A business partnership agreement requires key documents such as the partnership deed outlining roles, responsibilities, and profit-sharing arrangements. Identification documents of all partners and proof of business registration are essential to validate the partnership legally. Financial documents, including capital contributions and banking information, are also necessary to ensure transparent and efficient management.

What Documents are Needed for a Business Partnership Agreement?

| Number | Name | Description |

|---|---|---|

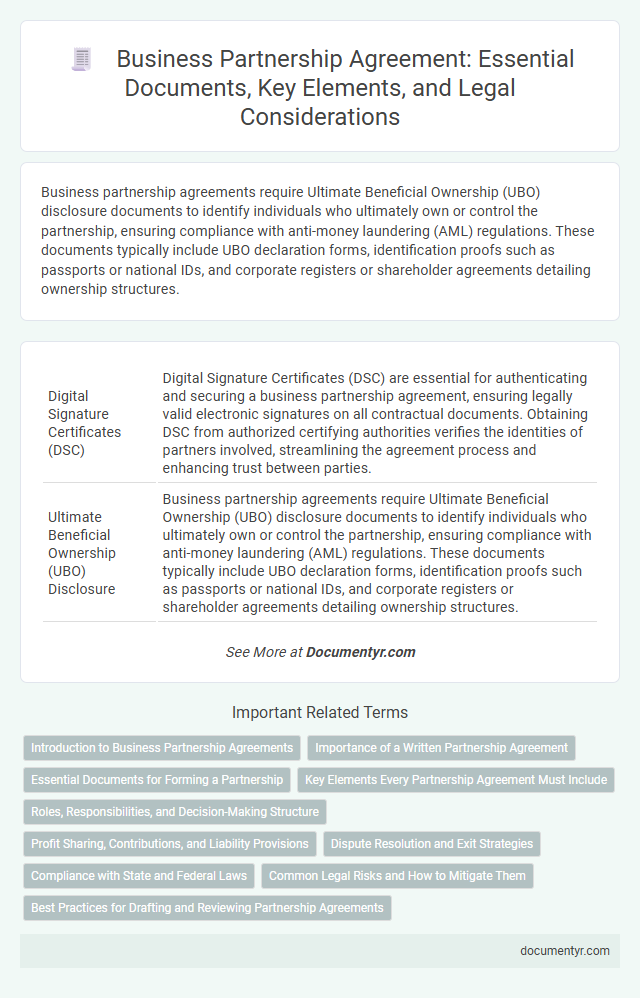

| 1 | Digital Signature Certificates (DSC) | Digital Signature Certificates (DSC) are essential for authenticating and securing a business partnership agreement, ensuring legally valid electronic signatures on all contractual documents. Obtaining DSC from authorized certifying authorities verifies the identities of partners involved, streamlining the agreement process and enhancing trust between parties. |

| 2 | Ultimate Beneficial Ownership (UBO) Disclosure | Business partnership agreements require Ultimate Beneficial Ownership (UBO) disclosure documents to identify individuals who ultimately own or control the partnership, ensuring compliance with anti-money laundering (AML) regulations. These documents typically include UBO declaration forms, identification proofs such as passports or national IDs, and corporate registers or shareholder agreements detailing ownership structures. |

| 3 | Intellectual Property Assignment Deed | A Business Partnership Agreement requires an Intellectual Property Assignment Deed to clearly transfer ownership rights of patents, trademarks, copyrights, and trade secrets between partners, ensuring legal protection and avoiding future disputes. This deed must detail the scope of IP rights assigned, the duration, and any conditions or royalties related to the use and commercialization of the intellectual property. |

| 4 | E-Governance Compliance Forms | E-Governance compliance forms essential for a business partnership agreement include registration certificates, digital signatures, and tax identification documents submitted through government portals. These digital records ensure legal conformity, streamline verification processes, and enhance transparency in partnership operations. |

| 5 | Data Processing Addendum (DPA) | The Data Processing Addendum (DPA) is essential in a business partnership agreement when personal data handling is involved, ensuring compliance with regulations like GDPR by outlining data protection responsibilities and security measures. This document specifies data processing terms, roles of each party, and protocols for data breach notifications. |

| 6 | Startup India Registration Certificate | A Business Partnership Agreement requires essential documents including identity proofs, address proofs, and the Startup India Registration Certificate to validate the startup's legitimacy and government recognition. The Startup India Registration Certificate serves as a critical document ensuring compliance with government policies, facilitating various benefits and legal protections for the partnership. |

| 7 | Environmental, Social, and Governance (ESG) Declarations | A comprehensive Business Partnership Agreement requires detailed Environmental, Social, and Governance (ESG) Declarations to outline each partner's commitments to sustainability practices, ethical standards, and regulatory compliance. These ESG documents ensure transparent accountability and set measurable goals for environmental impact, social responsibility, and corporate governance throughout the partnership. |

| 8 | KYC/AML Verification Reports | KYC (Know Your Customer) and AML (Anti-Money Laundering) verification reports are essential documents for a business partnership agreement, ensuring compliance with legal regulations and mitigating risks of fraud or financial crimes. These reports include identity verification, background checks, and financial history analysis of all partners to establish credibility and protect the partnership from potential liabilities. |

| 9 | Cybersecurity Policy Disclosure | A comprehensive Business Partnership Agreement requires a detailed Cybersecurity Policy Disclosure to ensure all parties understand the protocols for data protection, breach notifications, and risk management. This document outlines each partner's responsibilities in safeguarding sensitive information and maintaining compliance with relevant cybersecurity regulations. |

| 10 | Non-fungible Token (NFT) Asset Schedule | The NFT Asset Schedule in a business partnership agreement requires detailed documentation of each token, including unique identifiers, ownership history, metadata, and smart contract addresses to ensure clear asset distribution and rights management. Accurate records of token provenance and valuation are essential for transparency and legal enforceability within the partnership. |

Introduction to Business Partnership Agreements

What documents are needed for a business partnership agreement? A business partnership agreement outlines the roles, responsibilities, and expectations of each partner involved. It serves as a legal foundation to ensure clear communication and protection of all parties.

Importance of a Written Partnership Agreement

A written partnership agreement is essential for establishing clear roles and responsibilities among business partners. It serves as a legal document that protects all parties and prevents future disputes.

- Legal Clarity - A written agreement defines each partner's duties, rights, and profit-sharing arrangements to avoid misunderstandings.

- Conflict Prevention - Detailed documentation helps resolve potential disagreements by providing agreed-upon guidelines.

- Financial Transparency - The agreement outlines how capital contributions, expenses, and distributions are managed and recorded.

Having a comprehensive written partnership agreement ensures a strong foundation for a successful business collaboration.

Essential Documents for Forming a Partnership

Forming a business partnership requires several essential documents to establish clear terms and protect all parties involved. These documents outline responsibilities, profit sharing, and dispute resolution to ensure a smooth operation.

The primary document is the Partnership Agreement, detailing each partner's roles and financial contributions. You will also need a Business Registration Certificate to legally recognize the partnership. Additionally, obtaining any necessary licenses or permits specific to your industry is crucial for compliance and operation.

Key Elements Every Partnership Agreement Must Include

A business partnership agreement requires specific documents to clearly define the terms and responsibilities of each partner. Key elements ensure legal protection and smooth operation within the partnership.

- Partnership Agreement Document - Outlines the roles, contributions, profit sharing, and dispute resolution methods between partners.

- Financial Statements - Provides transparency on each partner's capital investment and ongoing financial obligations.

- Legal Identification Documents - Verifies the identity of partners and ensures compliance with local business regulations.

Roles, Responsibilities, and Decision-Making Structure

| Document | Description | Purpose |

|---|---|---|

| Partnership Agreement | Details roles, responsibilities, and ownership percentages of each partner. | Defines contributions, profit sharing, and outlines partners' obligations. |

| Decision-Making Framework | Specifies how decisions are made within the partnership, including voting rights and approval thresholds. | Ensures clarity on authority levels and prevents conflicts in business operations. |

| Roles and Responsibilities Document | Breaks down specific duties and management roles assigned to each partner. | Maintains accountability and streamlines operational effectiveness. |

| Conflict Resolution Clause | Defines methods for resolving disputes among partners. | Minimizes business disruption by providing structured conflict management. |

| Capital Contribution Records | Records initial and ongoing financial or asset contributions by each partner. | Provides transparency and documents the investment basis for ownership and responsibilities. |

| Amendment Procedures | Outlines the process for modifying the partnership agreement or related documents. | Facilitates structured updates to roles, responsibilities, and decision-making mechanisms as business evolves. |

Profit Sharing, Contributions, and Liability Provisions

Establishing a business partnership agreement requires specific documents that clearly outline profit sharing, contributions, and liability provisions. These documents help protect your interests and define each partner's responsibilities.

- Partnership Agreement Document - This primary document details the division of profits, capital contributions from each partner, and individual liability limits.

- Capital Contribution Records - Records specify the financial, asset, or service contributions made by each partner to the business.

- Liability Clause Addendum - An addendum clarifies the extent of each partner's liability for business debts and obligations.

Dispute Resolution and Exit Strategies

For a Business Partnership Agreement, key documents include a clear Dispute Resolution clause outlining the methods for resolving conflicts, such as mediation or arbitration. Detailed Exit Strategies must be documented, specifying processes for partners leaving the business or dissolving the partnership. Your agreement should prioritize these elements to ensure smooth conflict management and succession planning.

Compliance with State and Federal Laws

To ensure compliance with state and federal laws, you need several essential documents for a business partnership agreement. These documents include the partnership agreement itself, business registration forms, and any required licenses or permits. Proper documentation protects your partnership and ensures legal recognition and accountability.

Common Legal Risks and How to Mitigate Them

Establishing a business partnership agreement requires essential documents such as a partnership deed, identification proofs, and financial statements. These documents outline the roles, responsibilities, profit-sharing ratios, and dispute resolution mechanisms among partners.

Common legal risks include ambiguity in roles, mismanagement of funds, and conflicts over profit distribution. Mitigate these risks by clearly defining terms in the agreement, including dispute resolution clauses, and ensuring transparency through regular financial audits.

What Documents are Needed for a Business Partnership Agreement? Infographic