A startup requires several essential documents to create a comprehensive shareholder agreement, including the company's articles of incorporation, bylaws, and a cap table outlining ownership percentages. It also needs the founders' agreement to define roles and responsibilities, as well as any existing investment agreements or stock option plans. Clear documentation of rights, obligations, and procedures ensures smooth governance and protects all shareholders' interests.

What Documents Does a Startup Need for Shareholder Agreements?

| Number | Name | Description |

|---|---|---|

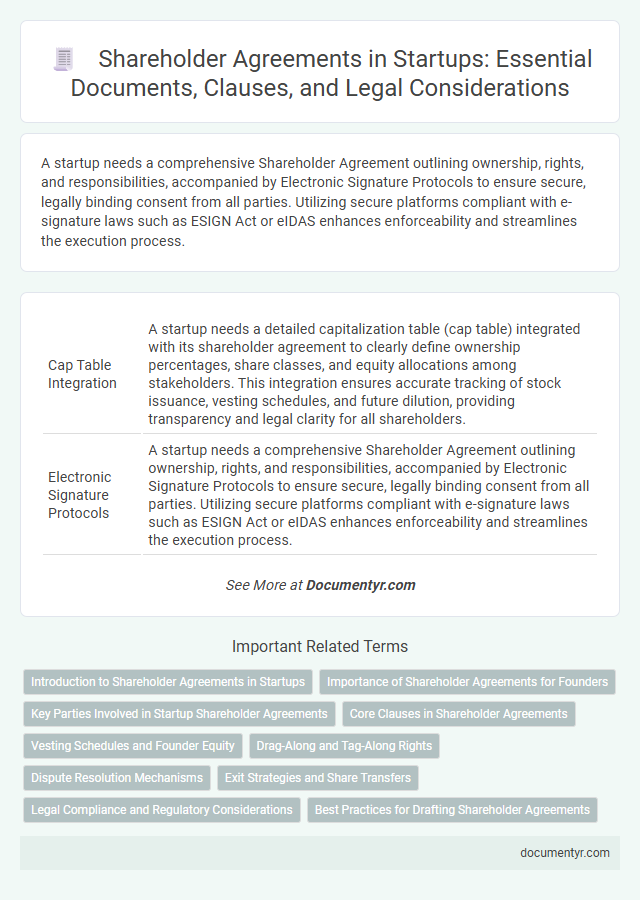

| 1 | Cap Table Integration | A startup needs a detailed capitalization table (cap table) integrated with its shareholder agreement to clearly define ownership percentages, share classes, and equity allocations among stakeholders. This integration ensures accurate tracking of stock issuance, vesting schedules, and future dilution, providing transparency and legal clarity for all shareholders. |

| 2 | Electronic Signature Protocols | A startup needs a comprehensive Shareholder Agreement outlining ownership, rights, and responsibilities, accompanied by Electronic Signature Protocols to ensure secure, legally binding consent from all parties. Utilizing secure platforms compliant with e-signature laws such as ESIGN Act or eIDAS enhances enforceability and streamlines the execution process. |

| 3 | Secondary Share Sale Framework | A startup requires a well-drafted Secondary Share Sale Agreement outlining the terms and conditions for transferring shares between existing and new shareholders, ensuring legal compliance and shareholder rights protection. Supporting documents such as board resolutions, updated share registers, and shareholder consent forms are essential to validate and execute the secondary share sale framework effectively. |

| 4 | SAFE Conversion Clauses | Startup shareholder agreements must include SAFE (Simple Agreement for Future Equity) conversion clauses detailing terms for equity conversion upon triggering events like equity financing, liquidity events, or dissolution. These clauses specify valuation caps, discount rates, and conversion mechanics to protect investor and founder interests during equity transitions. |

| 5 | Drag-Along/Rights of First Refusal (ROFR) Automation | Startup shareholder agreements require precise documentation of Drag-Along rights and Rights of First Refusal (ROFR) to automate the enforcement and execution of these provisions effectively. Implementing smart contracts or automated workflows ensures seamless trigger mechanisms for share transfer obligations and first refusal notifications, reducing legal friction and accelerating decision-making processes. |

| 6 | Digital Due Diligence Vault | A Digital Due Diligence Vault securely stores essential documents for shareholder agreements, including cap tables, investor rights agreements, and stock option plans. This centralized repository streamlines access and verification processes during funding rounds and legal audits. |

| 7 | Virtual Side Letter Appendices | Virtual Side Letter Appendices in shareholder agreements provide startups with a flexible method to outline specific rights, obligations, or amendments without altering the main agreement. These documents often include details on voting rights, transfer restrictions, and confidentiality clauses crucial for protecting founder and investor interests. |

| 8 | Dynamic Vesting Schedules | Dynamic vesting schedules in shareholder agreements require detailed documentation such as the founders' equity allocation agreements, vesting commencement dates, and performance or milestone criteria that trigger equity release. These documents ensure clear terms for gradual ownership transfer based on achievement metrics, protecting both the startup and its shareholders. |

| 9 | Blockchain Notarized Minutes | Blockchain notarized minutes provide an immutable and transparent record of shareholder meetings, enhancing the security and authenticity of startup agreements. Incorporating these notarized minutes into shareholder agreements ensures verifiable documentation of voting outcomes and key decisions critical for legal compliance and investor trust. |

| 10 | ESG (Environmental, Social, Governance) Alignment Addenda | Shareholder agreements for startups should include ESG alignment addenda that outline commitments to environmental sustainability, social responsibility, and transparent governance practices, ensuring all shareholders adhere to these principles. Key documents also encompass the main shareholder agreement, equity allocation schedules, and any amendments specifying ESG-related goals and compliance measures. |

Introduction to Shareholder Agreements in Startups

Shareholder agreements are critical legal documents that define the rights, responsibilities, and protections of shareholders in a startup. These agreements help prevent disputes by clearly outlining ownership structure and decision-making processes.

- Definition of Shareholder Agreement - A contract between shareholders that governs the management and control of the startup.

- Purpose in Startups - Ensures clarity on ownership, voting rights, and exit strategies to protect all parties involved.

- Key Components - Includes provisions on share transfers, dispute resolution, and dividend distribution tailored to startup needs.

Importance of Shareholder Agreements for Founders

What documents are essential for a startup to create an effective shareholder agreement? A comprehensive set of legal documents ensures clarity in ownership, roles, and responsibilities among founders. These documents protect the interests of all shareholders and prevent future disputes.

Why is a shareholder agreement critical for startup founders? It establishes clear guidelines for decision-making, equity distribution, and conflict resolution. This agreement helps maintain a healthy partnership and supports the startup's long-term growth.

Key Parties Involved in Startup Shareholder Agreements

Shareholder agreements are critical documents that define the rights and responsibilities of parties involved in a startup. Identifying the key parties involved ensures clarity and protects everyone's interests.

- Founders - The original creators of the startup who typically hold initial equity and set the company's vision.

- Investors - Individuals or entities providing capital in exchange for equity, influencing company decisions and growth.

- Directors and Officers - Appointed personnel responsible for managing daily operations and strategic governance.

Core Clauses in Shareholder Agreements

Shareholder agreements require essential documents including the Articles of Incorporation, Founders' Agreement, and Equity Distribution schedules to establish clear ownership and management terms. Core clauses typically cover voting rights, dividend policies, share transfer restrictions, and dispute resolution mechanisms to protect all parties involved. Ensuring your agreement contains these provisions helps maintain control and alignment among shareholders during the startup's growth.

Vesting Schedules and Founder Equity

Startup shareholder agreements require precise documentation to define ownership and protect both founders and investors. Essential documents include vesting schedules and founder equity allocations to ensure clear terms and prevent future disputes.

Vesting schedules specify the timeline over which founders earn their shares, typically linked to time or milestones, promoting commitment to the company. Founder equity documents outline each founder's ownership percentage, roles, and responsibilities, fostering transparency. These documents form the foundation of shareholder agreements, aligning interests and securing long-term business stability.

Drag-Along and Tag-Along Rights

Shareholder agreements are essential for startups to clearly outline the rights and obligations of shareholders. Key documents include the main shareholder agreement, which specifies Drag-Along and Tag-Along rights to protect investors and founders.

Drag-Along rights allow majority shareholders to compel minority shareholders to join in the sale of the company, ensuring smooth transaction processes. Tag-Along rights provide minority shareholders the ability to sell their shares alongside majority shareholders, offering protection against being left behind.

Dispute Resolution Mechanisms

| Document | Description | Relevance to Dispute Resolution Mechanisms |

|---|---|---|

| Shareholders' Agreement | A comprehensive contract outlining the rights, responsibilities, and obligations of shareholders within the startup. | Defines primary dispute resolution methods such as mediation, arbitration, or court proceedings to handle shareholder disagreements effectively. |

| Bylaws or Articles of Association | Governance documents specifying the operational rules and shareholder powers. | Includes provisions for resolving conflicts by directing dispute handling processes and escalation steps among shareholders. |

| Voting Agreements | Contracts that govern how shareholders vote on key issues. | Can mitigate disputes by pre-agreeing on voting procedures and tie-breaker mechanisms to avoid deadlocks. |

| Buy-Sell Agreements | Agreements that establish the terms for buying or selling shares between shareholders. | Helps prevent shareholder disputes by setting predetermined buyout processes triggered by disagreements or exit events. |

| Mediation and Arbitration Clauses | Specifically drafted clauses within agreements designating alternative dispute resolution methods. | Ensure structured, less adversarial dispute resolution outside of courts, reducing time and costs. |

Exit Strategies and Share Transfers

Shareholder agreements are essential for startups to clearly define exit strategies and share transfer procedures. Proper documentation safeguards all parties by establishing rules for selling or transferring shares.

- Exit Strategy Clause - Outlines the conditions and processes for shareholders to exit the company, including buybacks and IPO provisions.

- Right of First Refusal - Grants existing shareholders priority to purchase shares before outsiders can acquire them.

- Tag-Along and Drag-Along Rights - Ensures minority shareholders join in significant sales or are compelled to sell alongside majority holders.

Including these documents in shareholder agreements minimizes disputes and provides clarity on ownership changes.

Legal Compliance and Regulatory Considerations

Shareholder agreements for startups require key documents such as company bylaws, equity ownership details, and terms outlining shareholder rights and obligations to ensure legal compliance. Regulatory considerations include adherence to securities laws, corporate governance standards, and filing requirements with relevant authorities. You must ensure these documents are carefully drafted and reviewed to protect stakeholder interests and meet jurisdictional legal mandates.

What Documents Does a Startup Need for Shareholder Agreements? Infographic