Essential documents for a shareholder agreement include the company's articles of incorporation, share certificates, and identification of all shareholders. The agreement should also reference any existing contracts related to shareholder rights and obligations, including buy-sell agreements and voting arrangements. Financial statements and records of share ownership provide necessary context to ensure clarity and enforceability.

What Documents Are Necessary for a Shareholder Agreement?

| Number | Name | Description |

|---|---|---|

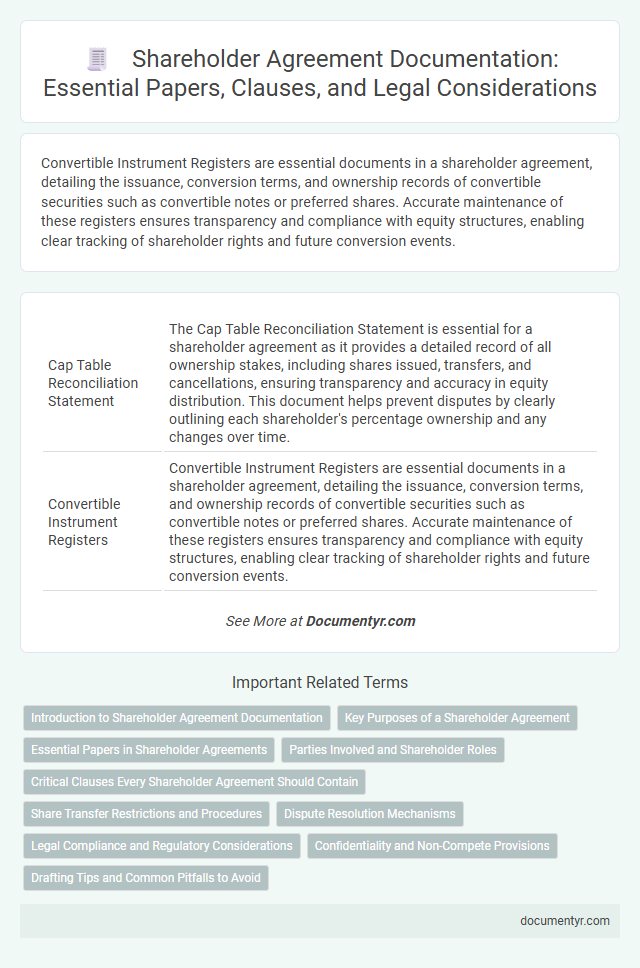

| 1 | Cap Table Reconciliation Statement | The Cap Table Reconciliation Statement is essential for a shareholder agreement as it provides a detailed record of all ownership stakes, including shares issued, transfers, and cancellations, ensuring transparency and accuracy in equity distribution. This document helps prevent disputes by clearly outlining each shareholder's percentage ownership and any changes over time. |

| 2 | Convertible Instrument Registers | Convertible Instrument Registers are essential documents in a shareholder agreement, detailing the issuance, conversion terms, and ownership records of convertible securities such as convertible notes or preferred shares. Accurate maintenance of these registers ensures transparency and compliance with equity structures, enabling clear tracking of shareholder rights and future conversion events. |

| 3 | ESOP (Employee Stock Option Plan) Schedules | Essential documents for a shareholder agreement include the ESOP schedules detailing the allocation, vesting periods, and exercise terms of options granted to employees. These schedules ensure clarity on stock option rights, facilitate compliance with company policies, and protect both shareholders' and employees' interests. |

| 4 | Drag-Along/Tag-Along Rights Declarations | Drag-along and tag-along rights declarations are essential documents in a shareholder agreement to protect minority and majority shareholders during the sale of shares, ensuring fair exit opportunities and control over share transfers. These declarations explicitly outline the conditions under which shareholders can compel or join in the sale, safeguarding interests and maintaining corporate governance stability. |

| 5 | Side Letter Agreements | Side Letter Agreements are essential supplemental documents to a Shareholder Agreement, providing bespoke terms tailored to specific shareholders without altering the main contract. These agreements clarify special rights, obligations, and confidentiality provisions, ensuring distinct shareholder arrangements are legally recognized and enforceable. |

| 6 | Pre-emptive Rights Certification | Pre-emptive Rights Certification is essential in a shareholder agreement to ensure existing shareholders maintain their proportional ownership by having the first option to purchase new shares before they are offered to external parties. This document safeguards shareholders' equity interests and prevents dilution of their voting power and dividends. |

| 7 | Valuation Waterfall Memorandum | A Valuation Waterfall Memorandum is essential for a shareholder agreement as it outlines the distribution hierarchy and financial returns during company liquidation or sale. This document provides clarity on how proceeds are allocated among shareholders, ensuring transparency and preventing disputes. |

| 8 | Restrictive Covenant Index | The Restrictive Covenant Index in a shareholder agreement typically requires detailed documentation such as non-compete clauses, confidentiality agreements, and non-solicitation provisions to protect company interests. These documents ensure shareholders are legally bound to refrain from activities that could harm the business or exploit proprietary information. |

| 9 | Shareholder Due Diligence Checklist | A comprehensive Shareholder Due Diligence Checklist typically includes identification documents, proof of share ownership, company financial statements, existing shareholder agreements, and records of past corporate resolutions. Ensuring all these documents are gathered facilitates transparency and legal compliance in drafting an effective Shareholder Agreement. |

| 10 | E-signature Audit Trail | A shareholder agreement requires essential documents such as the signed agreement itself, identity verification records, and a comprehensive E-signature audit trail that logs timestamps, IP addresses, and authentication methods to ensure legal compliance and enforceability. Maintaining a detailed audit trail enhances the agreement's validity by providing indisputable proof of consent and the signing process integrity. |

Introduction to Shareholder Agreement Documentation

| Document Type | Description | Purpose |

|---|---|---|

| Shareholder Agreement | Legal contract outlining rights, responsibilities, and obligations of shareholders. | Defines governance structure, decision-making processes, and conflict resolution methods. |

| Company Articles of Association | Constitutional document detailing company rules and internal management. | Supports the shareholder agreement by specifying company operations and share classifications. |

| Share Certificates | Official documents evidencing ownership of shares in the company. | Provides proof of shareholding as referenced in the agreement. |

| Founders' Agreement | Preliminary agreement among company founders regarding business roles and ownership. | Establishes initial arrangements prior to formal shareholder agreement. |

| Registry of Members | Official record maintained by the company listing all shareholders and shares held. | Ensures accurate tracking of ownership and compliance with shareholder terms. |

| Company Bylaws | Set of rules governing company operations and shareholder meetings. | Complements shareholder agreement by detailing procedural norms. |

Key Purposes of a Shareholder Agreement

A shareholder agreement requires specific documents to clearly outline the rights and obligations of shareholders. These documents help establish a structured framework for managing your company and resolving disputes.

- Shareholders' Details - Lists names, share ownership, and voting rights to identify all parties involved.

- Company Bylaws - Defines rules for governance and decision-making processes within the company.

- Transfer and Exit Clauses - Specifies procedures for selling shares or handling shareholder exits to protect all stakeholders.

Essential Papers in Shareholder Agreements

Essential papers for a shareholder agreement include the agreement document itself, which outlines the rights and obligations of each shareholder. Articles of incorporation are necessary to establish the company's legal foundation and share structure. Additionally, records of share ownership and any relevant amendments ensure clarity and enforceability of the agreement terms.

Parties Involved and Shareholder Roles

A shareholder agreement requires clear identification of all parties involved, including individual shareholders and entities holding shares. Precise documentation of each party's details ensures legal clarity and helps prevent disputes.

The agreement must outline specific shareholder roles, defining rights, responsibilities, and voting powers. Your understanding of these roles is crucial to safeguarding your interests and ensuring smooth company governance.

Critical Clauses Every Shareholder Agreement Should Contain

A shareholder agreement is a crucial document that outlines the rights, responsibilities, and obligations of shareholders within a company. It ensures clarity and prevents disputes by defining the terms of shareholder relationships and company management.

Critical clauses every shareholder agreement should contain include the share structure, detailing the types and classes of shares issued. A buy-sell clause is essential to govern the transfer of shares between existing shareholders and third parties. The decision-making process clause specifies voting rights and procedures for major company decisions.

Share Transfer Restrictions and Procedures

What documents are necessary for a shareholder agreement concerning share transfer restrictions and procedures? Share transfer restrictions must be clearly outlined in the shareholder agreement to prevent unauthorized transfers. Your agreement should include detailed procedures for approving and executing share transfers to protect the company's ownership structure.

Dispute Resolution Mechanisms

Dispute resolution mechanisms are essential components in shareholder agreements to manage conflicts effectively. These documents outline procedures to resolve disagreements while maintaining business continuity.

- Arbitration Clause - Specifies arbitration as the preferred method for dispute resolution to avoid lengthy court cases.

- Mediation Agreement - Details steps for mediation before pursuing formal arbitration or litigation to encourage amicable settlements.

- Governing Law Provision - Identifies the jurisdiction and legal framework applicable to disputes arising under the shareholder agreement.

Legal Compliance and Regulatory Considerations

A Shareholder Agreement requires essential documents such as the company's Articles of Incorporation, existing corporate bylaws, and detailed share certificates. Legal compliance mandates the inclusion of provisions adhering to local corporate laws and securities regulations to ensure the agreement's enforceability. Regulatory considerations involve submitting necessary filings to governmental authorities to validate the agreement and protect shareholder rights effectively.

Confidentiality and Non-Compete Provisions

Creating a comprehensive shareholder agreement requires careful inclusion of specific documents that protect the interests of all parties involved. Confidentiality and non-compete provisions are critical elements ensuring business security and competitive fairness.

- Confidentiality Agreement - This document safeguards sensitive company information from being disclosed to unauthorized parties by shareholders.

- Non-Compete Clause - It restricts shareholders from engaging in business activities that directly compete with the company during and after their involvement.

- Shareholder Agreement Addendum - An official attachment that explicitly details the terms and duration of confidentiality and non-compete obligations within the shareholder agreement.

Including these documents ensures legal protection and clarity for all shareholders regarding confidentiality and non-competition commitments.

What Documents Are Necessary for a Shareholder Agreement? Infographic