Nonprofits must prepare several key documents for grant agreement submission, including their IRS determination letter confirming tax-exempt status, a detailed project proposal outlining objectives and budget, and financial statements demonstrating fiscal responsibility. Organizational bylaws, board of directors list, and proof of insurance may also be required to ensure transparency and accountability. Accurate and complete documentation helps facilitate a smooth grant approval process.

What Documents Does a Nonprofit Need for Grant Agreement Submission?

| Number | Name | Description |

|---|---|---|

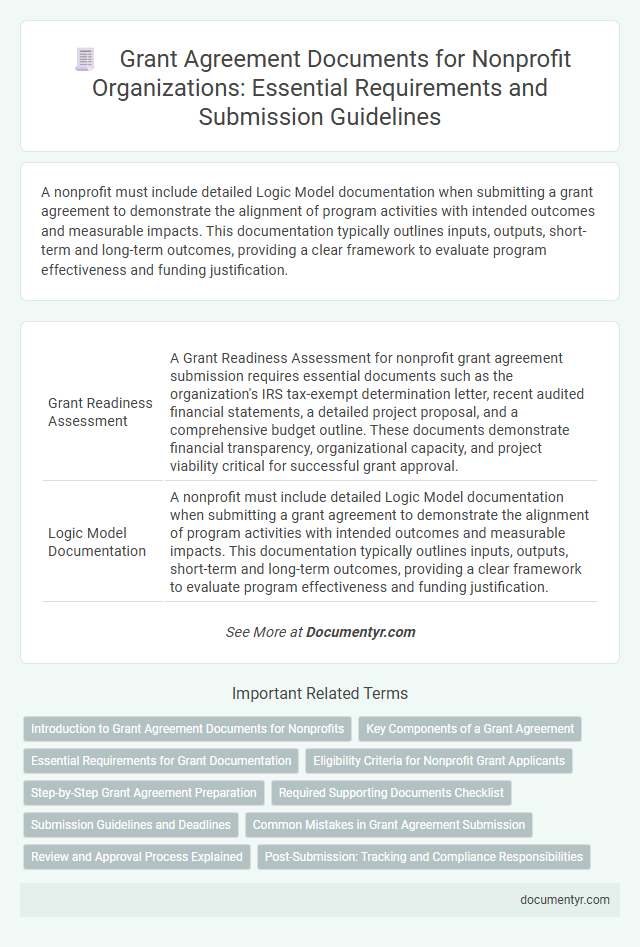

| 1 | Grant Readiness Assessment | A Grant Readiness Assessment for nonprofit grant agreement submission requires essential documents such as the organization's IRS tax-exempt determination letter, recent audited financial statements, a detailed project proposal, and a comprehensive budget outline. These documents demonstrate financial transparency, organizational capacity, and project viability critical for successful grant approval. |

| 2 | Logic Model Documentation | A nonprofit must include detailed Logic Model documentation when submitting a grant agreement to demonstrate the alignment of program activities with intended outcomes and measurable impacts. This documentation typically outlines inputs, outputs, short-term and long-term outcomes, providing a clear framework to evaluate program effectiveness and funding justification. |

| 3 | Digital Compliance Certificate | Nonprofits must include a Digital Compliance Certificate when submitting grant agreements to verify adherence to regulatory standards and secure digital authenticity. This certificate serves as a crucial digital endorsement ensuring the organization's compliance with legal and funding requirements during the grant application process. |

| 4 | Diversity, Equity & Inclusion (DEI) Policy | A nonprofit must include a comprehensive Diversity, Equity & Inclusion (DEI) policy outlining specific commitments, measurable goals, and inclusive practices to demonstrate organizational alignment with funder requirements during grant agreement submission. This document supports transparency and accountability, showcasing the nonprofit's dedication to fostering equitable opportunity and representation across all operations. |

| 5 | Impact Measurement Framework | Nonprofits must include a comprehensive Impact Measurement Framework document when submitting a grant agreement, detailing specific metrics, data collection methods, and evaluation timelines to demonstrate project effectiveness. This framework ensures accountability by providing clear criteria for assessing outcomes aligned with the grantor's objectives. |

| 6 | E-Signature Authorization Letter | An E-Signature Authorization Letter is essential for a nonprofit submitting a grant agreement, as it legally permits designated representatives to electronically sign documents on behalf of the organization. This letter must explicitly identify authorized signatories and comply with grantor requirements to ensure the validity and enforceability of the electronic signatures within the grant submission process. |

| 7 | Data Sharing Protocol Agreement | A Nonprofit must include a Data Sharing Protocol Agreement when submitting a grant application to outline how sensitive information will be securely exchanged and protected between involved parties. This document ensures compliance with privacy regulations like GDPR and HIPAA while promoting transparency and accountability in data handling during project implementation. |

| 8 | Virtual Program Delivery Plan | Nonprofits submitting grant agreements for virtual program delivery must include a detailed Virtual Program Delivery Plan outlining objectives, technology platforms, participant engagement strategies, and performance metrics. Supporting documents should also feature proof of digital infrastructure, staff training protocols, and contingency plans to ensure seamless online execution. |

| 9 | Funder-Specific Due Diligence Checklist | A nonprofit must provide a funder-specific due diligence checklist that typically includes proof of tax-exempt status, audited financial statements, organizational bylaws, and a list of board members to ensure compliance with the grant agreement requirements. This tailored documentation verifies the organization's eligibility, financial stability, and governance structure as mandated by the funding entity. |

| 10 | Cybersecurity Assurance Statement | A Cybersecurity Assurance Statement is a critical document required by nonprofits for grant agreement submission, ensuring that the organization has implemented adequate measures to protect sensitive data and mitigate cyber risks. This statement typically includes details on security policies, incident response plans, and compliance with industry standards such as NIST or ISO 27001, demonstrating the nonprofit's commitment to safeguarding grant-related information. |

Introduction to Grant Agreement Documents for Nonprofits

Grant agreements are essential legal documents that outline the terms and conditions between a nonprofit organization and a funding entity. Understanding the required documentation ensures a smooth and compliant submission process.

- IRS Determination Letter - Confirms the nonprofit's tax-exempt status recognized by the IRS.

- Organizational Bylaws - Defines the nonprofit's governing rules and operational structure.

- Board Resolution - Official approval from the board authorizing the application and acceptance of grant funds.

Your preparation of these documents helps guarantee compliance and increases the likelihood of grant approval.

Key Components of a Grant Agreement

Nonprofits must prepare specific documents for a successful grant agreement submission to ensure compliance and clear terms. Key components of a grant agreement outline responsibilities, funding details, and reporting requirements.

- Scope of Work - Defines the project objectives, activities, and expected outcomes.

- Budget and Financial Plan - Details the allocation of funds and allowable expenses for the grant period.

- Reporting and Compliance Requirements - Specifies deadlines for progress reports and guidelines for tracking grant usage.

Essential Requirements for Grant Documentation

Grant agreements require specific documentation to ensure compliance and eligibility. Essential requirements typically include your organization's IRS determination letter, demonstrating tax-exempt status.

Financial statements, such as audited reports or year-end summaries, provide transparency about fund management. Detailed project proposals and budgets outline planned activities and resource allocation.

Eligibility Criteria for Nonprofit Grant Applicants

Nonprofit organizations must meet specific eligibility criteria to qualify for grant agreements. Key documents include proof of nonprofit status, such as IRS 501(c)(3) determination letters, and organizational bylaws.

Applicants should provide financial statements demonstrating fiscal responsibility and transparency. A detailed project proposal outlining the grant's intended use is essential. Your submission must also include a current board of directors list and any required state registration certificates.

Step-by-Step Grant Agreement Preparation

Preparing a grant agreement for a nonprofit requires several key documents, including the project proposal, proof of nonprofit status, and a detailed budget plan. You must ensure that financial statements, board meeting minutes, and any required certifications are included to meet the grantor's submission criteria. Careful organization and verification of these materials streamline the review process and enhance the likelihood of approval.

Required Supporting Documents Checklist

| Required Supporting Document | Description | Purpose |

|---|---|---|

| Letter of Intent | A formal letter expressing the nonprofit's intent to apply for the grant. | Confirms commitment and preliminary project overview. |

| IRS Tax-Exempt Status Letter | Official document from the IRS verifying 501(c)(3) or other tax-exempt status. | Proves nonprofit status eligibility for funding. |

| Grant Proposal | Detailed description of the project, goals, budget, and timeline. | Provides comprehensive information for grant evaluation. |

| Board of Directors List | Current list of board members including titles and affiliations. | Demonstrates governance structure and accountability. |

| Financial Statements | Recent audited or reviewed financial reports and annual budgets. | Assures financial health and responsible use of funds. |

| IRS Form 990 | Annual federal tax return filed by nonprofit organizations. | Shows transparency and compliance with federal regulations. |

| Organizational Bylaws | Document outlining the governance policies and operational procedures. | Confirms organizational structure and legal compliance. |

| Letters of Support or Partnership | Endorsements from community partners or stakeholders. | Highlights collaboration and strengthens grant application. |

| Proof of Matching Funds | Documentation of additional funds committed to the project. | Indicates resource availability and project viability. |

Ensure you compile all required supporting documents accurately to meet the grant agreement submission standards and improve the chances of successful funding.

Submission Guidelines and Deadlines

What documents does a nonprofit need for grant agreement submission? Essential documents typically include a completed grant agreement form, proof of nonprofit status, and a detailed project budget. Submission guidelines require all materials to be organized and formatted according to the grantor's specifications.

When are the deadlines for submitting grant agreement documents? Deadlines are strictly enforced, often with a specific date and time stated in the grant instructions. Late submissions are usually not accepted, so adherence to the timeline is critical for approval.

Common Mistakes in Grant Agreement Submission

Submitting grant agreements requires careful preparation of specific nonprofit documents to ensure compliance and eligibility. Failure to provide accurate or complete documentation can result in delays or rejection of funding.

- Incomplete Organizational Documents - Missing articles of incorporation or bylaws limits proof of the nonprofit's legal status and governance structure.

- Failure to Include IRS Determination Letter - Omitting the 501(c)(3) tax-exempt status confirmation causes eligibility issues for federal grants.

- Incorrect Financial Statements - Submitting outdated or unaudited financial reports undermines credibility and transparency with grantors.

Review and Approval Process Explained

Grant agreement submission requires careful preparation of key documents including the nonprofit's mission statement, proof of tax-exempt status, and detailed project proposals. The review and approval process involves internal evaluation by the nonprofit's board followed by compliance checks from the granting agency to ensure all requirements are met. You must ensure timely submission of all specified documents to facilitate efficient approval and funding disbursement.

What Documents Does a Nonprofit Need for Grant Agreement Submission? Infographic