A loan agreement between friends requires essential documents such as a clear written contract outlining the loan amount, repayment terms, and interest rates if applicable. Both parties should provide valid identification and proof of address to verify identities and legal capacity. Including a promissory note and any collateral agreements ensures stronger protection and reduces the risk of disputes.

What Documents are Necessary for a Loan Agreement Between Friends?

| Number | Name | Description |

|---|---|---|

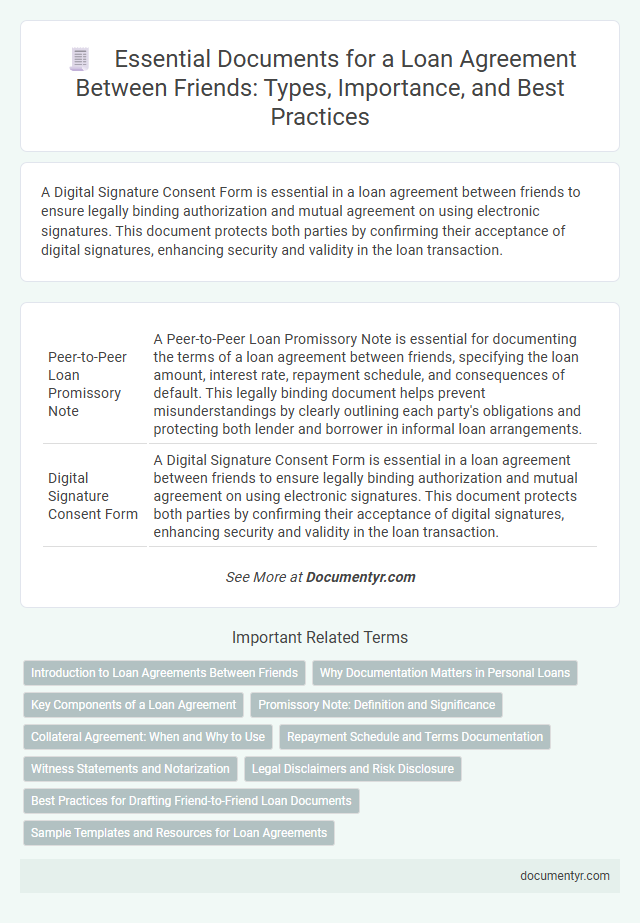

| 1 | Peer-to-Peer Loan Promissory Note | A Peer-to-Peer Loan Promissory Note is essential for documenting the terms of a loan agreement between friends, specifying the loan amount, interest rate, repayment schedule, and consequences of default. This legally binding document helps prevent misunderstandings by clearly outlining each party's obligations and protecting both lender and borrower in informal loan arrangements. |

| 2 | Digital Signature Consent Form | A Digital Signature Consent Form is essential in a loan agreement between friends to ensure legally binding authorization and mutual agreement on using electronic signatures. This document protects both parties by confirming their acceptance of digital signatures, enhancing security and validity in the loan transaction. |

| 3 | Informal Loan Disclosure Statement | An Informal Loan Disclosure Statement is essential for a loan agreement between friends as it clearly outlines the loan amount, repayment terms, interest rate if any, and the responsibilities of both parties. This document helps prevent misunderstandings and provides a simple, written record that can be referenced in case of disputes or confusion. |

| 4 | Repayment Schedule Addendum | A Repayment Schedule Addendum is essential in a loan agreement between friends as it clearly outlines the payment amounts, due dates, and duration, minimizing misunderstandings. Including this document ensures both parties have a transparent and legally binding timeline for loan repayment, protecting the lender's interests and maintaining trust. |

| 5 | Mutual Understanding Certificate | A Mutual Understanding Certificate is essential for a loan agreement between friends, clearly outlining the loan amount, repayment terms, and mutual obligations to prevent misunderstandings. Including this document strengthens trust and provides legal evidence of the agreed conditions, ensuring both parties recognize their responsibilities. |

| 6 | e-KYC Verification Document | An e-KYC verification document is essential for a loan agreement between friends as it authenticates the identity of both parties using digital means, ensuring legal compliance and reducing the risk of fraud. This document typically includes a government-issued ID, address proof, and a recent photograph verified through a secure electronic platform. |

| 7 | Purpose Declaration Statement | A clear Purpose Declaration Statement in a loan agreement between friends outlines the specific reason for the loan, ensuring both parties understand the intended use of the funds and preventing future disputes. This document helps establish transparency, aligns expectations, and serves as evidence of the agreed financial arrangement for legal and tax purposes. |

| 8 | Loan Forgiveness Clause Agreement | A Loan Forgiveness Clause in a Loan Agreement between friends must clearly outline conditions under which the debt will be partially or fully forgiven, specifying the forgiveness amount, timeline, and any required actions or events triggering the forgiveness. Essential documents include the written loan agreement detailing the forgiveness terms, signed by both parties, and any supporting evidence such as repayment schedules or correspondence confirming consent to the loan forgiveness conditions. |

| 9 | Private Mediation Agreement | A Private Mediation Agreement is essential in a loan agreement between friends to outline the process for resolving disputes without court intervention. This document specifies the mediator's role, confidentiality terms, and the framework for negotiation, ensuring a clear, amicable resolution pathway. |

| 10 | Conflict Resolution Protocol Form | A Conflict Resolution Protocol Form in a loan agreement between friends outlines clear procedures for addressing disputes, including mediation or arbitration methods, ensuring both parties have a predefined mechanism to resolve conflicts amicably. This document is crucial to prevent misunderstandings and maintain trust by providing a structured framework for negotiating disagreements. |

Introduction to Loan Agreements Between Friends

Loan agreements between friends establish clear terms for borrowing and repayment, preventing misunderstandings. These agreements document the responsibilities and expectations of both parties involved.

You should have specific documents to ensure the agreement is legally binding and transparent. Proper documentation helps protect your friendship and financial interests throughout the loan term.

Why Documentation Matters in Personal Loans

Creating a loan agreement between friends requires specific documentation to ensure clarity and legal protection. Essential documents include a written loan agreement, promissory note, and proof of identity for both parties.

Documentation matters in personal loans because it outlines the terms, repayment schedule, and interest rates, reducing misunderstandings. Clear records help protect both lender and borrower from potential disputes or legal issues. Well-prepared documents establish trust and accountability, making the lending process smoother and more secure.

Key Components of a Loan Agreement

| Key Component | Description |

|---|---|

| Loan Amount | Specifies the exact sum of money being borrowed between friends. |

| Interest Rate | Details any agreed-upon interest applicable to the loan, including the rate and calculation method. |

| Repayment Terms | Outlines the schedule, method, and timeframe for loan repayment. |

| Borrower and Lender Information | Includes full legal names, addresses, and identification details of both parties. |

| Purpose of Loan | Explains the intended use of the borrowed amount, ensuring clarity between friends. |

| Collateral (if any) | Specifies assets pledged as security to guarantee loan repayment, if applicable. |

| Default Terms | Defines consequences and remedies if the borrower fails to meet repayment obligations. |

| Signatures | Includes signatures of borrower, lender, and optionally, a witness to validate the agreement. |

| Effective Date | The date when the loan agreement becomes legally binding. |

| Governing Law | Specifies which jurisdiction's laws apply to the agreement. |

Promissory Note: Definition and Significance

A promissory note is a legally binding financial document that outlines the terms of a loan agreement between friends. It serves as a clear record of the borrower's promise to repay the loan under specified conditions.

- Definition - A promissory note is a written, signed promise to pay a specific amount of money at a defined time or on demand.

- Legal Significance - It provides enforceable evidence of the debt and the borrower's obligation to repay, reducing potential disputes.

- Essential Details - The note typically includes the principal amount, interest rate, repayment schedule, and consequences of default.

Collateral Agreement: When and Why to Use

When friends enter a loan agreement, clear documentation is essential to protect both parties and ensure mutual understanding. A collateral agreement serves as a key document in these arrangements, specifying assets pledged to secure the loan.

- Definition of Collateral Agreement - A legal document outlining the assets offered as security for the loan, providing assurance to the lender.

- When to Use Collateral Agreement - Necessary when the loan amount is significant or when the lender requires security to mitigate risk.

- Benefits of Using Collateral Agreement - Helps establish trust by clearly defining terms and reducing potential disputes between friends.

Including a collateral agreement in a loan contract between friends ensures clarity and protects both parties' interests.

Repayment Schedule and Terms Documentation

When creating a loan agreement between friends, it is essential to include a clear repayment schedule outlining payment amounts and due dates. Documentation of the repayment terms helps prevent misunderstandings and ensures both parties agree on the timeline for repayment.

Terms documentation should specify the interest rate, if any, and conditions for missed or late payments. Properly recording these details protects Your interests and maintains trust throughout the loan period.

Witness Statements and Notarization

Creating a loan agreement between friends requires specific documents to ensure clarity and legal protection. Witness statements and notarization play crucial roles in validating the agreement.

- Witness Statements - Witnesses provide impartial confirmation that both parties willingly entered into the loan agreement, adding credibility to the document.

- Notarization - Notarization authenticates signatures, prevents fraud, and legally recognizes the agreement's validity.

- Loan Agreement Document - A detailed written contract outlining loan terms, repayment schedules, and responsibilities signed by both parties and witnessed or notarized.

Legal Disclaimers and Risk Disclosure

Loan agreements between friends must include clear legal disclaimers to protect all parties involved. These disclaimers outline the limits of liability and clarify that the agreement does not constitute professional financial advice. Risk disclosure is essential to inform you about potential financial consequences and the possibility of default.

Best Practices for Drafting Friend-to-Friend Loan Documents

A loan agreement between friends requires clear documentation to avoid misunderstandings and protect both parties. Essential documents include a written loan agreement outlining the loan amount, repayment terms, interest rates if any, and signatures from both parties. Best practices involve specifying consequences of default, maintaining a record of payments, and consulting a legal professional to ensure enforceability and fairness.

What Documents are Necessary for a Loan Agreement Between Friends? Infographic