Partnership dissolution agreements typically require key documents such as the original partnership agreement, financial statements, and a detailed inventory of assets and liabilities. Legal paperwork including dissolution notices, tax filings, and settlement terms must also be prepared to ensure compliance with state laws. Proper documentation guarantees a clear and enforceable agreement, minimizing disputes between partners.

What Documents Are Required for Partnership Dissolution Agreements?

| Number | Name | Description |

|---|---|---|

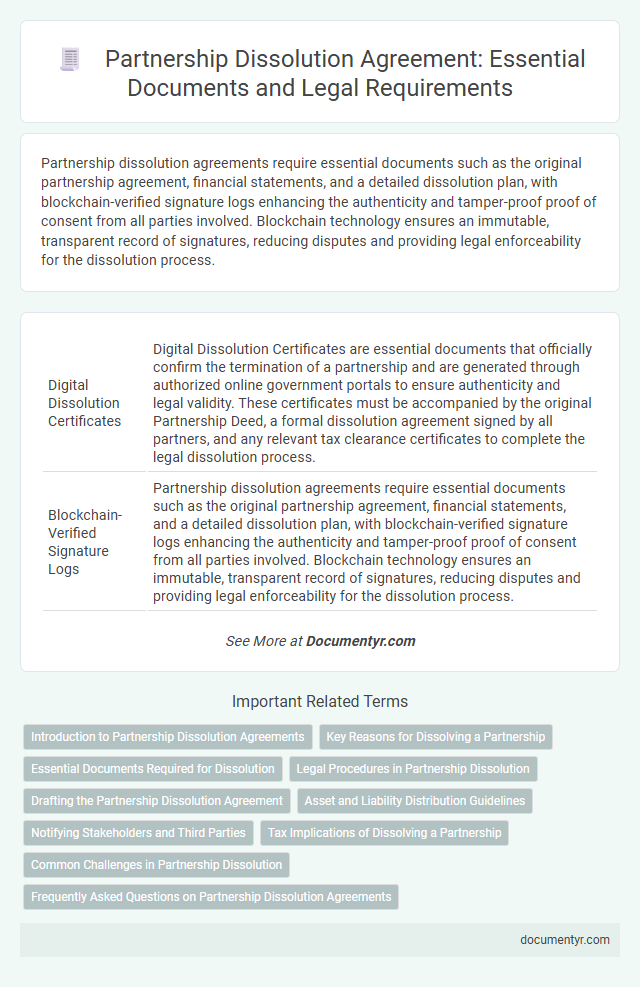

| 1 | Digital Dissolution Certificates | Digital Dissolution Certificates are essential documents that officially confirm the termination of a partnership and are generated through authorized online government portals to ensure authenticity and legal validity. These certificates must be accompanied by the original Partnership Deed, a formal dissolution agreement signed by all partners, and any relevant tax clearance certificates to complete the legal dissolution process. |

| 2 | Blockchain-Verified Signature Logs | Partnership dissolution agreements require essential documents such as the original partnership agreement, financial statements, and a detailed dissolution plan, with blockchain-verified signature logs enhancing the authenticity and tamper-proof proof of consent from all parties involved. Blockchain technology ensures an immutable, transparent record of signatures, reducing disputes and providing legal enforceability for the dissolution process. |

| 3 | E-Notarized Consent Forms | E-notarized consent forms expedite partnership dissolution agreements by providing legally binding electronic signatures verified through secure online notary services. These documents ensure authenticity and compliance with digital transaction laws, facilitating a streamlined and enforceable dissolution process. |

| 4 | Partner Exit Due Diligence Reports | Partner exit due diligence reports are essential documents in partnership dissolution agreements, providing comprehensive evaluations of the departing partner's financial contributions, liabilities, and ownership interests. These reports ensure transparency and accuracy in asset division and legal obligations, facilitating a smooth and equitable dissolution process. |

| 5 | Beneficial Ownership Disclosure Statements | Partnership dissolution agreements require Beneficial Ownership Disclosure Statements to identify all individuals who directly or indirectly own or control the partnership, ensuring transparency in asset distribution and liability allocation. These statements must comply with regulatory standards such as the Corporate Transparency Act to prevent fraud and facilitate legal accountability during the dissolution process. |

| 6 | GDPR-Compliant Data Transfer Agreements | Partnership dissolution agreements require GDPR-compliant data transfer agreements to ensure lawful processing and secure handling of personal data during the termination phase. These documents must explicitly outline data subject rights, data retention policies, and mechanisms for data transfer accountability between partners. |

| 7 | Intellectual Property Rights Assignment Addendums | Partnership dissolution agreements require Intellectual Property Rights Assignment Addendums to clearly transfer ownership of patents, trademarks, copyrights, and trade secrets between partners. This documentation ensures legal protection and avoids future disputes over intellectual property assets after the partnership terminates. |

| 8 | ESG (Environmental, Social, Governance) Impact Statements | Partnership dissolution agreements require environmental impact assessments, social responsibility reports, and governance compliance certificates to ensure alignment with ESG standards. Including these ESG impact statements facilitates transparent evaluation of the partnership's sustainability practices and responsibility commitments during the dissolution process. |

| 9 | Post-Dissolution Non-Compete Declarations | Post-dissolution non-compete declarations must be included in partnership dissolution agreements to legally restrict former partners from engaging in competing businesses within a specified geographic area and timeframe. These documents typically require detailed clauses outlining the scope, duration, and enforcement mechanisms to ensure compliance and protect the remaining partners' interests. |

| 10 | Crypto Asset Allocation Schedules | Partnership dissolution agreements require detailed documentation of crypto asset allocation schedules to ensure transparent division of digital assets according to ownership percentages and valuation at the time of dissolution. These schedules must include wallet addresses, asset types, quantities, current market values, and any pending transactions or locked assets to prevent disputes. |

Introduction to Partnership Dissolution Agreements

Partnership dissolution agreements are essential legal documents that outline the terms and conditions for ending a business partnership. These agreements help protect the interests of all partners and ensure a smooth transition during the dissolution process.

You need specific documents to create a comprehensive partnership dissolution agreement. Key paperwork includes the original partnership agreement, financial statements, and any records of outstanding debts or obligations.

Key Reasons for Dissolving a Partnership

| Key Reasons for Dissolving a Partnership | Required Documents for Partnership Dissolution Agreements |

|---|---|

| Disagreement Among Partners | Written Partnership Dissolution Agreement detailing terms and conditions |

| Financial Issues or Insolvency | Financial statements, balance sheets, and proof of debt settlement |

| Completion of Business Purpose | Original partnership agreement and a certificate of dissolution |

| Legal or Regulatory Compliance | Copies of licenses, permits, and compliance certificates relevant to dissolution |

| Retirement or Withdrawal of a Partner | Notice of withdrawal, buyout agreement, and amended partnership agreement |

| Death or Incapacity of a Partner | Death certificates, succession plan, and related legal documents |

| Business Strategy or Market Changes | Meeting minutes outlining dissolution decision and asset distribution plan |

Understanding these key reasons for dissolving a partnership helps you prepare the necessary documentation to ensure a smooth and legally compliant dissolution process.

Essential Documents Required for Dissolution

Understanding the essential documents required for partnership dissolution agreements is critical for a smooth termination process. Your collection of these documents ensures legal compliance and clarity between all partners involved.

- Dissolution Agreement - This primary document outlines the terms and conditions agreed upon by all partners for ending the partnership.

- Financial Statements - Detailed records of assets, liabilities, and capital accounts are necessary to facilitate equitable distribution and resolve outstanding debts.

- Notice of Dissolution - Official notification required by law to inform creditors, clients, and relevant authorities about the partnership's termination.

Legal Procedures in Partnership Dissolution

Partnership dissolution requires several key documents to ensure legal compliance and smooth termination of the business relationship. Essential paperwork includes the Partnership Dissolution Agreement, final financial statements, and a detailed inventory of shared assets and liabilities.

Legal procedures in partnership dissolution demand careful preparation of the Dissolution Agreement, which outlines the terms of ending the partnership, division of assets, and settlements of debts. You must also file dissolution forms with the appropriate state agency, such as the Secretary of State, to officially terminate the partnership's legal status. Accurate documentation helps prevent disputes and protects all partners' rights during the dissolution process.

Drafting the Partnership Dissolution Agreement

Drafting a partnership dissolution agreement requires key documents such as the original partnership agreement, financial statements, and a list of outstanding liabilities and assets. You need to clearly outline the division of assets, debt responsibilities, and the process for resolving any disputes. Including these documents ensures the agreement is comprehensive and legally binding.

Asset and Liability Distribution Guidelines

Partnership dissolution agreements require detailed documentation of asset and liability distribution to ensure clear division between partners. Essential documents include asset inventories, valuation reports, and creditor statements outlining outstanding liabilities. These records provide a structured framework for equitable allocation and legal compliance during the dissolution process.

Notifying Stakeholders and Third Parties

Partnership dissolution agreements require notifying all stakeholders, including partners, employees, and investors, to ensure transparency and compliance. Official documentation such as the dissolution notice must be prepared and distributed promptly.

Third parties like creditors, suppliers, and clients must also be informed to update contractual obligations and financial arrangements. Providing copies of the dissolution agreement to relevant government agencies ensures legal recognition of the partnership termination.

Tax Implications of Dissolving a Partnership

Partnership dissolution agreements require specific documents to address legal and financial responsibilities, especially tax matters. Proper documentation ensures clear communication with tax authorities and minimizes potential liabilities.

- Final Partnership Tax Return (Form 1065) - This form reports the income, gains, losses, deductions, and credits from the partnership's final tax year.

- Schedule K-1 - Each partner receives this to report their share of the partnership's income, deductions, and credits for their individual tax filings.

- Asset Distribution Records - Documentation of how partnership assets are allocated helps determine taxable gains or losses upon dissolution.

You must submit these documents timely to comply with IRS regulations and accurately reflect your tax obligations during the partnership's termination.

Common Challenges in Partnership Dissolution

Partnership dissolution agreements require several key documents to ensure legal clarity and proper asset division. Understanding common challenges in this process helps partners navigate disputes and financial settlements effectively.

- Partnership Agreement - This foundational document outlines the terms of partnership and dissolution procedures agreed upon initially.

- Financial Statements - Accurate records of assets, liabilities, profits, and losses are essential for fair distribution.

- Dispute Resolution Clauses - These clauses address potential conflicts and outline methods for resolving disagreements during dissolution.

What Documents Are Required for Partnership Dissolution Agreements? Infographic