A loan agreement typically includes documents such as the promissory note outlining the loan amount, interest rate, and repayment schedule, the security agreement detailing any collateral pledged, and disclosures related to fees and borrower rights. It may also incorporate guarantor agreements, terms of default, and conditions for loan modification or prepayment. These documents collectively ensure clarity on the obligations and protections for both lender and borrower throughout the loan term.

What Documents Does a Loan Agreement Typically Include?

| Number | Name | Description |

|---|---|---|

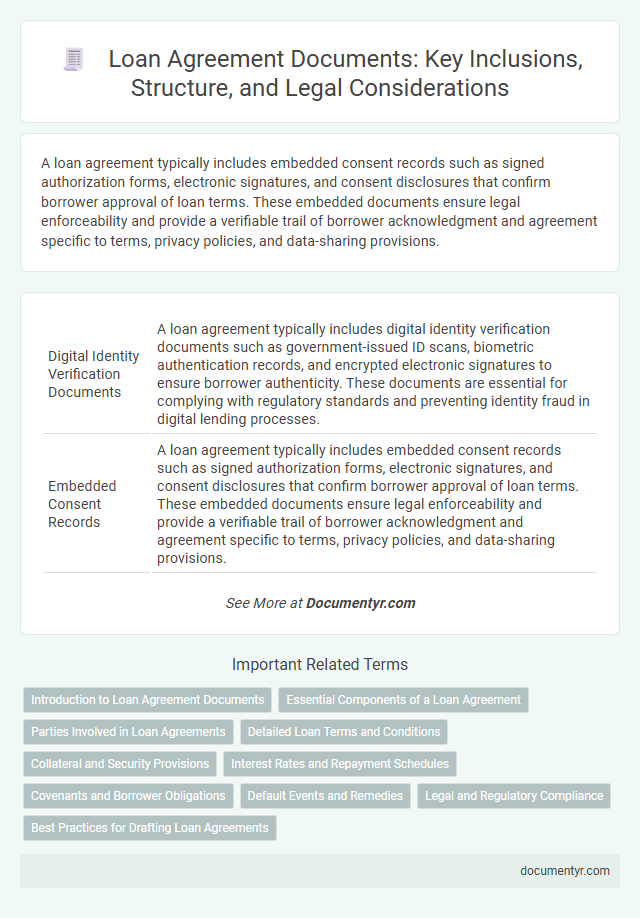

| 1 | Digital Identity Verification Documents | A loan agreement typically includes digital identity verification documents such as government-issued ID scans, biometric authentication records, and encrypted electronic signatures to ensure borrower authenticity. These documents are essential for complying with regulatory standards and preventing identity fraud in digital lending processes. |

| 2 | Embedded Consent Records | A loan agreement typically includes embedded consent records such as signed authorization forms, electronic signatures, and consent disclosures that confirm borrower approval of loan terms. These embedded documents ensure legal enforceability and provide a verifiable trail of borrower acknowledgment and agreement specific to terms, privacy policies, and data-sharing provisions. |

| 3 | Smart Contract Appendices | A Loan Agreement typically includes Smart Contract Appendices that detail the blockchain-based automation protocols, specifying terms such as repayment schedules, interest calculations, and default triggers coded into the smart contract. These appendices enhance transparency, enforceability, and real-time execution of loan conditions by integrating digital asset management and immutable record-keeping. |

| 4 | Electronic Fund Disbursement Schedule | A Loan Agreement typically includes an Electronic Fund Disbursement Schedule outlining the timing, amounts, and conditions for electronic transfers to ensure precise and secure fund allocation. This schedule facilitates transparency and compliance by detailing each disbursement milestone tied to loan terms and project progress. |

| 5 | Real-time Creditworthiness Snapshots | A loan agreement typically includes real-time creditworthiness snapshots that provide lenders with up-to-date financial information and risk assessments of the borrower, ensuring continuous evaluation throughout the loan term. These documents integrate dynamic credit reports, automated payment histories, and real-time debt-to-income ratios to support informed lending decisions and mitigate default risks. |

| 6 | e-KYC (Electronic Know Your Customer) Files | A loan agreement typically includes e-KYC (Electronic Know Your Customer) files, such as digital identity verification documents, proof of address, and biometric authentication records, ensuring compliance with regulatory requirements. These e-KYC files facilitate secure borrower identification and streamline the loan approval process by providing authenticated digital records. |

| 7 | Blockchain-backed Collateral Registry | A loan agreement typically includes documents such as the principal loan contract, promissory note, security agreement, and a Blockchain-backed collateral registry that records asset ownership and lien details securely and transparently. The Blockchain-backed collateral registry enhances trust and reduces fraud by providing an immutable, timestamped record of pledged assets linked to the loan agreement. |

| 8 | Pandemic Impact Disclosures | A loan agreement typically includes pandemic impact disclosures detailing potential risks to borrower's financial stability and lender's recovery options during health crises. These documents outline force majeure clauses, government relief measures, and covenants related to operational disruptions caused by pandemics. |

| 9 | ESG (Environmental, Social, Governance) Compliance Certificates | A loan agreement typically includes ESG Compliance Certificates to ensure that borrowers meet environmental, social, and governance standards, reflecting the lender's commitment to sustainable and responsible financing. These documents verify adherence to regulatory requirements and industry best practices, mitigating risks related to environmental impact, social responsibility, and corporate governance. |

| 10 | Open Banking Data Sharing Authorizations | A loan agreement typically includes Open Banking Data Sharing Authorizations that allow lenders to securely access a borrower's financial data from various banks and financial institutions, facilitating accurate credit assessment and risk evaluation. These authorizations are critical for enabling real-time financial data aggregation, supporting transparent loan underwriting and monitoring processes. |

Introduction to Loan Agreement Documents

A loan agreement is a formal contract outlining the terms and conditions of a loan between a lender and a borrower. It includes essential documents that detail the loan amount, interest rate, repayment schedule, and obligations of both parties. Understanding these documents is crucial for ensuring clear communication and legal protection throughout the loan process.

Essential Components of a Loan Agreement

| Component | Description |

|---|---|

| Loan Amount | Specifies the principal sum of money being lent from the lender to the borrower. |

| Interest Rate | Defines the percentage charged on the outstanding loan amount, detailing fixed or variable terms. |

| Repayment Schedule | Outlines the timeline and method for repayment, including installment amounts and due dates. |

| Loan Term | States the duration over which the loan must be fully repaid. |

| Collateral | Details any assets pledged as security for the loan, specifying conditions for seizure in default. |

| Default Terms | Describes circumstances considered as default and the resulting penalties or remedies available to the lender. |

| Governing Law | Specifies the jurisdiction and legal framework governing the agreement's enforcement. |

| Signatures | Includes signatures of both lender and borrower, indicating agreement to terms and legal binding. |

Parties Involved in Loan Agreements

What parties are typically involved in a loan agreement? The primary parties in a loan agreement include the lender, who provides the funds, and the borrower, who receives the loan. Sometimes, guarantors or co-signers may also be included to secure the loan obligations.

Detailed Loan Terms and Conditions

A loan agreement typically includes detailed loan terms and conditions that clearly outline the responsibilities of both the lender and borrower. These terms specify the principal amount, interest rate, repayment schedule, and any fees associated with the loan.

Additional conditions cover default provisions, collateral requirements, and rights of the lender in case of non-payment. Your agreement ensures clarity on penalties, early repayment options, and dispute resolution methods to protect all parties involved.

Collateral and Security Provisions

A loan agreement typically includes key documents outlining the terms of the loan, repayment schedules, and obligations of both parties. Collateral and security provisions form a vital part of the agreement, specifying assets pledged to secure the loan.

These provisions detail the type of collateral, conditions under which it may be seized, and the rights of the lender to enforce security interests. Clear descriptions of pledged assets, such as real estate, equipment, or receivables, protect the lender's investment. Your understanding of these security terms is crucial to managing risks and ensuring compliance with the loan agreement.

Interest Rates and Repayment Schedules

Loan agreements detail critical financial terms that govern the borrowing process, including interest rates and repayment schedules. These documents clarify the cost of borrowing and the timeline for repayment to protect both lender and borrower.

- Interest Rate Disclosure - Specifies the exact percentage of interest charged on the principal amount, which can be fixed or variable.

- Repayment Schedule - Outlines the timeline and frequency of payments, ensuring the borrower knows when and how much to pay.

- Calculation Method - Describes how interest is calculated, whether on a simple or compound basis, affecting total repayment amounts.

Covenants and Borrower Obligations

A loan agreement typically includes detailed covenants that outline specific actions the borrower must adhere to during the loan term. These covenants protect the lender's interests by setting financial ratios, restrictions on additional debt, and requirements for maintaining certain insurance policies.

Borrower obligations within the agreement specify Your responsibilities such as timely repayment, providing financial statements, and complying with all applicable laws. Clear definitions of these duties ensure transparency and reduce the risk of default throughout the loan period.

Default Events and Remedies

A loan agreement typically includes detailed descriptions of default events, such as missed payments, insolvency, or breach of covenants, which trigger specific remedies. Remedies may involve acceleration of the loan, increased interest rates, or legal actions to recover the outstanding balance. Understanding these provisions helps you manage risks and protect your financial interests effectively.

Legal and Regulatory Compliance

A loan agreement typically includes documents that ensure legal and regulatory compliance to protect both parties involved. These documents verify the legitimacy of the transaction and outline the legal obligations and rights of the borrower and lender.

- Promissory Note - Serves as the borrower's written promise to repay the loan under specified terms and conditions, establishing legal enforceability.

- Security Agreement - Details collateral pledged by the borrower, ensuring adherence to secured transaction laws and protecting lender interests.

- Disclosure Documents - Comply with federal and state regulations by transparently presenting loan terms, fees, and risks to the borrower.

What Documents Does a Loan Agreement Typically Include? Infographic