A Real Estate Purchase Agreement requires key documents such as the parties' identification, the property deed, and the purchase offer outlining terms and conditions. Essential financial documents include proof of funds or mortgage pre-approval, while inspection reports and disclosures ensure transparency about the property's condition. Title search results and any contingency clauses must also be included to finalize the agreement effectively.

What Documents are Needed for a Real Estate Purchase Agreement?

| Number | Name | Description |

|---|---|---|

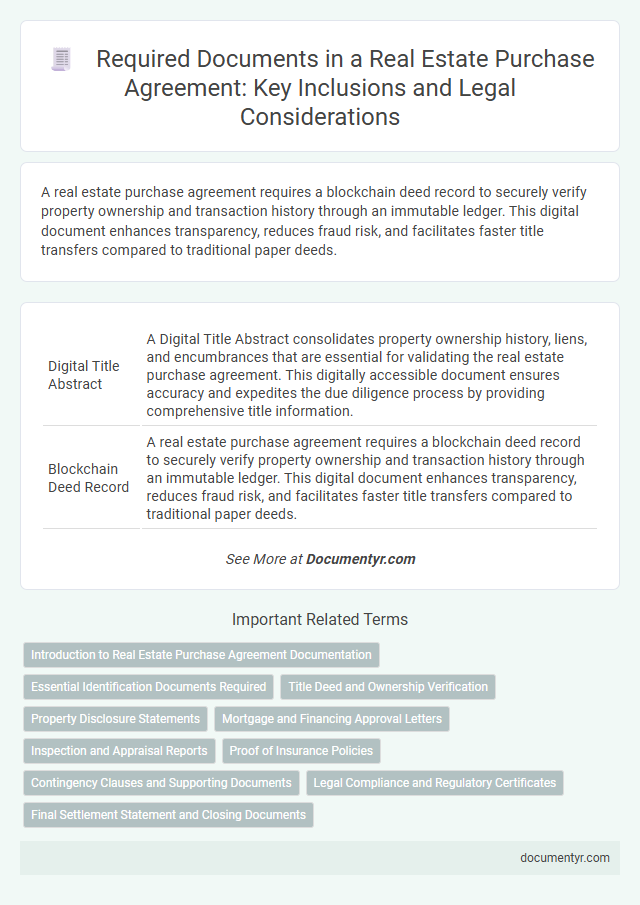

| 1 | Digital Title Abstract | A Digital Title Abstract consolidates property ownership history, liens, and encumbrances that are essential for validating the real estate purchase agreement. This digitally accessible document ensures accuracy and expedites the due diligence process by providing comprehensive title information. |

| 2 | Blockchain Deed Record | A real estate purchase agreement requires a blockchain deed record to securely verify property ownership and transaction history through an immutable ledger. This digital document enhances transparency, reduces fraud risk, and facilitates faster title transfers compared to traditional paper deeds. |

| 3 | Remote Online Notarization (RON) Certificate | A Real Estate Purchase Agreement requires specific documents, including a valid Remote Online Notarization (RON) Certificate that verifies the notarization process conducted electronically in compliance with state laws. The RON Certificate ensures the authenticity and legality of signatures executed remotely, facilitating a secure and efficient property transaction. |

| 4 | EARNEST Token Receipt | The Earnest Token Receipt is a crucial document in a Real Estate Purchase Agreement, serving as proof of the buyer's good faith deposit to secure the offer. This token receipt outlines the amount deposited, buyer and seller details, and terms under which the deposit may be forfeited or returned, ensuring transparency and commitment within the transaction. |

| 5 | Geo-Verification Survey Report | A Geo-Verification Survey Report is crucial in a real estate purchase agreement as it confirms the exact boundaries and physical features of the property, ensuring legal compliance and preventing boundary disputes. This report must be included alongside title deeds and property tax receipts to validate ownership and land integrity. |

| 6 | Environmental Encumbrance Disclosure | Environmental Encumbrance Disclosure is a critical document required in a real estate purchase agreement, detailing any environmental restrictions or liabilities associated with the property, such as contamination or protected wetlands. This disclosure ensures buyers are fully informed about potential environmental risks that could affect property value or usage. |

| 7 | AI-Generated Property Condition Analysis | A Real Estate Purchase Agreement requires essential documents such as the property deed, buyer and seller identification, financing and loan approval papers, and an AI-generated Property Condition Analysis report that provides a detailed evaluation of the property's structural integrity, potential defects, and maintenance needs. This AI-generated analysis enhances the accuracy and transparency of the transaction by offering predictive insights based on historical and current data, ensuring informed decision-making for both parties. |

| 8 | ESG (Environmental, Social, and Governance) Compliance Affidavit | A Real Estate Purchase Agreement requires an ESG Compliance Affidavit to verify adherence to environmental regulations, social responsibility, and governance standards, ensuring responsible property usage and sustainable investment. This document supports transparency by confirming that parties comply with relevant ESG criteria that impact property valuation and risk assessment. |

| 9 | eClosing Compliance Audit Trail | A Real Estate Purchase Agreement requires key documents such as the purchase contract, seller's disclosure, title report, and buyer's financing information, all integrated within the eClosing Compliance Audit Trail to ensure legal verifiability and regulatory adherence. This audit trail meticulously records timestamps, digital signatures, and transaction logs, providing a secure, transparent record that supports compliance with state and federal eClosing regulations. |

| 10 | Cybersecurity Disclosure Agreement | A Cybersecurity Disclosure Agreement is essential in a real estate purchase agreement to detail the protocols for protecting sensitive buyer and seller information from data breaches and cyber threats. This document ensures both parties acknowledge cybersecurity risks and agree on measures to secure digital transactions and personal data throughout the real estate process. |

Introduction to Real Estate Purchase Agreement Documentation

A Real Estate Purchase Agreement is a crucial document that outlines the terms and conditions of a property transaction. Proper documentation ensures all parties understand their rights and obligations, minimizing disputes. Your file should include the purchase agreement, property disclosures, and proof of financing to complete the transaction successfully.

Essential Identification Documents Required

When entering into a real estate purchase agreement, providing essential identification documents is crucial to ensure legal verification and transaction validity. These documents confirm the identities of all parties involved and protect against fraud.

- Government-Issued Photo ID - A valid driver's license or passport is required to verify the buyer's and seller's identity.

- Social Security Number or Tax Identification - This is necessary for tax reporting and compliance with financial regulations.

- Proof of Residency - Utility bills or official mail serve to confirm the current address of the parties involved.

Title Deed and Ownership Verification

Securing the correct documents is crucial for a real estate purchase agreement to ensure legal ownership and clear title transfer. The two primary documents are the Title Deed and Ownership Verification, which confirm the property's legal status and seller's rights.

- Title Deed - Legal document proving ownership of the property and outlining property boundaries and encumbrances.

- Ownership Verification - Official records or certificates verifying that the seller has clear and undisputed ownership of the real estate.

- Importance of Verification - Helps prevent fraud, liens, or claims against the property before finalizing the purchase agreement.

Property Disclosure Statements

Property Disclosure Statements are crucial documents in a Real Estate Purchase Agreement. They provide detailed information about the condition and history of the property, helping to identify any potential issues. Your review of these statements ensures transparency and protects your interests throughout the transaction.

Mortgage and Financing Approval Letters

Mortgage and financing approval letters are essential documents for a real estate purchase agreement. These letters verify that you have secured the necessary funds to complete the property transaction.

The mortgage approval letter comes from your lender, confirming your loan eligibility and terms. Financing approval letters detail the amount approved and any conditions attached. Including these documents in the agreement provides assurance to both buyers and sellers, streamlining the closing process.

Inspection and Appraisal Reports

Inspection and appraisal reports are essential documents in a real estate purchase agreement. These reports provide an objective assessment of the property's condition and market value, ensuring informed decision-making.

The inspection report identifies potential issues or repairs needed, while the appraisal report confirms the property's fair market value. You should include these documents to protect your interests and facilitate a smooth transaction.

Proof of Insurance Policies

Proof of insurance policies is a crucial document required in a real estate purchase agreement to protect both buyer and seller from potential risks. These documents verify that the property is insured against damages or liabilities before the transaction is finalized.

- Homeowner's Insurance Certificate - Confirms that the property is covered against fire, theft, and natural disasters.

- Title Insurance Policy - Provides security against potential defects or disputes related to property ownership.

- Liability Insurance Proof - Demonstrates coverage in case of injuries or accidents occurring on the property.

Submitting proof of insurance policies ensures a smoother, legally protected real estate transaction.

Contingency Clauses and Supporting Documents

| Document Type | Description | Purpose |

|---|---|---|

| Real Estate Purchase Agreement | Legally binding contract that outlines the terms and conditions of the property sale. | Establishes purchase price, parties involved, and key sale terms. |

| Contingency Clauses | Specific conditions included in the agreement that must be met for the contract to be valid. | Protects buyer and seller by allowing termination or renegotiation if terms are not satisfied. |

| Inspection Contingency | Clause that permits the buyer to conduct a home inspection and request repairs or cancel the contract. | Ensures property condition meets buyer expectations before finalizing the purchase. |

| Financing Contingency | Clause requiring the buyer to secure mortgage financing within a specified timeframe. | Provides a safeguard if the buyer cannot obtain the necessary loan. |

| Appraisal Contingency | Clause making the sale contingent on the property appraising at or above the purchase price. | Protects buyer from overpaying if the property value is lower than expected. |

| Title Report | Document detailing the legal ownership and any liens or encumbrances on the property. | Ensures clear title transfer without legal issues or outstanding debts. |

| Home Inspection Report | Professional evaluation of the property's condition including structural, electrical, and plumbing. | Supports inspection contingency and informs repair negotiations. |

| Loan Approval Letter | Documentation from a lender confirming the buyer's mortgage application approval. | Validates the financing contingency and buyer's ability to complete payment. |

| Appraisal Report | Certified valuation report conducted by a licensed appraiser. | Supports the appraisal contingency by confirming property's market value. |

Legal Compliance and Regulatory Certificates

Legal compliance in a real estate purchase agreement requires specific documents to validate the transaction and protect all parties involved. Essential documents include the deed, title report, and proof of seller's ownership to ensure clear property transfer rights.

Regulatory certificates such as zoning compliance, environmental clearances, and occupancy permits are critical for confirming that the property meets all local laws and regulations. These certificates help prevent future legal disputes and ensure the property is safe and suitable for the buyer's intended use.

What Documents are Needed for a Real Estate Purchase Agreement? Infographic