Independent contractor agreements in Texas require specific documents to ensure legality and clarity, including a detailed contract outlining the scope of work, payment terms, and duration. Tax forms such as the IRS Form W-9 must be completed to report payments made to the contractor. It is also essential to include proof of insurance and any necessary licenses or permits relevant to the contracted work.

What Documents Are Needed for Independent Contractor Agreements in Texas?

| Number | Name | Description |

|---|---|---|

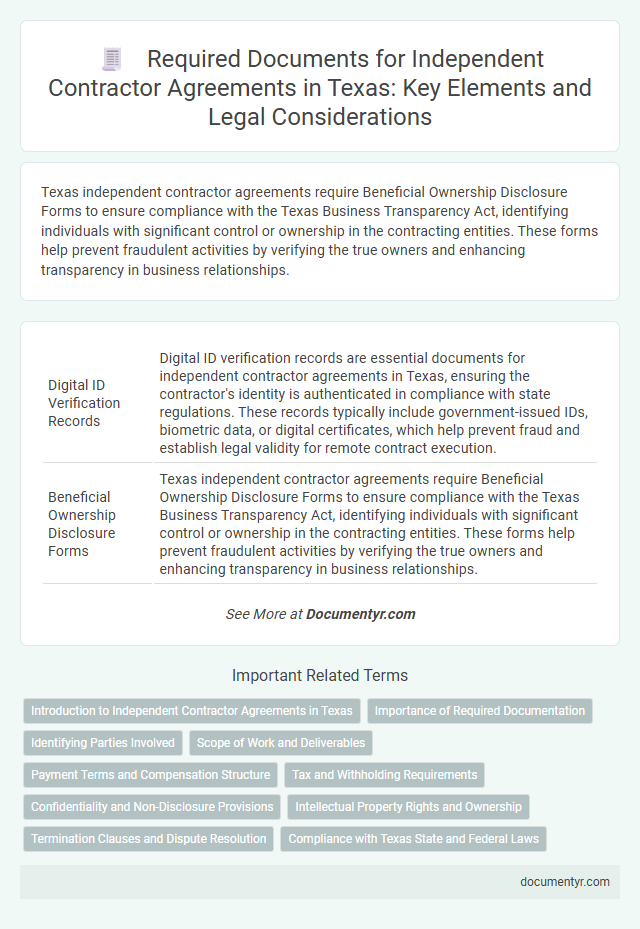

| 1 | Digital ID Verification Records | Digital ID verification records are essential documents for independent contractor agreements in Texas, ensuring the contractor's identity is authenticated in compliance with state regulations. These records typically include government-issued IDs, biometric data, or digital certificates, which help prevent fraud and establish legal validity for remote contract execution. |

| 2 | Beneficial Ownership Disclosure Forms | Texas independent contractor agreements require Beneficial Ownership Disclosure Forms to ensure compliance with the Texas Business Transparency Act, identifying individuals with significant control or ownership in the contracting entities. These forms help prevent fraudulent activities by verifying the true owners and enhancing transparency in business relationships. |

| 3 | Texas Electronic Signature Certificate | Texas Independent Contractor Agreements require a signed contract that outlines the scope of work, payment terms, and confidentiality clauses, with the Texas Electronic Signature Certificate validating the authenticity of digital signatures to comply with state electronic transaction laws. Utilizing the Texas Electronic Signature Certificate ensures enforceability and legal recognition of contracts executed electronically under the Texas Uniform Electronic Transactions Act (UETA). |

| 4 | IRS Form 1099-NEC Filing Receipt | For Independent Contractor Agreements in Texas, accurate record-keeping of IRS Form 1099-NEC filing receipts is essential to document payments made to contractors. This form verifies non-employee compensation and must be filed with the IRS to ensure compliance with tax reporting requirements. |

| 5 | E-Verify Participation Agreement | The E-Verify Participation Agreement is a crucial document for independent contractor agreements in Texas, demonstrating compliance with federal immigration laws by verifying the contractor's employment eligibility. This agreement must be completed alongside the contract to ensure legal adherence and avoid penalties under Texas government code Chapter 2264. |

| 6 | Data Privacy Consent Acknowledgment | Independent contractor agreements in Texas require a Data Privacy Consent Acknowledgment to comply with state and federal privacy laws, ensuring contractors understand how their personal data will be collected, used, and protected. This document is essential for maintaining transparency and mitigating legal risks related to data breaches or unauthorized information sharing. |

| 7 | Worker Classification Statement (Texas Workforce Commission) | The Worker Classification Statement from the Texas Workforce Commission is essential for Independent Contractor Agreements in Texas to verify proper classification and avoid misclassification penalties. This document ensures compliance with state labor laws by providing clear evidence that the worker is not an employee but an independent contractor. |

| 8 | Nontraditional Payment Structure Addendum | Independent contractor agreements in Texas with a nontraditional payment structure require a detailed addendum specifying payment terms such as milestones, commissions, or profit-sharing arrangements. This addendum must outline clear schedules, calculation methods, and conditions to ensure compliance with Texas labor laws and avoid misclassification risks. |

| 9 | Gig Economy Platform Compliance Disclosure | Independent contractor agreements in Texas require clear Gig Economy Platform Compliance Disclosures outlining workers' rights, payment terms, and classification under state law to ensure regulatory adherence. Essential documents include compliance disclosure forms, proof of identity, tax information (such as IRS Form W-9), and detailed service descriptions. |

| 10 | Blockchain Timestamped Contract Version | Blockchain timestamped contract versions provide an immutable record verifying the exact creation and modification dates of independent contractor agreements in Texas, ensuring legal authenticity. Including these blockchain-verified documents alongside standard contract elements like scope of work, payment terms, and confidentiality clauses enhances compliance and dispute resolution capabilities. |

Introduction to Independent Contractor Agreements in Texas

Independent contractor agreements in Texas establish clear terms between businesses and contractors, defining the scope of work, payment, and responsibilities. Essential documents include the written agreement itself, proof of contractor status, and tax forms such as the W-9. These documents protect both parties and ensure compliance with Texas state regulations.

Importance of Required Documentation

Proper documentation is essential for Independent Contractor Agreements in Texas to ensure legal protection and clarity in the working relationship. Required documents include a signed contract, proof of contractor's business registration, and relevant tax forms such as the IRS Form W-9.

These documents establish the terms of service, payment structure, and tax responsibilities, preventing potential disputes and compliance issues. You must retain these records to verify contractor status and meet state and federal regulations effectively.

Identifying Parties Involved

Identifying the parties involved is a crucial step in drafting Independent Contractor Agreements in Texas. This includes clearly naming the contractor and the hiring company with their full legal names and addresses.

The agreement should specify the contractor's status as an independent entity rather than an employee. Precise identification helps prevent legal disputes and ensures both parties understand their roles and responsibilities.

Scope of Work and Deliverables

What documents are needed for independent contractor agreements in Texas? A detailed scope of work document is essential to define specific tasks and responsibilities. Clear deliverables must be outlined to ensure both parties understand the expected outcomes and deadlines.

Payment Terms and Compensation Structure

Independent contractor agreements in Texas require clear documentation of payment terms to avoid disputes. Specify the compensation structure, including whether payments are hourly, per project, or milestone-based. Outline payment schedules, methods, and any conditions for bonuses or reimbursements.

Tax and Withholding Requirements

For Independent Contractor Agreements in Texas, specific documents address critical tax and withholding requirements. These documents ensure compliance with federal and state tax obligations.

- IRS Form W-9 - Collects the contractor's Taxpayer Identification Number (TIN) for accurate tax reporting.

- Texas Workforce Commission Guidelines - Clarifies withholding rules and contractor classification.

- Form 1099-NEC - Used to report nonemployee compensation paid during the tax year to both the IRS and the contractor.

Confidentiality and Non-Disclosure Provisions

Independent contractor agreements in Texas must include specific documents to ensure legal compliance and protection of all parties involved. Confidentiality and non-disclosure provisions are essential components, safeguarding sensitive business information from unauthorized use or disclosure.

These provisions clearly define what information is considered confidential and outline the contractor's obligations to prevent its dissemination. Including detailed non-disclosure clauses helps protect trade secrets, client lists, and proprietary processes. Texas law supports enforcing these provisions, provided they are reasonable in scope and duration.

Intellectual Property Rights and Ownership

| Document | Description |

|---|---|

| Independent Contractor Agreement | This contract defines terms of the working relationship, including scope of work, payment, and intellectual property rights. It clearly states ownership of created materials and usage rights to avoid disputes. |

| Intellectual Property Assignment Clause | A specific clause or separate document that transfers ownership of all intellectual property created during the engagement to the hiring party. This ensures you retain full rights to inventions, designs, and creative works. |

| Confidentiality Agreement (NDA) | Protects proprietary information shared with the contractor. It restricts unauthorized use or disclosure of trade secrets and intellectual property both during and after the contract term. |

| Work-for-Hire Statement | Establishes that all deliverables are considered work-for-hire under Texas law, granting the hiring party immediate ownership of copyrights and related rights in all created content. |

| Invention Assignment Agreement | Used if the independent contractor develops patentable inventions. This agreement assigns patent rights and associated intellectual property generated within the contract period. |

Termination Clauses and Dispute Resolution

Independent contractor agreements in Texas require clear termination clauses and dispute resolution provisions to protect both parties and ensure legal compliance. These documents define the conditions under which the agreement can end and the method for resolving conflicts.

- Termination Clauses - Specify the conditions, notice period, and obligations required to end the contract legally in Texas.

- Dispute Resolution - Outline mediation, arbitration, or litigation processes to resolve disagreements efficiently and cost-effectively.

- Legal Compliance - Ensure your agreement adheres to Texas state laws governing independent contractor relationships and protects your business interests.

What Documents Are Needed for Independent Contractor Agreements in Texas? Infographic