An LLC needs key documents for an operating agreement, including the member's names and ownership percentages, management structure details, and procedures for profit distribution and decision-making. The agreement should also outline roles and responsibilities, voting rights, and protocols for adding or removing members. Comprehensive documentation ensures clarity and legal protection for all parties involved in the LLC.

What Documents Does an LLC Need for an Operating Agreement?

| Number | Name | Description |

|---|---|---|

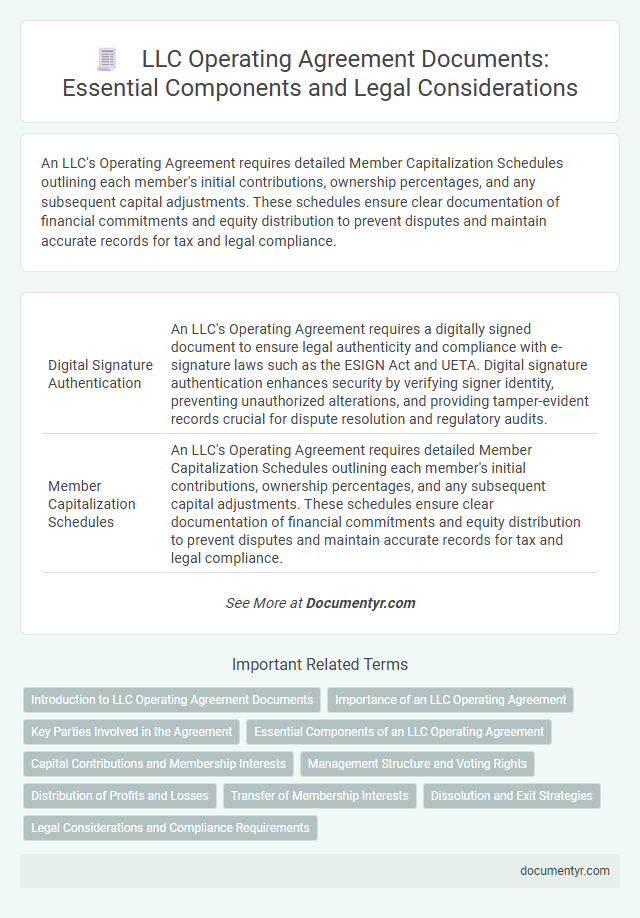

| 1 | Digital Signature Authentication | An LLC's Operating Agreement requires a digitally signed document to ensure legal authenticity and compliance with e-signature laws such as the ESIGN Act and UETA. Digital signature authentication enhances security by verifying signer identity, preventing unauthorized alterations, and providing tamper-evident records crucial for dispute resolution and regulatory audits. |

| 2 | Member Capitalization Schedules | An LLC's Operating Agreement requires detailed Member Capitalization Schedules outlining each member's initial contributions, ownership percentages, and any subsequent capital adjustments. These schedules ensure clear documentation of financial commitments and equity distribution to prevent disputes and maintain accurate records for tax and legal compliance. |

| 3 | Virtual Board Resolutions | An LLC requires a comprehensive Operating Agreement, including Virtual Board Resolutions that authorize decisions made during online meetings to ensure legal compliance and clear governance. These resolutions must document member approvals, confirm quorum, and record votes to validate actions taken virtually under state laws. |

| 4 | Blockchain-Recorded Amendments | An LLC operating agreement with blockchain-recorded amendments ensures immutable and transparent updates, enhancing legal certainty and auditability. These documents typically include the original operating agreement, amendment records, and digital signatures secured on the blockchain ledger. |

| 5 | Remote Participation Clauses | An LLC's Operating Agreement should include detailed Remote Participation Clauses to specify how members can attend and vote during meetings via telecommunication methods, ensuring compliance with state laws and maintaining valid quorum requirements. These clauses typically outline acceptable technologies, notification procedures, and confidentiality measures to facilitate seamless remote meetings and protect member rights. |

| 6 | E-Governance Protocols | An LLC's Operating Agreement must incorporate e-governance protocols that outline digital signatures, electronic voting procedures, and secure data storage requirements compliant with state laws and cybersecurity standards. These documents ensure seamless member communication, legally binding consent, and transparent management in a virtual environment. |

| 7 | Dynamic Voting Rights Provisions | An LLC Operating Agreement must include dynamic voting rights provisions that outline how voting power adjusts based on members' capital contributions, roles, or performance milestones. Clearly defining these provisions in the agreement ensures flexible governance and equitable decision-making aligned with members' evolving interests. |

| 8 | Digital Asset Allocation Statements | An LLC operating agreement must include a Digital Asset Allocation Statement that specifies the ownership, management, and transfer rights of digital assets such as cryptocurrencies, NFTs, and domain names. Clearly defining these digital asset allocations mitigates disputes and ensures compliance with regulatory and tax obligations. |

| 9 | Sustainability Compliance Appendices | An LLC operating agreement requiring sustainability compliance appendices should include detailed documentation of environmental policies, resource management protocols, and regulatory adherence reports to ensure transparency and accountability in sustainable practices. These appendices often contain compliance checklists, audit results, and certification records essential for meeting local, state, and federal sustainability standards. |

| 10 | AI-Powered Compliance Tracking | An LLC needs a comprehensive Operating Agreement outlining member roles, profit distribution, and management structure, which can be enhanced through AI-powered compliance tracking to ensure real-time updates and regulatory adherence. Utilizing AI tools automates monitoring of state-specific requirements and amendment deadlines, reducing legal risks and maintaining operational integrity. |

Introduction to LLC Operating Agreement Documents

An LLC Operating Agreement is a critical document that outlines the management structure and operational guidelines of a Limited Liability Company. It establishes the rights, duties, and responsibilities of members and managers within the LLC.

- Articles of Organization - This foundational document officially registers the LLC with the state and provides essential company information.

- Membership Certificates - Records ownership interests and membership stakes held by individuals or entities in the LLC.

- Initial Resolutions - Documents the initial decisions and authorizations made by members or managers to outline operational procedures.

These documents collectively ensure clarity and legal protection for the LLC's internal governance and member relationships.

Importance of an LLC Operating Agreement

What documents are essential for creating an LLC Operating Agreement? An LLC Operating Agreement requires foundational documents such as member information, ownership percentages, management structure, and voting rights. This agreement legally outlines the roles and responsibilities of members, ensuring clarity and preventing future disputes.

Why is an LLC Operating Agreement important for business operations? It establishes a clear framework for decision making, profit distribution, and conflict resolution among members. Without this agreement, state default rules apply, which may not align with the members' intentions or best interests.

Key Parties Involved in the Agreement

An LLC Operating Agreement requires identification of key parties involved to establish clear roles and responsibilities. These parties typically include members, managers, and any appointed officers.

You need to clearly define each member's ownership percentage and management rights within the document. Detailing these roles ensures smooth decision-making and legal protection for the LLC.

Essential Components of an LLC Operating Agreement

An LLC Operating Agreement is a crucial document that outlines the management structure and operational guidelines of the company. It ensures clear roles, responsibilities, and ownership percentages among members.

Essential components include the company's name, purpose, and principal office location. The agreement must also specify member contributions, profit and loss distribution, and procedures for meetings and voting.

Capital Contributions and Membership Interests

An LLC Operating Agreement requires specific documents that detail capital contributions and membership interests to ensure clear ownership and financial structure. These documents formalize each member's investment and stake in the company.

- Capital Contribution Records - Document initial and ongoing financial or asset contributions made by each member to the LLC.

- Membership Interest Certificates - Define the percentage of ownership and voting rights assigned to each member based on their capital contributions.

- Amendment Agreements - Record any changes to capital contributions or membership interests over time to maintain accurate and updated LLC records.

Management Structure and Voting Rights

| Document | Description |

|---|---|

| Operating Agreement | The primary document outlining the LLC's management structure and voting rights. It specifies whether management is member-managed or manager-managed, detailing each member's or manager's roles and responsibilities. |

| Member Information | Lists all LLC members, their ownership percentages, and voting power. This helps clarify voting rights and decision-making authority within the company. |

| Voting Procedures | Defines the rules for voting on key business matters, including quorum requirements, voting thresholds, and methods for resolving disputes or tie votes. |

| Manager Appointment Documents | Documents related to the selection and appointment of managers if the LLC is manager-managed. These specify manager roles, powers, and terms of service. |

| Amendments to the Operating Agreement | Records of any changes made to the management structure or voting rights. These amendments must be kept with the original agreement for legal clarity. |

Your Operating Agreement serves as the foundation to clearly establish how management and voting function within your LLC, ensuring smooth governance and compliance.

Distribution of Profits and Losses

An LLC Operating Agreement must clearly outline the distribution of profits and losses among members. This document ensures all parties understand their financial rights and responsibilities within the company.

The Operating Agreement specifies the percentage of profits and losses allocated to each member, often based on ownership interest or capital contributions. It provides guidelines for handling distributions in different scenarios, such as losses carried forward or special allocations. Precise documentation of these terms helps prevent disputes and supports transparent financial management.

Transfer of Membership Interests

An LLC Operating Agreement must include detailed provisions about the transfer of membership interests to ensure clarity and prevent disputes. This document specifies the conditions under which members can sell, assign, or transfer their ownership shares, protecting the LLC's stability and continuity. Your Operating Agreement should clearly outline rights of first refusal, approval requirements, and any restrictions on transfers to maintain control over membership changes.

Dissolution and Exit Strategies

An LLC's Operating Agreement must include detailed provisions on dissolution and exit strategies to ensure clear guidelines for ending the business or member withdrawal. Key documents often specify the conditions triggering dissolution, asset distribution, and procedures for member buyouts or transfers. Defining these elements protects members' interests and facilitates a smooth, legally compliant transition during company closure or member exit.

What Documents Does an LLC Need for an Operating Agreement? Infographic