To complete an employment contract, an employee typically needs to provide identification documents such as a passport or national ID card, proof of address, and tax identification number. Relevant certificates or diplomas, work permits for foreign employees, and social security details are also commonly required. Employers may request these documents to verify eligibility and comply with legal and administrative regulations.

What Documents Does an Employee Need for an Employment Contract?

| Number | Name | Description |

|---|---|---|

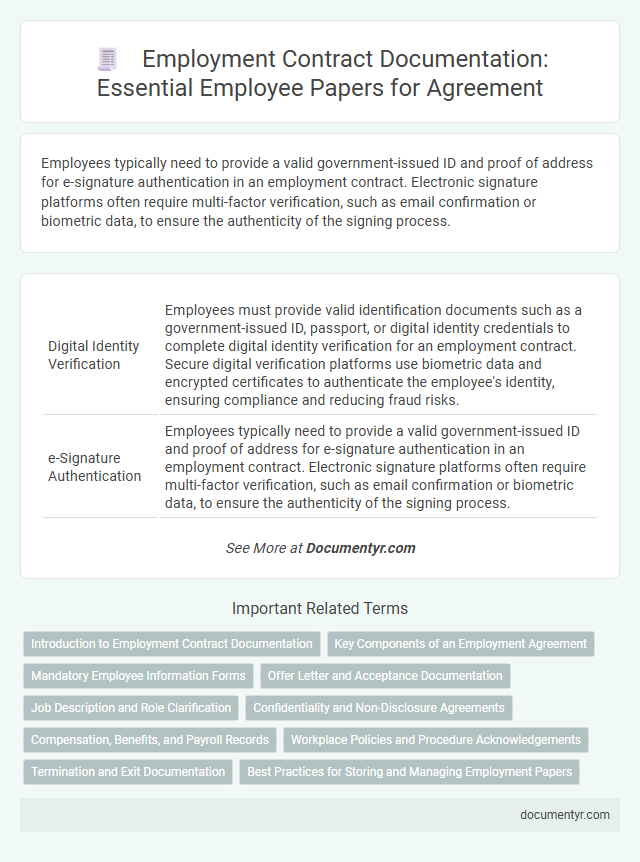

| 1 | Digital Identity Verification | Employees must provide valid identification documents such as a government-issued ID, passport, or digital identity credentials to complete digital identity verification for an employment contract. Secure digital verification platforms use biometric data and encrypted certificates to authenticate the employee's identity, ensuring compliance and reducing fraud risks. |

| 2 | e-Signature Authentication | Employees typically need to provide a valid government-issued ID and proof of address for e-signature authentication in an employment contract. Electronic signature platforms often require multi-factor verification, such as email confirmation or biometric data, to ensure the authenticity of the signing process. |

| 3 | Anti-Money Laundering (AML) Declarations | An employee must provide Anti-Money Laundering (AML) declarations as part of their employment contract documentation to ensure compliance with legal and regulatory standards. These declarations include certified identification documents and statements confirming the absence of involvement in money laundering activities, safeguarding the company from financial and reputational risks. |

| 4 | GDPR Consent Forms | Employees typically need to provide GDPR consent forms as part of their employment contract documentation to ensure lawful processing of their personal data. These forms confirm that the employee agrees to the collection, use, and storage of their data in compliance with GDPR regulations, protecting both the employee's rights and the employer's legal obligations. |

| 5 | Remote Onboarding Checklist | Employees require essential documents such as proof of identity, tax information, signed offer letters, and confidentiality agreements for a comprehensive remote onboarding checklist. This checklist ensures legal compliance and seamless integration into the company's employment contract framework. |

| 6 | Blockchain Credential Verification | Employees must provide verifiable identity and qualification documents, which can be securely authenticated through blockchain credential verification to ensure authenticity and prevent fraud. Blockchain technology enhances the employment contract process by enabling employers to validate employee credentials instantly and transparently. |

| 7 | Work-from-Home Compliance Agreement | Employees must provide a signed Work-from-Home Compliance Agreement along with their employment contract to ensure adherence to company policies and remote work regulations. This document typically includes terms related to data security, workspace requirements, and communication protocols to maintain productivity and legal compliance. |

| 8 | Diversity & Inclusion Self-Disclosure | Employees must provide a Diversity & Inclusion Self-Disclosure form alongside standard identification and employment eligibility documents to support company initiatives on workplace equity. This information enables employers to tailor inclusive policies and comply with affirmative action regulations while maintaining confidentiality. |

| 9 | Cybersecurity Training Acknowledgement | An Employee must provide a signed Cybersecurity Training Acknowledgement as part of the employment contract to confirm understanding and compliance with company security policies. This document ensures the employee is aware of data protection protocols and cyber threat prevention measures critical to organizational security. |

| 10 | Automated Tax Residency Confirmation | An employee needs a valid government-issued identification and completed tax forms such as the W-4 for U.S. employees or equivalent international tax residency documentation for employment contract processing. Automated tax residency confirmation systems streamline verification by cross-referencing government databases to ensure accurate tax status classification and compliance. |

Introduction to Employment Contract Documentation

An employment contract establishes the legal relationship between an employer and an employee. Proper documentation is essential to clearly define the terms, responsibilities, and rights of both parties. Knowing the necessary documents helps ensure a smooth and compliant hiring process.

Key Components of an Employment Agreement

| Document | Description |

|---|---|

| Employment Contract | Details the terms and conditions of employment including job title, responsibilities, and duration. |

| Identification Proof | Valid government-issued ID such as a passport or driver's license to verify identity and eligibility to work. |

| Tax Documents | Forms like W-4 or equivalent for tax withholding purposes, depending on the country of employment. |

| Proof of Qualifications | Certificates, diplomas, or licenses that confirm educational background and professional credentials required for the role. |

| Background Check Consent | Authorization form permitting the employer to conduct criminal, credit, or employment history checks. |

| Non-Disclosure Agreement (NDA) | Protects confidential company information and intellectual property during and after employment. |

| Benefit Enrollment Forms | Documents related to health insurance, retirement plans, and other employee benefits offered by the employer. |

Your employment agreement should clearly outline these key components to establish a transparent and legally binding relationship.

Mandatory Employee Information Forms

When entering an employment contract, certain mandatory employee information forms are required to ensure compliance with labor laws. These documents include personal identification, tax forms, and proof of eligibility to work.

Your employment contract will typically require you to provide a completed W-4 form, a valid government-issued ID, and an I-9 Employment Eligibility Verification form. These documents verify your identity, tax status, and legal right to work in the country.

Offer Letter and Acceptance Documentation

An employment contract requires specific documents for validity, primarily the offer letter and acceptance documentation. The offer letter outlines job details, compensation, and terms, serving as the employer's formal proposal. Acceptance documentation, such as a signed acceptance letter or email, confirms the employee's agreement to the contract terms.

Job Description and Role Clarification

Clear documentation of job description and role clarification is essential for forming an effective employment contract. These documents define the employee's responsibilities and expectations, preventing future disputes.

- Job Description - Details the specific duties, tasks, and responsibilities assigned to the employee.

- Role Clarification - Outlines the position's scope, reporting structure, and performance standards.

- Contractual Reference - Ensures that the employment contract explicitly incorporates the job description and role details for legal validation.

Confidentiality and Non-Disclosure Agreements

When entering an employment contract, certain documents are essential to protect both the employee and employer. Confidentiality and Non-Disclosure Agreements (NDAs) play a critical role in safeguarding sensitive information.

- Confidentiality Agreement - This document ensures you agree to keep company information private and secure.

- Non-Disclosure Agreement (NDA) - It legally binds you from sharing proprietary data with outside parties.

- Employment Contract Incorporation - These agreements are often included as part of your main employment contract to reinforce confidentiality obligations.

Submitting these documents is crucial for compliance and protecting business interests.

Compensation, Benefits, and Payroll Records

Employment contracts require accurate documentation of compensation details to ensure clarity and legal compliance. Payroll records must reflect salary, bonuses, and deductions precisely to avoid disputes.

Benefits documentation should outline health insurance, retirement plans, and other employee perks clearly. You need to provide all relevant records to guarantee transparency and proper contract enforcement.

Workplace Policies and Procedure Acknowledgements

What documents are necessary for acknowledging workplace policies and procedures in an employment contract? You need to provide signed policy acknowledgements that confirm understanding of company rules and guidelines. These documents ensure compliance with safety standards, confidentiality agreements, and operational procedures.

Termination and Exit Documentation

Understanding the necessary documentation for termination and exit processes ensures a smooth departure from employment. Proper handling of exit paperwork protects both the employee and employer legally and administratively.

- Termination Letter - A formal letter detailing the end of employment, specifying the reasons and effective date of termination.

- Final Pay Slip - Documentation of the last payment, including wages, bonuses, and any deductions.

- Exit Interview Form - A record of feedback and company property returns conducted during the exit process.

What Documents Does an Employee Need for an Employment Contract? Infographic