Small businesses need key documents for lease renewal including the original lease agreement, proof of rent payments, and any amendments or addendums. Financial statements and business licenses may be required to demonstrate ongoing viability. Having these documents organized facilitates a smoother negotiation and renewal process.

What Documents Does a Small Business Need for Lease Renewal?

| Number | Name | Description |

|---|---|---|

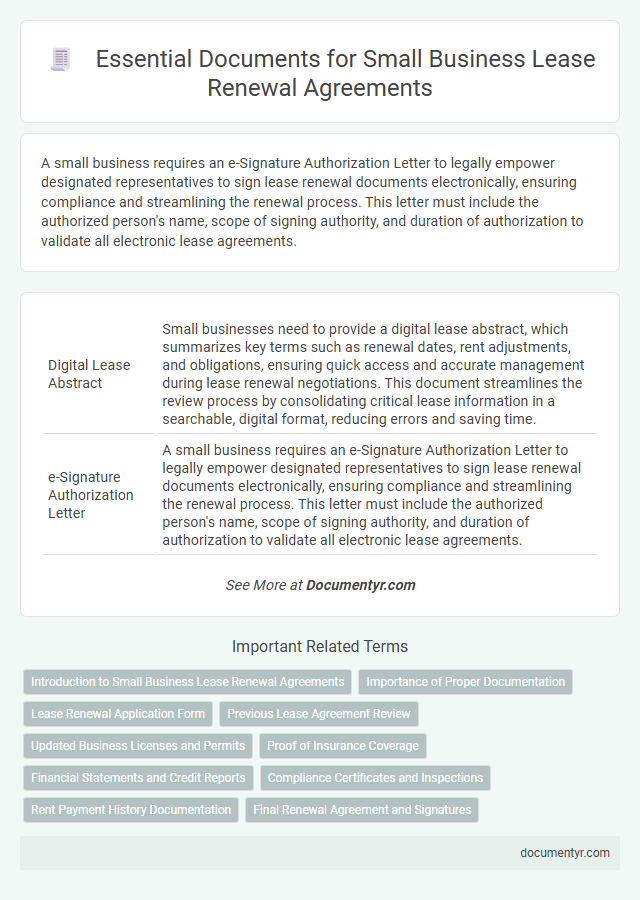

| 1 | Digital Lease Abstract | Small businesses need to provide a digital lease abstract, which summarizes key terms such as renewal dates, rent adjustments, and obligations, ensuring quick access and accurate management during lease renewal negotiations. This document streamlines the review process by consolidating critical lease information in a searchable, digital format, reducing errors and saving time. |

| 2 | e-Signature Authorization Letter | A small business requires an e-Signature Authorization Letter to legally empower designated representatives to sign lease renewal documents electronically, ensuring compliance and streamlining the renewal process. This letter must include the authorized person's name, scope of signing authority, and duration of authorization to validate all electronic lease agreements. |

| 3 | Environmental Compliance Certificate | A small business must include an Environmental Compliance Certificate (ECC) during lease renewal to ensure adherence to environmental regulations and demonstrate commitment to sustainable operations. This document verifies that the business complies with local environmental laws, preventing potential legal issues and supporting a responsible lease agreement. |

| 4 | Lease Amendment Matrix | The Lease Amendment Matrix is a critical document for small businesses during lease renewal, outlining all necessary modifications, approvals, and timelines to streamline contract updates. It ensures clear tracking of amendments such as rent adjustments, term extensions, and tenant obligations, minimizing disputes and facilitating smooth negotiations. |

| 5 | Rent Escalation Index Report | A Rent Escalation Index Report is essential for small businesses during lease renewal as it provides an objective measure of rent adjustments based on economic indicators and market trends. This report ensures transparency and helps negotiate fair rental increases aligned with current inflation rates and real estate market conditions. |

| 6 | Tenant Improvement Scope Appendix | The Tenant Improvement Scope Appendix details the specific modifications and enhancements the landlord agrees to provide or allow during the lease renewal, ensuring clarity on responsibilities and cost allocations. This document is essential for small businesses to outline agreed-upon changes to the leased space, helping avoid disputes and facilitating smooth lease negotiations. |

| 7 | ESG (Environmental, Social, Governance) Clause Disclosure | A small business renewing a lease should prepare key documents including the current lease agreement, proof of business ownership, and financial statements, while ensuring the inclusion of an ESG clause disclosure outlining environmental impact, social responsibility commitments, and governance practices. Incorporating ESG criteria in lease agreements supports sustainable business operations, mitigates risks, and aligns with increasing stakeholder expectations for corporate transparency. |

| 8 | Subletting Consent Form | A subletting consent form is essential for small businesses seeking lease renewal as it obtains the landlord's permission to sublease the property to another party, ensuring legal compliance and protecting tenant rights. This document typically outlines conditions, duration, and responsibilities of the subtenant, preventing potential disputes during the lease term. |

| 9 | Cybersecurity Insurance Documentation | Small businesses must provide updated cybersecurity insurance documentation during lease renewal to demonstrate financial protection against data breaches and cyber threats. These documents typically include the insurance policy, coverage details, proof of premium payment, and any amendments reflecting new cyber risk assessments relevant to the leased property. |

| 10 | COVID-19 Rental Relief Addendum | Small businesses seeking lease renewal should obtain the COVID-19 Rental Relief Addendum to address rent adjustments and payment deferrals negotiated during the pandemic. This addendum, alongside the original lease agreement and any prior rent relief documentation, ensures clear terms for ongoing rental obligations under updated conditions. |

Introduction to Small Business Lease Renewal Agreements

Renewing a lease for a small business involves specific documentation to ensure a smooth transition and legal compliance. Understanding the essential papers helps prevent disputes and secures favorable terms.

- Lease Renewal Agreement - The primary document outlining the new lease terms between the landlord and tenant.

- Original Lease Contract - The initial agreement that provides a reference for existing terms and conditions.

- Financial Documents - Proof of business income or creditworthiness to support lease negotiations.

Having these documents prepared streamlines the lease renewal process and protects the interests of the small business owner.

Importance of Proper Documentation

Renewing a lease for your small business requires specific documents to ensure a smooth process and protect your interests. Proper documentation minimizes risks and clarifies terms between you and the landlord.

Essential documents include the original lease agreement, proof of business ownership, and current financial statements. These provide a clear reference and demonstrate your reliability as a tenant. Maintaining accurate records helps avoid disputes and supports negotiations during lease renewal.

Lease Renewal Application Form

Renewing a lease for your small business requires precise documentation to ensure a smooth process. One key document is the Lease Renewal Application Form, which formalizes your intent to continue renting the space.

- Lease Renewal Application Form - This form details your intent to extend the lease agreement and allows the landlord to review your current terms and conditions.

- Up-to-Date Business Information - Accurate business details in the application help verify your identity and operational status, supporting seamless contract updates.

- Review of Lease Terms - Submitting the renewal form often triggers a review of existing lease conditions, making it essential to highlight any requested changes or confirmations.

Previous Lease Agreement Review

Reviewing the previous lease agreement is essential for a smooth lease renewal process. It outlines the original terms, rental rates, and any specific clauses that may affect the new lease.

Checking for clauses related to renewal options, rent increases, and maintenance responsibilities provides a clear understanding of your obligations. This review helps avoid surprises and supports informed negotiations for your small business lease renewal.

Updated Business Licenses and Permits

Small businesses must present updated business licenses and permits when renewing a lease to ensure compliance with local regulations. These documents verify that the business operates legally and meets all zoning and safety requirements.

Renewed licenses and permits protect landlords from potential liabilities and confirm the tenant's legitimacy. Failure to provide these updates can delay the lease renewal process or result in penalties.

Proof of Insurance Coverage

| Document | Description | Importance for Lease Renewal | Key Details |

|---|---|---|---|

| Proof of Insurance Coverage | Official document from the insurance provider confirming the business's active insurance policy | Demonstrates financial responsibility and adherence to lease requirements | Includes policy number, coverage limits, effective dates, and insured parties |

| Certificate of Liability Insurance (COI) | Standardized form showing liability insurance coverage for the leased property | Required by landlords to protect against potential claims arising from business operations | Lists landlord as additional insured party, coverage amount, and expiration date |

| Renewed Insurance Policy Documents | Updated policy documents reflecting renewal beyond the current lease term | Ensures continuous coverage during the lease renewal period | Confirms no lapse in coverage and aligns with lease renewal timeline |

Financial Statements and Credit Reports

Renewing a lease for a small business requires specific documentation to demonstrate financial stability and creditworthiness. Financial statements and credit reports are essential to support your lease renewal application.

- Financial Statements - Detailed profit and loss statements provide insight into your business's revenue, expenses, and overall financial health.

- Balance Sheets - These documents outline your business's assets, liabilities, and equity, illustrating its net worth.

- Credit Reports - Credit reports from major agencies highlight your business's credit history and payment reliability, which landlords assess before lease renewal.

Compliance Certificates and Inspections

Small businesses must obtain compliance certificates to ensure that the leased property meets all legal and safety regulations before lease renewal. These certificates verify that the premises adhere to building codes, fire safety standards, and health regulations. Scheduling property inspections is essential to identify any required repairs or updates, preventing potential lease disputes.

Rent Payment History Documentation

What documents does a small business need to provide for lease renewal? Rent payment history documentation is essential to demonstrate the tenant's reliability and financial responsibility. This record helps landlords evaluate the consistency of payments and decide on lease terms.

What Documents Does a Small Business Need for Lease Renewal? Infographic