A business needs key documents for a partnership agreement, including the partnership deed outlining roles, profit sharing, and decision-making processes. Essential records like identification proofs, business licenses, and financial statements help verify partners' credentials and protect interests. Drafting these documents clearly minimizes disputes and ensures smooth collaboration among partners.

What Documents Does a Business Need for a Partnership Agreement?

| Number | Name | Description |

|---|---|---|

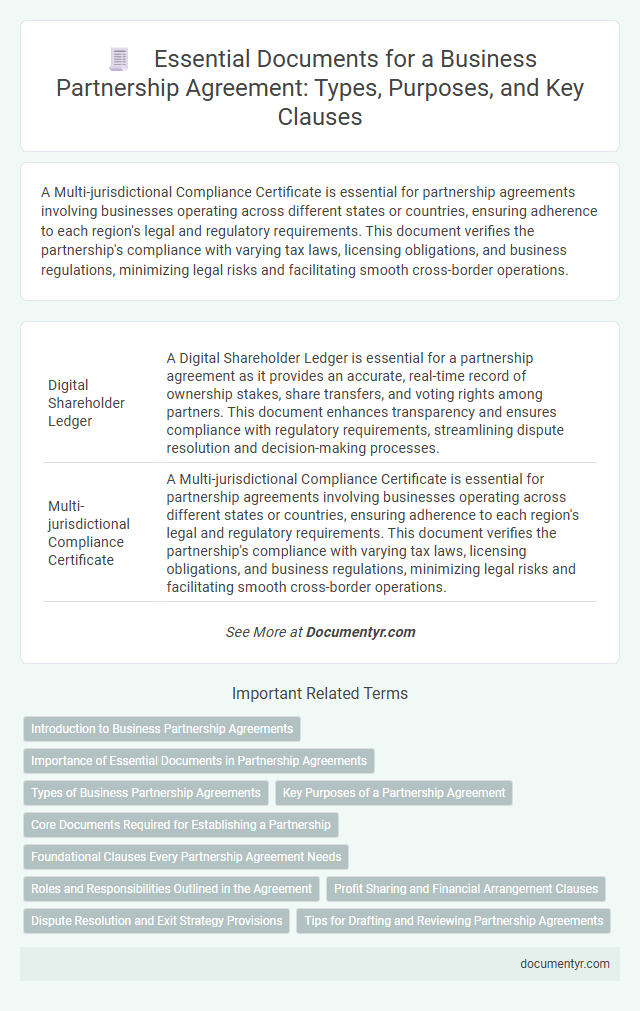

| 1 | Digital Shareholder Ledger | A Digital Shareholder Ledger is essential for a partnership agreement as it provides an accurate, real-time record of ownership stakes, share transfers, and voting rights among partners. This document enhances transparency and ensures compliance with regulatory requirements, streamlining dispute resolution and decision-making processes. |

| 2 | Multi-jurisdictional Compliance Certificate | A Multi-jurisdictional Compliance Certificate is essential for partnership agreements involving businesses operating across different states or countries, ensuring adherence to each region's legal and regulatory requirements. This document verifies the partnership's compliance with varying tax laws, licensing obligations, and business regulations, minimizing legal risks and facilitating smooth cross-border operations. |

| 3 | ESG (Environmental, Social, Governance) Disclosure Addendum | A business partnership agreement should include an ESG Disclosure Addendum to transparently outline each partner's commitments to environmental sustainability, social responsibility, and governance practices. This document ensures accountability and aligns partner roles with compliance standards relevant to ESG criteria, fostering long-term ethical and regulatory adherence. |

| 4 | Electronic Signature Audit Trail | A Business Partnership Agreement requires an Electronic Signature Audit Trail to ensure legal compliance and validate the authenticity of signatures by recording timestamps, IP addresses, and user actions. This audit trail enhances security and provides a reliable record for dispute resolution and regulatory verification. |

| 5 | Beneficial Ownership Statement | A Beneficial Ownership Statement is essential for a partnership agreement as it identifies the individuals who ultimately own or control the business, ensuring transparency and compliance with legal regulations. This document helps prevent fraud and facilitates due diligence by clarifying the true ownership structure within the partnership. |

| 6 | Data Processing Agreement (DPA) Annex | A Business Partnership Agreement must include a Data Processing Agreement (DPA) Annex to ensure compliance with data protection regulations like GDPR, outlining the responsibilities and liabilities related to the processing of personal data between partners. This annex details data security measures, processing scope, breach notification protocols, and rights of data subjects to safeguard sensitive information during the partnership. |

| 7 | Intellectual Property Assignment Schedule | A Business Partnership Agreement should include an Intellectual Property Assignment Schedule detailing ownership rights, usage permissions, and transfer conditions for trademarks, patents, copyrights, and trade secrets contributed by each partner. This schedule ensures clear intellectual property management, preventing disputes and protecting the business's valuable intangible assets. |

| 8 | Cross-border Tax Residency Declaration | A Cross-border Tax Residency Declaration is crucial in a partnership agreement to establish each partner's tax jurisdiction and avoid double taxation. This document ensures compliance with international tax laws and clarifies tax obligations across different countries involved in the partnership. |

| 9 | Founders’ Vesting Terms Protocol | A partnership agreement must include detailed founders' vesting terms protocol outlining the schedule, cliff period, and conditions under which equity vests to protect each partner's ownership interests. This protocol ensures alignment on equity distribution, incentivizes long-term commitment, and mitigates risks of premature departure or disputes among founders. |

| 10 | Blockchain Partnership Verification Record | A Blockchain Partnership Verification Record provides an immutable, transparent ledger essential for establishing and authenticating partnership agreements, ensuring all contractual documents such as the partnership deed, financial statements, and consent forms are securely recorded. This technology enhances trust by enabling real-time access and verification of partnership documents, reducing the risk of fraud and disputes in business collaborations. |

Introduction to Business Partnership Agreements

A business partnership agreement establishes the roles, responsibilities, and financial commitments between partners. It is essential to have specific documents to ensure clarity and legal protection for all parties involved.

- Partnership Agreement Document - This primary document outlines the terms, profit sharing, and decision-making processes between partners.

- Initial Capital Contribution Records - Documentation of each partner's investment helps define ownership percentages and financial stakes.

- Operating Agreement - Details the day-to-day management and operational procedures within the partnership structure.

Importance of Essential Documents in Partnership Agreements

Essential documents form the foundation of a partnership agreement, ensuring clarity and legal protection for all parties involved. These documents outline roles, responsibilities, profit sharing, and dispute resolution mechanisms.

Without properly drafted paperwork, misunderstandings and conflicts can arise, jeopardizing the partnership's success. Your partnership agreement should include key documents such as the partnership deed, financial statements, and confidentiality agreements to secure the business relationship.

Types of Business Partnership Agreements

When forming a business partnership, you need specific documents to establish clear terms and responsibilities. Types of business partnership agreements outline these details to protect all parties involved.

There are several types of partnership agreements, including general partnerships, limited partnerships, and limited liability partnerships. Each type defines the extent of liability and management roles of the partners. Your agreement should specify profit sharing, decision-making authority, and dispute resolution methods to ensure smooth operations.

Key Purposes of a Partnership Agreement

A partnership agreement outlines the key terms and conditions governing a business partnership. It defines roles, responsibilities, profit-sharing, and decision-making processes to prevent disputes. Essential documents for this agreement include the partnership deed, financial statements, and identification documents of all partners.

Core Documents Required for Establishing a Partnership

Establishing a partnership requires specific legal documents to ensure clarity and protect all parties involved. These core documents define the roles, responsibilities, and operational guidelines for the business partnership.

- Partnership Agreement - Outlines the terms, profit sharing, decision-making processes, and dispute resolution methods for the partners.

- Business License and Permits - Confirms the legal authorization to operate the partnership within a specific jurisdiction and industry.

- Initial Capital Contribution Records - Documents each partner's financial investment or assets contributed to start the business.

Foundational Clauses Every Partnership Agreement Needs

| Foundational Clause | Description | Importance |

|---|---|---|

| Partnership Name and Purpose | Specifies the official business name and clearly defines the primary activities and objectives of the partnership. | Establishes the identity and scope of the partnership's operations, ensuring alignment among partners. |

| Capital Contributions | Details the amount and type of assets or cash each partner contributes to the partnership. | Clarifies each partner's financial investment and ownership percentage, preventing disputes over equity. |

| Profit and Loss Distribution | Defines how profits and losses will be shared among the partners, typically in proportion to their contributions. | Ensures fair allocation of financial results and mitigates conflicts regarding income distribution. |

| Management and Decision-Making | Outlines roles, responsibilities, and voting rights for managing daily operations and strategic decisions. | Facilitates smooth governance and operational clarity among partners. |

| Duration and Termination | Specifies the length of the partnership and conditions under which it may be ended or dissolved. | Provides clear guidelines for the partnership lifecycle and exit strategies. |

| Dispute Resolution | Establishes procedures for resolving conflicts, such as mediation or arbitration methods. | Reduces legal risks and promotes amicable resolutions between partners. |

| Withdrawal or Addition of Partners | Describes the process for admitting new partners or handling partner withdrawal or expulsion. | Maintains partnership stability and controls changes in ownership structure. |

| Confidentiality and Non-Compete | Imposes obligations to protect sensitive business information and restrict competing activities. | Safeguards business interests and competitive advantage. |

Roles and Responsibilities Outlined in the Agreement

A comprehensive partnership agreement must include documents that clearly outline the roles and responsibilities of each partner. These documents define decision-making authority, financial contributions, profit sharing, and individual duties. Detailed role descriptions help prevent conflicts and ensure smooth business operations within the partnership.

Profit Sharing and Financial Arrangement Clauses

A business partnership agreement requires specific documents, including the profit-sharing and financial arrangement clauses that define the distribution of earnings among partners. These clauses clarify each partner's financial contributions, roles, and share of the profits to prevent disputes.

Profit-sharing terms outline how net income or losses are allocated, often based on ownership percentages or agreed ratios. Financial arrangement clauses cover capital investments, expense responsibilities, and mechanisms for handling additional funding or debt within the partnership.

Dispute Resolution and Exit Strategy Provisions

Creating a comprehensive partnership agreement requires specific documents that address key aspects such as dispute resolution and exit strategy provisions. These documents protect the interests of all partners and provide clear guidelines for handling conflicts and business dissolution.

- Dispute Resolution Clause - Outlines the methods for resolving disagreements, including mediation or arbitration, to avoid costly court battles.

- Exit Strategy Agreement - Defines the terms for a partner's departure, including buyout options and valuation methods to ensure a smooth transition.

- Amendment Records - Documents any changes to the agreement, ensuring all partners agree on updates related to dispute or exit procedures.

Your partnership agreement will be stronger and more enforceable with these key documents included.

What Documents Does a Business Need for a Partnership Agreement? Infographic