To create a business partnership agreement, essential documents include proof of identity for all partners, the partnership's business plan, and any licenses or permits required for operation. Legal documents such as the partnership deed detailing roles, contributions, profit sharing, and dispute resolution terms are crucial. Financial records and tax identification information help ensure compliance and smooth partnership management.

What Documents Are Needed to Create a Business Partnership Agreement?

| Number | Name | Description |

|---|---|---|

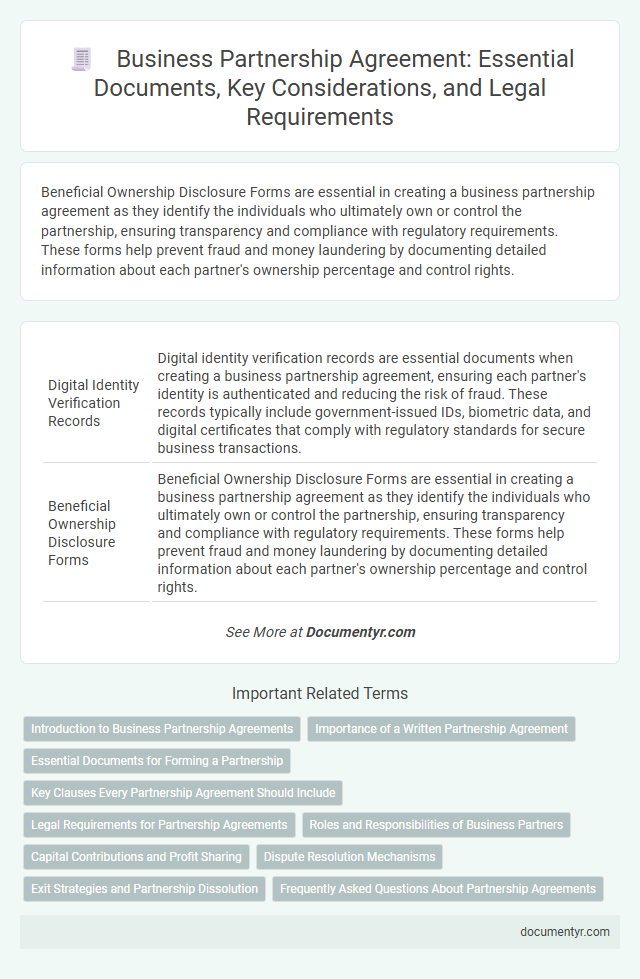

| 1 | Digital Identity Verification Records | Digital identity verification records are essential documents when creating a business partnership agreement, ensuring each partner's identity is authenticated and reducing the risk of fraud. These records typically include government-issued IDs, biometric data, and digital certificates that comply with regulatory standards for secure business transactions. |

| 2 | Beneficial Ownership Disclosure Forms | Beneficial Ownership Disclosure Forms are essential in creating a business partnership agreement as they identify the individuals who ultimately own or control the partnership, ensuring transparency and compliance with regulatory requirements. These forms help prevent fraud and money laundering by documenting detailed information about each partner's ownership percentage and control rights. |

| 3 | E-signature Compliance Certificates | E-signature compliance certificates, such as those adhering to eIDAS, ESIGN Act, or UETA standards, are essential documents to ensure the legal validity and enforceability of a business partnership agreement signed electronically. Including these certificates verifies the authentication, integrity, and non-repudiation of signatures, safeguarding the agreement against disputes. |

| 4 | Partnership Information Statement (PIS) | A Partnership Information Statement (PIS) is essential for creating a business partnership agreement as it outlines critical details such as partner names, capital contributions, profit-sharing ratios, and management responsibilities. This document ensures clarity and legal compliance, serving as a foundation for drafting a comprehensive and enforceable partnership agreement. |

| 5 | Capital Contribution Blockchain Ledger | A business partnership agreement requires detailed documentation of each partner's capital contribution, recorded transparently on a blockchain ledger to ensure immutability and real-time verification. This digital ledger securely tracks the assets, cash, or intellectual property each partner invests, providing a reliable foundation for dispute resolution and equitable profit distribution. |

| 6 | Data Privacy Consent Declarations | Data Privacy Consent Declarations are essential documents in a business partnership agreement to ensure that all parties comply with relevant data protection laws, such as GDPR or CCPA. These declarations outline how personal data will be collected, processed, stored, and shared, safeguarding partner and client information throughout the partnership. |

| 7 | Dynamic Profit-Sharing Protocol Addendums | Dynamic Profit-Sharing Protocol Addendums require detailed financial statements, initial partnership agreement drafts, and clearly defined revenue distribution metrics to ensure flexible and transparent profit allocation. These documents establish criteria for adjusting profit shares based on changing business performance, enhancing adaptability in the partnership agreement. |

| 8 | ESG (Environmental, Social, Governance) Clauses | Essential documents for creating a business partnership agreement with a focus on ESG clauses include the partnership deed, which explicitly incorporates environmental impact assessments, social responsibility commitments, and governance policies. Supplementary documentation such as ESG risk reports, stakeholder engagement records, and compliance certifications ensure alignment with sustainability standards and regulatory requirements. |

| 9 | Crypto Asset Integration Agreements | Essential documents for creating a business partnership agreement with crypto asset integration include a comprehensive partnership agreement outlining roles, profit-sharing, and decision-making authority, as well as a detailed crypto asset integration addendum specifying blockchain protocols, asset custody arrangements, and transaction validation processes. Legal compliance certificates, Know Your Customer (KYC) documents, and cybersecurity measures agreements are critical to ensure regulatory adherence and secure handling of digital assets. |

| 10 | Cross-border Regulatory Alignment Addenda | Creating a business partnership agreement with cross-border regulatory alignment addenda requires notarized identification documents, proof of business registration in each jurisdiction, and compliance certificates aligned with local and international trade laws. Legal opinions from cross-border regulatory experts and translated and apostilled agreements ensure enforceability and adherence to multinational compliance standards. |

Introduction to Business Partnership Agreements

A business partnership agreement is a legal document that defines the roles, responsibilities, and rights of each partner involved in a business venture. This agreement helps prevent conflicts by clearly outlining the terms of the partnership.

Creating a comprehensive partnership agreement requires specific documents that establish the foundation of the business relationship.

- Identification Documents - Personal identification such as passports or driver's licenses verifies the identities of all partners involved.

- Business Registration Papers - Official documents like the business registration certificate confirm the legal status of the partnership entity.

- Financial Records - Banking information and capital contribution details specify each partner's financial investment in the business.

Importance of a Written Partnership Agreement

A written partnership agreement outlines the roles, responsibilities, and financial contributions of each partner, providing a clear framework for the business. This document helps prevent conflicts by establishing guidelines for decision-making, profit sharing, and dispute resolution.

- Legal Validity - A written agreement ensures the partnership is legally recognized and enforceable in court if disputes arise.

- Clarity of Roles - Specifies each partner's duties and responsibilities, reducing confusion and potential conflicts.

- Financial Arrangements - Details profit distribution, capital contributions, and expense responsibilities to maintain financial transparency.

Essential Documents for Forming a Partnership

| Document | Description | Purpose |

|---|---|---|

| Partnership Agreement | Legal contract outlining roles, responsibilities, profit sharing, and decision-making processes. | Defines the terms of the partnership and protects all parties involved. |

| Business Registration Certificate | Official document issued by local or state government registering the partnership. | Legally establishes the partnership as a recognized business entity. |

| Federal Employer Identification Number (EIN) | Identification number issued by the IRS for tax purposes. | Used for tax filings, opening business bank accounts, and hiring employees. |

| Operating Agreement | Internal document detailing management structure, operational rules, and partner duties. | Clarifies the internal functioning and avoids future disputes. |

| Capital Contribution Records | Documents outlining the initial investments made by each partner. | Tracks ownership percentages and financial responsibilities. |

| Business Licenses and Permits | Required local, state, or federal permits depending on the business industry. | Ensures legal compliance for operating the partnership business. |

Key Clauses Every Partnership Agreement Should Include

Creating a business partnership agreement requires several important documents. These include identification of partners, business name registration, and a detailed outline of contributions and profit sharing.

Key clauses every partnership agreement should include are roles and responsibilities, decision-making processes, and dispute resolution methods. Clearly defining these elements protects Your interests and ensures smooth operation of the partnership.

Legal Requirements for Partnership Agreements

Creating a business partnership agreement requires specific legal documents to ensure the partnership is properly established and protected. Essential documents include the partnership deed, identification proofs of all partners, and any licenses relevant to the business activity.

Legal requirements vary by jurisdiction but typically mandate a written agreement outlining roles, profit distribution, and dispute resolution methods. You must also register the partnership with the appropriate government authority and obtain any required tax identification numbers.

Roles and Responsibilities of Business Partners

Creating a business partnership agreement requires specific documents that clearly define the roles and responsibilities of each partner. These documents establish the foundation for mutual understanding and legal protection.

The key documents include a detailed partnership agreement outlining each partner's duties, capital contributions, profit-sharing ratios, and decision-making authority. A comprehensive roles and responsibilities section helps prevent conflicts by specifying individual tasks and commitments. You must ensure all partners review and consent to these terms to maintain transparency and accountability.

Capital Contributions and Profit Sharing

What documents are needed to create a business partnership agreement focusing on capital contributions and profit sharing? A detailed statement of each partner's capital contributions is essential to outline the initial investment and ownership stakes clearly. A profit-sharing agreement document specifies how profits and losses will be distributed among the partners according to their contributions or agreed terms.

Dispute Resolution Mechanisms

Dispute resolution mechanisms are essential components of a business partnership agreement, outlining how conflicts will be managed. Key documents needed include a mediation and arbitration agreement, which specifies the procedures and governing rules for resolving disputes outside of court. Including these documents ensures clarity, reduces potential litigation costs, and preserves the partnership's operational stability.

Exit Strategies and Partnership Dissolution

Creating a business partnership agreement requires specific documents to address exit strategies and partnership dissolution effectively. These documents ensure clarity and protect all parties involved in case of withdrawal or termination.

- Partnership Agreement Draft - This document outlines the terms, roles, and responsibilities related to exit procedures and dissolution processes.

- Buy-Sell Agreement - Specifies how a partner's share is handled upon exit, including valuation methods and buyout terms.

- Dissolution Plan - Details the steps for orderly winding up of the partnership, allocation of assets, and liabilities settlement.

Having these documents in place facilitates smooth transitions and minimizes conflicts during exit or dissolution phases.

What Documents Are Needed to Create a Business Partnership Agreement? Infographic