Business partnership agreements require essential documents such as a detailed partnership contract outlining roles, responsibilities, and profit-sharing arrangements. Financial records, including capital contributions and initial investments, are necessary to clarify each partner's stake. Compliance documents like business licenses, tax identification numbers, and any regulatory permits must also be included to ensure legal validity.

What Documents are Needed for Business Partnership Agreements?

| Number | Name | Description |

|---|---|---|

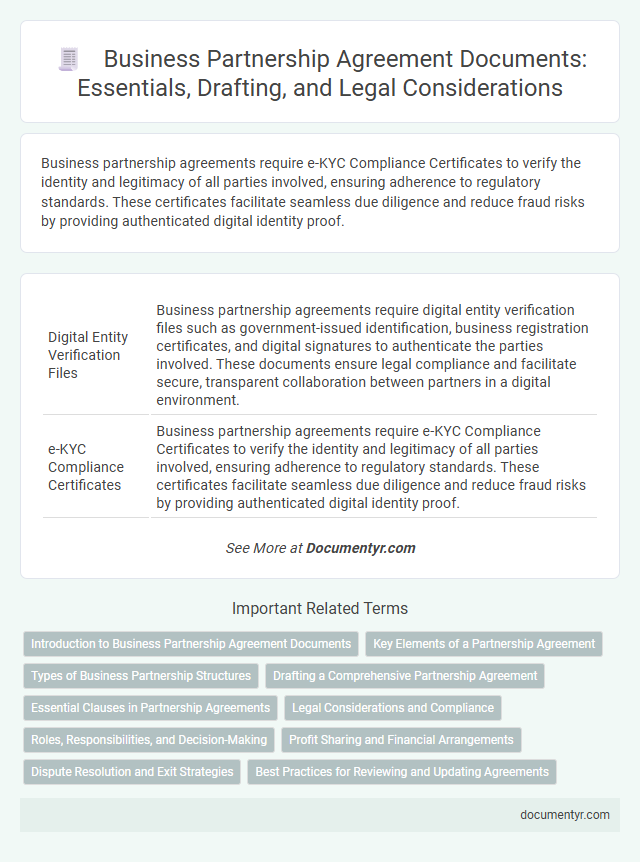

| 1 | Digital Entity Verification Files | Business partnership agreements require digital entity verification files such as government-issued identification, business registration certificates, and digital signatures to authenticate the parties involved. These documents ensure legal compliance and facilitate secure, transparent collaboration between partners in a digital environment. |

| 2 | e-KYC Compliance Certificates | Business partnership agreements require e-KYC Compliance Certificates to verify the identity and legitimacy of all parties involved, ensuring adherence to regulatory standards. These certificates facilitate seamless due diligence and reduce fraud risks by providing authenticated digital identity proof. |

| 3 | Beneficial Ownership Declarations | Beneficial Ownership Declarations are essential documents in business partnership agreements as they disclose the identities of individuals who ultimately own or control the partnership, ensuring transparency and compliance with anti-money laundering regulations. These declarations help prevent fraud, facilitate due diligence processes, and are often required by financial institutions and regulatory bodies to maintain the integrity of the partnership. |

| 4 | UBO (Ultimate Beneficial Owner) Registers | Business partnership agreements require submission of UBO (Ultimate Beneficial Owner) registers to identify individuals with significant ownership or control, ensuring transparency and regulatory compliance. Accurate UBO documentation is essential for mitigating risks related to money laundering and maintaining trust among stakeholders. |

| 5 | ESG (Environmental, Social, Governance) Commitment Addendums | Business partnership agreements require ESG Commitment Addendums that outline environmental policies, social responsibility initiatives, and governance standards to ensure aligned sustainability goals. These documents include detailed disclosures on carbon footprint reduction, diversity and inclusion metrics, and compliance frameworks to promote transparency and accountability. |

| 6 | AI-Generated Contract Summaries | Business partnership agreements require essential documents such as the partnership deed, financial statements, identification proofs, and regulatory compliance certificates to establish clear terms and responsibilities. AI-generated contract summaries streamline the review process by accurately extracting key clauses, obligations, and deadlines from complex legal texts, enhancing efficiency and reducing errors. |

| 7 | Blockchain-Based Signature Logs | Business partnership agreements require essential documents such as the partnership deed, identification proofs, and financial statements, while blockchain-based signature logs provide an immutable, cryptographically secure record of all signed agreements, ensuring transparency and preventing tampering. These digital signature logs enhance legal enforceability and streamline audit trails by timestamping and verifying each partner's consent on a decentralized ledger. |

| 8 | Cross-Border Data Transfer Consents | Business partnership agreements involving cross-border data transfers require comprehensive consents including data processing agreements, privacy impact assessments, and detailed consent forms compliant with GDPR and other relevant international data protection regulations. Ensuring these documents clearly define the scope, purpose, and security measures for data transfer minimizes legal risks and fosters trust between international partners. |

| 9 | Cyber Liability Indemnity Clauses | Cyber liability indemnity clauses in business partnership agreements require detailed documentation including a comprehensive cyber risk assessment report, proof of cybersecurity insurance coverage, and clearly defined indemnification terms outlining each party's responsibilities in the event of a cyber incident. These documents ensure that both partners are financially protected and legally accountable for breaches, data loss, or cyberattacks, minimizing potential disputes. |

| 10 | GDPR/CCPA Alignment Documents | Business partnership agreements require key documents such as data processing agreements and privacy policies to ensure GDPR and CCPA compliance. These documents outline data handling procedures, consent management, and security measures essential for legal adherence and risk mitigation. |

Introduction to Business Partnership Agreement Documents

Business partnership agreements require specific documents to establish clear terms, roles, and responsibilities between partners. Proper documentation ensures legal protection and smooth operation of the partnership.

- Partnership Agreement Document - This core document outlines the rights, duties, profit sharing, and dispute resolution methods among partners.

- Business Registration Papers - Legal registration supports the partnership's legitimacy and compliance with local business laws.

- Financial Statements and Contributions - Detailed records of each partner's capital contributions and financial involvement safeguard transparency and accountability.

Key Elements of a Partnership Agreement

Business partnership agreements require specific documents to ensure clarity and legal protection. Key elements include the roles and responsibilities of each partner.

Essential documents outline profit sharing, decision-making processes, and dispute resolution methods. Your agreement should also specify the duration and conditions for partnership termination.

Types of Business Partnership Structures

Business partnership agreements require specific documents that vary by partnership structure. Understanding the types of business partnership structures is essential for preparing the correct documentation.

- General Partnership - Requires a partnership agreement outlining roles, responsibilities, and profit distribution among partners.

- Limited Partnership (LP) - Needs formation documents including certificates of limited partnership and agreements defining general and limited partners' obligations.

- Limited Liability Partnership (LLP) - Involves registration documents and a detailed LLP agreement to protect individual partners from liabilities.

Identifying the partnership structure ensures that all necessary legal documents are accurately prepared for a valid business partnership agreement.

Drafting a Comprehensive Partnership Agreement

What documents are needed for drafting a comprehensive business partnership agreement? A well-drafted partnership agreement requires essential documents such as identification proofs, business registration certificates, and details of capital contributions. Including documents that outline roles, responsibilities, profit-sharing ratios, and dispute resolution mechanisms ensures clarity and legal protection for all partners.

Essential Clauses in Partnership Agreements

Business partnership agreements require specific documents to ensure clarity and legal validity. Essential clauses within these agreements define the responsibilities, profit shares, and dispute resolution methods between partners.

- Capital Contribution Clause - Specifies the amount and type of investment each partner commits to the business.

- Profit and Loss Sharing Clause - Details how profits and losses are distributed among partners based on their agreement.

- Dispute Resolution Clause - Outlines the methods for handling conflicts, such as mediation or arbitration, to avoid litigation.

Legal Considerations and Compliance

| Document | Purpose | Legal Considerations | Compliance Requirements |

|---|---|---|---|

| Partnership Agreement | Defines roles, responsibilities, profit sharing, and management structure | Must clearly outline dispute resolution, capital contributions, and exit strategies to avoid legal conflicts | Ensure the agreement complies with state partnership laws and commercial codes |

| Business Licenses and Permits | Authorize the partnership to legally operate | Must be valid, up-to-date, and specific to the industry and location of the business | Compliance with local, state, and federal regulations is mandatory |

| Operating Agreement (for LLCs) | Details the management and operational procedures of the partnership | Should address members' rights and responsibilities clearly to prevent legal ambiguity | Required for compliance with state LLC formation laws |

| Tax Identification Documents | Identify the partnership for tax reporting purposes | MUST be obtained from the IRS, including EIN (Employer Identification Number) | Essential for compliance with federal and state tax authorities |

| Registered Agent Information | Designates an official recipient of legal documents | Legal requirement in most states to maintain good standing | Registered agent must be continuously maintained as per state regulations |

| Non-Disclosure and Confidentiality Agreements | Protect sensitive business information | Enforceable contracts that help safeguard proprietary data and trade secrets | Ensure compliance with intellectual property laws and contractual obligations |

| Compliance Certificates and Reports | Verify adherence to industry-specific regulations | May be required for regulated sectors like finance, healthcare, or manufacturing | Demonstrates regulatory compliance to avoid legal penalties |

| Insurance Policies | Provide risk management and liability coverage | May be mandated depending on the business type and jurisdiction | Compliance with local laws regarding mandatory business insurance |

Your partnership should include these essential documents to ensure strong legal foundations and regulatory compliance, reducing risks related to disputes and penalties.

Roles, Responsibilities, and Decision-Making

Business partnership agreements require clear documentation outlining the roles, responsibilities, and decision-making processes of each partner. These documents ensure all parties understand their contributions and authority within the partnership.

Key documents include a partnership agreement detailing individual roles, a responsibilities matrix specifying tasks and obligations, and a decision-making framework defining voting rights and dispute resolution. Financial agreements and liability clauses often accompany these to protect all partners legally and financially. Your partnership's success depends on thorough, well-structured documentation that clarifies expectations and operational procedures.

Profit Sharing and Financial Arrangements

Business partnership agreements require specific documents outlining profit sharing and financial arrangements to ensure clarity and legal protection. Key documents include the profit-sharing agreement specifying each partner's percentage and the financial contribution records detailing initial and ongoing investments.

The agreement must also contain detailed financial statements and tax-related documents to establish transparency and compliance. Accurate documentation of profit distribution methods and liability allocation is essential for resolving disputes and maintaining partnership harmony.

Dispute Resolution and Exit Strategies

Business partnership agreements require essential documents such as dispute resolution clauses and exit strategy plans to ensure clarity and protection for all parties. Dispute resolution documents outline methods like mediation or arbitration to handle conflicts efficiently, minimizing potential litigation. Exit strategies define procedures for withdrawal or dissolution, safeguarding Your interests and maintaining business continuity.

What Documents are Needed for Business Partnership Agreements? Infographic