A business partnership agreement requires key documents such as the partnership agreement itself, which outlines each partner's roles, responsibilities, and profit-sharing details. Other essential documents include identification proofs of all partners, business registration certificates, and any applicable licenses or permits. Financial documents like capital contribution records and tax identification numbers also play a crucial role in formalizing the partnership.

What Documents Are Required for a Business Partnership Agreement?

| Number | Name | Description |

|---|---|---|

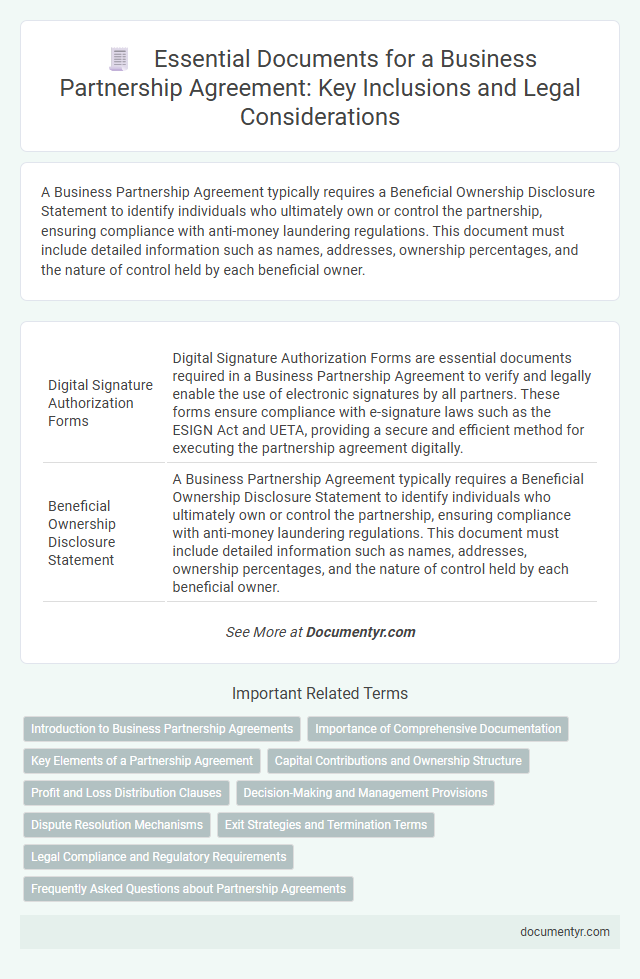

| 1 | Digital Signature Authorization Forms | Digital Signature Authorization Forms are essential documents required in a Business Partnership Agreement to verify and legally enable the use of electronic signatures by all partners. These forms ensure compliance with e-signature laws such as the ESIGN Act and UETA, providing a secure and efficient method for executing the partnership agreement digitally. |

| 2 | Beneficial Ownership Disclosure Statement | A Business Partnership Agreement typically requires a Beneficial Ownership Disclosure Statement to identify individuals who ultimately own or control the partnership, ensuring compliance with anti-money laundering regulations. This document must include detailed information such as names, addresses, ownership percentages, and the nature of control held by each beneficial owner. |

| 3 | Environmental, Social, and Governance (ESG) Compliance Certificate | A Business Partnership Agreement requires an Environmental, Social, and Governance (ESG) Compliance Certificate to demonstrate adherence to sustainable and ethical business practices, ensuring transparency and accountability. This certificate supports risk management and investor confidence by verifying compliance with relevant ESG standards and regulations. |

| 4 | Data Privacy and Processing Addendum | A Business Partnership Agreement requires a Data Privacy and Processing Addendum to ensure compliance with data protection regulations such as GDPR, clearly outlining the roles, responsibilities, and security measures for handling personal data between partners. This addendum must include specifics on data processing activities, consent mechanisms, data breach protocols, and retention policies to protect sensitive information and mitigate legal risks. |

| 5 | Cryptocurrency Asset Declaration | A Business Partnership Agreement requires a detailed Cryptocurrency Asset Declaration outlining all digital assets owned or managed by the partners, including wallet addresses, types of cryptocurrencies, and current valuations. This declaration ensures transparency, establishes clear ownership rights, and mitigates potential disputes related to digital asset management within the partnership. |

| 6 | Virtual Partnership Clause | A business partnership agreement requires essential documents such as a partnership deed, proof of identity, and business registration certificates, specifically including a Virtual Partnership Clause to define online collaboration terms. This clause ensures clarity on digital communication protocols, intellectual property rights, and dispute resolution mechanisms tailored for virtual partnerships. |

| 7 | Blockchain Transaction Record | A comprehensive business partnership agreement must include a Blockchain transaction record to ensure transparency and immutability of financial contributions and asset exchanges. This digital ledger serves as verifiable proof of each partner's investment and contractual obligations, enhancing trust and legal enforceability. |

| 8 | Remote Work Policy Agreement | A Business Partnership Agreement for remote work must include a Remote Work Policy Agreement, outlining work hours, communication protocols, cybersecurity measures, and equipment usage. This document ensures clear expectations and legal compliance for all partners operating in different locations. |

| 9 | Non-Solicitation of AI Talent Clause | A Business Partnership Agreement requires specific documents including a detailed Non-Solicitation of AI Talent Clause to prevent partners from poaching each other's AI professionals. This clause must clearly define the scope, duration, and penalties to protect proprietary AI expertise and maintain competitive advantage within the partnership. |

| 10 | Smart Contract Supplement | A Business Partnership Agreement requires essential documents such as identification papers, partnership details, and capital contribution records, with a Smart Contract Supplement enhancing automation and enforcement of terms through blockchain technology. This supplement ensures transparent, immutable execution of agreement clauses, reducing disputes and increasing operational efficiency. |

Introduction to Business Partnership Agreements

Business partnership agreements are essential legal documents that define the roles, responsibilities, and profit-sharing among partners. These agreements establish a clear framework to prevent disputes and ensure smooth collaboration.

- Partnership Agreement Document - This core document outlines the terms, management structure, and financial arrangements between partners.

- Identification Documents - Valid government-issued IDs verify the identities of all partners involved in the agreement.

- Financial Records - These include initial capital contributions and asset valuations to establish each partner's equity in the business.

Importance of Comprehensive Documentation

A comprehensive business partnership agreement requires essential documents such as identification proofs, business licenses, and detailed financial statements. Including these documents ensures clarity on partner roles, responsibilities, and investment contributions. Proper documentation protects all parties and helps prevent future disputes by establishing a clear legal framework.

Key Elements of a Partnership Agreement

Understanding the necessary documents for a business partnership agreement is crucial for establishing clear terms and responsibilities. These documents outline the key elements that define the partnership structure and operation.

- Partnership Agreement - This core document details the roles, contributions, profit sharing, and decision-making processes of each partner.

- Financial Statements - Accurate financial records are essential to assess the current assets, liabilities, and capital contributions within the partnership.

- Legal Licenses and Permits - These ensure the partnership complies with local regulations and is legally authorized to operate.

Your business partnership agreement must comprehensively address these key elements to protect all partners and ensure smooth collaboration.

Capital Contributions and Ownership Structure

A Business Partnership Agreement requires essential documents detailing Capital Contributions and Ownership Structure. These documents ensure clear understanding and legal protection for all partners involved.

Capital Contributions documents list the exact amount of money, property, or services each partner invests in the business. Ownership Structure papers specify the percentage of ownership and voting rights allocated to each partner. You must provide these documents to establish transparency and avoid future disputes in the partnership.

Profit and Loss Distribution Clauses

What documents are essential for outlining Profit and Loss Distribution Clauses in a Business Partnership Agreement? A detailed partnership agreement should include clauses specifying the exact method of profit and loss distribution among partners. Clear documentation ensures transparency and prevents future disputes regarding financial sharing.

Decision-Making and Management Provisions

Business partnership agreements require clear documentation of decision-making and management provisions to ensure smooth operation. These provisions define how partners share authority and responsibilities within the business.

Essential documents include detailed clauses outlining voting rights, management roles, and dispute resolution methods. Specifying these elements prevents conflicts and supports effective governance of the partnership.

Dispute Resolution Mechanisms

Business partnership agreements must clearly outline dispute resolution mechanisms to prevent conflicts from escalating. You should include specific documents that define how disputes will be managed and resolved.

- Arbitration Clause - This document specifies that disputes will be resolved through arbitration rather than court litigation, ensuring a faster, confidential resolution process.

- Mediation Agreement - Details an agreed-upon mediation process where a neutral third party assists partners in reaching a voluntary settlement.

- Jurisdiction and Governing Law - Defines the legal jurisdiction and the governing laws applicable to disputes, providing clarity on where and how disputes will be adjudicated.

Exit Strategies and Termination Terms

When drafting a business partnership agreement, including clear Exit Strategies and Termination Terms is crucial for protecting all parties involved. Essential documents include detailed clauses outlining conditions for voluntary withdrawal, buyout procedures, and dispute resolution mechanisms. Your agreement should specify the process and consequences of termination to ensure a smooth and legally compliant separation.

Legal Compliance and Regulatory Requirements

To establish a legally compliant business partnership agreement, essential documents include the partnership deed, identification proofs, and business registration certificates. These documents ensure regulatory adherence and clearly define roles and responsibilities within the partnership.

Additional legal requirements may involve tax registration, licenses specific to your industry, and compliance with local jurisdiction laws. Ensuring all necessary paperwork is complete protects your partnership from potential legal disputes and regulatory penalties.

What Documents Are Required for a Business Partnership Agreement? Infographic