To finalize a loan agreement, essential documents typically include valid identification, proof of income, bank statements, and credit reports. Borrowers must also provide the loan application form and any collateral documentation if applicable. Ensuring all paperwork is complete and accurate streamlines the approval and signing process.

What Documents Are Required for Loan Agreement Finalization?

| Number | Name | Description |

|---|---|---|

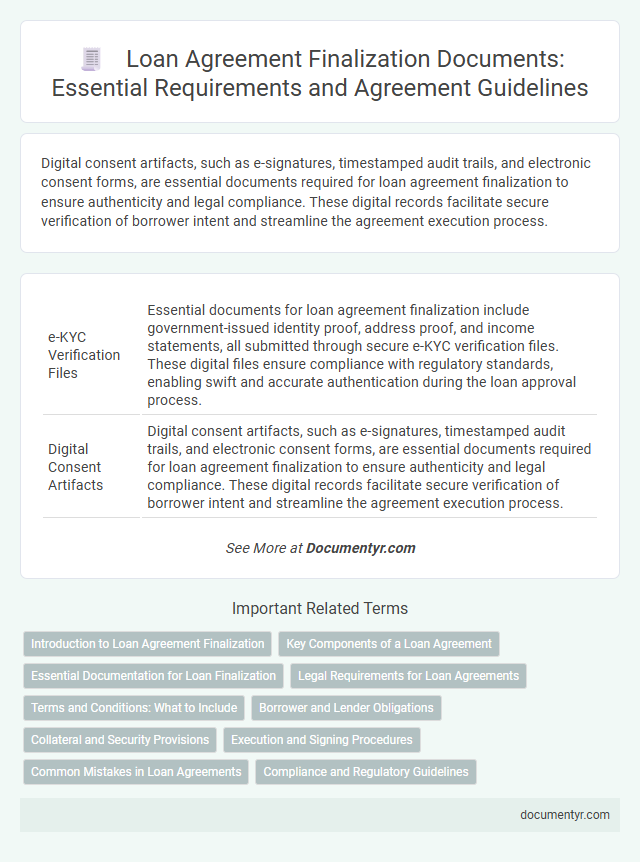

| 1 | e-KYC Verification Files | Essential documents for loan agreement finalization include government-issued identity proof, address proof, and income statements, all submitted through secure e-KYC verification files. These digital files ensure compliance with regulatory standards, enabling swift and accurate authentication during the loan approval process. |

| 2 | Digital Consent Artifacts | Digital consent artifacts, such as e-signatures, timestamped audit trails, and electronic consent forms, are essential documents required for loan agreement finalization to ensure authenticity and legal compliance. These digital records facilitate secure verification of borrower intent and streamline the agreement execution process. |

| 3 | Blockchain-Stamped ID Proofs | Loan agreement finalization requires blockchain-stamped ID proofs such as government-issued digital IDs or blockchain-verified passports to ensure authenticity and tamper-proof verification. These documents enhance security by providing immutable records, reducing fraud risks in the loan approval process. |

| 4 | Income Tokenization Statements | Income tokenization statements are essential documents required for loan agreement finalization as they provide verified proof of income through blockchain-based records, enhancing transparency and reducing fraud risks. These statements enable lenders to accurately assess borrower creditworthiness by offering immutable, easily verifiable income data. |

| 5 | AI-Generated Risk Assessment Certificates | Loan agreement finalization requires various documents, including AI-generated risk assessment certificates that provide precise, data-driven evaluations of borrower creditworthiness and potential financial risks. These certificates enhance decision-making accuracy by integrating advanced algorithms and predictive analytics into the risk assessment process. |

| 6 | ESG (Environmental, Social, Governance) Compliance Declarations | Loan agreement finalization mandates submission of ESG compliance declarations, including environmental impact assessments, social responsibility reports, and corporate governance disclosures to ensure adherence to sustainable financing criteria. These documents facilitate transparent risk evaluation and demonstrate the borrower's commitment to responsible business practices aligned with lender ESG policies. |

| 7 | Crypto-Asset Disclosure Sheets | Crypto-Asset Disclosure Sheets are essential documents in loan agreement finalization, providing detailed information on the borrower's cryptocurrency holdings and associated risks. These sheets ensure transparency and compliance by verifying the value, source, and legal status of crypto-assets involved in collateral or repayment terms. |

| 8 | Open Banking Data Permissions | Loan agreement finalization requires submission of identification documents, income proof, and explicit Open Banking data permissions, enabling lenders to access comprehensive financial histories for accurate risk assessment. Open Banking permissions include authorization to retrieve transaction records, account balances, and credit usage, ensuring streamlined and secure verification processes. |

| 9 | Smart Contract Addenda | Loan agreement finalization requires key documents such as identification proofs, financial statements, and the core loan contract, while Smart Contract Addenda serve as essential digital appendices that ensure programmable, automated enforcement of specific terms and conditions within blockchain-based loan agreements. Integrating Smart Contract Addenda enhances transparency, reduces processing time, and secures compliance through immutable, verifiable code executed on decentralized ledgers. |

| 10 | Alternative Creditworthiness Reports | Alternative creditworthiness reports, such as utility bill payment histories, rental payment records, and employment verification letters, provide critical supplementary data for loan agreement finalization. These documents help lenders assess borrower reliability beyond traditional credit scores, facilitating more inclusive and accurate risk evaluation. |

Introduction to Loan Agreement Finalization

Loan agreement finalization is a critical step in securing a loan, ensuring that all terms and conditions are clearly defined and legally binding. This process involves thorough documentation to protect both the lender and borrower.

Essential documents verify the identity, financial status, and creditworthiness of the borrower. Proper documentation helps prevent misunderstandings and facilitates smooth loan disbursement and repayment.

Key Components of a Loan Agreement

What documents are required for loan agreement finalization? A comprehensive loan agreement includes identification proof, income statements, and collateral documents to ensure clarity. These key components establish the terms, repayment schedule, and obligations for both parties involved.

Essential Documentation for Loan Finalization

Finalizing a loan agreement requires submitting specific essential documents to ensure legal and financial compliance. Your timely preparation of these documents facilitates a smooth loan processing experience.

- Proof of Identity - Valid government-issued IDs such as a passport or driver's license verify your identity.

- Income Verification - Recent pay stubs, tax returns, or bank statements demonstrate your repayment ability.

- Property or Asset Documents - Relevant titles or appraisal reports confirm collateral details if applicable.

Legal Requirements for Loan Agreements

Finalizing a loan agreement requires essential legal documents such as the signed loan contract, proof of identity, and financial statements. Lenders typically request credit reports, collateral documentation, and income verification to comply with regulatory standards. These documents ensure transparency, legal compliance, and protection for both parties involved in the loan agreement.

Terms and Conditions: What to Include

| Terms and Conditions | Description |

|---|---|

| Loan Amount | Specifies the principal sum borrowed and the currency involved in the agreement. |

| Interest Rate | Defines the fixed or variable interest rate applied to the loan principal throughout the repayment period. |

| Repayment Schedule | Details the frequency and amounts of repayment installments, including start and end dates. |

| Loan Tenure | Indicates the full duration or maturity date of the loan agreement. |

| Security or Collateral | Describes any assets pledged as security to guarantee loan repayment. |

| Default and Penalties | Outlines consequences of missed payments, including late fees and legal actions. |

| Prepayment Terms | Specifies conditions under which the borrower may repay the loan early without penalty. |

| Representations and Warranties | Includes declarations by both parties regarding their authority and the accuracy of information provided. |

| Governing Law and Jurisdiction | Establishes the legal framework and court jurisdiction governing the loan agreement. |

| Amendment Clause | Details how modifications to the loan agreement can be made and requires mutual consent. |

Borrower and Lender Obligations

Finalizing a loan agreement requires the borrower to provide identification documents, proof of income, and details of collateral if applicable. The lender must prepare the agreement, ensure compliance with legal standards, and disclose all terms clearly.

You must submit accurate documentation to verify your financial status and fulfill obligations under the contract. The lender has the responsibility to review these documents thoroughly and confirm all conditions are met before signing.

Collateral and Security Provisions

Finalizing a loan agreement requires detailed documentation of collateral and security provisions to protect both parties. Collateral documents must clearly describe assets pledged to secure the loan and their valuation.

Security agreements specify the rights and obligations related to the collateral, including perfecting security interests with appropriate filings. You need to provide titles, appraisal reports, and any lien releases pertinent to the collateral. These documents ensure enforceability and reduce risks in the agreement finalization process.

Execution and Signing Procedures

Loan agreement finalization requires precise execution and signing procedures to ensure legal validity. Proper documentation streamlines this process and protects all involved parties.

- Identification Documents - Valid government-issued IDs verify the identities of all borrowers and guarantors during signing.

- Signature Pages - Executed signature pages serve as formal consent and confirmation of the parties' agreement to loan terms.

- Notarization Certificates - Notarized documents authenticate signatures and prevent disputes regarding document legitimacy.

Collecting and verifying all required documents before signing safeguards the enforceability of the loan agreement.

Common Mistakes in Loan Agreements

Finalizing a loan agreement requires submitting specific documents to ensure legal and financial clarity. Overlooking essential paperwork or misinterpreting terms often leads to common mistakes in loan agreements.

- Incomplete Documentation - Failure to provide all required documents such as identification, proof of income, and collateral details can delay or invalidate the loan agreement.

- Ambiguous Terms - Vague or unclear language regarding repayment schedules, interest rates, or penalties can cause disputes between lender and borrower.

- Ignoring Legal Compliance - Neglecting to adhere to local regulations and legal standards risks the enforceability of the loan contract and potential legal repercussions.

What Documents Are Required for Loan Agreement Finalization? Infographic