A loan agreement between individuals requires clear documentation to ensure legality and mutual understanding, including a written contract outlining the loan amount, interest rate, repayment schedule, and signatures of both parties. Identification documents such as government-issued IDs help verify the identities of the lender and borrower. Supporting documents like proof of income, collateral details, and witness statements can strengthen the agreement and safeguard both parties' interests.

What Documents Are Required for a Loan Agreement Between Individuals?

| Number | Name | Description |

|---|---|---|

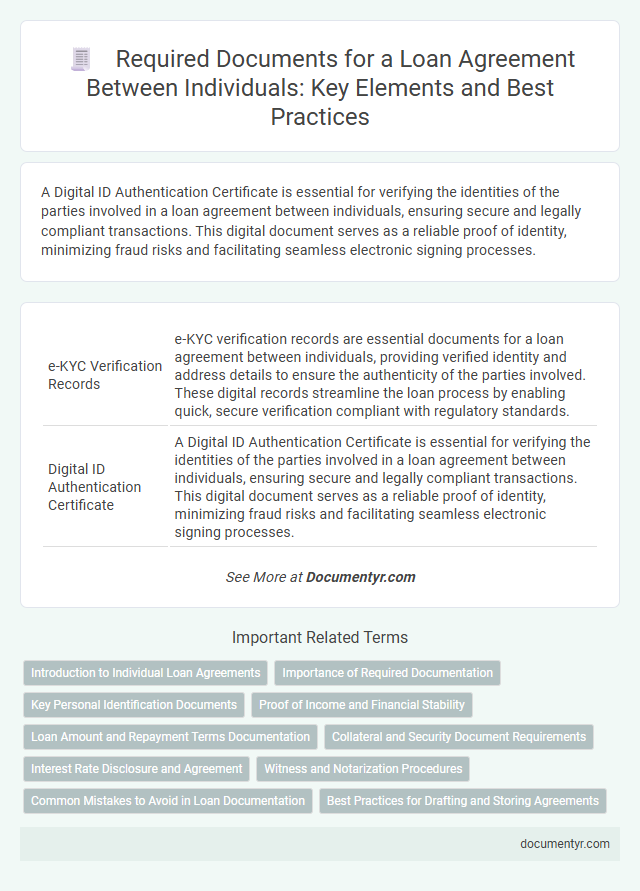

| 1 | e-KYC Verification Records | e-KYC verification records are essential documents for a loan agreement between individuals, providing verified identity and address details to ensure the authenticity of the parties involved. These digital records streamline the loan process by enabling quick, secure verification compliant with regulatory standards. |

| 2 | Digital ID Authentication Certificate | A Digital ID Authentication Certificate is essential for verifying the identities of the parties involved in a loan agreement between individuals, ensuring secure and legally compliant transactions. This digital document serves as a reliable proof of identity, minimizing fraud risks and facilitating seamless electronic signing processes. |

| 3 | Blockchain Timestamped Agreement | A loan agreement between individuals typically requires a signed contract detailing the loan amount, interest rate, repayment terms, and borrower and lender identities, with additional proof of identity such as government-issued IDs. Utilizing blockchain timestamped agreements enhances security and authenticity by providing an immutable, verifiable record of the contract's creation and any subsequent modifications. |

| 4 | e-Stamp Duty Receipt | The e-Stamp Duty Receipt serves as a critical legal document in a loan agreement between individuals, ensuring the transaction is officially recorded and validated under the Stamp Act. This receipt confirms payment of the required stamp duty, which varies by state, thereby strengthening the enforceability of the loan agreement in courts. |

| 5 | UPI Transaction Trail Statement | A UPI transaction trail statement serves as crucial evidence of fund transfers between individuals in a loan agreement, providing transparent proof of payment history and loan servicing. This document helps validate repayment schedules and supports the enforceability of the loan contract by confirming the financial transactions through secure digital records. |

| 6 | Crypto-collateral Valuation Report | A Crypto-collateral Valuation Report is essential in a loan agreement between individuals to accurately determine the current market value and volatility of the digital assets offered as collateral. This document ensures transparency and helps mitigate risks by providing an expert assessment of the crypto-assets' worth at the time of the loan agreement. |

| 7 | E-signature Audit Log | An E-signature audit log is a crucial document in a loan agreement between individuals, providing a detailed electronic record of the signing process, including date, time, and IP address of each signatory. This audit trail ensures the authenticity and enforceability of the agreement by verifying the identity of parties and capturing consent in compliance with legal standards. |

| 8 | Aadhaar-Linked Consent Declaration | Aadhaar-linked consent declaration is essential for verifying the identity of both parties in a loan agreement between individuals, ensuring the authenticity and legal compliance of the contract. This document facilitates secure access to biometric and demographic data tied to Aadhaar, preventing fraud and enabling efficient processing of the loan agreement. |

| 9 | Remote Notarization Proof | A loan agreement between individuals requires identification documents and a signed contract, with remote notarization proof including a notarized video recording or digital certificate verifying the signer's identity and authenticity of the agreement. Utilizing blockchain or secure electronic notary platforms enhances the legal enforceability and transparency of remote notarization in personal loan contracts. |

| 10 | Smart Contract Hash Reference | A loan agreement between individuals requires identification documents, proof of address, loan amount details, and terms of repayment, with the Smart Contract Hash Reference ensuring the agreement's authenticity and immutability on the blockchain. The Smart Contract Hash acts as a unique digital fingerprint, enabling secure verification and traceability of the loan terms without the need for intermediaries. |

Introduction to Individual Loan Agreements

An individual loan agreement is a formal contract between two parties outlining the terms of a personal loan. This agreement helps prevent misunderstandings by clearly defining repayment schedules and loan amounts.

Specific documents are essential to validate and enforce the loan agreement between individuals. These documents provide legal protection and ensure transparency throughout the loan process.

Importance of Required Documentation

Documents required for a loan agreement between individuals ensure clarity and legal protection for both parties. Essential paperwork includes identification, loan terms, repayment schedule, and signatures to validate the agreement.

Proper documentation minimizes disputes by clearly outlining obligations and expectations. Your thorough preparation of required documents strengthens credibility and enforces accountability in the loan process.

Key Personal Identification Documents

Securing a loan agreement between individuals requires essential documentation to verify the identities of all parties involved. Key personal identification documents ensure the legitimacy and enforceability of the agreement.

- Government-issued ID - A valid passport, driver's license, or national ID card confirms the borrower's and lender's identities.

- Proof of Address - Utility bills or bank statements validate the residential address linked to the individuals, helping prevent fraud.

- Social Security Number or National Identification Number - This unique identifier distinguishes individuals in legal and financial records.

Proof of Income and Financial Stability

Loan agreements between individuals require specific documents to verify financial reliability. Proof of income and financial stability are essential to ensure the lender's confidence in repayment ability.

- Proof of Income - This typically includes recent pay stubs, tax returns, or bank statements showing consistent earnings.

- Financial Stability Documents - Credit reports or statements of assets demonstrate your ability to manage debt responsibly.

- Loan Agreement Form - A written contract outlining terms, repayment schedules, and obligations solidifies the agreement legally.

Loan Amount and Repayment Terms Documentation

A loan agreement between individuals requires clear documentation of the loan amount and repayment terms. Precise figures and schedules ensure mutual understanding and legal enforceability.

Loan amount documentation should include the principal sum, specifying currency and payment method. Repayment terms must outline the installment schedule, interest rates if applicable, and any late payment penalties. These details protect both lender and borrower by providing a transparent financial framework.

Collateral and Security Document Requirements

When drafting a loan agreement between individuals, specifying collateral is essential for securing the loan. You must provide security documents such as a mortgage deed, vehicle title, or lien agreement to establish ownership rights over the pledged assets. Clear documentation ensures legal protection and enforces repayment terms effectively.

Interest Rate Disclosure and Agreement

Loan agreements between individuals require specific documents to ensure clarity and legal compliance. Interest rate disclosure and a clear agreement are crucial components to protect both parties.

- Promissory Note - This document outlines the loan amount, repayment schedule, and interest rate in detail.

- Interest Rate Disclosure - A statement that clearly specifies the agreed-upon interest rate to avoid misunderstandings.

- Signed Loan Agreement - A formal contract signed by both parties confirming the loan terms and conditions.

You must keep these documents to safeguard your financial transaction and ensure enforceability.

Witness and Notarization Procedures

| Document | Description | Purpose | Details on Witness and Notarization |

|---|---|---|---|

| Loan Agreement | Written contract outlining the terms between lender and borrower | Defines loan amount, interest rate, repayment schedule, and obligations | Must be signed by both parties in the presence of a witness; ensures clear consent |

| Witness Statement | Document recording the presence and verification of signatures | Confirms the authenticity of the agreement by neutral third party | Witness signs the loan agreement or a separate attestation confirming the signing event |

| Notarization Certificate | Official acknowledgment by a licensed notary public | Provides legal validation and prevents future disputes | Notary verifies identities of parties, witnesses signing, and affixes seal to the document |

| ID Proofs of Parties | Government-issued identification for lender and borrower | Confirms identity and capacity to enter the agreement | Verified in presence of witness or during notarization; essential for record accuracy |

| Repayment Schedule | Detailed timeline of loan repayments | Outlines deadlines and amounts owed by borrower | Signed and witnessed along with the loan agreement to reinforce compliance |

Common Mistakes to Avoid in Loan Documentation

Loan agreements between individuals require key documents such as a signed contract, proof of identity, and details of the loan amount and repayment terms. Common mistakes to avoid include vague language, missing signatures, and lack of a repayment schedule, which can lead to disputes. Ensuring clarity and completeness in documentation protects both parties legally and financially.

What Documents Are Required for a Loan Agreement Between Individuals? Infographic