To ensure timely contractor payment processing, essential documents include a valid contract or agreement outlining the scope of work, invoices detailing services rendered with accurate dates and amounts, and any required tax forms such as W-9 for independent contractors. Proof of completed work, such as deliverables or approval sign-offs, supports verification and compliance with payment terms. Maintaining organized records of these documents streamlines the approval and payment workflow, reducing delays and errors.

What Documents Are Necessary for Contractor Payment Processing?

| Number | Name | Description |

|---|---|---|

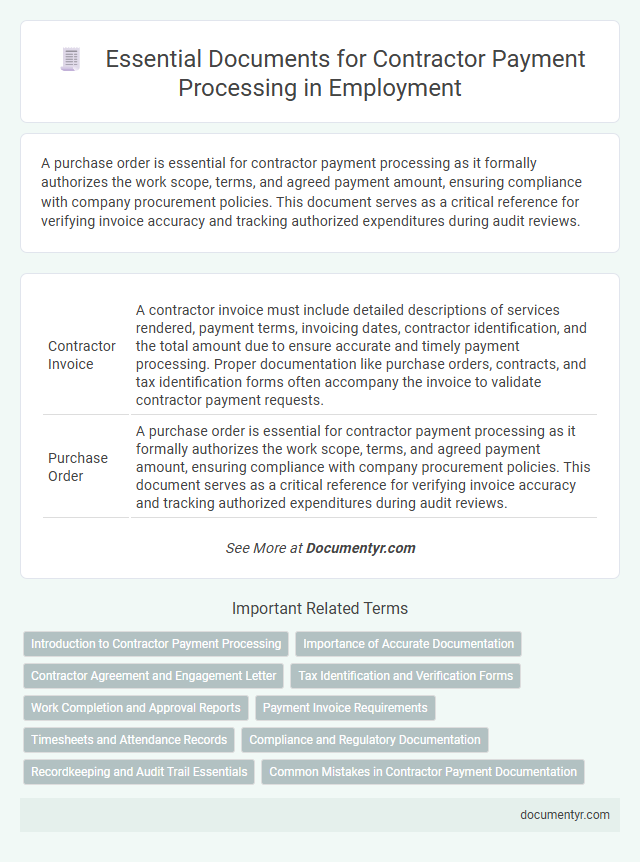

| 1 | Contractor Invoice | A contractor invoice must include detailed descriptions of services rendered, payment terms, invoicing dates, contractor identification, and the total amount due to ensure accurate and timely payment processing. Proper documentation like purchase orders, contracts, and tax identification forms often accompany the invoice to validate contractor payment requests. |

| 2 | Purchase Order | A purchase order is essential for contractor payment processing as it formally authorizes the work scope, terms, and agreed payment amount, ensuring compliance with company procurement policies. This document serves as a critical reference for verifying invoice accuracy and tracking authorized expenditures during audit reviews. |

| 3 | Contract Agreement | A fully executed Contract Agreement outlining the scope, deliverables, payment terms, and timelines is essential for contractor payment processing. This document ensures compliance with organizational policies and provides legal authorization to release funds. |

| 4 | Statement of Work (SOW) | A Statement of Work (SOW) is essential for contractor payment processing as it clearly defines project scope, deliverables, timelines, and payment terms, ensuring accurate invoicing and approval. This document serves as the primary reference to validate work completed and authorize payment disbursements in compliance with contractual agreements. |

| 5 | Timesheet | Accurate timesheets are essential documents for contractor payment processing, detailing hours worked and tasks completed to ensure proper invoice validation and compliance. These records must be submitted timely and accurately to facilitate seamless payroll workflows and prevent payment delays. |

| 6 | Work Completion Certificate | A Work Completion Certificate is essential for contractor payment processing as it verifies that the contracted tasks have been satisfactorily completed according to agreed specifications. This document serves as key proof for finance departments to authorize timely payments and avoid disputes over project deliverables. |

| 7 | Tax Identification Document (e.g., W-9, W-8BEN) | To process contractor payments efficiently, obtaining a valid Tax Identification Document such as Form W-9 for U.S.-based contractors or Form W-8BEN for foreign contractors is essential to ensure compliance with IRS regulations and accurate tax reporting. These forms provide the contractor's taxpayer identification number (TIN) or foreign tax identification to facilitate proper withholding and documentation. |

| 8 | Payment Request Form | A Payment Request Form is essential for contractor payment processing as it formally documents the services rendered, billing amount, and payment terms. This form ensures accuracy and compliance with contract agreements, streamlining approval and disbursement workflows. |

| 9 | Proof of Insurance | Proof of insurance is a critical document required for contractor payment processing, ensuring coverage for liability and worker's compensation risks associated with the project. Contractors must provide valid insurance certificates demonstrating compliance with contract terms and regulatory standards to facilitate prompt and secure payment transactions. |

| 10 | Vendor Registration Form | A Vendor Registration Form is essential for contractor payment processing as it collects critical information such as tax identification number, business license details, and contact information needed for compliance and payment verification. Proper submission of this form ensures timely processing of invoices and accurate disbursement of funds within the company's financial system. |

| 11 | Bank Account Details / Direct Deposit Form | Submitting accurate bank account details or a completed direct deposit form is essential for contractor payment processing to ensure timely and secure fund transfers. These documents typically include the contractor's bank name, account number, routing number, and authorization signature to facilitate electronic payments. |

| 12 | Change Order Document | A Change Order Document is essential for contractor payment processing as it formally authorizes alterations to the original contract scope, schedule, or cost. This document ensures all modifications are documented and approved, preventing payment disputes and maintaining compliance with contractual obligations. |

| 13 | Approval/Authorization Form | The Approval/Authorization Form is essential for contractor payment processing as it verifies that the work completed meets project requirements and has been formally approved by the authorized personnel. This document ensures compliance with company policies and serves as a critical record for financial auditing. |

| 14 | Receipt of Goods or Services | Contractor payment processing requires a receipt of goods or services to verify that the deliverables meet contract specifications and have been satisfactorily received. This document serves as essential proof for accounts payable, ensuring compliance with payment terms and preventing disputes. |

| 15 | Compliance Certification | Compliance certification is essential for contractor payment processing as it verifies adherence to regulatory standards, contract terms, and labor laws, ensuring lawful and timely payments. Key documents often include signed compliance certificates, tax forms like W-9, proof of insurance, and any required audit or inspection reports to validate contractual obligations. |

Introduction to Contractor Payment Processing

Contractor payment processing involves verifying and handling the necessary documentation to ensure accurate and timely payments. Understanding the required documents streamlines this process and minimizes payment delays.

You must gather essential documents such as signed contracts, approved invoices, and tax forms like W-9 for individual contractors or W-8BEN for foreign entities. Proof of work completion, including timesheets or delivery receipts, is also crucial. Maintaining organized records supports compliance with company policies and legal regulations during payment processing.

Importance of Accurate Documentation

Accurate documentation is essential for contractor payment processing to ensure compliance with legal and financial regulations. Proper records prevent payment delays and reduce the risk of disputes between contractors and clients.

Necessary documents commonly include signed contracts, invoices, proof of work completion, and tax forms such as W-9 or 1099. Maintaining precise and organized documentation supports efficient verification and timely payment approval.

Contractor Agreement and Engagement Letter

Contractor payment processing requires specific documents to ensure compliance and accuracy. The Contractor Agreement outlines the terms, payment schedule, and scope of work agreed upon between the parties.

The Engagement Letter serves as a formal confirmation of the contractor's role, responsibilities, and agreed deliverables. Your payment will be processed efficiently when both documents are complete and signed.

Tax Identification and Verification Forms

Contractor payment processing requires accurate tax identification and verification documents to comply with legal and financial regulations. Proper submission of these forms ensures timely and correct contractor compensation without delays.

- W-9 Form - Collects the contractor's Taxpayer Identification Number (TIN) to report income payments to the IRS.

- W-8BEN Form - Used for foreign contractors to certify foreign status and claim tax treaty benefits.

- IRS Verification - Confirms the validity of the provided TIN against IRS records to prevent payment errors.

Submitting accurate tax identification and verification forms is essential for compliant and efficient contractor payment processing.

Work Completion and Approval Reports

Work completion and approval reports are essential documents for processing contractor payments. These reports confirm that contracted tasks meet agreed-upon standards and receive formal approval before payment.

- Work Completion Report - Documents the finished work details, verifying adherence to contract specifications.

- Approval Report - Records official confirmation from stakeholders that the work satisfies quality and scope requirements.

- Payment Authorization - Ensures that approved reports trigger the release of funds to the contractor.

Payment Invoice Requirements

| Document Type | Importance | Key Requirements |

|---|---|---|

| Payment Invoice | Essential for payment processing |

|

| Supporting Documents | Verifies invoice accuracy |

|

| Tax Forms | Compliance with tax regulations |

|

Your payment processing will proceed smoothly when all these documents meet the specified criteria.

Timesheets and Attendance Records

Timesheets are essential documents for contractor payment processing as they provide detailed records of hours worked, ensuring accurate compensation. Attendance records complement timesheets by verifying the contractor's presence and adherence to scheduled work periods. Together, these documents establish a reliable foundation for timely and precise contractor payments.

Compliance and Regulatory Documentation

Contractor payment processing requires strict adherence to compliance and regulatory documentation to ensure lawful transactions. Essential documents include signed contracts, tax identification forms such as W-9 for U.S. contractors, and proof of insurance coverage. Maintaining accurate compliance records helps prevent legal issues and guarantees timely payment processing.

Recordkeeping and Audit Trail Essentials

Accurate recordkeeping is vital for contractor payment processing to ensure compliance and facilitate audits. Maintaining a clear audit trail helps verify all transactions and supports accountability.

- Signed Contracts - Documentation of agreed terms protects both parties and serves as a legal reference.

- Invoices and Payment Records - Detailed invoices and proof of payment provide a transparent financial history.

- Timesheets and Work Reports - Verified records of hours worked or services rendered validate the payment amounts.

What Documents Are Necessary for Contractor Payment Processing? Infographic