Necessary documents to create a partnership agreement include identification proofs of all partners, a detailed business plan outlining roles and responsibilities, and financial contributions made by each partner. A written draft of the partnership agreement specifying terms like profit sharing, dispute resolution, and duration must also be prepared. Official registrations, such as business licenses and tax identification numbers, are required to validate the partnership legally.

What Documents are Necessary to Create a Partnership Agreement?

| Number | Name | Description |

|---|---|---|

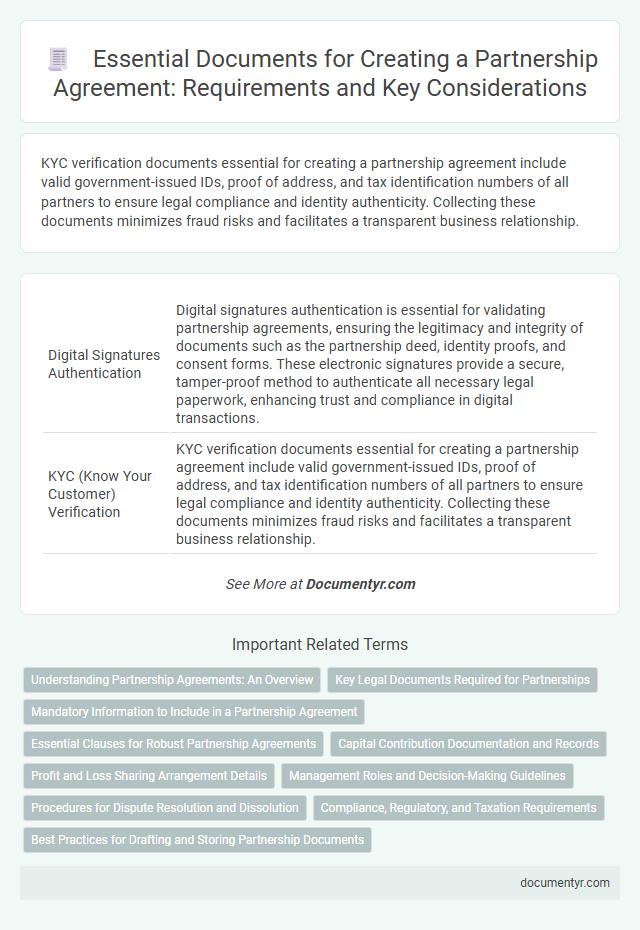

| 1 | Digital Signatures Authentication | Digital signatures authentication is essential for validating partnership agreements, ensuring the legitimacy and integrity of documents such as the partnership deed, identity proofs, and consent forms. These electronic signatures provide a secure, tamper-proof method to authenticate all necessary legal paperwork, enhancing trust and compliance in digital transactions. |

| 2 | KYC (Know Your Customer) Verification | KYC verification documents essential for creating a partnership agreement include valid government-issued IDs, proof of address, and tax identification numbers of all partners to ensure legal compliance and identity authenticity. Collecting these documents minimizes fraud risks and facilitates a transparent business relationship. |

| 3 | Blockchain-Stamped Agreement | A Blockchain-stamped partnership agreement requires essential documents including the partnership deed, identification proofs of all partners, and the proof of capital contribution, all digitized and securely recorded on the blockchain ledger. This ensures tamper-proof verification, immutable timestamping, and enhanced transparency for legal and operational compliance. |

| 4 | E-Governance Filings | Creating a partnership agreement requires essential documents such as the partnership deed, identity proofs of all partners, and address proofs, which must be submitted through e-governance portals like the Ministry of Corporate Affairs (MCA) for digital filing. Electronic signatures and digital certificates are mandatory for validating the agreement, ensuring compliance with regulatory frameworks and enabling seamless online registration. |

| 5 | ESG (Environmental, Social, and Governance) Disclosures | Essential documents for creating a partnership agreement with ESG disclosures include a detailed environmental impact assessment, social responsibility policies, and governance frameworks outlining roles, accountability, and ethical standards. Incorporating sustainability reports, stakeholder engagement records, and compliance certificates ensures transparency and alignment with regulatory ESG requirements. |

| 6 | Beneficial Ownership Declaration | A Beneficial Ownership Declaration is essential in creating a partnership agreement as it discloses the identities of individuals who ultimately own or control the partnership, ensuring transparency and compliance with legal regulations. This document helps prevent fraud and facilitates due diligence by clearly outlining each partner's ownership stake and control rights. |

| 7 | AI-Generated Cap Table | A partnership agreement requires key documents including the AI-generated cap table, which provides an accurate ownership structure and equity distribution of partners. This digital cap table enhances transparency and precision, essential for preventing disputes and aligning stakeholder interests. |

| 8 | Data Processing Addendum (DPA) | A Data Processing Addendum (DPA) is essential in a partnership agreement to ensure compliance with data protection regulations such as GDPR, clearly outlining each party's responsibilities for handling personal data. This document specifies data processing terms, security measures, breach notification protocols, and data subject rights to mitigate legal risks and establish accountability between partners. |

| 9 | Cross-Jurisdiction Compliance Certificate | A Cross-Jurisdiction Compliance Certificate is essential to ensure the partnership agreement adheres to legal requirements across different regions or countries, confirming that all parties comply with local regulations. This document helps prevent disputes by verifying that the business operations meet the statutory standards in each relevant jurisdiction. |

| 10 | IP Rights Allocation Schedule | A comprehensive Partnership Agreement requires an IP Rights Allocation Schedule to clearly define the ownership, usage, and management of intellectual property generated during the partnership. This document ensures all parties understand their rights and responsibilities regarding patents, trademarks, copyrights, and trade secrets, preventing potential disputes. |

Understanding Partnership Agreements: An Overview

Creating a partnership agreement requires specific documents to ensure clarity and legal protection for all parties involved. Understanding the essential documents helps streamline the formulation of a comprehensive partnership agreement.

- Partnership Deed - This primary document outlines the roles, responsibilities, profit-sharing, and management of the partnership.

- Identity Proofs of Partners - Valid identification documents verify the identities of all individuals entering the partnership.

- Business License and Registration - Official licenses and registration certificates legitimize the partnership and allow it to operate legally.

Key Legal Documents Required for Partnerships

What documents are necessary to create a partnership agreement? Key legal documents required for partnerships include the Partnership Agreement itself, which outlines the roles, responsibilities, and profit-sharing ratios of each partner. Other essential documents may include a Business Registration Certificate and Tax Identification Number to ensure legal compliance.

Mandatory Information to Include in a Partnership Agreement

Creating a partnership agreement requires certain mandatory documents to ensure clarity and legal validity. Essential information includes the names of all partners, the business purpose, and each partner's capital contribution. You must also detail profit-sharing ratios, decision-making authority, and dispute resolution procedures.

Essential Clauses for Robust Partnership Agreements

Creating a partnership agreement requires several key documents to ensure clarity and legal protection. The primary documents include the partnership deed, details of all partners, and a clear outline of contributions and profit sharing.

Essential clauses for a robust partnership agreement cover profit distribution, decision-making authority, and dispute resolution mechanisms. You must also include the duration of the partnership and procedures for adding or removing partners to avoid future conflicts.

Capital Contribution Documentation and Records

To create a partnership agreement, capital contribution documentation is essential to clearly define each partner's financial input. Accurate records must include detailed information on cash, property, and other assets contributed by each partner. Your thorough documentation helps prevent disputes and ensures transparency throughout the partnership.

Profit and Loss Sharing Arrangement Details

Creating a partnership agreement requires specific documents to clearly define the profit and loss sharing arrangement between partners. Accurate documentation ensures transparent financial responsibilities and equitable distribution of earnings and liabilities.

- Partnership Agreement Draft - Outlines the detailed terms and conditions governing profit and loss sharing among partners.

- Financial Contribution Records - Documents each partner's initial and ongoing financial input to calculate profit and loss distribution accurately.

- Tax Identification Information - Ensures correct reporting of income and losses as per each partner's share for tax compliance.

Properly documented profit and loss sharing arrangements protect partners' interests and support smooth business operations.

Management Roles and Decision-Making Guidelines

| Document Type | Purpose | Key Elements Related to Management Roles and Decision-Making |

|---|---|---|

| Partnership Agreement | Establishes the foundation and legal framework of the partnership | Specifies management roles, responsibilities, and authority of each partner; outlines decision-making procedures and voting rights |

| Management Structure Document | Defines the hierarchy and reporting relationships within the partnership | Details positions such as managing partner or committees; clarifies limits of authority and delegation of tasks |

| Decision-Making Policy | Guidelines for how decisions are made and conflicts resolved | Includes consensus requirements, voting thresholds, and processes for urgent or routine decisions |

| Roles and Responsibilities Matrix | Breaks down duties and accountability of each partner | Maps specific management functions to respective partners or teams, ensuring clarity in operations and control |

| Amendment Procedures Document | Outlines how the partnership agreement or management guidelines can be changed | Defines approval requirements, notice periods, and documentation needed to update management roles or decision-making processes |

| Conflict Resolution Agreement | Establishes methods for resolving disagreements among partners | Specifies mediation or arbitration procedures related to disputes over management roles or decisions |

Collecting these documents ensures your partnership agreement clearly addresses management roles and decision-making guidelines, promoting effective governance and reducing conflicts.

Procedures for Dispute Resolution and Dissolution

Creating a partnership agreement requires clear documentation of dispute resolution procedures to manage conflicts effectively. Essential documents include mediation and arbitration clauses that outline steps to resolve disagreements amicably.

Procedures for dissolution must detail the conditions and process for ending the partnership smoothly. Your agreement should specify asset division, debt settlement, and notification requirements to prevent future conflicts.

Compliance, Regulatory, and Taxation Requirements

Creating a partnership agreement requires careful attention to compliance, regulatory, and taxation documentation to ensure legality and operational clarity. Properly gathered documents help protect partners' interests and fulfill governmental obligations.

- Identification Documents - Legal identification for all partners is necessary to verify identities and establish official records.

- Tax Identification Numbers - Obtaining EINs or relevant tax IDs is essential for taxation reporting and compliance with IRS or local tax authorities.

- Compliance Certifications - Relevant licenses, permits, and regulatory approvals must be included to comply with industry-specific laws and local regulations.

What Documents are Necessary to Create a Partnership Agreement? Infographic