Essential documents for partnership dissolution agreements include the original partnership agreement, financial statements, and a detailed dissolution plan outlining asset distribution and liabilities. A comprehensive agreement should also include release forms to waive future claims and any required state filings to officially terminate the partnership. Proper documentation ensures legal compliance and helps prevent disputes during the dissolution process.

What Documents are Essential for Partnership Dissolution Agreements?

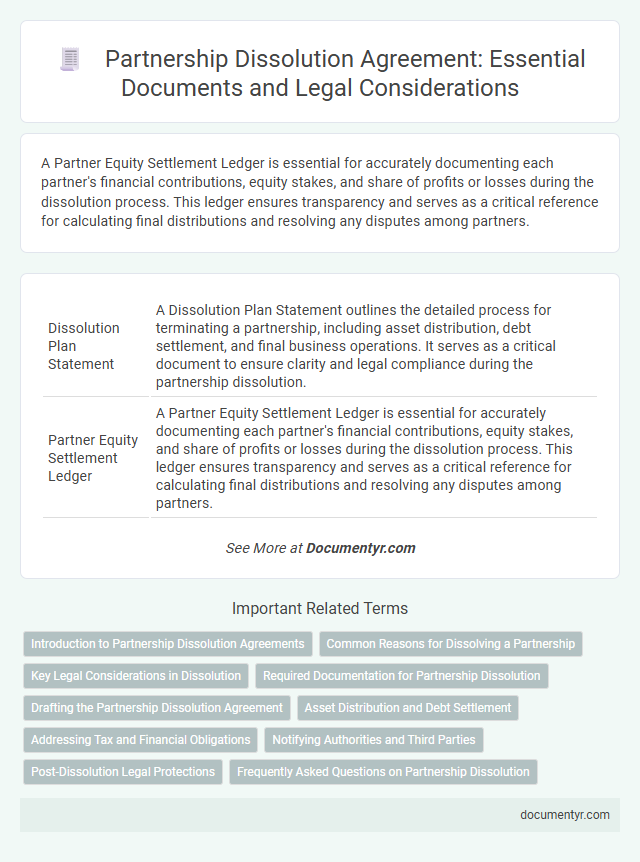

| Number | Name | Description |

|---|---|---|

| 1 | Dissolution Plan Statement | A Dissolution Plan Statement outlines the detailed process for terminating a partnership, including asset distribution, debt settlement, and final business operations. It serves as a critical document to ensure clarity and legal compliance during the partnership dissolution. |

| 2 | Partner Equity Settlement Ledger | A Partner Equity Settlement Ledger is essential for accurately documenting each partner's financial contributions, equity stakes, and share of profits or losses during the dissolution process. This ledger ensures transparency and serves as a critical reference for calculating final distributions and resolving any disputes among partners. |

| 3 | Exit Consents Affidavit | Exit Consents Affidavit is a crucial document in partnership dissolution agreements, serving to confirm that all partners have agreed to the terms of exit and release of claims. This affidavit ensures legal clarity by providing a sworn statement that the departing partner consents to the dissolution terms, protecting all parties involved from future disputes. |

| 4 | Intellectual Property Division Addendum | The Intellectual Property Division Addendum is essential in partnership dissolution agreements to clearly outline the ownership, rights, and use of patents, copyrights, trademarks, and trade secrets. This document prevents future disputes by specifying how intellectual property assets are divided and managed post-dissolution. |

| 5 | Non-Compete Waiver Memorandum | A Non-Compete Waiver Memorandum is essential in partnership dissolution agreements as it explicitly releases former partners from restrictions preventing them from engaging in similar business activities, thereby facilitating smoother transitions and protecting individual business interests. This document must clearly outline the scope, duration, and geographic limitations waived to prevent future disputes and ensure mutual understanding. |

| 6 | Digital Asset Distribution Schedule | A Digital Asset Distribution Schedule is crucial in partnership dissolution agreements as it clearly itemizes all digital assets, including cryptocurrencies, domain names, social media accounts, and intellectual property rights, ensuring equitable division among partners. This document prevents disputes by specifying transfer methods, ownership percentages, and deadlines for digital asset handover. |

| 7 | Final Tax Allocation Worksheet | The Final Tax Allocation Worksheet is essential for partnership dissolution agreements as it details the precise distribution of income, deductions, and credits among partners, ensuring accurate tax reporting and compliance with IRS regulations. This document helps prevent disputes by clearly outlining each partner's tax responsibilities during the winding-up process. |

| 8 | ESG (Environmental, Social, Governance) Dissolution Disclosure | Partnership dissolution agreements must include comprehensive ESG dissolution disclosure documents detailing environmental impact assessments, social responsibility compliance records, and governance audit reports to ensure transparency and regulatory adherence. These critical documents facilitate the equitable division of assets and liabilities while addressing ongoing ESG obligations and potential risks. |

| 9 | Cyber Liability Release Certificate | A Cyber Liability Release Certificate is essential in partnership dissolution agreements to mitigate risks related to cyber threats and data breaches, ensuring that all parties are legally protected against potential cyber liabilities incurred during or after the partnership. Including this certificate confirms that the partnership has addressed cybersecurity responsibilities, safeguarding sensitive information and reducing future legal exposure. |

| 10 | E-signature Audit Trail Record | A crucial document for partnership dissolution agreements is the E-signature audit trail record, which provides a secure and verifiable history of all digital signatures and signing events. This audit trail ensures the authenticity and integrity of the agreement, preventing disputes and supporting compliance with legal standards. |

Introduction to Partnership Dissolution Agreements

Understanding the essential documents for partnership dissolution agreements is crucial for a smooth and legal separation process. These agreements outline the terms and conditions for ending a business partnership effectively.

Partnership dissolution agreements typically include the original partnership agreement, financial statements, and a detailed dissolution plan. You must gather records of assets, liabilities, and any outstanding obligations to ensure transparency. Proper documentation protects all parties involved and helps avoid future disputes.

Common Reasons for Dissolving a Partnership

Partnership dissolution agreements require essential documents such as the original partnership agreement, financial statements, and a formal dissolution notice. Common reasons for dissolving a partnership include conflicts between partners, financial difficulties, and changes in business goals or market conditions. Proper documentation ensures a smooth legal process and clear resolution of responsibilities and asset distribution.

Key Legal Considerations in Dissolution

When dissolving a partnership, certain documents are crucial to ensure the process is legally sound and clear. Understanding the key legal considerations helps protect your interests and prevents future disputes.

- Partnership Agreement - This foundational document outlines the terms of dissolution and asset division agreed upon by all partners.

- Financial Statements - Recent and accurate financial records are necessary to determine each partner's share of liabilities and assets.

- Dissolution Agreement - A formal contract signed by all partners detailing the terms, responsibilities, and timelines for ending the partnership.

Required Documentation for Partnership Dissolution

| Document Type | Description | Importance |

|---|---|---|

| Partnership Dissolution Agreement | A formal legal document outlining the terms, conditions, and responsibilities of each partner during the dissolution process. | Essential for legally terminating the partnership and avoiding future disputes. |

| Final Financial Statements | Includes balance sheets, income statements, and cash flow reports prepared at the time of dissolution. | Critical for accurately assessing the financial position and distributing assets and liabilities. |

| Asset Distribution Records | Documentation detailing how partnership assets are divided among partners. | Ensures clear and equitable allocation of property and resources. |

| Debt Settlement Proof | Records of payment or agreement regarding partnership debts settled during dissolution. | Prevents unresolved liabilities and protects partners from future claims. |

| Notification of Dissolution | Official notices sent to creditors, clients, and government agencies about the partnership's termination. | Required for legal compliance and transparency. |

| Tax Clearance Certificates | Documents confirming all partnership tax obligations have been met. | Necessary to avoid penalties and finalize tax responsibilities with authorities. |

| Amendments to Registration Documents | Updated business registration forms filed with state or local authorities reflecting the dissolution. | Mandatory for official records and legal recognition of the terminated partnership. |

Drafting the Partnership Dissolution Agreement

Drafting the partnership dissolution agreement requires careful consideration of all essential documents to ensure clarity and legal compliance. Key documents include the original partnership agreement, financial statements, and any prior amendments or addendums related to the partnership.

Clear identification of asset division, debt responsibilities, and any ongoing obligations must be detailed in the agreement. You should also include mutual releases and confidentiality clauses to protect all parties after the dissolution is finalized.

Asset Distribution and Debt Settlement

Partnership dissolution agreements must include key documents that address asset distribution and debt settlement to ensure a smooth termination process. Proper documentation protects all parties' rights and clarifies financial responsibilities.

- Asset Inventory Report - This document lists all partnership assets, providing a clear basis for equitable distribution among partners.

- Debt Settlement Agreement - Details the allocation and repayment plan for existing partnership debts to prevent future liabilities.

- Final Partnership Accounting - Summarizes all financial transactions up to dissolution, ensuring transparency in asset division and debt obligations.

Addressing Tax and Financial Obligations

What documents are essential for partnership dissolution agreements to address tax and financial obligations? Comprehensive financial statements and detailed tax returns are critical to ensure all liabilities are accounted for. Proper documentation helps clarify each partner's obligations and prevent future disputes.

Notifying Authorities and Third Parties

Essential documents for partnership dissolution agreements include the formal dissolution agreement and notification letters. These documents must clearly outline the terms of dissolution and the distribution of assets and liabilities.

Notifying relevant authorities such as tax agencies and business registries is crucial to legally formalize the dissolution. Informing third parties like clients, suppliers, and creditors ensures transparency and helps manage ongoing obligations effectively.

Post-Dissolution Legal Protections

Partnership dissolution agreements require specific documents to ensure clear post-dissolution legal protections. These documents safeguard the rights and obligations of all parties involved after the dissolution.

- Dissolution Agreement - This primary document outlines the terms of ending the partnership and asset distribution.

- Release of Claims - Protects partners by preventing future legal disputes over partnership matters.

- Non-Compete Clause - Restricts partners from engaging in competing businesses, preserving business interests.

Properly prepared documents are essential for mitigating risks and ensuring smooth transitions after partnership dissolution.

What Documents are Essential for Partnership Dissolution Agreements? Infographic