Providing accurate and complete information on this form ensures timely and secure deposit of employee wages directly into their bank accounts. |

| 5 | Employee Identification (ID) | Employee identification for payroll direct deposit setup typically requires government-issued photo IDs such as a driver's license, passport, or state ID card to verify identity. Employers may also request a Social Security card or tax identification number to ensure accurate payroll processing and compliance with tax regulations. |

| 6 | Social Security Number (SSN) Card | The Social Security Number (SSN) card is a crucial document required for payroll direct deposit setup, as it verifies the employee's legal identity and eligibility to work in the United States. Employers use the SSN to accurately report wages and withhold taxes, ensuring compliance with IRS and Social Security Administration regulations. |

| 7 | Employee Personal Information Form | The Employee Personal Information Form is essential for payroll direct deposit setup, collecting crucial data such as full name, Social Security number, and bank account details. Accurate completion of this form ensures seamless salary transfers and compliance with company payroll policies. |

| 8 | Employer Payroll Setup Form | Employers require the Payroll Setup Form, which typically includes employee identification details, bank account information, and tax withholding allowances, to facilitate direct deposit setup efficiently. This form ensures accurate processing of salary payments and compliance with legal payroll reporting requirements. |

| 9 | W-4 Form | The W-4 form is essential for payroll direct deposit setup as it provides employers with accurate employee tax withholding information needed to calculate federal income tax deductions. Employers require a completed W-4 form to ensure correct payroll processing and compliance with IRS regulations. |

| 10 | I-9 Form | The I-9 form is essential for payroll direct deposit setup as it verifies an employee's eligibility to work in the United States, ensuring compliance with federal employment laws. Employers must collect a completed I-9 form along with valid identification documents to process direct deposit and maintain accurate payroll records. |

Introduction to Payroll Direct Deposit

Payroll direct deposit is a secure and efficient method for employees to receive their wages electronically. Setting up direct deposit requires specific documents to ensure accurate and timely payment. Understanding the necessary paperwork simplifies the enrollment process and avoids payroll delays.

Importance of Providing Accurate Documentation

Setting up payroll direct deposit requires providing accurate and complete documentation to ensure timely and correct payment. Incorrect or missing information can lead to payment delays or errors, impacting employee trust and financial stability.

- Bank Account Information - Accurate bank account number and routing number are essential for directing funds correctly into the employee's account.

- Employee Identification - Providing valid identification such as a driver's license or social security number verifies the employee's identity and prevents fraud.

- Payroll Authorization Form - A signed authorization form confirms employee consent for direct deposit and outlines banking details for payroll processing.

Ensuring all documentation is precise minimizes processing errors and supports efficient payroll management.

Commonly Required Identification Documents

Setting up payroll direct deposit requires submitting specific identification documents to verify your identity and bank information. Employers use these documents to ensure accurate and secure payment processing.

Commonly required identification documents include a government-issued photo ID such as a driver's license or passport. Additionally, employees must provide a voided check or a bank account statement to confirm their account details. Social Security numbers or taxpayer identification numbers are often requested to validate the employee's identity further.

Proof of Bank Account Ownership

What documents are needed to verify proof of bank account ownership for payroll direct deposit setup? A voided check or a bank statement clearly showing your name, account number, and bank routing number is required. These documents confirm your account details to ensure accurate and secure deposit of your payroll funds.

Direct Deposit Authorization Form

| Document | Description |

|---|---|

| Direct Deposit Authorization Form | This form authorizes your employer to deposit your paycheck directly into your bank account. It includes essential details such as your bank's routing number, your account number, and the type of account (checking or savings). |

| Void Check or Bank Letter | A voided check or a bank-issued letter verifies the bank account information you provide on the authorization form to ensure accuracy in the deposit process. |

| Identification Document | Some employers require a government-issued ID to confirm your identity during payroll setup for security purposes. |

Social Security Number Verification

To set up payroll direct deposit, verifying your Social Security Number (SSN) is essential for identity confirmation and tax reporting. Employers require documents such as your Social Security card, W-2 form, or pay stubs that display your SSN clearly. Accurate SSN verification ensures timely and secure deposit of your earnings into your bank account.

Employer-Specific Document Requirements

Employers often require specific documents to facilitate payroll direct deposit setup, ensuring accurate and secure payment processing. Commonly requested documents include a voided check or a bank account verification letter to confirm account details.

Some employers may also ask for a direct deposit authorization form completed by the employee, which grants permission to deposit wages electronically. Verification of identification, such as a driver's license or social security number, may be necessary to comply with company policies and legal regulations.

Steps to Submit Payroll Direct Deposit Documents

Setting up payroll direct deposit requires submitting specific documents to ensure accurate and timely payments. Employees must provide essential information such as a voided check or a direct deposit form from their bank.

The first step is to complete the employer's direct deposit authorization form, which includes personal details and banking information. Next, attach a voided check or a bank letter verifying account details to avoid errors during payroll processing.

Protecting Your Personal Information

Setting up payroll direct deposit requires careful attention to documentation and data security. Protecting sensitive personal information is crucial to prevent identity theft and unauthorized access.

- Bank Account Information - Provide a voided check or a direct deposit authorization form from your bank to verify account details accurately.

- Personal Identification - Submit a government-issued ID such as a driver's license or passport to confirm your identity during setup.

- Secure Transmission - Use encrypted platforms or secure methods to submit documents, ensuring that personal data remains confidential and protected from cyber threats.

What Documents Are Needed for Payroll Direct Deposit Setup? Infographic