Key documents necessary for shareholder agreement drafting include the company's articles of incorporation, existing bylaws, and a comprehensive list of shareholders with their respective shareholdings. Detailed records of previous agreements, financial statements, and any issued stock certificates are essential to ensure clarity on ownership and voting rights. Legal identification documents of all parties involved help verify identities and maintain compliance throughout the agreement process.

What Documents Are Necessary for Shareholder Agreement Drafting?

| Number | Name | Description |

|---|---|---|

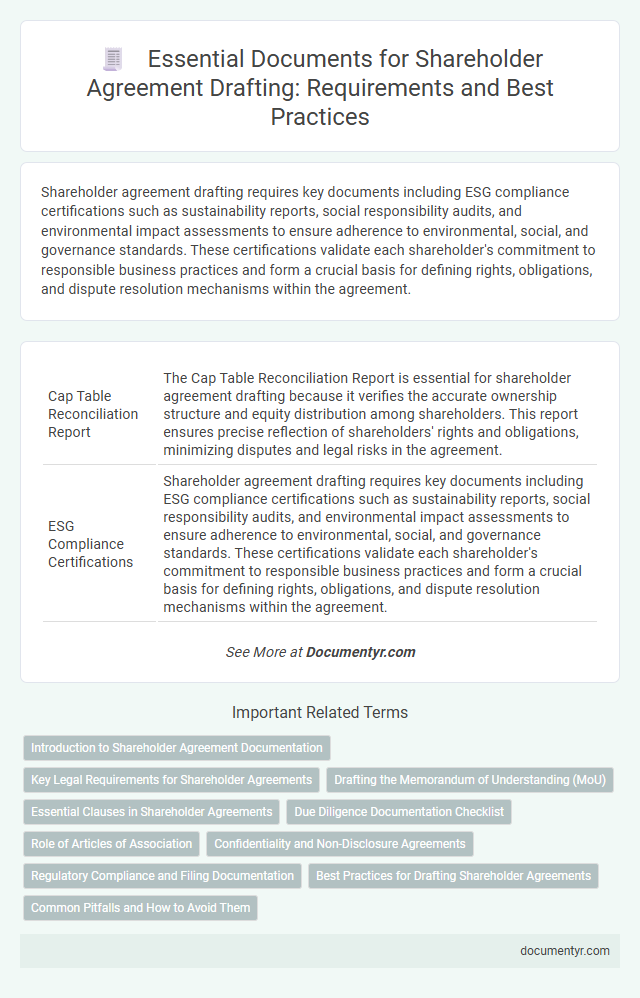

| 1 | Cap Table Reconciliation Report | The Cap Table Reconciliation Report is essential for shareholder agreement drafting because it verifies the accurate ownership structure and equity distribution among shareholders. This report ensures precise reflection of shareholders' rights and obligations, minimizing disputes and legal risks in the agreement. |

| 2 | ESG Compliance Certifications | Shareholder agreement drafting requires key documents including ESG compliance certifications such as sustainability reports, social responsibility audits, and environmental impact assessments to ensure adherence to environmental, social, and governance standards. These certifications validate each shareholder's commitment to responsible business practices and form a crucial basis for defining rights, obligations, and dispute resolution mechanisms within the agreement. |

| 3 | Digital Asset Ownership Ledger | A Digital Asset Ownership Ledger is essential for shareholder agreement drafting as it provides a secure, verifiable record of individual digital asset holdings and transaction history. This document ensures clarity in ownership distribution, supports dispute resolution, and facilitates transparent governance among shareholders in blockchain-based or digitally managed assets. |

| 4 | Cross-Border Taxation Declarations | Cross-border taxation declarations, including tax residency certificates and relevant international tax treaties, are essential documents for shareholder agreement drafting to ensure compliance with tax obligations and avoid double taxation. Providing accurate financial statements and proof of tax withholdings supports transparency and effective tax planning across jurisdictions. |

| 5 | Web3 Shareholder Identification Token | For drafting a Shareholder Agreement with a focus on Web3 Shareholder Identification Tokens, essential documents include the company's Articles of Association, investor subscription agreements, and the digital token issuance records that verify shareholder identities on the blockchain. Incorporating smart contract code audits and token distribution ledgers ensures legal clarity and compliance within decentralized ownership structures. |

| 6 | Founders' Vesting Agreement | Founders' vesting agreements require essential documents such as the company's articles of incorporation, initial share allocation schedules, and detailed founder roles and responsibilities. Precise records of capital contributions and intellectual property assignments are also critical to ensure enforceable shareholder rights and vesting conditions. |

| 7 | Preemption Rights Notification | Preemption rights notification documents are essential in shareholder agreement drafting to ensure existing shareholders have the first option to purchase newly issued shares and maintain their ownership percentage. These documents must clearly outline the terms, timelines, and procedures for notifying shareholders to prevent dilution and protect their investment interests. |

| 8 | Sustainable Investment Criteria Documentation | Sustainable investment criteria documentation required for drafting a shareholder agreement includes environmental, social, and governance (ESG) policy statements, impact assessment reports, and relevant certifications such as B Corp or Climate Neutral verification. These documents ensure alignment of shareholder interests with sustainability goals and provide a clear framework for responsible investment decision-making within the agreement. |

| 9 | AI-Enhanced Due Diligence Summary | An AI-enhanced due diligence summary streamlines the identification and verification of essential documents such as corporate charters, shareholder registers, and previous agreements, ensuring accuracy and completeness for drafting a shareholder agreement. Leveraging AI accelerates analysis of financial statements, ownership structures, and regulatory compliance records, reducing risks and supporting informed decision-making. |

| 10 | Electronic Consent Protocol Record | The Electronic Consent Protocol Record is essential for shareholder agreement drafting as it provides a legally recognized digital record of shareholders' approvals, ensuring compliance with corporate governance requirements. This document facilitates efficient and transparent decision-making processes, reducing the need for physical meetings and expediting agreement execution. |

Introduction to Shareholder Agreement Documentation

A shareholder agreement outlines the rights and responsibilities of shareholders within a company. Proper documentation is essential to ensure all parties are clearly informed and legally protected.

Key documents for drafting a shareholder agreement include the company's articles of incorporation, share certificates, and any prior agreements related to share ownership. Financial statements and organizational bylaws also play critical roles in defining shareholder terms. These documents help you establish clear guidelines for decision-making, share transfers, and dispute resolution.

Key Legal Requirements for Shareholder Agreements

Drafting a shareholder agreement requires several key documents to ensure legal clarity and enforceability. Essential documents include the company's articles of incorporation, existing shareholder agreements, and detailed share ownership records.

A thorough understanding of the company's bylaws, financial statements, and relevant regulatory filings is crucial for compliance. You must also incorporate any specific clauses related to voting rights, dividend distribution, and dispute resolution to meet key legal requirements.

Drafting the Memorandum of Understanding (MoU)

| Document | Description | Importance in Shareholder Agreement Drafting |

|---|---|---|

| Memorandum of Understanding (MoU) | An initial, non-binding document outlining the preliminary terms and intentions of the parties involved in the shareholder agreement. | Serves as the foundation for the shareholder agreement by clarifying key points such as share distribution, voting rights, and duties before formal drafting begins. |

| Company Incorporation Documents | Includes articles of incorporation, business registration certificates, and other official paperwork proving the company's legal formation. | Essential for verifying company structure and ownership details, which influence shareholder roles and rights in the agreement. |

| Shareholder Identification Documents | Legal identification and contact details of all shareholders involved. | Used to confirm parties to the agreement and ensure correct attribution of shares and responsibilities. |

| Previous Shareholder Agreements | Any prior agreements or amendments that affect current shareholder rights and obligations. | Helps in understanding existing arrangements to avoid conflicts and provide continuity in the new agreement. |

| Financial Statements and Valuation Reports | Documents reflecting the company's financial health and valuation. | Important for determining share value, profit distribution, and investment obligations within the shareholder agreement. |

Essential Clauses in Shareholder Agreements

Drafting a shareholder agreement requires careful inclusion of essential clauses to protect shareholders' rights and ensure smooth company operations. Understanding the necessary documents and key provisions is crucial for creating an effective and legally binding agreement.

- Shareholder Details and Ownership Structure - This document outlines the identities of shareholders and their respective shareholdings to establish ownership rights clearly.

- Rights and Obligations Clause - Defines each shareholder's rights, duties, and restrictions, ensuring clarity in decision-making and participation.

- Dispute Resolution Mechanism - Specifies procedures for resolving conflicts among shareholders to maintain company stability and avoid litigation.

Due Diligence Documentation Checklist

What documents are necessary for shareholder agreement drafting? A comprehensive due diligence documentation checklist ensures all relevant corporate, financial, and legal information is accounted for. This includes company articles, shareholder registers, financial statements, and any existing agreements affecting ownership or governance.

Role of Articles of Association

Drafting a shareholder agreement requires careful consideration of various legal documents, with the Articles of Association playing a crucial role. These articles establish the internal regulations of the company, defining rights, duties, and responsibilities of shareholders and directors.

The Articles of Association serve as a foundational document that your shareholder agreement must align with to ensure consistency and legal compliance. Incorporating key provisions from the articles helps prevent conflicts and clarifies governance structures within the agreement.

Confidentiality and Non-Disclosure Agreements

Confidentiality and Non-Disclosure Agreements (NDAs) are crucial documents when drafting a shareholder agreement. These agreements protect sensitive company information and ensure trust among shareholders.

- Confidentiality Agreement - Protects proprietary business information from unauthorized disclosure during shareholder negotiations.

- Non-Disclosure Agreement (NDA) - Legally binds shareholders to keep trade secrets and confidential data secure and private.

- Incorporation in Shareholder Agreement - Clearly integrates confidentiality and non-disclosure terms to prevent leaks of strategic information post-agreement.

Having these documents in place ensures that all parties maintain discretion and safeguard the company's valuable information throughout the shareholder agreement process.

Regulatory Compliance and Filing Documentation

Drafting a shareholder agreement requires careful attention to regulatory compliance to ensure all corporate laws are adhered to. Proper preparation and filing of documentation streamline approval processes and legal validity.

- Corporate Charter Documents - These include the articles of incorporation and bylaws, which establish the legal framework of the company and must be reviewed for consistency with the shareholder agreement.

- Regulatory Filings - Necessary filings with government bodies such as the Securities and Exchange Commission or local business registries ensure the shareholder agreement meets statutory requirements.

- Share Register and Certificates - Accurate records of share ownership must be maintained and updated to reflect changes agreed upon in the shareholder agreement.

Best Practices for Drafting Shareholder Agreements

Drafting a shareholder agreement requires key documents such as the company's Articles of Association, existing shareholder agreements, and detailed shareholder information. Best practices include clearly defining roles, rights, and responsibilities to avoid future disputes. You should ensure all legal requirements are met and consult relevant corporate records to create a comprehensive agreement.

What Documents Are Necessary for Shareholder Agreement Drafting? Infographic