Loan repayment agreements require essential documents such as the original loan agreement, identification records of both parties, and proof of payment history. Supporting financial statements or income verification may also be necessary to confirm the borrower's repayment capacity. Proper documentation ensures clarity, legal compliance, and smooth enforcement of loan terms.

What Documents Are Required for Loan Repayment Agreements?

| Number | Name | Description |

|---|---|---|

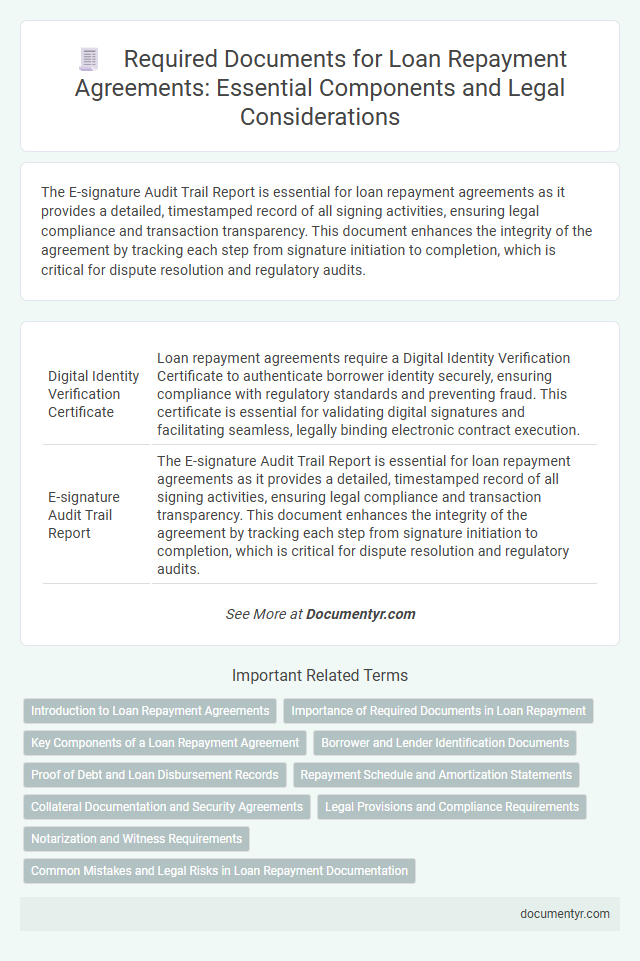

| 1 | Digital Identity Verification Certificate | Loan repayment agreements require a Digital Identity Verification Certificate to authenticate borrower identity securely, ensuring compliance with regulatory standards and preventing fraud. This certificate is essential for validating digital signatures and facilitating seamless, legally binding electronic contract execution. |

| 2 | E-signature Audit Trail Report | The E-signature Audit Trail Report is essential for loan repayment agreements as it provides a detailed, timestamped record of all signing activities, ensuring legal compliance and transaction transparency. This document enhances the integrity of the agreement by tracking each step from signature initiation to completion, which is critical for dispute resolution and regulatory audits. |

| 3 | Blockchain-Notarized Agreement | Blockchain-notarized loan repayment agreements require digital identification documents, a notarized smart contract stored on the blockchain, and proof of original loan terms encoded within the contract to ensure immutability and transparency. These documents provide verifiable timestamps, tamper-proof records, and automated enforcement mechanisms crucial for validating and executing the repayment terms securely. |

| 4 | Consent-to-Repayment GDPR Form | The Consent-to-Repayment GDPR form is essential for loan repayment agreements as it ensures compliance with data protection regulations by obtaining explicit borrower consent for processing personal data. This document validates that all parties acknowledge their rights under GDPR, facilitating transparent and secure handling of sensitive financial information during the loan repayment process. |

| 5 | KYC (Know Your Customer) Data Sheet | Loan repayment agreements require a comprehensive KYC (Know Your Customer) Data Sheet to verify borrower identity and prevent fraud, including government-issued ID, proof of address, and financial statements. Accurate KYC documentation ensures compliance with regulatory standards and facilitates smooth loan processing and repayment tracking. |

| 6 | Open Banking Transaction Summary | The essential documents for loan repayment agreements include the Open Banking Transaction Summary, which provides a detailed record of all banking transactions to verify income and expenditure patterns. This summary enables lenders and borrowers to ensure accurate repayment terms based on real-time financial data, enhancing transparency and trust in the agreement. |

| 7 | Loan Repayment Amortization Schedule | A Loan Repayment Amortization Schedule is essential for clearly outlining the payment structure, including principal and interest breakdowns over the loan term. This document ensures transparency and serves as a critical reference for both lenders and borrowers in formalizing loan repayment agreements. |

| 8 | Automated Payment Mandate Authorization | The Automated Payment Mandate Authorization form is essential for loan repayment agreements, enabling automatic debit from the borrower's bank account to ensure timely loan installments. This document must include borrower details, bank account information, authorization signatures, and terms outlining the repayment schedule and conditions. |

| 9 | Credit Risk Assessment Addendum | Loan repayment agreements require a Credit Risk Assessment Addendum, which includes detailed borrower financial statements, credit history reports, and risk analysis metrics to evaluate repayment capacity. This addendum ensures lenders have comprehensive data to mitigate default risks and tailor repayment terms accordingly. |

| 10 | Borrower’s Income Source Authentication File | Borrower's income source authentication files typically include recent pay stubs, bank statements, tax returns, and employment verification letters, ensuring accurate assessment of repayment capacity. These documents provide lenders with essential data to confirm the borrower's financial stability and ability to meet loan obligations. |

Introduction to Loan Repayment Agreements

| Introduction to Loan Repayment Agreements |

|---|

| Loan repayment agreements are formal contracts outlining the terms under which a borrower repays a loan to a lender. These agreements specify the repayment schedule, interest rates, payment amounts, and consequences of default. Understanding the necessary documents for these agreements ensures that Your loan repayment process is clear and legally binding. |

| What Documents Are Required for Loan Repayment Agreements? |

The essential documents for loan repayment agreements include:

|

Importance of Required Documents in Loan Repayment

Loan repayment agreements require specific documents to ensure clarity and legal enforceability. The importance of these documents lies in protecting both parties and defining repayment terms clearly.

- Loan Agreement - Details the original loan amount, interest rate, and repayment schedule.

- Identification Documents - Verifies the identities of all parties involved to prevent fraud.

- Proof of Income - Demonstrates your ability to fulfill repayment obligations.

Collecting all required documents carefully strengthens your loan repayment agreement and avoids future disputes.

Key Components of a Loan Repayment Agreement

Loan repayment agreements require specific documents to ensure clarity and legal enforceability. These documents outline the terms of repayment, interest rates, and obligations of both parties involved.

Key components of a loan repayment agreement include the principal amount, repayment schedule, and interest rate. The agreement must detail the borrower's and lender's information, payment methods, and consequences of default. Clear documentation protects both parties and helps prevent future disputes.

Borrower and Lender Identification Documents

Loan repayment agreements require specific identification documents for both the borrower and the lender to verify their identities accurately. Commonly requested documents include government-issued IDs such as passports or driver's licenses, along with proof of address like utility bills or bank statements. You must ensure these documents are current and valid to facilitate a smooth and legally binding repayment process.

Proof of Debt and Loan Disbursement Records

Loan repayment agreements require specific documents to ensure clarity and legal validity. Among the most critical are the proof of debt and loan disbursement records, which verify the loan's existence and terms.

Proof of debt typically includes signed promissory notes, invoices, or statements confirming the borrower's obligation. Loan disbursement records detail the transaction dates, amounts released, and payment methods used, providing transparent evidence for repayment schedules.

Repayment Schedule and Amortization Statements

Loan repayment agreements require detailed documents to ensure clarity and enforceability. A repayment schedule outlines the timeline for payments, including dates and amounts. Amortization statements provide a breakdown of each payment, showing principal and interest components over the loan term.

Collateral Documentation and Security Agreements

Loan repayment agreements often necessitate specific documents to secure the lender's interests and outline the terms clearly. Collateral documentation and security agreements are essential components to validate and enforce the loan's security provisions.

- Collateral Documentation - Includes detailed descriptions and valuations of the assets pledged as security for the loan.

- Security Agreements - Legal contracts that specify the obligations of the borrower and the rights of the lender concerning the collateral.

- Title or Ownership Proof - Documents such as titles or certificates affirming the borrower's legal ownership of the collateral to avoid disputes.

Legal Provisions and Compliance Requirements

Loan repayment agreements must comply with specific legal provisions to ensure enforceability and protect the rights of all parties involved. Proper documentation is essential to demonstrate compliance with regulatory requirements and contractual obligations.

- Promissory Note - This document outlines the borrower's promise to repay the loan, detailing the amount, interest rate, and repayment schedule.

- Identification Documents - Legal IDs are required to verify the identity of both borrower and lender, ensuring valid contractual consent.

- Compliance Certificates - Proof of adherence to jurisdiction-specific lending laws and financial regulations is often necessary to validate the agreement.

Notarization and Witness Requirements

Loan repayment agreements require specific documents to ensure legality and enforceability. These typically include the signed agreement itself, proof of the loan amount, repayment schedule, and identification documents of the parties involved.

Notarization is often essential to authenticate the signatures and confirm the parties' identities, adding a layer of legal credibility. Witness requirements vary by jurisdiction; some agreements require a neutral third party to witness and sign the document to validate its execution.

What Documents Are Required for Loan Repayment Agreements? Infographic